Do you need a Credit card without Income proof ?

Do you want a Credit card without CIBIL or Credit history enquires ?

If yes, then, you should definitely go through IDFC First Wow Credit Card issued by IDFC First Bank.

This IDFC First Bank is a Mumbai based Private Sector Bank which started its operations in October 2015. Both IDFC Bank and Capital First Bank together started the “IDFC First Bank”.

If you are looking for an instant approval with assured Life Time FREE credit card, then, you can apply. Not only that, before you apply for this Credit card, I request you to read this post completely so that you can easily understand about this Credit card.

Without a further ado let’s see What are the Features, Charges and also I will share my Genuine opinion on this Credit card by discussing about its Drawbacks as well.

Let’s get Started..!!

IDFC First Wow Credit Card Overview

| Reward Type | Reward Points |

| Joining Fees | Nil |

| Renewal Fees | Nil |

| Best Suited for | Shopping & Dining |

What Benefits you get from IDFC First Wow Credit Card ?

IDFC First Wow Credit Card Benefits:

Let me go through 8 Top benefits offering of this Credit Card [Incl. My Analysis]

1. Welcome Benefit

As a Welcome benefit, this IDFC First Wow Credit Card holder will get 5% Cashback upto Rs.1,000/- on their First EMI transaction done within 90 days of issuance of the card.

My Analysis

This feature might be helpful if you convert you Big purchases made on this IDFC First Wow Credit Card into EMI’s but don’t be enthusiastic to spend for the sake of Cashbacks.

2. Fuel Benefit

Fuel Surcharge Waiver

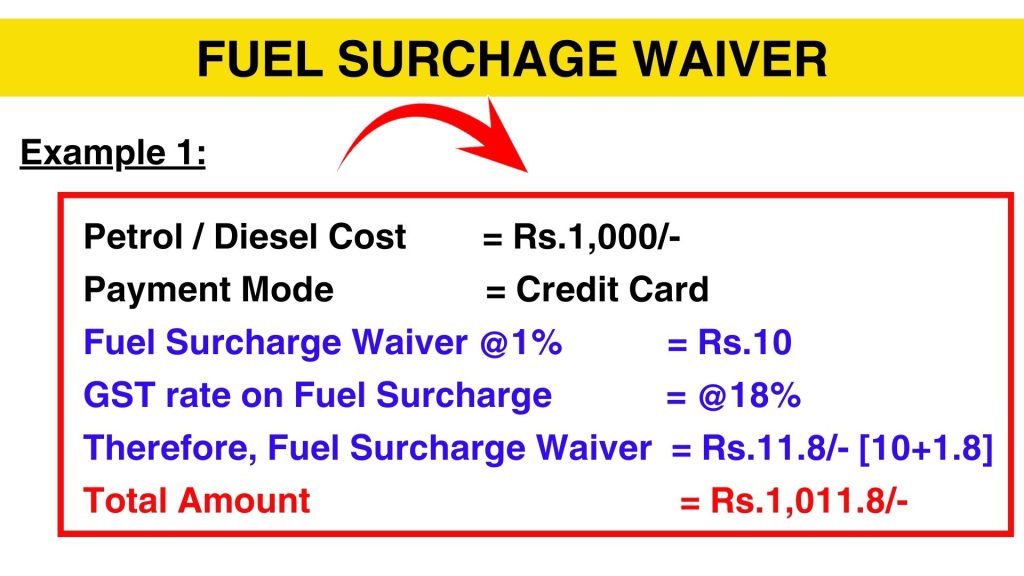

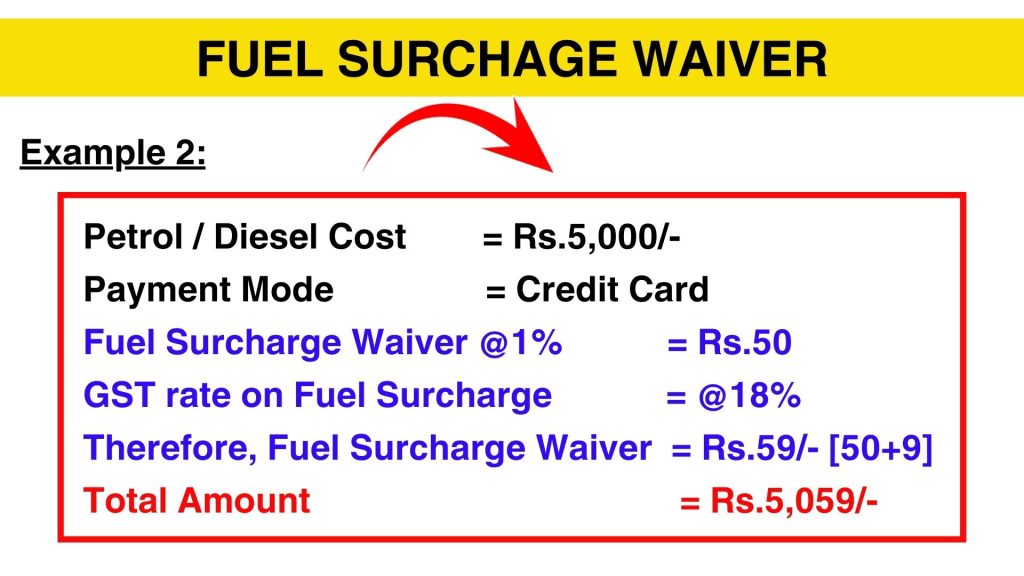

By using this Credit Card If you spend on Petrol/Diesel between in any fuel stations, then, a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost. In case you paid it through this card, you will be eligible for 1% of Fuel Surcharge Waiver.

