Introduction

In this article, let’s understand how to claim the income tax deduction in sec 80GG of the Income Tax Act for the house rent paid by the individual taxpayers.

For many of us, rental expenditure is one of the common expenditure in our monthly budget. If you are an employee and HRA component exists in your pay structure, rental expense can be claimed as an exemption under sec 10(13A) of Income tax act.

Instead, if you do not have HRA component in the pay structure then deduction for such rental expenditure has to be claimed under sec 80GG of Income Tax Act only.

So, let’s go through the provisions relating to sec 80GG and also understand how to file Form-10BA (Income tax form for claiming sec 80GG deduction) on the Income Tax Portal.

Who can claim a deduction under sec 80GG

This deduction is available only to the

- Self-employed individuals and

- Employees who do not have HRA component in their salary structure.

Points to be noted before claiming deduction under sec 80GG

1. HRA exemption under sec 10(13A) and 80GG Deduction cannot be claimed simultaneously

2. No rent – No deduction

3. 80GG deduction is not available under New tax regime

Conditions for sec 80GG

- Individuals should not claim HRA exemption u/s 10(13A)

- Individual or his/her spouse, or minor child should not have residential house property where the individual is staying or working.

- Having a house property in any other place? – Such house property should not be claimed as a self-occupied property in ITR.

All the above 3 conditions should be satisfied in order to claim deduction under 80GG. Upon satisfying the conditions, deduction under sec 80GG will be least of the following.

80GG Deduction Limit

Then deduction under this section will be least of the following:

- Rs. 5000 per month

- 25% of Adjusted Total Income

- Rent paid over 10% of Adjusted Total Income (i.e. Rent – 10% of ATI)

Adjusted Total Income is “Gross Total Income – LTCG – STCG under sec 111A – Deductions from sec 80C to 80U (except sec 80GG deduction)

Lower component from the above calculation will be allowed as deduction under sec 80GG.

Which Form for sec 80GG

One needs to file Form-10BA to claim deduction under sec 80GG and this form should be filed before filing your ITR.

Now, let’s understand the step-by-step process of filing Form-10BA online on the Income Tax Portal.

