Introduction

Till now if you made any mistake in the income tax challan you need to approach the Assessing Officer in off-line mode to rectify it.

But from this year onwards the income tax department has launched an online collection mechanism for rectifying mistakes in the income tax challans.

This facility is available from the Assessment Year 2020-2021 onwards, which means even if the correction is needed for the past years also you can do it online.

In this article, let’s discuss which corrections you can make in the income tax challan through the online mode on the Income Tax Portal.

Which details can be rectified?

Currently, through the online mode, you can submit the rectification request for the following corrections in the income tax challan.

1. Correction in the Assessment Year

In case you have chosen the wrong AY, you can correct it.

2. Correction in the Major head

If you wrongly paid income tax under the major head of “Companies” but it should have been remitted under “Other than companies” you can rectify it here.

3. Correction in the Minor head

Self-assessment tax, Advance tax and Tax on regular assessments can be changed here.

Only these corrections can be done online and for the rest of the corrections, one needs to approach the concerned jurisdictional assessing officer in the off-line mode.

Now let’s understand how to rectify your income tax challan online on the Income Tax portal.

Step-by-step process

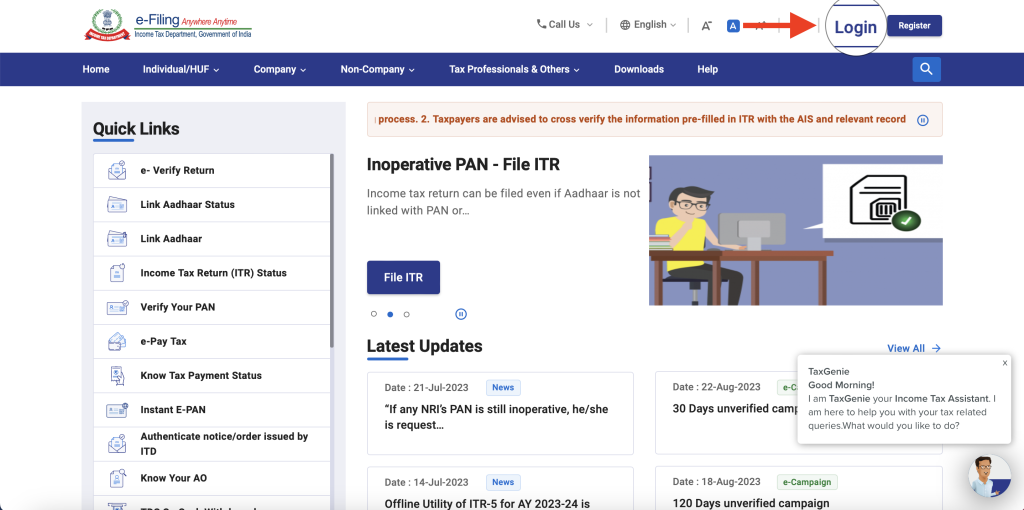

Step 1: Visit the incometax.gov.in website and log in with your income tax credentials

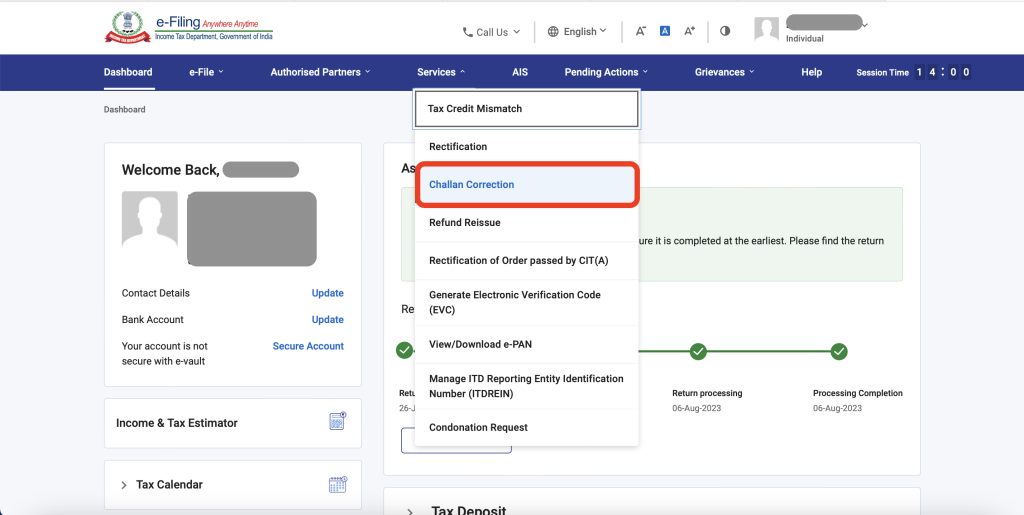

Step 2: Go to the “Services tab” and click on “Challan Correction”.

