Sukanya Samriddhi Yojana Post Office :

Do you have a Girl child?

Are you worrying about her Higher education and Marriage?

In India, Education and Marriage becomes the costliest matters. In case, if you are worrying to save money to make these things smoother for your Girl child. Then, you should read this post completely.

The Central Government as part of ‘Beti Bachao, Beti Padao‘ campaign had introduced a Welfare scheme for the Girl Child i.e. Sukanya Samriddhi Yojana (SSY).

Let’s discuss in this post, What are the advantages a girl will get..!

Will this scheme really cover Girl’s education and marriage ?

And also how much money you can save in this Sukanya Samriddhi Yojana Post Office scheme ?

Let’s get Started..!!

1. Who can Join in Sukanya Samriddhi Yojana Post office account?

Sukanya Samriddhi Yojana Age:

If your daughter is under 10 years of age, then, the Parents / Guardian can open this Sukanya Samriddhi Yojana account in the name of either your Daughter or Parents or in the name of Guardians.

You can open this account either in Post office or in the Authorized banks. It is to be noted that a Maximum two girls in a family have a chance to open this account. More than two accounts can be allowed only if twins / triplets are born.

2. Who will Maintain Sukanya Samriddhi Yojana A/c ?

Sukanya samriddhi Yojana Post office account will be operated by the Guardian / Parents till the girl child attends the age of majority i.e. till 18 years age.

3. How much Money can be Deposited in Sukanya Samriddhi Yojana?

Sukanya Samriddhi Yojana Deposit Limit :

You can open a Sukanya samriddhi Yojana Post office account with a Minimum deposit of Rs.250/- only in a Financial Year and the Maximum deposit you can make in a Financial year is up to Rs.1,50,000/-.

All the deposit shall be made in the multiples of Rs.50/- rupees only. And this amount can either be deposited in Lumpsum or in Instalments.

4. How long I should deposit money in Sukanya Samriddhi Yojana ?

Sukanya Samriddhi Yojana Time period :

Once you open a Sukanya Samruddhi Yojana account, you should make deposits up to 15 completed years from the year of account opening.

5. No Money to Deposit ?

I lost my job & I couldn’t deposit money into Sukanya Samriddhi Yojana, What will happen now ?

If for any reason, you are unable to deposit the Minimum deposit of Rs.250/- in any financial year, then, your account will be considered as a Default account.

If you want to continue the defaulted account again, you can continue your account by paying an Annual Minimum deposit of Rs.250/- as well as the Default fees of Rs.50/- for as many years as you have defaulted.

So, once you opened the Sukanya Samriddhi Yojana Post Office account, you should make time-to-time deposits till the Maximum 15 years are completed. Simply, you should continue making deposits upto 15 years period.

Also Read: Mahila Samman Saving Certificate 2023 [Complete guide]

6. Sukanya Samriddhi Yojana Interest rate

The Interest rates in Sukanya Samriddhi Yojana Post office is decided by the Ministry of Finance on Quarterly basis. From 1st Jan, 2024, the Post office is offering 8.20% interest on Sukanya Samriddhi Yojana account.

This interest under this scheme is calculated by the post office on annually on a compounding basis. Therefore, under Sukanya Samriddhi Yojana, you can earn Compounding interest.

The Interest earned will be Credited to your account at the end of each year i.e. by 31st March of every year at the rate of interest offered under Sukanya samriddhi Yojana.

7. How long I should deposit money in Sukanya samriddhi Yojana?

Sukanya Samriddhi Yojana Maturity :

Once you open the Sukanya Samriddhi Yojana Post Office account, you should continue deposits till 15 completed years. And you should wait for the Maturity amount till the 21 years from the year of account opening. Even during this gap, Compounding interest will be paid on your account balance .

8. Withdraw rules

I cannot wait for 21 Years, Can I withdraw Money before ?

If you want to Withdraw money from this Sukanya Samriddhi Yojana Post office account, then, your daughter should have completed 18 years of age or else she has qualified 10th standard, then only you have a chance to withdraw money.

Can I withdraw 100% of Money?

You have a chance to withdraw only 50% balance in your Sukanya Samriddhi Yojana account and that too it will be calculated on Previous year balance.

