Introduction

Life insurance policies play a major role in everyone’s life. It gives dual benefits such as Life security as well as Tax benefits under Income Tax Act.

But, the recent Budget 2023 has changed some of the conditions relating to the exemption of life insurance proceeds on maturity.

In this article, let’s find out how this change impacts the taxability of these policies in the hands of taxpayers.

Current position

With respect to Life Insurance policies, there are 2 sections in the Income Tax Act which will provide some benefits to taxpayers.

One is section 80C, which deals with the deduction for Life Insurance policy premium

And the second one is section 10(10D), which deals with tax exemption to Life Insurance policy proceeds. Currently, such exemption is available only if the premium paid shall not exceed 10% of the sum assured.

What has changed in Budget 2023

Sec 80C: There is NO change in the deduction that can be claimed for the policy premium.

Sec 10(10D): But, regarding the exemption of policy proceeds upon maturity, another condition is added, effective from 1.4.2023.

What happens from 1.4.2023

W.e.f. 1.4.2023, the taxability of the maturity proceeds (including bonus) will be as follows:

Any Life Insurance policy (other than ULIP) which is issued

(i) on or after 1.4.2023 &

(ii) annual premium or aggregate of such premium is NOT more than 5 lakh (in any FY during the tenure of the policy) & also such premium is NOT more than 10% of the sum assured

then only proceeds from such policy will be exempted in the hands of the recipient.

Otherwise, such proceeds are taxable under “Income from Other sources” and tax should be charged as per the applicable slab rates.

An exception is when such proceeds are received by the nominee or legal heir upon the insured’s death.

Practical Understanding

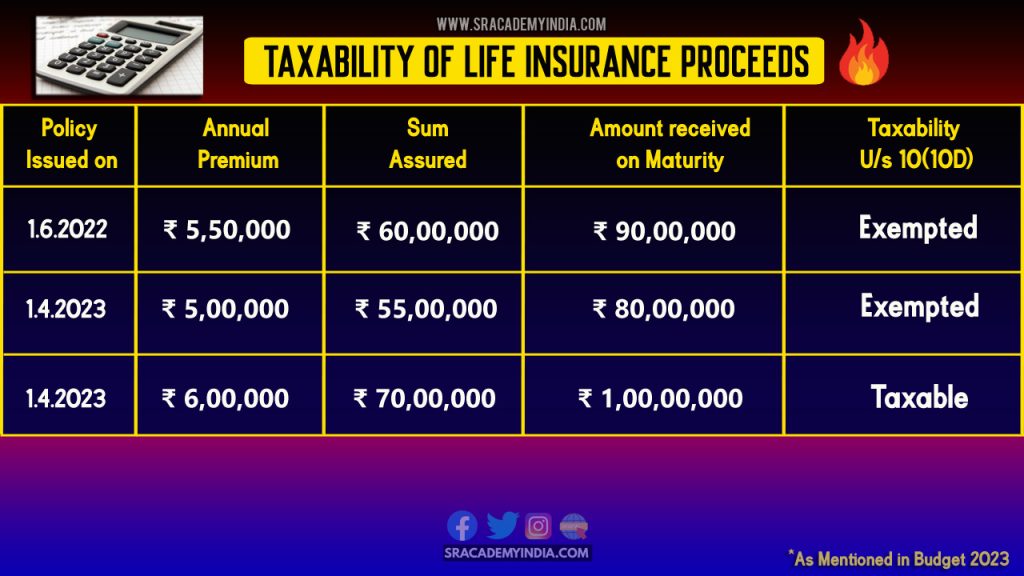

Let’s understand it with the help of some examples:

Scenario 1:

Reason for exemption – Since the policy was issued on or before 1.4.2023, even though the annual premium is more than Rs. 5 Lakh, maturity proceeds of Rs. 90 lakhs are exempted

Scenario 2:

Reason for exemption – Though the policy was issued on 1.4.2023, the annual premium is not more than Rs. 5 Lakh and hence maturity proceeds of Rs. 80 lakhs are exempted

Scenario 3:

Reason for taxability – Since the policy was issued on 1.4.2023 and the annual premium is more than Rs. 5 Lakh, maturity proceeds of Rs. 1 crore is taxable.

Conclusion

Hence, please keep these points in mind whenever you are planning to take life insurance policies. And make sure to satisfy the conditions discussed above to get full tax exemption of the proceeds.

So, if you are planning to buy extensive life insurance policies make sure to buy them before this 31st March 2023.