How to file Form-10BA online

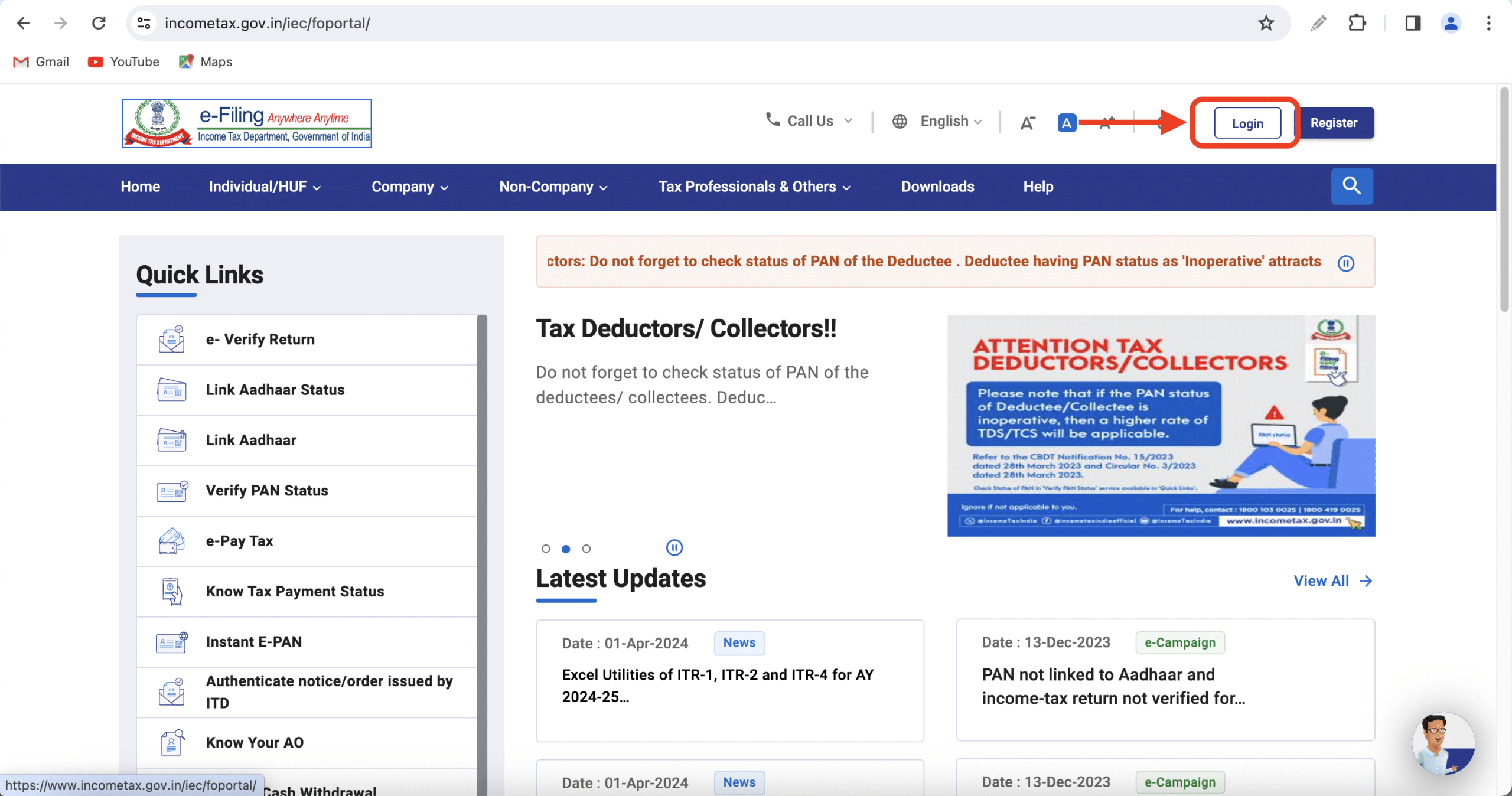

Step 1: Go to incometax.gov.in & login with your income tax credentials

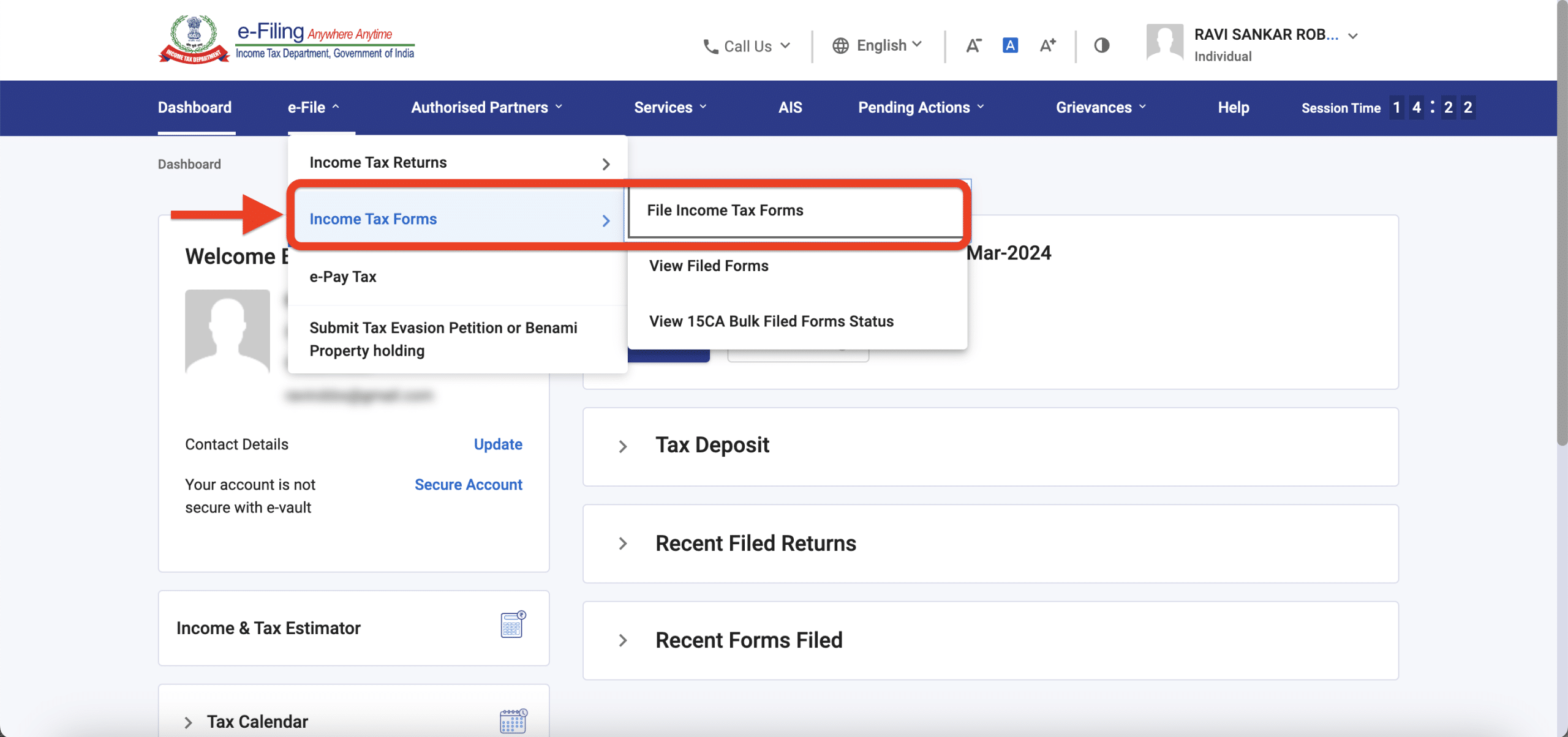

