Difference between Cash discount and Trade discount

Suneetha, a 25 Years Software Engineer went to a famous GVK Shopping Mall in Hyderabad. As usual, the Shopping Mall is anchored not only with full of fabulous lighting but also she observed special festival discount banners like

> Flat Rs.2,000 off on Samsung LED TV,

> 20% Discount on Clothing for Purchase over Rs.2,999,

> Buy 1 Get 1 Pizza i.e. 50% Discount.

Normally shopping malls and businesses will provide numerous Discounts to customers every season to attract them.

But here the question is, the discount which is offered by the Malls to customers is what kind of the discount..!

Whether it is a Cash discount or Trade Discount..?

Is there any difference between the two..!!

Everyone knows the term “Discount”. It’s not a new term. But to understand the discount in short it can be defined in general as the

“Discount is an amount of reduction on the Invoice price which will be provided by the Businessman to sell their products by attracting more customers.”

As per Accounting, “Discount” is a reduction from an Invoice price/ List price / Quoted price. It is also a price that will be allowed for obtaining payment on a bill before its maturity .

We are going to discuss on two different types of “Discount”,

1. Trade discount

2. Cash discount

Normally people will get confused about these two terms. To understand, read this full article of “What is the difference between Cash discount and Trade discount” to get clarified.

Basket of Mangoes

- Trade discount meaning

- Trade discount in Accounting with example

- FAQ on Trade Discount

- What is a Cash Discount

- Types of Cash Discount

- Cash Discount Accounting Treatment

- Cash discount 3 Example Problems

- Differences between Trade Discount and Cash discount

1. Trade Discount

Trade discount meaning

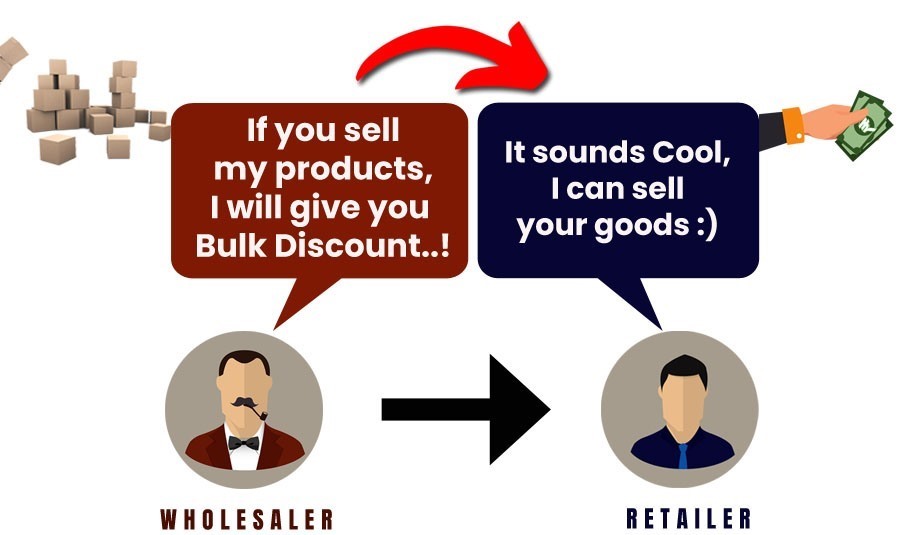

Trade Discount is a “Discount which will be allowed by the Wholesaler or Manfacturer to the Retailer for bulk quantities on a fixed percentage basis“. The Trade discount will be allowed against a certain Quantity of material or on the total Invoice value. The discount computation will be done based on Invoice Price or List price and Sales will be done on the basis of Net price. i.e List price less Trade discount.

M/s Sony India Pvt Ltd is a Branded Electronic Manufacturer like TV, Fridge, Refrigerator, Washing machines etc. Here, M/s Sony India Pvt Ltd is the Manufacturer of Goods. After manufacture of goods, what Sony company will do. Will it kept all the manufactured goods in its stores/ Godowns idle.

No..!!! It will sell their goods.

Right..!

How it sells the goods..!!!

Here, Sony sells its goods in two ways.

