Post office PPF calculator

Introduction

The Public Provident Fund (PPF) in Post office is one of the popular savings schemes in India which is offered by the Government of India. PPF is a long-term investment scheme with a Lock-in period of 15 Years.

Most of the people deposits their money in PPF accounts through different commercial banks in India. However, Most of the them may not be aware of potential returns they can earn through PPF.

This post, aims to provide a good guidance to the Post office PPF account holders by answering few common questions related to PPF.

We will also explore, in case If you deposit Rs.500/- rupees on monthly basis in PPF account, then, how much earnings you will get by the end of the maturity period ?

If you want to earn Rs.15,00,000/- from the Post office PPF account, then how much amount is to deposited on every month ?

If you need Rs.40,00,000/- from PPF account, then, how much money is to deposited every month will be discussed by using a Simple Free Excel sheet.

Additionally, We also introduce a Post office PPF calculator, a Customisable tool that aims to tailor the calculations as per your specific needs.

Without a further ado, Let’s get Started..!!

Features of Post office PPF

The Main features of Post office Public Provident Fund (PPF) is as follows

| S.No. | Particulars | Details |

|---|---|---|

| 1. | Scheme Name | Public Provident Fund (PPF) |

| 2. | Eligibility | – Individuals – For Minor or a Person of Unsound mind by their Guardian can open the account. |

| 3. | Deposit Limits | Minimum Deposit – Rs.500/- per Financial Year Maximum Deposit – Rs.1,50,000/- per Financial Year |

| 4. | Maturity period | 15 Years |

| 5. | Rate of Interest p.a. | @ 7.10% p.a. w.e.f. 01st Jan,2024 |

| 6. | Pre-mature Withdrawal & Loans | Allowed subject to T & C |

| 7. | Income Tax benefits | U/s 80C of the Income Tax Act, 1961 |

| 8. | Nomination Facility | Available |

Also Read: 9 Things to know about SBI Green Rupee Term Deposit Scheme

Post office PPF calculator for 15 years : How to Use Excel ?

Now, I’m going to explain you about Excel Post office PPF calculator. Not only that I will showcase you, how to use this Excel sheet to calculate your PPF Savings simply by entering 2 fields as per your needs with out any hustle.

I’m also trying to explain you with 8 simple PPF Examples to understand your PPF earnings quite easily.

Let’s get into examples my friend.

How to Download Post office PPF Calculator Excel [Free]

Steps:

1. Download Free Excel Post office PPF calculator here.

2. No Passwords given.

3. Double click on the downloaded file to “Open” it

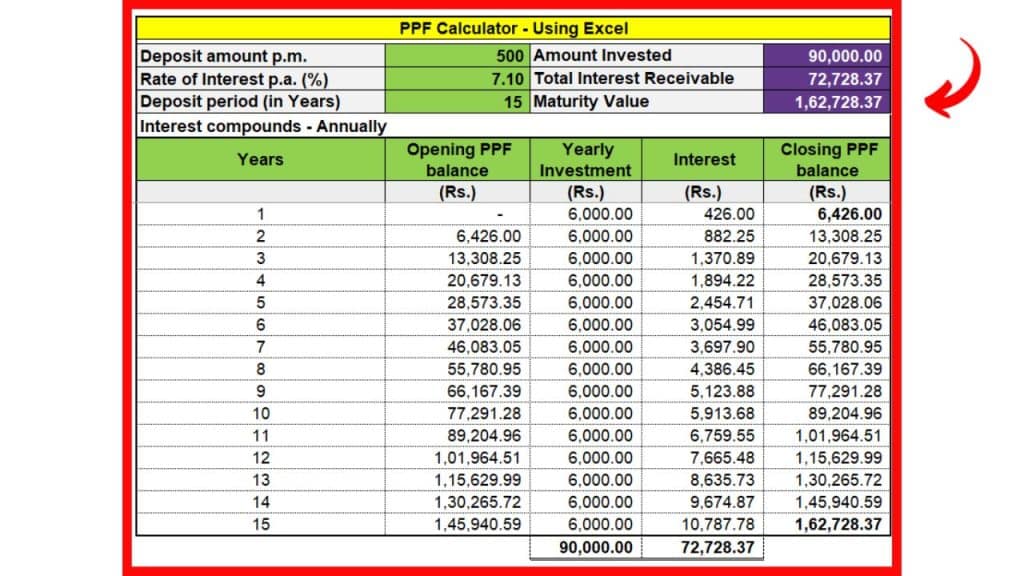

Example 1: When you deposit Rs.500 per month [Post office PPF Calculator Monthly]

Step 1:

Enter your Monthly deposit under the column of “Deposit Amount p.m”. It can be from Rs.500 rupees to Rs.12,500/- only.