Step 2: Go to e-file –> Income Tax Forms –> File Income Tax forms

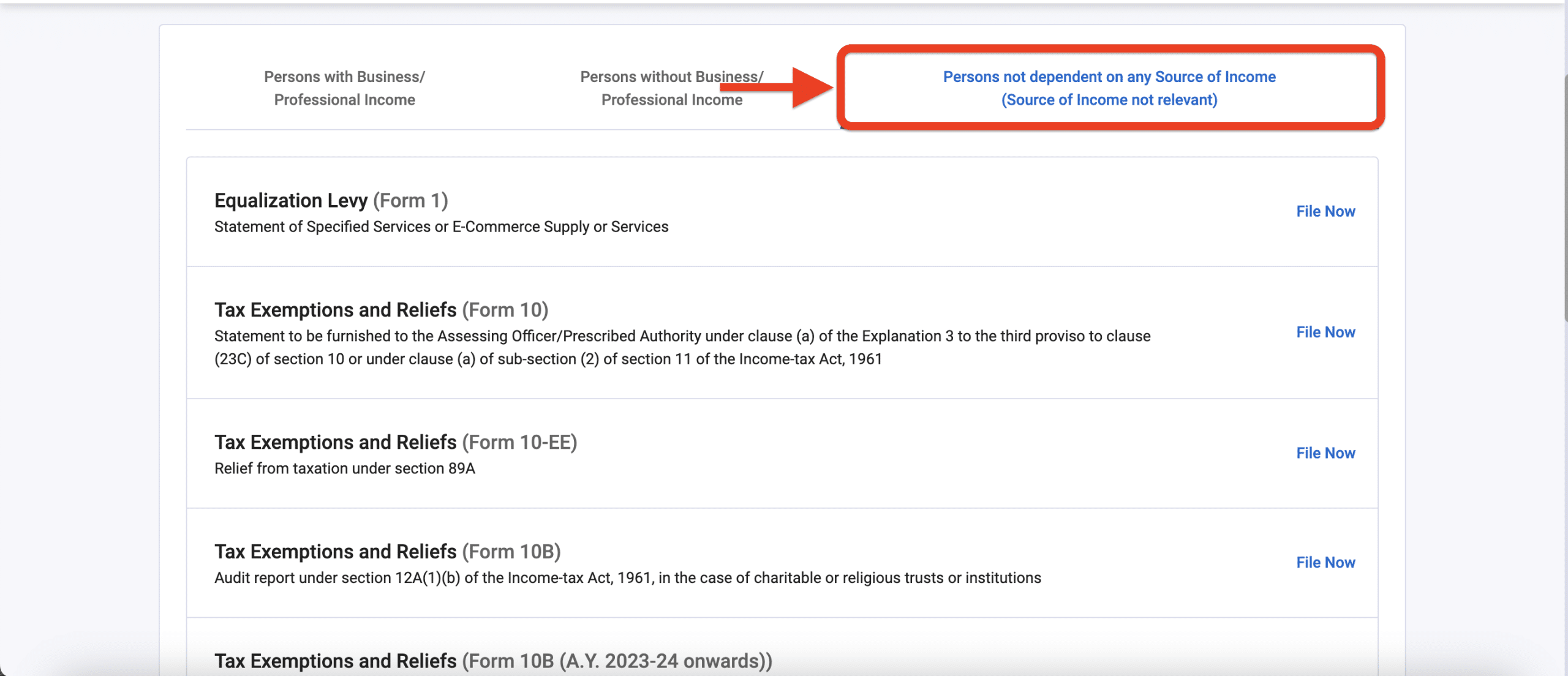

Step 3: Go to tab “Persons not dependent on any source of income”

