Income Tax Rates Slabs in India- AY 2021-22 (FY 2020-21) & AY 2022-23 (FY 2021-22)

Budget 2020 & Budget 2021 did not specify any changes in the income tax rates slabs applicable for FY 2019-20 and hence there are NO changes in the income tax rates slabs even for FY 2020-21 & FY 2021-22.

Income tax rates slabs for computation of tax liability of various assessees i.e. Individuals, HUF, Firms (including LLP), Companies, Co-operative societies, AOP, BOI & Artificial Juridical Person for AY 2021-22 (i.e. FY 2020-21) is given below for ready reference:

1. Income Tax Rates Slabs for Individuals for FY 2020-21 (AY 2021-22) & FY 2021-22 (AY 2022-23) in India

(a) Income Tax Rates Slabs for Individuals (Residents or Non-Residents) age is below 60 years

For Individuals who are either Resident or Non-Resident & whose age is below 60 years at any time during the relevant financial year

| Total Income* | Income Tax |

| Upto Rs. 2,50,000 | Nil |

| From Rs. 2,50,000 to Rs. 5,00,000 | 5% on the amount exceeding Rs. 2,50,000 |

| From Rs. 5,00,000 to Rs. 10,00,000 | Rs. 12,500 + 20% on the amount exceeding Rs. 5,00,000 |

| More than Rs. 10,00,000 | Rs. 1,12,500 + 30% on the amount exceeding Rs. 10,00,000 |

(b) Income Tax Rates Slabs For Resident Senior Citizens

For Resident Individuals whose age is 60 years or more but below 80 years at any time during the relevant financial year

| Total Income* | Income Tax |

| Upto Rs. 3,00,000 | Nil |

| From Rs. 3,00,000 to Rs. 5,00,000 | 5% on the amount exceeding Rs. 3,00,000 |

| From Rs. 5,00,000 to Rs. 10,00,000 | Rs. 10,000 + 20% on the amount exceeding Rs. 5,00,000 |

| More than Rs. 10,00,000 | Rs. 1,10,000 + 30% on the amount exceeding Rs. 10,00,000 |

This slab is NOT applicable to “Non-Resident Senior Citizens“. For them, slab rates specified in category (a) is applicable.

(c) Income Tax Rates Slabs For Resident Super Senior Citizens

For Resident Individuals whose age is 80 years or more at any time during the relevant financial year

| Total Income* | Income Tax |

| Upto Rs. 5,00,000 | Nil |

| From Rs. 5,00,000 to Rs. 10,00,000 | 20% on the amount exceeding Rs. 5,00,000 |

| More than Rs. 10,00,000 | Rs. 1,00,000 + 30% on the amount exceeding Rs. 10,00,000 |

This slab is NOT applicable to “Non-Resident Super Senior Citizens“. For them, slab rates specified in category (a) is applicable.

*Total Income = Gross Total Income (i.e. Income from all sources) – Deductions from Sec 80C to 80U

Key point1:

For Non-Resident Individuals (either Senior Citizens or Super Senior Citizens) basic exemption limit is ONLY Rs. 2,50,000. Higher exemption limit of Rs. 3,00,000 or Rs. 5,00,000 is NOT applicable for them.

Surcharge:

| Total Income | Surcharge |

| From Rs. 50 lakh to Rs. 1 crore | 10% of Income Tax |

| From Rs. 1 crore to Rs. 2 crore | 15% of Income Tax |

| From Rs. 2 crore to Rs. 5 crore | 25% of Income Tax |

| More than Rs. 5 crore | 37% of Income Tax |

Marginal Relief:

When surcharge is applicable, then individual can claim marginal relief (which is a kind of deduction from surcharge) which is as follows:

| Total Income | Marginal Relief |

| More than Rs. 50,00,000 | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 50,00,000 by more than the amount of income that exceeds Rs. 50,00,000 |

| More than Rs. 1 crore | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore |

| More than Rs. 2 crore | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 2 crore by more than the amount of income that exceeds Rs. 2 crore |

| More than Rs. 5 crore | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 5 crore by more than the amount of income that exceeds Rs. 5 crore |

Rebate u/s 87A: Resident Individuals whose total income does not exceed Rs. 5,00,000 are eligible to claim rebate. Rebate available under sec 87A is 100% of income tax or Rs. 12,500 whichever is less.

