How to save capital gain tax on sale of residential property?

Introduction

Before going on how to save capital gain tax on sale of residential property in India, let us understand why we need to pay tax even when we sell our own property.

To understand this, first we need to have some basic knowledge about the capital gains. In simple words, capital gain is nothing but the gain arising from transfer of a capital asset. Such gain can be either Long term gain or Short term gain depending on the period of holding of such asset.

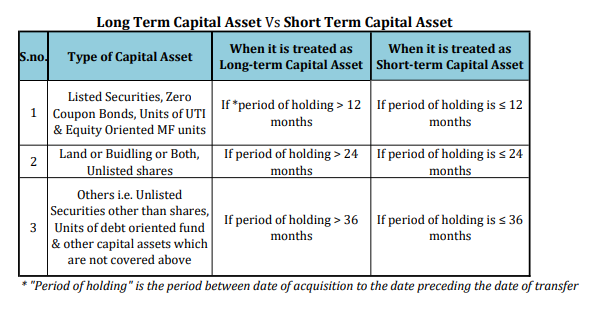

Criteria for determining the nature of gain (i.e. Long-term or Short-term) depends on the type of capital asset you are holding. Here is the quick glimpse:

For immovable property (I.e. Land or Building or both), if the period of holding is more than 24 months and if any gain arised on transfer of such asset, then such gain is called as “Long term Capital Gainâ€.

Contrary to this, i.e. If the period of holding is less than or equal to 24 months and if any gain raised on transfer of such asset, then such gain is called as “Short term capital gainâ€.

Example: Mr. X acquired a flat in Mumbai on 3.5.2018 for Rs. 45 Lakh, used for quite sometime and sold it on 9.7.2020 for Rs. 52 Lakh. (Assuming there is no cost of improvement & expenses on transfer). In this transaction, there was a gain of Rs. 7 lakh (i.e. Rs. 52 lakh – Rs. 45 lakh) to Mr.X. In normal terminology we call it as profit, but in Income Tax terminology it is called as “Capital Gain†& to be more precise it is called as “Long Term Capital Gain†(Since it is a Capital asset, held for more than 24 months & gain arised on sale)

Now in the above instance, Let’s assume Mr. X has sold his flat on 26.7.2019 for Rs. 52 lakh. In such case also, there was a capital gain but it is called as “Short term capital gain†as the period of holding is less than 24 months (From 3.5.2018 to 25.7.2019).

Hope you got some basic idea about the capital gains. Now we will discuss about the taxability of capital gains and methods to save capital gain tax on sale of residential property.

Capital Gain Tax on sale of Residential Property

In case of Long term capital gains

Long term capital gains (LTCG) will be taxable @20% as per Sec 112 of Income Tax Act. And, there are few things needs to be considered while computing the tax on long term capital gains. Those are:

1. No Chapter VI-A deductions available against LTCG. That means you cannot reduce your tax liability by making savings/investment under sec 80C to 80U

2. Resident Individuals or HUF can avail Un-exhausted Basic Exemption limit

3. While computing total tax liability, incomes chargeable at special rates of tax have to be separated from normal income and tax shall be computed separately for normal and special incomes at their respective rates.

In case of Short term capital gains

Short term capital gains will be taxable as per your tax slab rates.

How to save capital gain tax on sale of residential property in India

Now, we will discuss the multiple options on how to save capital gain tax on sale of residential house property in India.

Unfortunately, there are no exemptions available for Short term capital gains but there are few exemptions for Long term capital gains arising on sale of residential house property.

Given below are the list of exemptions for LTCG:

1. Sec 54 – Investment in one or two residential houses

2. Sec 54EC – Investment in NHAI/RECL bonds or notified bonds

3. Sec 54GB – Investment in equity shares of an eligible start-up

I. Sec 54 of Income Tax Act – Investment in one or two residential houses

Eligibility

Individual & HUF

Conditions for exemption

One can claim exemption under this section only if the following conditions are satisfied:

1. There should be transfer of residential house and

2. Such house is a long term capital asset (i.e. period of holding is more than 24 months)

That means, gain should be Long term capital gain from transfer of residential house.

Before going further, you need to ensure that the above conditions are satisfied to claim exemption under this section.