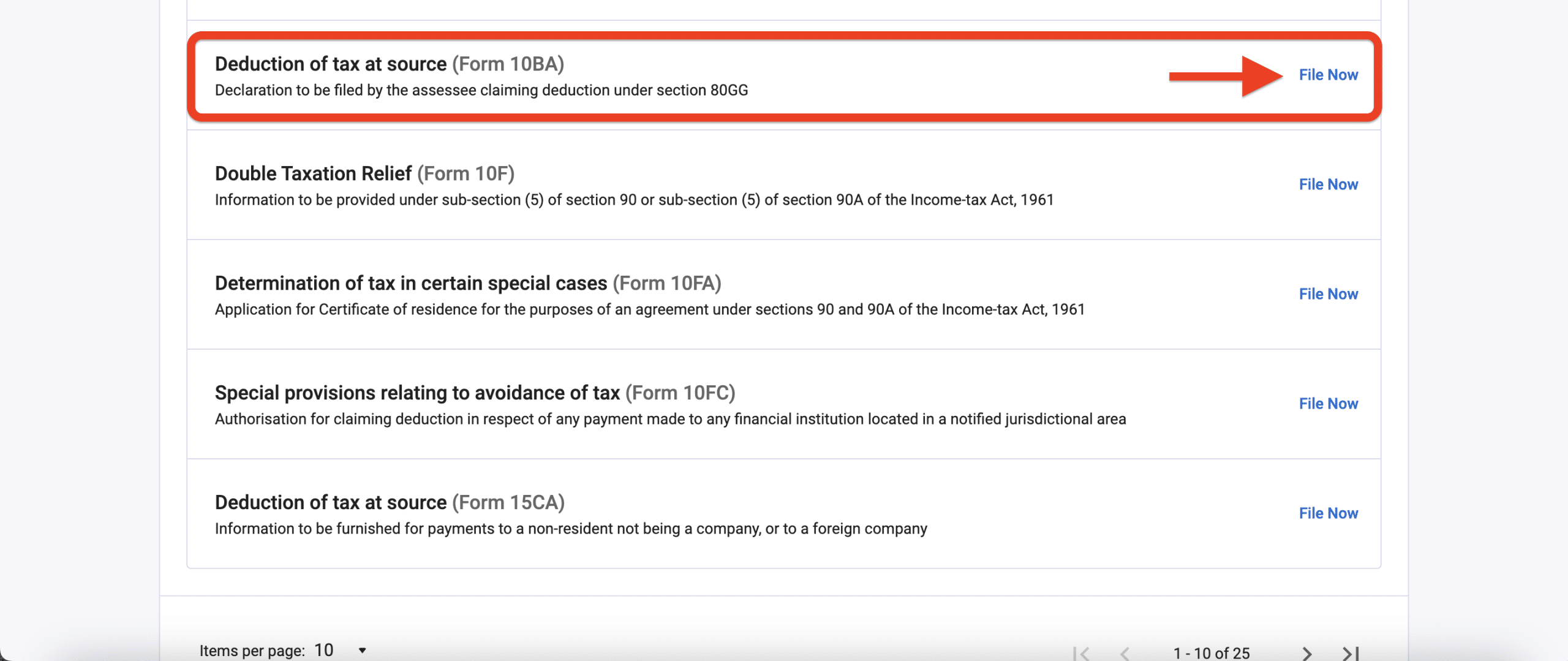

Step 4: Scroll down to find Form-10BA and click on “File now”