1. Through its exclusive Showroom to it’s customers located at different places within and outside India and

2. Through its Retailer / Dealers.

The top 3 reasons for offering Trade Discount is

1. To attract more customers

2. By increasing customers, Sales will also be increased

3. And to encourage to make Bulk purchases

Who are the “Dealers/Retailers“…!!

Retailers / Dealers are the persons who act as a middleman between Wholesaler like Sony and the the Customers.

Why Can’t Sony sell it only through it’s Showroom.

As all the goods will not be sold by the Sony, therefore, it will distribute their products to its Retailers/ dealers.

Then, what is the benefit for Retailers..!!

Here the Retailer / Dealers gets price reduction in selling of goods as compared to the customers in the form of Discount which is also called as “Trade Discount”. Here the Wholesaler is ” M/s Sony India Pvt Ltd” and the Dealer is “Mr.Sundar”, an Individual.

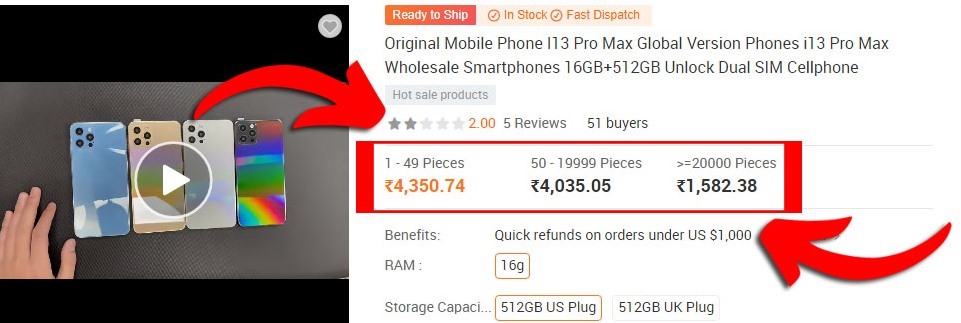

Now a days you can see the Top brands like Alibaba.com and Wallmart provides products based on price range. If you purchase products in Bulk you will get more discounts. Such discounts are also called as “Trade Discount”only.

Trade discount in Accounting

“Trade Discount” enables the Retailer to make profits. And one more important thing is that “Trade Discount will not be entered in the books of Accounts“.

There will be NO Entry passed for the Trade Discount in the books of both the Wholesaler and Retailer. The amount of reduction will be done before any type of exchange between the parties. Therefore, Trade discount does not form part of books of accounts.

Example

M/s Sony India Pvt Ltd, the manufacturer sells a LED Tv with Invoice value of Rs.1,00,000 with a 20% discount on it to the Mr. Sundar, a Retailer.

It means, Mr.Sundar will get the TV here for Rs.80,000/- only [Rs.1,00,000-(Rs.1,00,000@20%)] not Rs.1,00,000/-. And Mr.Sundar can sell this TV to its Customers till the Invoice Value or MRP Price. It means, Mr.sundar can sell this TV to its customers between price range of Rs.80,000-Rs.1,00,000/- but not more than Rs.1,00,000/- as it is the Maximum price as decided by the wholesaler M/s Sony India Pvt Ltd.

This Discount is called as “Trade Discount“. These transactions will be recorded at Net Values only. In this case, the Transaction will be recorded at Rs.80,000/- only.

FAQ on Trade Discount

Q1) Why Trade Discount will be provided ?

Trade Discount will be provided to encourage Bulk Sales and to attract more customers to the business.

Q2) To Whom Trade discount will be allowed ?

Trade discount will be allowed to the Retailers who make purchases in Bulk.

Q3) Whether any Entry is to be passed in the Books of Accounts ?

No entry is required to be passed in the books of both the Supplier of the goods or receiver of the goods

Q4) Trade discount is recorded in the Cashbook?

No. Trade discount will not be recorded in the Cashbook.

Q5) When the Trade Discount takes place?

It will takes before any type of exchange of goods and at the time of purchase only it will takes place.

Q6) Trade discount is given on credit transactions only?