That means, if you are Resident Individual and your net income (i.e. Gross Total Income less deductions from Sec 80C to 80U) is less than or equal to Rs. 5,00,000 then your tax liability for the relevant financial year is zero.

Key Point 2:

If Surcharge is applicable then Marginal relief is also applicable. In such cases, rebate u/s 87A is NOT applicable. Similarly, when rebate u/s 87A is applicable then Surcharge and Marginal relief are NOT applicable.

Health & Education Cess: 4% of Income Tax and Surcharge (If applicable)

Total tax payable by any Assessee = Income tax + Surcharge (if applicable) + Health & Education Cess

2. Income Tax Rates Slabs for HUF, Association of Persons, Body of Individuals and any other Artificial Juridical Person for FY 2020-21 (AY 2021-22) & FY 2021-22 (AY 2022-23)

| Total Income | Income Tax |

| Upto Rs. 2,50,000 | Nil |

| Exceeds Rs. 2,50,000 but not exceeding Rs. 5,00,000 | 5% on the amount exceeding Rs. 2,50,000 |

| Exceeds Rs. 5,00,000 but not exceeding Rs. 10,00,000 | Rs. 12,500 + 20% on the amount exceeding Rs. 5,00,000 |

| Exceeding Rs. 10,00,000 | Rs. 1,12,500 + 30% on the amount exceeding Rs. 10,00,000 |

Surcharge:

| Total Income | Surcharge |

| Exceeds Rs. 50,00,000 but does not exceed Rs. 1 crore | 10% of Income Tax |

| Exceeds Rs. Rs. 1 crore but does not exceed Rs. 2 crore | 15% of Income Tax |

| Exceeds Rs. 2 crore but does not exceed Rs. 5 crore | 25% of Income Tax |

| Exceeds Rs. 5 crore | 37% of Income Tax |

Marginal Relief:

When surcharge is applicable, then assessee can claim marginal relief (which is a kind of deduction from surcharge) which is as follows:

| Total Income | Marginal Relief |

| Exceeds Rs. 50,00,000 | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 50,00,000 by more than the amount of income that exceeds Rs. 50,00,000 |

| Exceeds Rs. Rs. 1 crore | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore |

| Exceeds Rs. 2 crore | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 2 crore by more than the amount of income that exceeds Rs. 2 crore |

| Exceeds Rs. 5 crore | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 5 crore by more than the amount of income that exceeds Rs. 5 crore |

Health & Education Cess: 4% of Income Tax and Surcharge (if applicable)

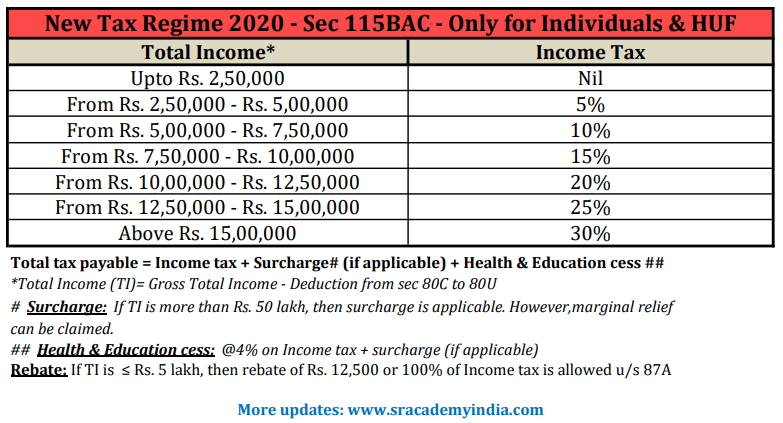

3. New Tax Regime 2020 for Individuals & HUF (Sec 115BAC) – Optional

Budget 2020 has introduced new tax regime for individuals & HUF, an optional tax slab rates system at reduced rates. They can continue with the old regime (i.e. existing slab rates) or new regime as per their convenience. However, under the new tax regime 2020 assessee need to forego certain exemptions/deductions to avail the lower rates of tax.