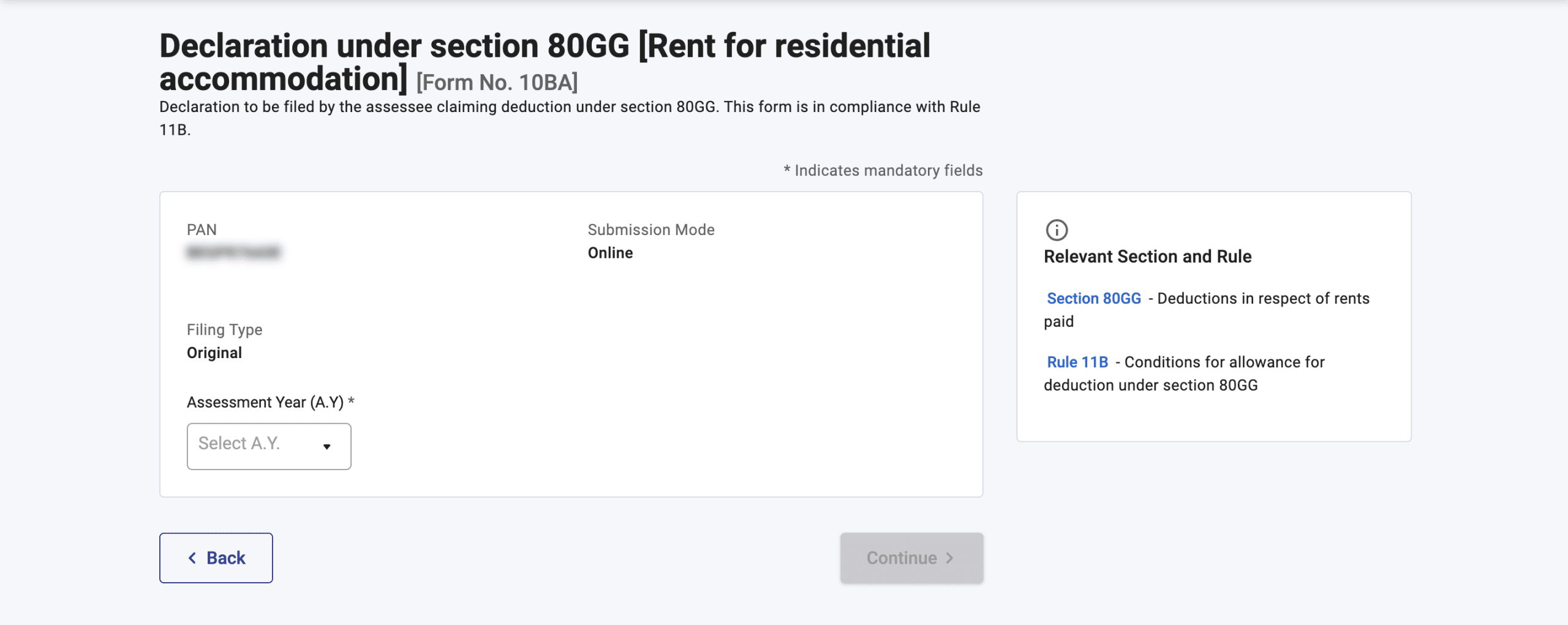

Step 5: On this page, choose the Assessment Year for which you want to file Form-10BA.