No. Trade Discount will be allowed both on Cash and Credit transactions.

Q7 ) What is List Price

List price is the Proposed Retailer Price which will be decided by the Manufacturer or Wholesaler. After deciding, the Price will be listed on their Catalog and will be called List Price.

Q8 ) What is Net Price

The difference between List Price and the Discount amount is called Net Price.

2. Cash Discount

What is a Cash Discount?

Cash discount is a “Discount which will be given by the Dealer to it’s Customer for the recovery of Bad debts“.

(OR)

In other terms it can also be defined as It is allowed to encourage prompt payment to clear the customer outstanding immediately.

If Mr.X sold the goods to Mr.Y with due period of 90 days, but the seller may offer the customer a discount of 5% if he makes the payment with in first 10 days of receipt of goods.

Here, there may be chances that the Seller may receive the amount before the due period. Even though cash discount is a loss to the Supplier but he can recover the total amount before the due date.

Types of Cash Discount

In accounting, there are 2 ways, the Cash discounts can be recorded.

- Gross Method

Under the Gross method of Cash discount, Sales are accounted at Invoice price and Cash discount allowed to the customer will be shown separately. - Net Method

Sales under this method will not be recorded at full Invoice value but will be recorded at reduced value after considering the effect of Cash discount

Cash Discount Accounting Treatment

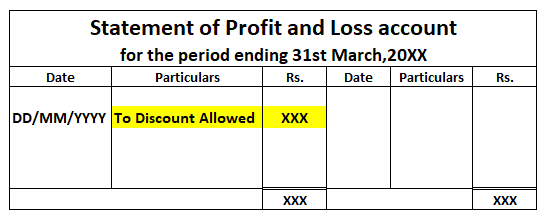

Cash discount will be shown in the books of accounts of both “Seller” and the “Customer”. It will be shown on Debit side of “Statement of Profit and Loss account” as “Discount allowed” in the Books of the Dealer / Supplier of the goods.

Journal Entry is as follows:

> When Discount is allowed to Customer

Discount allowed a/c Dr

To Profit and Loss a/c

(Being Discount allowed to Customer)

Cash discount Example : 3 Problems

Problem 1

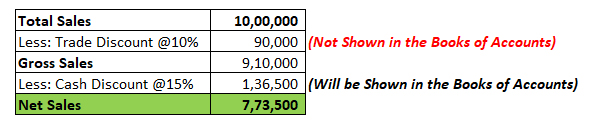

M/s.Priya Traders Sold goods worth of Rs.10,00,000 to Mr. Govind on 01st Apr,2021 in a bulk with 10% trade discount and 15% Cash discount. On 30th May,2021 M/s.Priya Traders received 50% by cheque and 30% by Cash. What will be the Journal Entries in the books of both the Seller?

Solution:

As per the given data,

M/s Priya Traders is the Seller of the Goods and Mr.Govind is the Buyer of the goods.

In the Books of M/s.Priya Traders (Seller)

The above example can be understood as below

As the Trade discount will not be entered in the books of accounts of either Seller or Purchaser, No Entry will be recorded in the books of M/s Priya Traders. Whereas for Cash Discount the Journal Entries are as follows.

M/s Priya Traders

JOURNAL ENTRIES

As the Goods sold on credit, the amount is to be receivable from Customer Mr.Govind. So, the Debtors / Accounts Receivable account is debited. Also for the Seller, the “Cash discount” is a Loss. Therefore “Cash Discount” is debited. The Sales is an “Income” its balance is increasing, So credited.

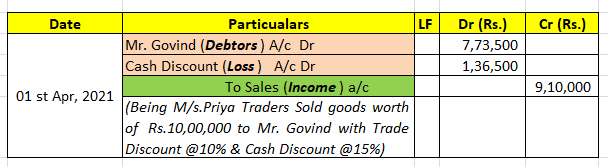

> When M/s.Priya Traders sold good to Mr.Govind of Rs.10,00,000

> When M/s Priya Traders received 50% of the amount by Cheque and 30% by Cash

Now the remaining Debtors balance [Rs.7,73,500- Rs.6,18,800] will be reflected in the Balance sheet as an Outstanding balance to be receivable from Mr.Govind.