Enter Rs.500 rupees in the “Deposit Amount p.m” column.

Step 2:

Now, You need to enter the “Rate of Interest p.a. (%)”

If you know the latest Post office interest rate, you can enter it here.

If you don’t know the latest Post Office Public Provident Fund (PPF) Interest rates, then click here.

At present, the Post Office Public Provident Fund (PPF) Interest rate for 2024 is 7.10% p.a. I considered the same rate of interest uniformly through all the 15 Years.

But if you want change Rate of interest, you can change it under E Column of “Interest”. I will also tell you the same.

Don’t worry.

Step 3:

Now, you just no need to enter any of the other fields like

– Deposit period (in Years)

– Amount Invested

– Total Interest Receivable

– Maturity Value

Your computation is now Ready 🙂

My Analysis:

| Particulars | Rs. |

| Deposited amount | Rs.500/- per Month |

| Amount Invested per year [A] | Rs.90,000/- per Month |

| Total Interest you receive is [B] | Rs.72,728/- |

| Total Maturity Value for 15 Years | Rs.1,62,728 /- |

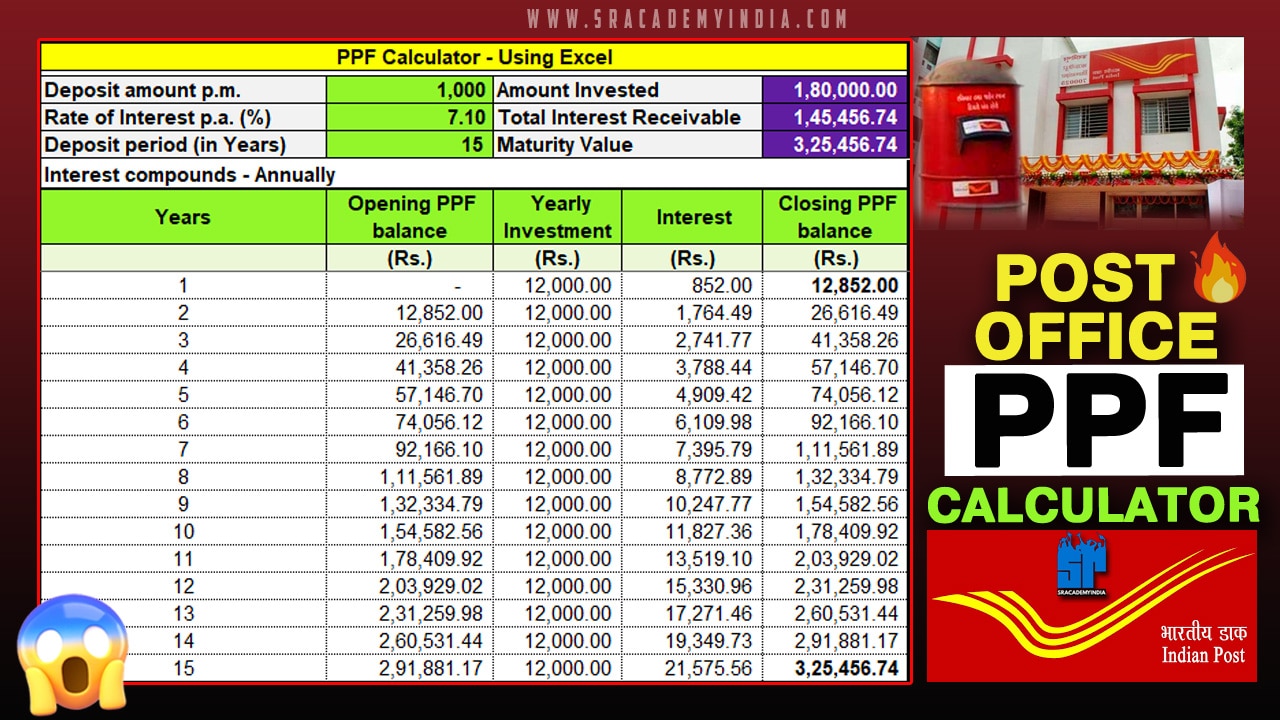

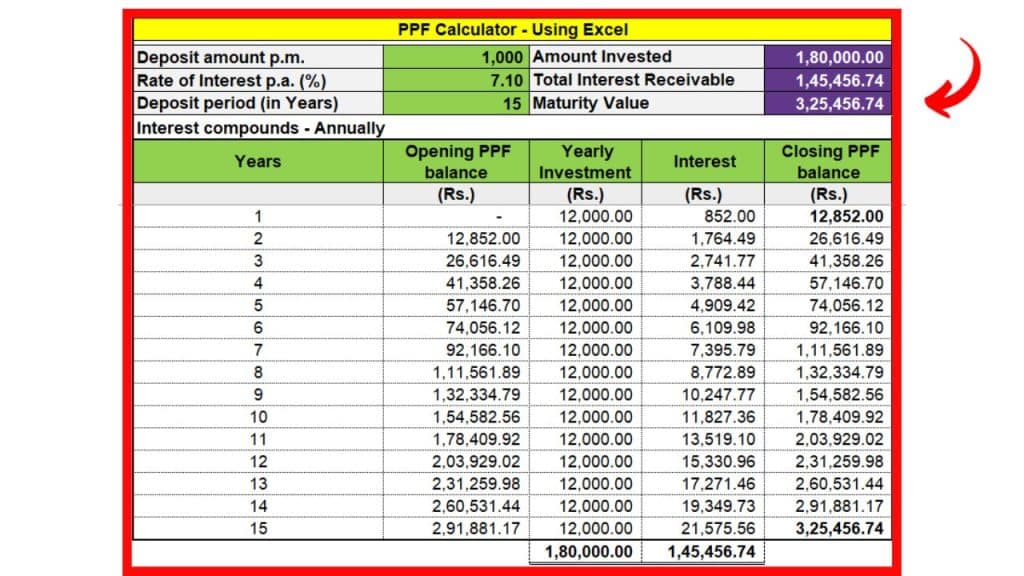

Example 2: When you deposit Rs.1,000 Monthly [Post office PPF Calculator Monthly]

Step 1:

Enter Rs.1,000 rupees in the “Deposit Amount p.m” column.

Step 2:

Now, you just No need to enter any of the other fields like

– Rate of Interest p.a. (%)

– Deposit period (in Years)

– Amount Invested

– Total Interest Receivable

– Maturity Value

Step 3:

Your computation is Ready 🙂

My Analysis:

| Particulars | Rs. |

| Deposited amount | Rs.1,000/- per Month |

| Amount Invested per year [A] | Rs.1,80,000/- |

| Total Interest you receive is [B] | Rs.1,45,456/- |

| Total Maturity Value for 15 Years | Rs.3,25,456 /- |

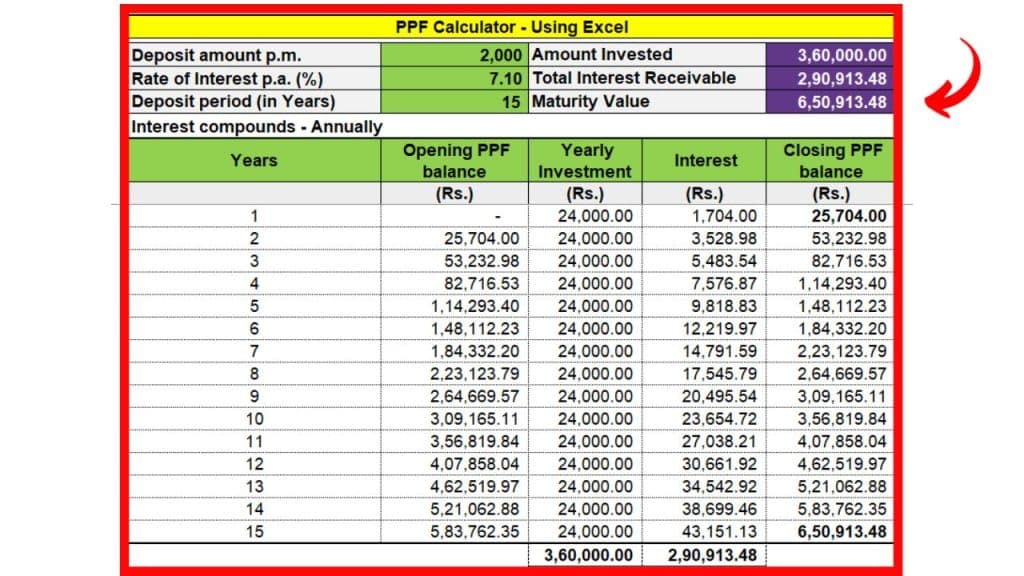

Example 3: When you deposit Rs.2,000 Monthly [Post office PPF Calculator Monthly]

Step 1:

Enter Rs.2,000 rupees in the “Deposit Amount p.m” column.

Step 2:

Now, you just No need to enter any of the other fields like

– Rate of Interest p.a. (%)

– Deposit period (in Years)

– Amount Invested

– Total Interest Receivable

– Maturity Value

Step 3:

Your computation is Ready 🙂

My Analysis:

| Particulars | Rs. |

| Deposited amount | Rs.2,000/- per Month |

| Amount Invested per year [A] | Rs.3,60,000/- |

| Total Interest you receive is [B] | Rs.2,90,913/- |

| Total Maturity Value for 15 Years | Rs.6,50,913/- |

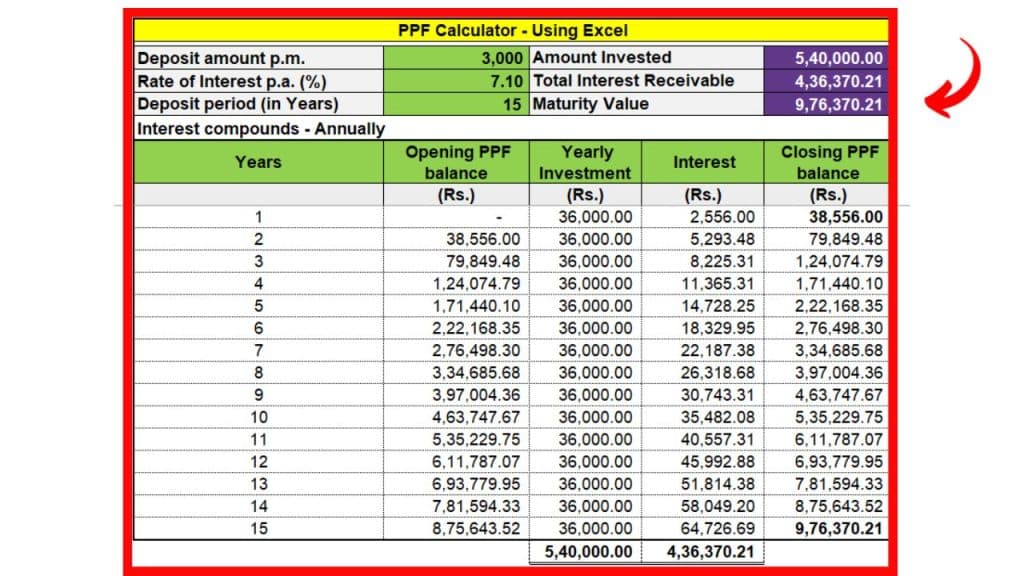

Example 4: When you deposit Rs.3,000 Monthly [Post office PPF Calculator Monthly]

Step 1:

Enter Rs.3,000 rupees in the “Deposit Amount p.m” column.

Step 2:

Now, you just No need to enter any of the other fields like

– Rate of Interest p.a. (%)

– Deposit period (in Years)

– Amount Invested

– Total Interest Receivable

– Maturity Value

Step 3:

Your computation will be Ready 🙂

My Analysis:

| Particulars | Rs. |

| Deposited amount | Rs.3,000/- per Month |

| Amount Invested per year [A] | Rs.540,000/- |

| Total Interest you receive is [B] | Rs.4,36,370/- |

| Total Maturity Value for 15 Years | Rs.9,76,370/- |

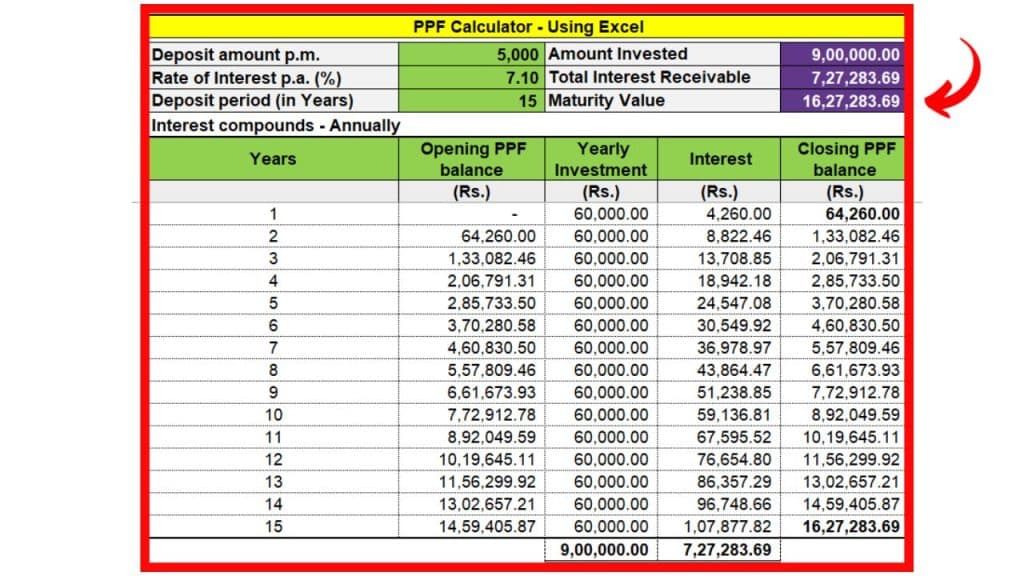

Example 5: When you deposit Rs.5,000 Monthly [Post office PPF Calculator Monthly]

Step 1:

Enter Rs.5,000 rupees in the “Deposit Amount p.m” column.

Step 2:

Now, you just No need to enter any of the other fields like

– Rate of Interest p.a. (%)

– Deposit period (in Years)

– Amount Invested

– Total Interest Receivable

– Maturity Value

Step 3:

Your computation is Ready 🙂

My Analysis:

| Particulars | Rs. |

| Deposited amount | Rs.5,000/- per Month |

| Amount Invested per year [A] | Rs.9,00,000/- |

| Total Interest you receive is [B] | Rs.7,27,283/- |

| Total Maturity Value for 15 Years | Rs.16,27,283/- |

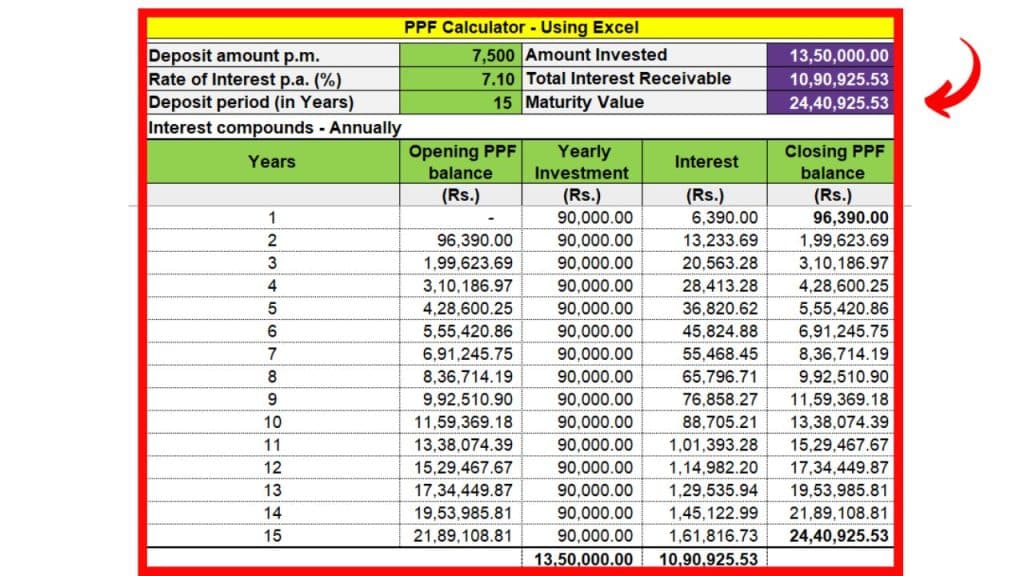

Example 6: When you deposit Rs.7,500 Monthly [Post office PPF Calculator Monthly]

Step 1:

Enter Rs.7,500 rupees in the “Deposit Amount p.m” column.

