Standard Chartered Platinum Rewards Card

Introduction

Standard Chartered Bank offers an entry-level credit card with 5x Reward points on Fuel and Dining through its Standard Chartered Platinum Rewards Card.

It is a Lifetime-Free credit card. i.e. You don’t need to pay for Annual fee and Renewal fee.

So, Without further ado let’s see What Features and benefits this Credit card is offering?

And I also share my Genuine opinion on this Credit card by discussing its Drawbacks as well.

Let’s get Started..!!

Standard Chartered Platinum Rewards Card Overview

| Credit Card Type | Reward Points |

| Joining Fees | Nil |

| Renewal Fees | Nil |

| Best Suited for | Dining & Fuel |

Standard Chartered Bank is a British Multinational bank. i.e. a UK-based bank.

This bank has operations across Asia, Africa, and Middle Eastern countries as well.

This entry-level credit card is offered especially for first-time credit card users. If you are applying for a Credit card for the first time, then, you can try this.

What Benefits do you get from Standard Chartered Platinum Rewards Card?

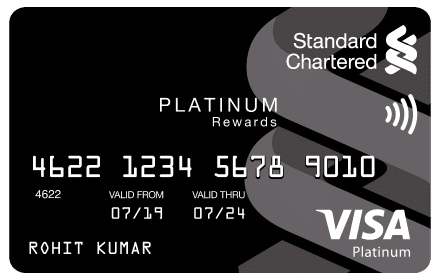

When it comes to Standard Chartered Platinum Rewards Card, it comes with Black and silver colour combinations.

You can see the Standard Chartered Bank Logo on the top right side of this card. Along with that the logo of the Contactless card feature appears on the right side of it. i.e. with Near-field Communication (NFC) support.

On the right bottom side of the card, you can see the type of Credit card network i.e. Visa.

Now, Let me go through the Top benefits offered by this Credit Card [Incl. My Analysis]

Standard Chartered Bank Platinum Rewards Credit Card Benefits

1. Lifetime free

If you use this Standard Chartered Platinum Rewards Card and spend a minimum of Rs.500 within 30 days of card issue, then, you will get this card free for life.

2. Contactless card feature

Standard Chartered Bank Platinum Rewards credit card comes with Contactless technology. In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

3. Reward Benefits

Coming to this credit card reward points,

You can earn 5 reward points for every Rs.150 rupees spent by using this credit card in Hotels or Restaurants and on Fuel spending.

If you spend on any other categories, then, you will get 1 reward point for every Rs.150 rupees you spend through this credit card.

And one reward point is worth of Rs.0.25/- paisa.

4. Free Add on card

This Standard Chartered Credit cardholder can get a Free add-on card.

If any of your family members aged above 18 years need a credit card, then, they can get a Free add-on card.

Who is Eligible?

1. Applicants aged between 21-65 years old can apply for this card, whether they are Salaried or Self Employed.

2. Applicants who have a monthly gross income of more than Rs.20,000/- are eligible for this card.

Standard Chartered Platinum Rewards card Apply

If you want this Standard Chartered Platinum Rewards Card, You can apply.

Apply NowStandard Chartered Platinum Rewards card Charges [Must Read]

Let’s check all the applicable charges for using this Standard Chartered Platinum Rewards card.

| S.No. | Particulars | Description |

|---|---|---|

| 1. | Joining Fees & Renewal Fees | Nil |

| 2. | Cash advance fees | 3% Transaction fee with a Minimum fee of Rs.300/- |

| 3. | Interest charges | @3.50% p.m. i.e. 42% p.a. |

| 4. | Rewards redemption charges | Rs.99/- per request |

| 5. | Foreign Currency Markup | 3.50% of transaction |

| 6. | Late payment charges | From Rs.Nil – Rs.1200 |

1. Joining Fees & Renewal Fees

This Credit card holder should pay Joining fees and a Renewal fee of Rs. 250/- each.

But if they spend a minimum of Rs.500 rupees within 30 days of the issuance of this card, then, they will get this Standard Chartered Platinum Rewards Card for Lifetime-free.