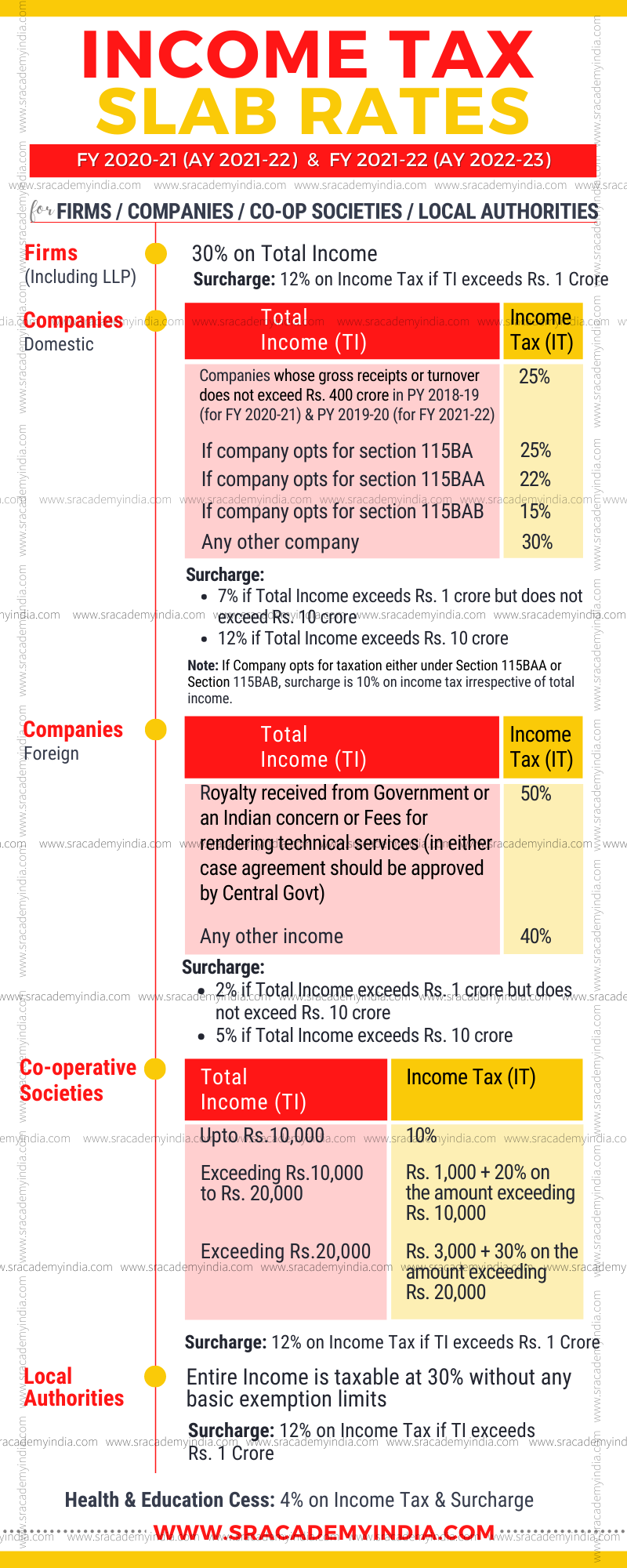

4. Income Tax Rates Slabs for Partnership Firm (including LLP) for FY 2020-21 (AY 2021-22) & FY 2021-22 (AY 2022-23)

Entire Income is taxable @30% without any basic exemption limits.