Step 2:

Now, you just No need to enter any of the other fields like

– Rate of Interest p.a. (%)

– Deposit period (in Years)

– Amount Invested

– Total Interest Receivable

– Maturity Value

Step 3:

Your computation is now Ready 🙂

My Analysis:

| Particulars | Rs. |

| Deposited amount | Rs.7,500/- per Month |

| Amount Invested per year [A] | Rs.13,50,000/- |

| Total Interest you receive is [B] | Rs.10,90,925/- |

| Total Maturity Value for 15 Years | Rs.24,40,925/- |

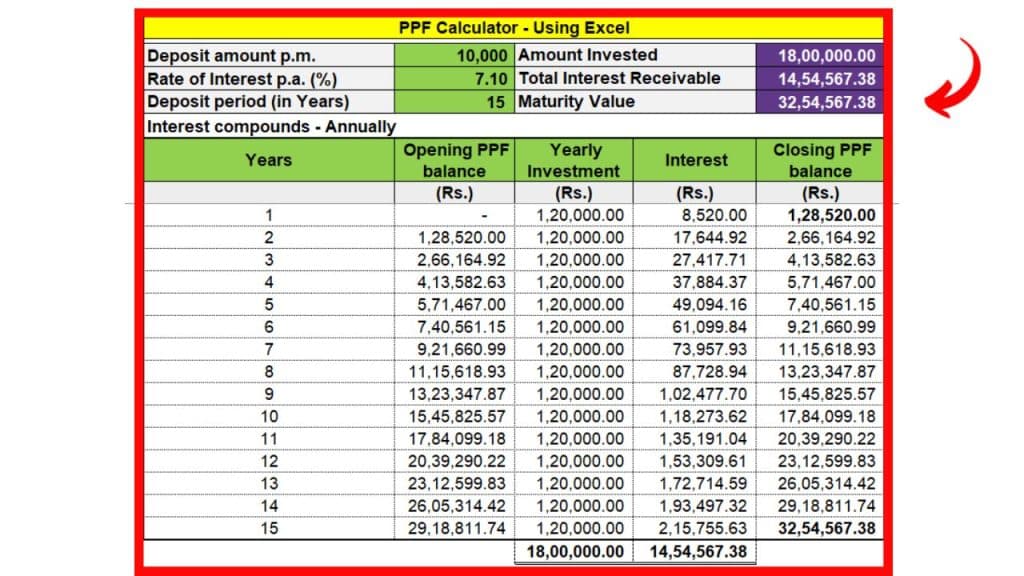

Example 7: When you deposit Rs.10,000 Monthly [Post office PPF Calculator Monthly]

Step 1:

Enter Rs.10,000 rupees in the “Deposit Amount p.m” column.

Step 2:

Now, you just No need to enter any of the other fields like

– Rate of Interest p.a. (%)

– Deposit period (in Years)

– Amount Invested

– Total Interest Receivable

– Maturity Value

Step 3:

Your computation is now Ready 🙂

My Analysis:

| Particulars | Rs. |

| Deposited amount | Rs.10,000/- per Month |

| Amount Invested per year [A] | Rs.18,00,000/- |

| Total Interest you receive is [B] | Rs.14,54,567/- |

| Total Maturity Value for 15 Years | Rs.32,54,567/- |

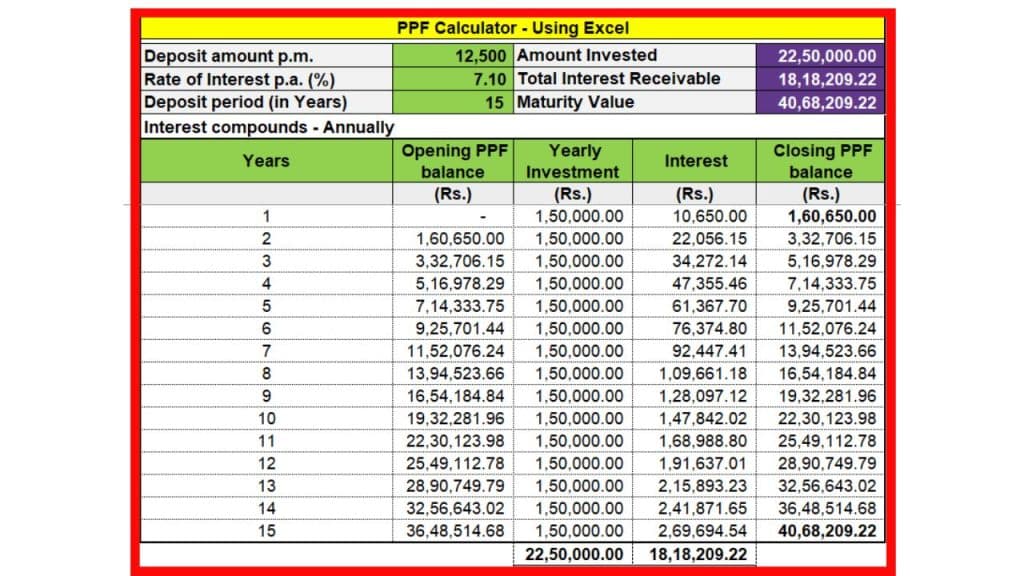

Example 8: When you deposit Rs.12,500 Monthly

Step 1:

Enter Rs.12,500 rupees in the “Deposit Amount p.m” column.

Step 2:

Now, you just No need to enter any of the other fields like

– Rate of Interest p.a. (%)

– Deposit period (in Years)

– Amount Invested

– Total Interest Receivable

– Maturity Value

Step 3:

Your computation is now Ready 🙂

My Analysis:

| Particulars | Rs. |

| Deposited amount | Rs.12,500/- per Month |

| Amount Invested per year [A] | Rs.22,50,000/- per Month |

| Total Interest you receive is [B] | Rs.18,18,209/- |

| Total Maturity Value for 15 Years | Rs.40,68,209/- |

Conclusion

The Public Provident Fund (PPF) Scheme is a good option for the investors who wants invest money in different basket. You can definitely consider the PPF as one of such option as you can earn interest on a Compounding basis.

If you want to earn at least Rs.15,00,000/- from the Post office PPF account, then, you should deposit Rs.5,000 per month for 15 years. Then, you will get Interest of Rs.Rs.7,27,283/- with a Maturity value of Rs.16,27,283/- at the end of 15 years.

If you need Rs.40,00,000/- from PPF account, then, you should deposit Rs.12,500 per month for 15 years. Then, you will get Interest of Rs.Rs.1818209/- with a Maturity value of Rs.40,68,209/- at the end of 15 years.

FAQ’s

1. How much will I get after 15 years in PPF?

If you invest Rs.6,000 per year with an annual Interest rate of 7.10% can earn upto Rs.1.62 Lakhs at the end of 15 Years. In case, If you make a Maximum monthly deposit of Rs.12,500 per month can earn upto Rs.40.68 Lakhs at the end of 15 Years.

2. What if I invest 5,000 per month in PPF?

If you invest Rs.5,000 per month then your Yearly investment is Rs.60,000. With an annual Interest rate is 7.10%, a person can create a corpus of upto Rs.16.27 Lakhs by the end of 15 Years.

3. What is PPF 10000 per month?

If you invest Rs.10,000 per month, then, your Yearly investment will be Rs.1,20,000. With an annual Interest rate is 7.10%, a person can create a corpus of upto Rs.32.54 Lakhs by the end of 15 Years.

4. What is the return of PPF in Post office?

The latest interest rate in Post office for Public Provident Fund (PPF) is 7.10% per annum. PPF account holders can earn interest on a Compounding basis.

5. Post office PPF scheme 15 years calculator ?

The Post Office Public Provident Fund (PPF) Scheme comes with a tenure of 15 Years. If you want to make your own calculations then you can earn from Rs.1.62 Lakhs to Rs.40.68 Lakhs at the end of 15 Years by using a Free excel calculator.

Thanks for your time 🙂