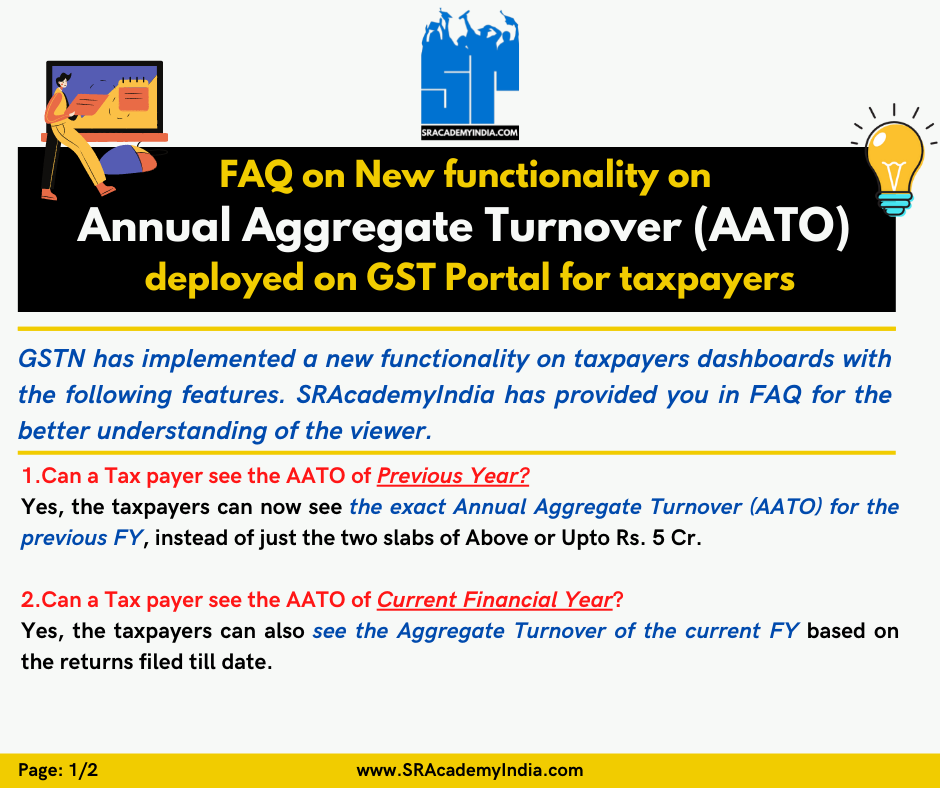

FAQ on New functionality on Annual Aggregate Turnover (AATO) deployed on GST Portal for taxpayers

GSTN has implemented a new functionality on taxpayers dashboards with the following features. SRAcademyIndia provided you in FAQ for the better understanding of the viewer.

1.Can a Tax payer see the AATO of Previous Year?

Yes. Tthe taxpayers can now see the exact Annual Aggregate Turnover (AATO) for the previous FY, instead of just the two slabs of Above or Upto Rs. 5 Cr.

2.Can a Tax payer see the AATO of Current Financial Year?

Yes. The taxpayers can also see the Aggregate Turnover of the current FY based on the returns filed till date.

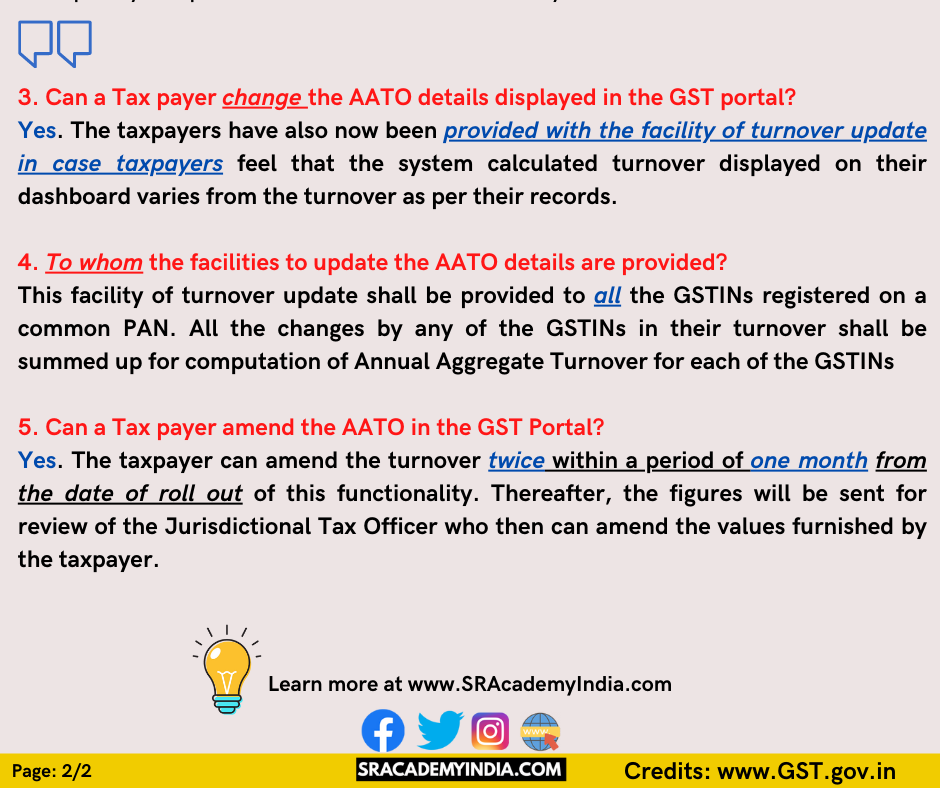

3. Can a Tax payer change the AATO details displayed in the GST portal?

Yes. The taxpayers have also now been provided with the facility of turnover update in case taxpayers feel that the system calculated turnover displayed on their dashboard varies from the turnover as per their records.

4. To whom the facilities to update the AATO details are provided?

This facility of turnover update shall be provided to all the GSTINs registered on a common PAN. All the changes by any of the GSTINs in their turnover shall be summed up for computation of Annual Aggregate Turnover for each of the GSTINs

5. Can a Tax payer amend the AATO in the GST Portal?

Yes. The taxpayer can amend the turnover twice within a period of one month from the date of roll out of this functionality. Thereafter, the figures will be sent for review of the Jurisdictional Tax Officer who then can amend the values furnished by the taxpayer.