With this IDFC First Wow Credit Card, you will get a Fuel Surcharge Waiver upto a Maximum of Rs.200/- per month.

Let me clarify you about Fuel Surcharge Waiver with 2 Examples.

I really don’t understand why Credit card companies are highlighting Fuel Surcharge Waiver..!! This is not even a Nominal benefit to the Card user because you have to pay it only if you use this Credit card. Normally if you pay it in cash there will be No such Surcharges at all.

Also Read: How I lost Money by Paying Petrol Bills with Credit Cards

3. Dining and Health

If you spend by using IDFC First Wow Credit Card, you can enjoy 20% discount at more than 1500+ restaurants and also you can also get up to 15% discount on Health and Wellness over 3000 outlets.

4. Reward Benefits

You can earn 4 reward points both on Online and Offline spends, UPI Spending. These reward points comes with no expiry date. You will get 1 reward point on every Rs.100/- rupees spends.

Here, 1 Reward Point = Rs. 0.25/- paisa.

5. Zero Forex markup fees

The IDFC first wow credit card comes with Zero Foreign Markup fees.

If you pay for any International transactions simply zero charges are applicable on international transactions done using this IDFC credit card. It’s really an advantage since the other credit card companies usually charge between 1.00%-3.50% as a foreign markup fees on all international transactions.

6. Insurance benefits

The IDFC First Wow Credit Card also provides a Personal Accident Cover benefit to their Card holders and it’s coverage is up to Rs. 2,00,000/-.

The following insurance benefits are offered by IDFC First Wow credit card.

| Personal Accident | Rs.2,00,000/- |

| Card Liability cover | Rs.25,000/- |

| Credit Shield cover | Rs.25,000/- |

| Purchase protection | Rs.25,000/- |

7. Roadside Assistance

With this IDFC First Wow Credit Card, you will get 4 Complimentary Roadside assistance worth of Rs.1,399/- included with the benefits of Towing of Vehicle, Alternate Battery, Tyre change, Breakdown support, Taxi benefit, Arrangement of Fuel and a lot more.

8. Can I convert any Transaction into EMI ?

By using with this Credit Card, which transactions can be converted into EMI?

If you use this credit card and do any transaction above Rs.2,500/- rupees, then, you can convert those transactions into EMI through the Mobile app itself.

EMI option is applicable for Online transactions only but not applicable on Jewellery purchases.

How to Apply

IDFC Wow Credit Card Apply:

If you want this IDFC First Wow Credit Card, then, You can apply.

Who are Eligible for this Card?

IDFC First Wow Credit Card Eligibility:

Individuals

– Aged 18 years old

– Must be Indian resident

– The applicant of this card must have a Fixed deposit of Rs.5,000/- in his or her name with the IDFC first bank are eligible to apply for this card.

IDFC First Wow Credit Card Charges [Must Read]

1. Cash Withdrawal charges

One of the major benefit of using this IDFC First Wow Credit Card, is that “Interest Free Cash Withdrawal“. Read this point little carefully My dear Friends.

“Interest Free Cash Withdrawal” means no interest will be charged up to 48 days if you withdraw Cash anywhere either in Domestic or in International ATM’s. But you need to pay Cash Advance Fee of Rs.250/- per transaction excluding GST.

If for any reason whatsoever you are unable to pay the withdrawn amount within 48 days, you will have to pay huge interest. That is also covered in this article, so Keep on reading till the end.

2. Joining & Renewal Fees

This IDFC First Wow Credit Card comes with Zero Joining fees and Zero Renewal Fees.

3. Interest charges / Finance Charges ?

IDFC First Wow Credit Card Interest rate :

You have used this IDFC First Wow Credit Card and bought all the stuff as per your needs. But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the IDFC First bank will charge you Interest between @0.75% – @3.50% per month. It means, the Annual interest is almost 9% – 42% per annum.

4. Late payment charges

Apart from Interest charges, if you delay paying this Credit card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, even if you delay IDFC Credit Card payment by one day, IDFC bank will charge almost 15% on the Due amount of your credit card. The Late payment charges ranges from Minimum Rs.100/- rupees to Maximum Rs. 1,300/-.

So if you use credit card you have to be very organized and should deal with Credit card timelines properly.

5. Over the limit charges

You might not have heard about these charges earlier. Let check it out.

If you spend more than available limit on this idfc first credit card. That means you have over used your Credit card. Then, you will be charged with “Over The Limit charges”.

The more you spend than your Credit card limit, the more you will be charged i.e. @2.50% on the overdrawn amount. The Minimum amount will be charged starts from Rs.550/- rupees.

IDFC First Wow Credit Card Review

People who are looking for a No joining and renewal fees & also who needs 1 Credit card without worrying of CIBIL score or Credit history. Then, IDFC First Wow Credit Card is a must have credit card to them whether you are a Student, Traveller, First jobber, Self-Employed, Home Maker, Senior Citizen, NRI, you can apply for this credit card even though you have no credit history.

This credit card has no movie ticket offer, has no lounge benefit but If you want a FREE credit card for your personal use, then, you can apply.

Thanks for your time 🙂