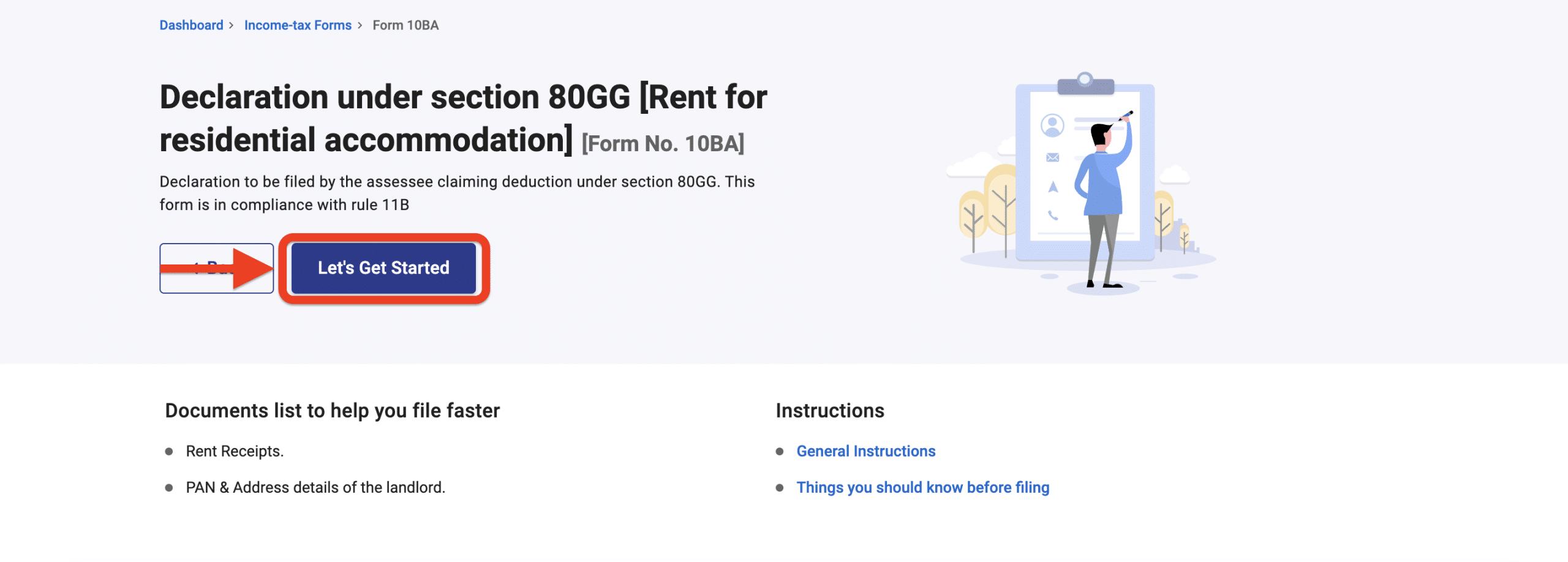

Step 6: Click on “Let’s get started”

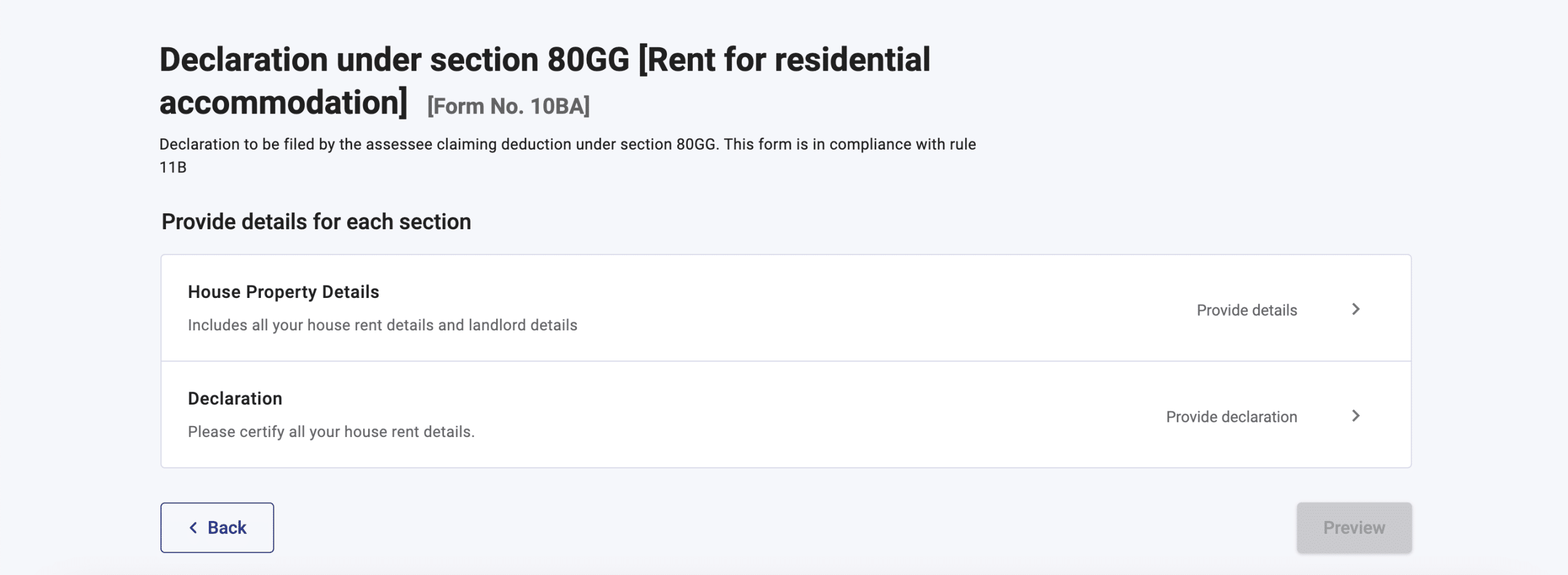

Step 7: On this page, you will be asked to fill “House Property details” and “Declaration”.

