Did you know?

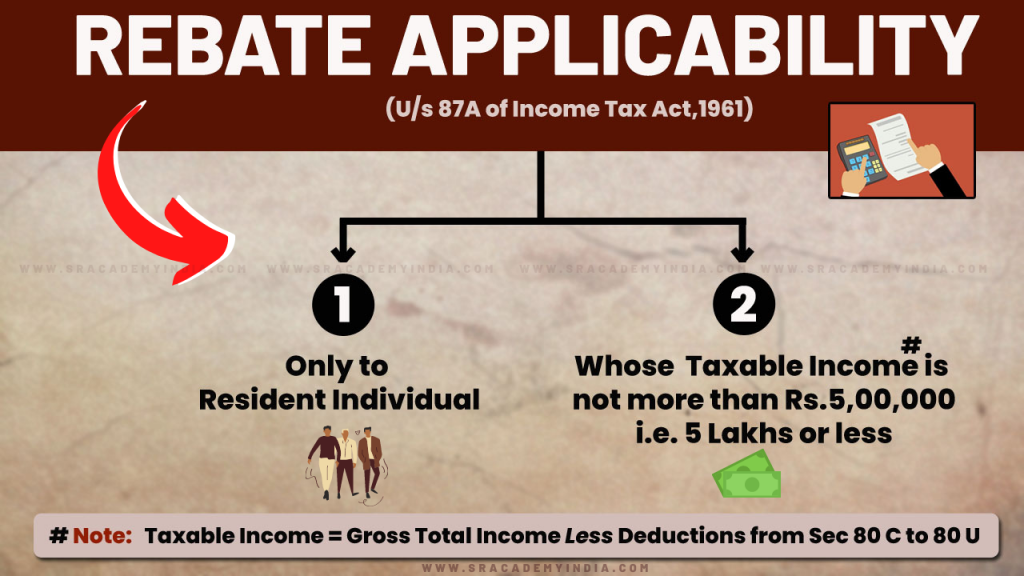

Unlike basic exemption limit, Rebate under Section 87A is NOT for all Individuals.

Section 87A rebate is a tax benefit, which is available only to Resident Individuals whose taxable income (i.e. Gross Total Income less Deduction from 80C to 80U) is not more than Rs. 5 lakhs.

So if you satisfy both the conditions, then you can claim rebate and pay ZERO tax.

In this article, let’s understand:

- What is section 87A rebate?

- Conditions for claiming it and

- Maximum amount which can be claimed

So let’s begin. .

Introduction

Government has introduced section 87A (which deals with rebate) in Finance Act 2013 with an intention to reduce the tax burden to the small tax payers.

When it was first introduced, maximum amount that can be claimed was only Rs. 2,000 but it keeps on changing from time to time and now it has become Rs. 12,500.

What is section 87A Rebate?

In simple words, Section 87A rebate is a kind of tax benefit available to Individual tax payers if they satisfy certain conditions in a financial year. Remember, Rebate is not a blanket exemption available for each and every individual, it is available only for certain individuals who satisfy the eligibility criteria mentioned below.

Conditions for claiming rebate

If you satisfy the following conditions in a financial year, then you can claim rebate. Those are:

- You must be Resident Individual and

- Your Total Income should not be more than Rs. 5 lakh.

Here, Total Income is Gross Total Income less Chapter VI-A deductions less set-off and carry forward of losses.

How much can be claimed as rebate?

If you satisfy both the above conditions, then

(i) Rs. 12,500 or

(ii) Tax payable whichever is lower

is allowed as rebate under section 87A of Income Tax Act.

Key Points to remember:

– Rebate is always allowed from tax payable before adding Health & Education cess @4%

– It is NOT available for tax payable on LTCG @10% under sec 112A

Practical understanding of Rebate

Let’s consider two scenarios here to understand it better:

Assume X is a resident individual and his income is as follows under two different circumstances:

| Particulars | Scenario 1 (Rs) | Scenario 2 (Rs) |

|---|---|---|

| Salary Income | 7,00,000 | 6,00,000 |

| Income from House Property | 50,000 | 25,000 |

| Interest Income | 15,000 | 15,000 |

| Gross Total Income | 7,65,000 | 6,40,000 |

| Less: Chapter VI-A deductions | 1,50,000 | 1,50,000 |

| Taxable Income (or) Total Income | 6,15,000 | 4,90,000 |

| Rebate eligibility under sec 87A | Not Eligible | Eligible |

If you observe the above scenarios; in the 1st scenario X is NOT eligible for rebate since his total income is more than Rs. 5 lakhs. Whereas in the 2nd scenario, X is eligible for 87A rebate since his total income is not more than Rs. 5 lakhs.

Not applicable for whom?

As mentioned earlier, it is applicable only to Resident Individuals. So, Non-Resident Individuals (NRI) and other category of tax payers like HUF, Firms & Companies etc. are NOT eligible to claim this rebate.

What is difference between Rebate and Basic Exemption Limit?

Often people get confused with these two terms.

Rebate is only for specific individuals upon satisfying the conditions mentioned in Sec 87A of Income Tax Act. Whereas, Basic exemption limit is the income up to which you need not pay any tax.

Let’s see what is the difference.

| Particulars | Rebate u/s 87A | Basic Exemption limit |

| 1. For whom? | Only for Resident Individuals | For all Individuals |

| 2. Changes with age? | Fixed for all age groups | Varies as per age |

| 3. Any conditions? | Two conditions need to be satisfied | No such conditions |

FAQ

Who is eligible for 87A Rebate?

All resident individuals including senior citizens whose total income is not more than Rs. 5 lakh is eligible

Is this available to Super Senior Citizens also?

No. It is not available, since super senior citizens avail higher basic exemption limit of Rs. 5 lakhs.

Can I claim rebate in new tax regime also?

Yes. Rebate under section 87A available under both the tax regimes.

Can it be claimed by NRI?

No. It is only for Resident Individuals who satisfies above two conditions.

What is the maximum rebate under Section 87A?

Rs. 12,500 or Tax payable whichever is lower

Am I exempted from filing Income Tax Return?

No. You still need to file your ITR if your total income before excluding the deductions is more than the basic exemption limit.

Which income has to be considered for 87A Rebate?

It is your taxable income after adjusting for set-off and carry forward of losses and after deducting chapter-VI A deductions.

Is this applicable to Incomes taxable at Special rates also?

No. Incomes which are chargeable at special rates are out of the purview of section 87A. Example, STCG chargeable @15% and LTCG chargeable @20% are to be paid even if your taxable income is below Rs. 5 lakhs

Is this available to HUF?

No. It is only for Resident individuals.

is it before adding HEC of 4% or after?

Rebate should be applied before adding the cess of 4%

Any document required for claiming rebate?

No document is required. You need to submit or keep proof of your deductions and exemptions.

Can it be claimed online?

Yes. you can claim it online while filing your ITR

What if you have already paid taxes?

You can avail rebate and claim refund.

Is this applicable to women also?

Yes. It is applicable for women as well except Super senior citizens

How to claim rebate?

You can claim it while filing the ITR