9. Sukanya Samriddhi Yojana Tax benefit

As per Section 80C of Income Tax Act,1961, you can claim deduction on the amounts deposited under Sukanya Samriddhi Yojana Post office Account.

It is to be noted that in a financial year, you can claim Maximum amount of Rs.1,50,000/- only as a deduction inclusive of all your other deductions under Section 80C.

10. Premature Closure

Your Sukanya Samriddh Yojana Post office account can be closed before Maturity period. i.e. Premature closure. It will be allowed only on the Death of the account holder / Girl child but in this case, the Post office Savings account interest rates will be applicable.

11. Sukanya Samriddhi Yojana Calculator [With Examples]

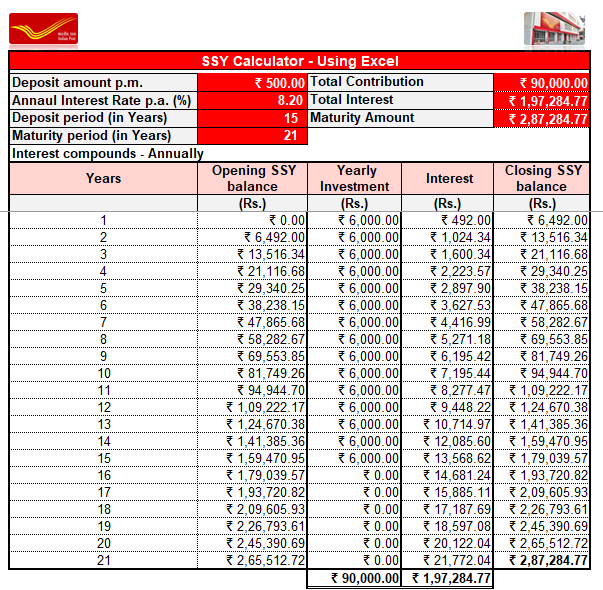

Example 1: Sukanya Samriddhi Yojana Calculator

Sukanya Samriddhi Yojana 500 per month

If you deposit Rs.500/- per month in Sukanya Samriddhi Yojana Post Office account, then, your Total deposits for a period of 15 years is Rs.90,000/-. i.e. your Total Investment.

Then, you will get interest @8.20% i,e. Rs.1,97,284/- and you will get the Maturity amount of Rs.2,87,284/-

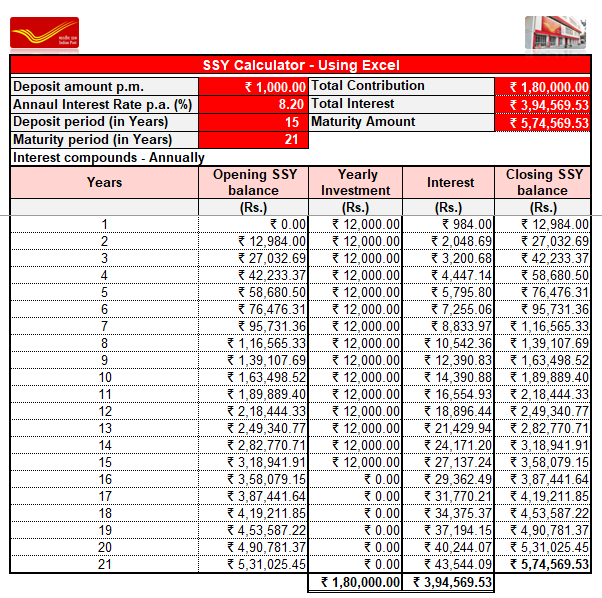

Example 2: Sukanya Samriddhi Yojana Calculator

Sukanya Samriddhi Yojana 1000 per month

If you deposit Rs.1,000/- per month in Sukanya Samriddhi Yojana Post Office account, then, your Total deposits for a period of 15 years is Rs.1,80,000/-. i.e. your Total Investment.

Then, you will get interest @8.20% i,e. Rs.3,94,569/- and you will get the Maturity amount of Rs.5,74,569/-

Example 3: Sukanya Samriddhi Yojana Calculator

Sukanya Samriddhi Yojana 12500 per month

If you deposit Rs.12,500/- per month in Sukanya Samriddhi Yojana Post Office account, then, your Total deposits for a period of 15 years is Rs.22,50,000/-. i.e. your Total Investment.