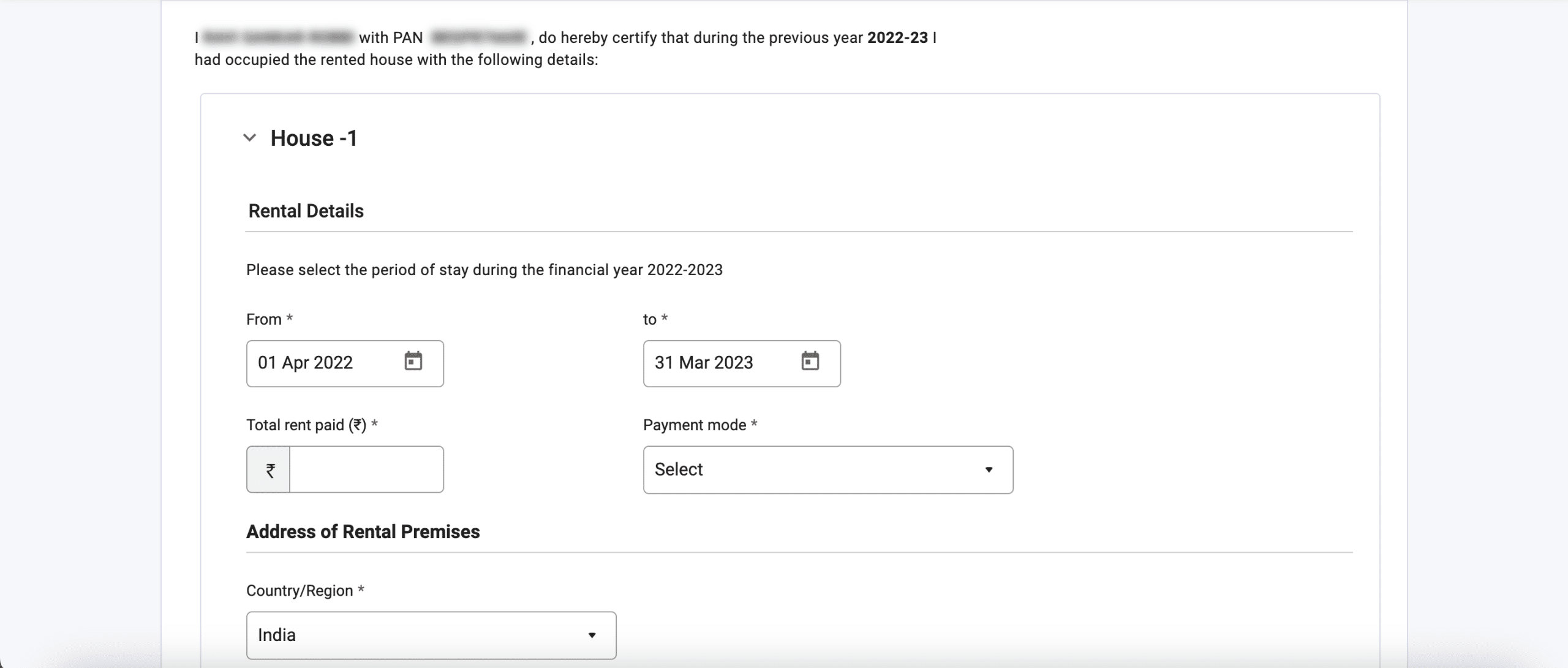

Step 8: Upon clicking on “House Property details” in step 7, you will be redirected to the below page where you need to fill Rental premises details, period of occupation, Landlord details and Rent paid etc.

Step 9: After entering house property details, click SAVE on the bottom of the page. Then click on the declaration tab (as shown in step 7). You will be redirected to the below page where you need to tick the checkbox and enter you place and then “Save”.

Step 10: You will be redirected to page shown in step 7 with both house property details and declaration marked as COMPLETE. Before submitting the form, preview it and then go for final submission through DSC or EVC method.

Conclusion

In this way, you can claim the income tax deduction under sec 80GG for house rent expenditure. But make sure to file Form-10BA before filing your ITR to claim the deduction. Otherwise, deduction will not be allowed.

Hope you have enjoyed reading this article. Thank you for your time.