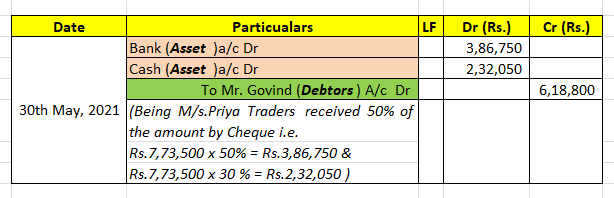

Problem 2 (Gross Method)

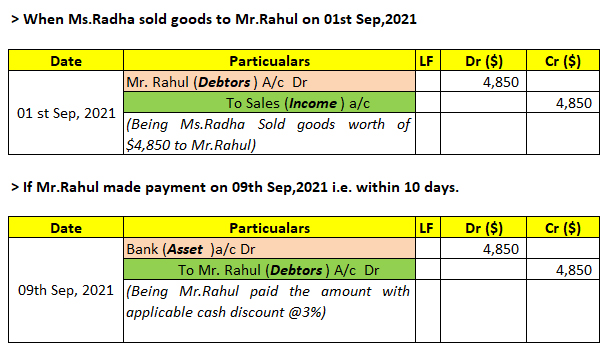

Ms.Radha Sold goods worth of $5,000 to its customer Mr.Rahul on 01st September 2021. The payment terms offered by Ms.Radha is 3/10, n/60. This means the credit period is 60 days and a cash discount of 3% is offered if the payment is made within 10 days.

Write the Journal Entries in the books of Ms.Radha

Solution:

What is 3/10 , n/60 means?

If the buyer makes the payment within 10 days of Sale then, 3% of discount will be allowed by the Seller to the Customer. If the buyer is unable to get the cash discount if he makes payment after 10 days but the customer is obliged to clear the payment with 60 days of Sale. i.e. Credit period of 60 days.

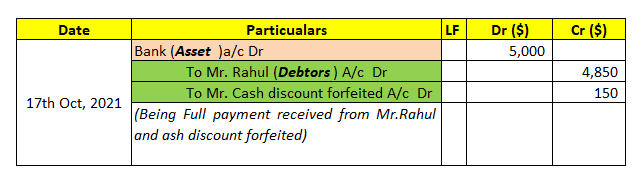

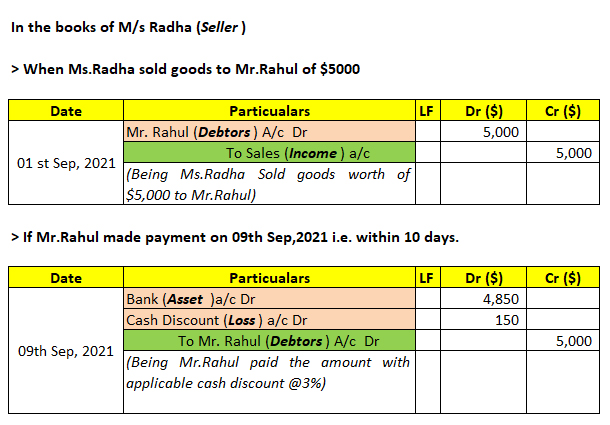

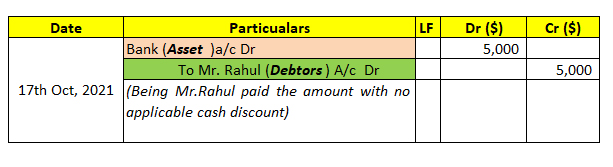

> If Mr. Rahul made payment on 17th Oct,2021 i.e. After 10 days. Then, Cash discount will not be applicable. Therefore, the entry will be as follows

Problem 3 (Net Method)

Continuing to the above problem, pass the journal entries on Net method basis.

> If Mr. Rahul made payment on 17th Oct,2021 i.e. After 10 days. Then, Cash discont will not be applicable and the balance amount will be transferred to “Cash discount forfeited account”.

The journal entry will be as follows.