Then, you will get interest @8.20% i,e. Rs.49,32,119/- and you will get the Maturity amount of Rs.71,82,119/-

12. Frequently Asked Questions [FAQ’s]

1. Is Sukanya Samriddhi Yojana One time investment ?

A Minimum deposit of Rs.250/- is required to open this Sukanya Samriddhi Post office account and Maximum Rs.1,50,000/- per financial year is allowed. You should continue making deposits into this account for a period of 15 years from the year of account opening.

2. Maturity of Sukanya Samriddhi Yojana ?

Once you have opened Sukanya Samriddhi Yojana Post office account, you should continue deposits till 15 completed years. But you should wait for the Maturity amount till 21 years from the year of account opening. Even during this gap, on your account balance Compounding interest will be paid.

3. Maximum age for Sukanya Samriddhi Yojana Post office account ?

A Girl child aged below 10 years only eligible to open Sukanya Samriddhi Yojana Post office account in the name of either your Daughter or Parents or in the name of Guardians.

4. Maximum deposit in Sukanya Samriddhi Yojana ?

You can open a Sukanya samriddhi Yojana account with a Minimum deposit of Rs.250/- only in a Financial Year and the Maximum deposit you can make in a Financial year is up to Rs.1,50,000/-.

5. SBI Sukanya Samriddhi Yojana?

Sukanya Samriddhi Yojana account can be opened in SBI with an Initial deposit of Rs.250/- and with a Maximum ceiling limit of Rs.1,50,000/- per Finacial Year to promote the welfare of Girl Child. Interest will be paid on Compounded annually with an option for Monthly interest pay outs.

6. Sukanya Samriddhi Yojana Documents?

1. Birth Certificate of your Girl child.

2. Identity proof and Address proof of Parents / Guardian

3. Other KYC documents like Voter ID, Aadhar Card, PAN etc

7. Sukanya Samriddhi Yojana Online apply ?

sukanya samriddhi yojana Post office account can be opened in Post office or in authorised banks by submitting the relevant documents along with the deposit amount between Rs.250 to Rs.1,50,000/-

8. Sukanya samriddhi Yojana for NRI ?

NRI’s are not eligible to open sukanya samriddhi yojana account for their girl child aged below 10 years. As per the Post office, only resident Indians at the time of account opening and remains the citizen till the maturity of the account is eligible.

9. Axis Bank Sukanya Samriddhi Yojana ?

Step 1: You should fill “Sukanya Samriddhi Registration Form“

Step 2: Submit the relevant documents

– Birth certificate of the girl child is must

Step 3: Photograph of the Parent / Guardian of Girl child

Step 4: Pay your deposit amount (Anywhere between Rs.250 to Rs.1,50,000/-)

Step 5: Sukanya Samriddhi Yojana account will be created.

10. Bank of Baroda Sukanya Samriddhi Yojana ?

Step 1: You should fill “Sukanya Samriddhi Registration Form“

Step 2: Submit the relevant documents

– Birth certificate of the girl child

– ID proof of the depositor

– Residential proof of the depositor

– Stamp sized photos

Step 3: Pay your deposit amount (Anywhere between Rs.250 to Rs.1,50,000/-)

Step 4: Sukanya Samriddhi Yojana account will be created.

11. BOI Sukanya Samriddhi Yojana

An individual can open for maximum 2 daughters under Sukanya Samriddhi Yojana who aged below 10 years.

Step 1: You should fill “SSY Account” opening Form

Step 2: Submit the Proof of address and Identification documents

– PAN

– Addhar / Driving licence, Voter ID card etc

with Child and Parents /Guardian Passport Photographs.

Step 3: Pay your deposit amount (Anywhere between Rs.250 to Rs.1,50,000/-)

Step 4: Sukanya Samriddhi Yojana account will be created.

12. HDFC Sukanya Samriddhi Yojana

Step 1: You should fill “SSY Account” opening Form

Step 2: Submit the relevant documents with Child and Parents /Guardian Passport Photographs

Step 3: Pay your deposit amount (Anywhere between Rs.250 to Rs.1,50,000/-)

Step 4: Sukanya Samriddhi Yojana account will be created.

Thanks for your time 🙂