Surcharge: 12% of income tax, if total income exceeds Rs. 1 Crore

Marginal Relief:

When surcharge is applicable, then partnership firm or LLP can claim marginal relief (which is a kind of deduction from surcharge) which is as follows:

If total income exceeds Rs. 1 crore, total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore

Health & Education Cess: 4% of Income Tax and Surcharge (if applicable)

5. Income Tax Rates Slabs for Company for FY 2020-21 (AY 2021-22) & FY 2021-22 (AY 2022-23)

(a) Domestic Companies Rates Slabs for FY 2020-21 (AY 2021-22)

| Particulars | Income Tax |

| Companies whose gross receipts or turnover does not exceed Rs. 400 crore in PY 2018-19 | 25% |

| If company opts for section 115BA | 25% |

| If company opts for section 115BAA | 22% |

| If company opts for section 115BAB | 15% |

| Any other company | 30% |

Domestic Companies Rates Slabs for FY 2021-22 (AY 2022-23)

| Particulars | Income Tax |

| Companies whose gross receipts or turnover does not exceed Rs. 400 crore in PY 2019-20 | 25% |

| If company opts for section 115BA | 25% |

| If company opts for section 115BAA | 22% |

| If company opts for section 115BAB | 15% |

| Any other company | 30% |

Surcharge:

| Total Income | Surcharge |

| Exceeds Rs. 1 crore but does not exceed Rs. 10 crore | 7% |

| Exceeds Rs. 10 crore | 12% |

Note: If Company opts for taxation either under Section 115BAA or Section 115BAB, surcharge is 10% on income tax irrespective of total income.

Marginal Relief:

When surcharge is applicable, then domestic companies can claim marginal relief (which is a kind of deduction from surcharge) which is as follows:

| Total Income | Marginal Relief |

| Exceeds Rs. 1 crore | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore |

| Exceeds Rs. 10 crore | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 10 crore by more than the amount of income that exceeds Rs. 10 crore |

Health & Education Cess: 4% of Income Tax and Surcharge (if applicable)

(b) Foreign Companies Rates Slabs

| Nature of Income | Income Tax |

| Royalty received from Government or an Indian concern or Fees for rendering technical services (in either case agreement should be approved by Central Govt) | 50% |

| Any other income | 40% |

Surcharge:

| Total Income | Surcharge |

| Exceeds Rs. 1 crore but does not exceed Rs. 10 crore | 2% |

| Exceeds Rs. 10 crore | 5% |

Marginal Relief:

When surcharge is applicable, then foreign companies can claim marginal relief (which is a kind of deduction from surcharge) which is as follows:

| Total Income | Marginal Relief |

| Exceeds Rs. 1 crore | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore |

| Exceeds Rs. 10 crore | Total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 10 crore by more than the amount of income that exceeds Rs. 10 crore |

Health & Education Cess: 4% of Income Tax and Surcharge (if applicable)

6. Income Tax Rates Slabs for Co-operative Society FY 2020-21 (AY 2021-22) & FY 2021-22 (AY 2022-23)

| Total Income | Tax rate |

| Upto Rs. 10,000 | 10% |

| Exceeding Rs. 10,000 to Rs. 20,000 | Rs. 1,000 + 20% on the amount exceeding Rs. 10,000 |

| Exceeding Rs. 20,000 | Rs. 3,000 + 30% on the amount exceeding Rs. 20,000 |

Surcharge: 12% of income tax, if total income exceeds Rs. 1 Crore

Marginal Relief:

When surcharge is applicable, then co-operative society can claim marginal relief (which is a kind of deduction from surcharge) which is as follows:

If total income exceeds Rs. 1 crore, total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore

Health & Education Cess: 4% of Income Tax and Surcharge (if applicable)

7. Income Tax Rates Slabs for Local Authority for FY 2020-21 (AY 2021-22) & FY 2021-22 (AY 2022-23)

Entire Income is taxable @30% without any basic exemption limits.

Surcharge: 12% of income tax, if total income exceeds Rs. 1 Crore

Marginal Relief:

When surcharge is applicable, then local authority can claim marginal relief (which is a kind of deduction from surcharge) which is as follows:

If total income exceeds Rs. 1 crore, total income tax including surcharge on such income shall not exceed the amount of income tax payable on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore

Health & Education Cess: 4% of Income Tax and Surcharge (if applicable)

Recommended read: How to save capital gain tax on sale of Residential Property

(Disclaimer: All the content in the article is for general information only. Any advice or suggestion by the author should not be construed as legal opinion)