2. Cash advance fees / Cash Withdrawal charges

If you withdraw money by using this Standard Chartered Platinum Rewards Card, a 3% Transaction fee will be levied on all such Cash Withdrawals at Domestic ATMs. Such fees would be billed to the Cardholder in the next statement.

Let’s see an example.

if you withdraw Rs.10,000 from an ATM by using this Standard Chartered Platinum Rewards Card, then, you will be charged Rs.354/- i.e.(Rs.300 +18% GST)

Similarly, if you withdraw Rs.1,00,000/- then, you have to pay Rs.3,540 rupees i.e. (Rs.3,000 +18% GST).

No matter how much cash you withdraw using this credit card, you will be charged a minimum of Rs.300 rupees per transaction.

It’s my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

You can Withdraw Money using this SBI Titan Credit card but Don’t withdraw cash from any credit card. If you have an urgent cash requirement / Cash crunch, then I suggest you take a Gold Loan or a Personal Loan. Those are much better options.

Because in a Personal Loan, you pay the Principal amount plus Interest as an EMI every month. The interest rate for Personal Loans ranges from 15 to 20% p.a. on a higher note.

Do you know how much interest you will be charged on Credit Cards?

As per the SBI Card website, the Rate of interest will be charged is up to 3.25% per month. It means you have to pay up to 42% per annum as a Finance / Interest charge on your Credit Card Outstanding balance.

The rate of interest you get through a personal loan is more than double the interest rate you get on a credit card.

3. Interest charges

What about the interest charges on this Standard Chartered Platinum Rewards Card?

You have used this Standard Chartered Platinum Rewards Credit card and bought all the stuff you need. But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the bank will charge you interest between @3.50% per month.

It means the Annual interest is almost 42% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

4. Rewards redemption charges

– The Cardholder has to pay Rs.99 rupees per redemption to redeem the accumulated reward points.

– You can also redeem these reward points against Retail items and Gift vouchers.

5. Foreign Currency Markup

Whatever International transactions you do by using this Standard Chartered Platinum Rewards Card, you will be charged a Foreign mark fee of 3.50% on that transaction.

6. Late payment charges

Apart from Interest charges, if you delay paying this Standard Chartered Platinum Rewards Credit card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, the Late payment charges range from a Minimum of Rs.100/- rupees to a Maximum Rs. 1,200/- depending on your Credit card outstanding.

The Standard Chartered Platinum Rewards Credit card, Late payment charges are as follows

| Credit Card Outstanding Balance | Late Payment Fee (Rs.) |

|---|---|

| Rs. 0 – Rs.100/- | Nil |

| Rs. 100 – Rs.500/- | Rs.100/- |

| Rs. 501 – Rs.5,000/- | Rs.500/- |

| Rs. 5,001 – Rs.10,000/- | Rs.700/- |

| > Rs.10,000/- | Rs.1,200/- |

So if you use a credit card you have to be very organized and should deal with Credit card timelines properly.

Standard Chartered Platinum Rewards Card Review

The Standard Chartered Platinum Rewards Card is a complete entry-level credit card. If anyone wants a Basic Credit card either for loan purposes or to improve their CIBIL score then, I would recommend this card.

As it is an entry-level card, this credit card does not have too many features. Also, this card has no Fuel Surcharge Waiver and also no Airport Lounge facility.

If you are looking for a credit card with a Fuel surcharge waiver, then, you can check IDFC First WOW Credit Card.

Frequently Asked Questions

1. Standard Chartered Platinum Rewards Credit card Lounge access?

The Standard Chartered Platinum Rewards Credit card has no Airport or Railway lounge facility.

2. Standard Chartered Platinum Credit Card reward points Value?

The Standard Chartered Platinum Rewards Card, 1 reward point worth Rs.0.25/- paisa.

3. Standard Chartered Platinum Rewards credit card fuel surcharge?

Standard Chartered Platinum Rewards credit card has no fuel surcharge waiver benefit.

4. Standard Chartered Platinum Rewards Credit card Annual fee?

Standard Chartered Platinum Rewards cardholders should pay Joining fees of Rs. 250/-. But if the cardholder spends more than Rs.500 rupees within 30 days of the issuance of this card, then, they will get this credit card for Lifetime-free.

Thanks for your time folks 🙂