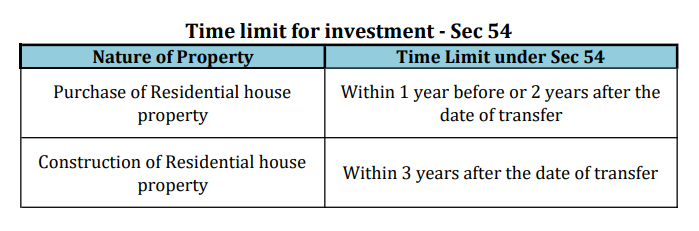

Time limit for investment

Sec 54 grants the exemption if you invest (either construction or acquisition) the long term capital gain arised from sale of residential property in residential houses in India within the time period mentioned below.

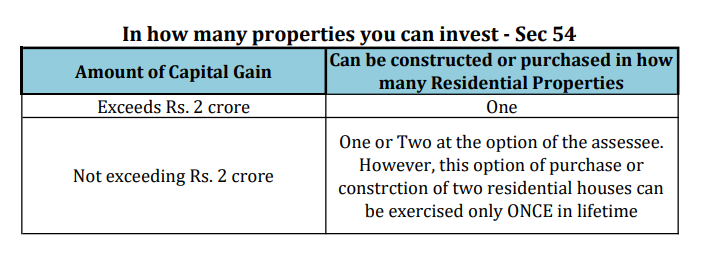

You can invest in how many properties?

Further depending on the amount of capital gain, you will have an option to invest in more than one residential house property which is summarised below:

Amount of exemption under Sec 54

In such case, the amount of Long Term Capital Gain or Cost of new residential house whichever is lower is exempted under this section.

Lock-in Period

But do remember, you need to hold the new residential property at least 3 years from the date of its acquisition or construction before you transfer.

Consequences for violation

If newly acquired residential property is transferred before 3 years from the date of acquisition or construction, previously exempted capital gains will be now taxable during the year of such transfer. It means while computing the capital gain for the new residential property, cost of new residential property will be reduced by capital gains exempted earlier.

II. Sec 54EC of Income Tax Act – Investment in NHAI/RECL bonds or notified bonds

Eligibility

Any assessee

Conditions for exemption

1. There should be transfer of Long term capital asset of Land or Building or both

2. Long term capital gain should be invested in NHAI bonds or RECL bonds or any other bonds notified by CG

Time limit for investment

Invested within 6 months from the date of transfer

Amount of exemption under Sec 54EC

Capital gain or amount invested in the above bonds whichever is lower is allowed as exemption. But upper ceiling limit for investment under sec 54EC is Rs. 50 lakh.

Lock-in Period

Assessee should not transfer or convert or avail loan or advance on the basis of the above bonds for a period of 5 years from the date of acquisition of such bonds.

Consequences for violation

If assessee transfers or converts or avail loan or advance on the basis of the above bonds before 5 years from the date of acquisition of such bonds, long term capital gain exempted earlier will be taxed in the year of such violation.

III. Sec 54GB of Income Tax Act – Investment in equity shares of an eligible start-up

Eligibility

Individual or HUF

Eligible asset

Equity shares of an eligible start-up company

Unlike the above two sections, exemption under this section is available only if you invest in equity shares of an eligible start-up company.

Conditions to be satisfied

1. Company should be an eligible start-up which is engaged in eligible business & has to be incorporated in the same financial year in which transfer of residential house property takes place or in the next financial year but before due date u/s 139(1) &

2. Assessee should subscribe for more than 25% of share capital before the due date u/s 139(1) from the net consideration from the sale of residential house property &

3. Such company shall purchase new Plant & Machinery (i.e. P&M) within 1 year from the date of subscription out of the proceeds of the subscription amount of share capital received from the assessee.

Amount of exemption under Sec 54GB

If you invest entire net consideration in P&M then entire capital gain is exempted.

Instead, if you invested only part of net consideration in new P&M then proportionate capital gain (LTCG * Amount invested in new P&M / Net Consideration) only is exempted.

Key point: Exemption under this section would be available for transfer of residential property up to 31st March, 2021 I.e. FY 2020-21.

Lock-in period

Neither equity shares of the company acquired by assessee (i.e. Individual or HUF) nor new P&M acquired by the company should be transferred within 5 years from the date of acquisition.

However, for a technology driven start-up company the above mentioned lock-in period is only 3 years from the date of acquisition, provided the new asset acquired is a computer or computer software.

Consequences for Violation

If assessee violates the conditions mentioned in the lock-in period above, entire capital gain exempted earlier under this section shall be chargeable to tax in the year of transfer of such shares or P&M.

(Disclaimer: All the content in the article is for general information only. Any suggestion or advice by the author should not be construed as legal opinion)

1 thought on “How to Save capital gain Tax on sale of Residential property?”