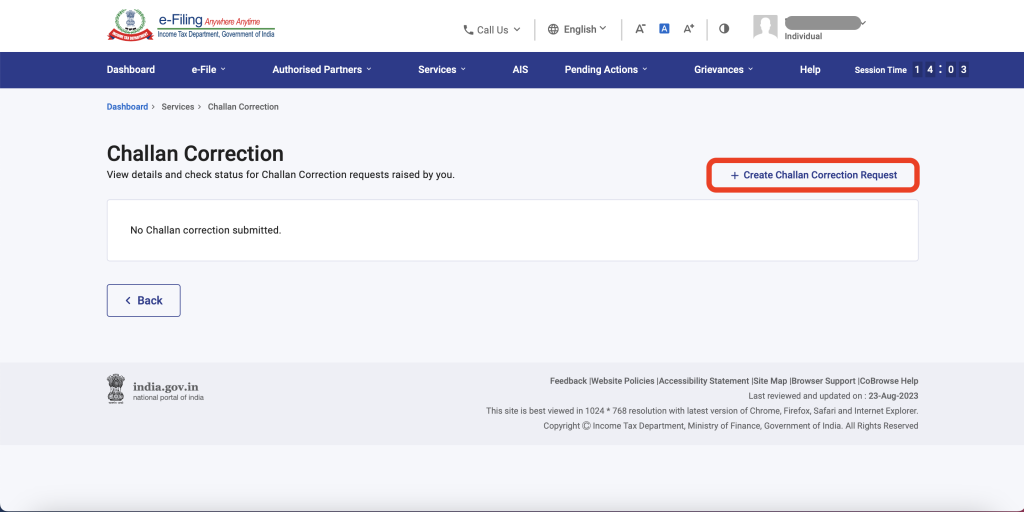

Step 3: You will be redirected to this page, where you can see all your submitted challan correction requests. If you have submitted it already, you can see it here. If you want to submit a fresh request, click on “create challan correction request”.

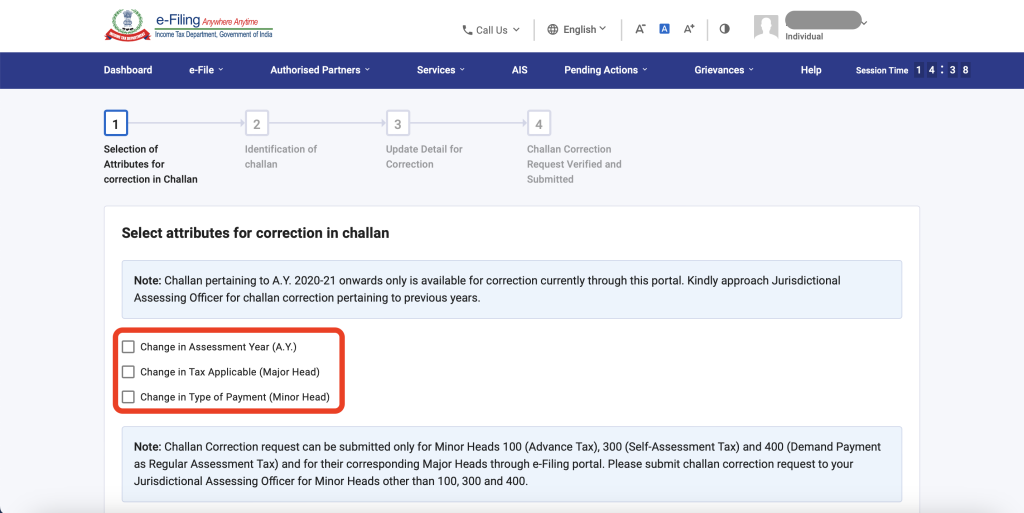

Step 4: On this page, you need to choose the correction you want to do out of the 3 corrections. If you want to correct all three also you can select all. Instead, if you want to proceed with one change, you may do so.

Choose and click on “Continue”

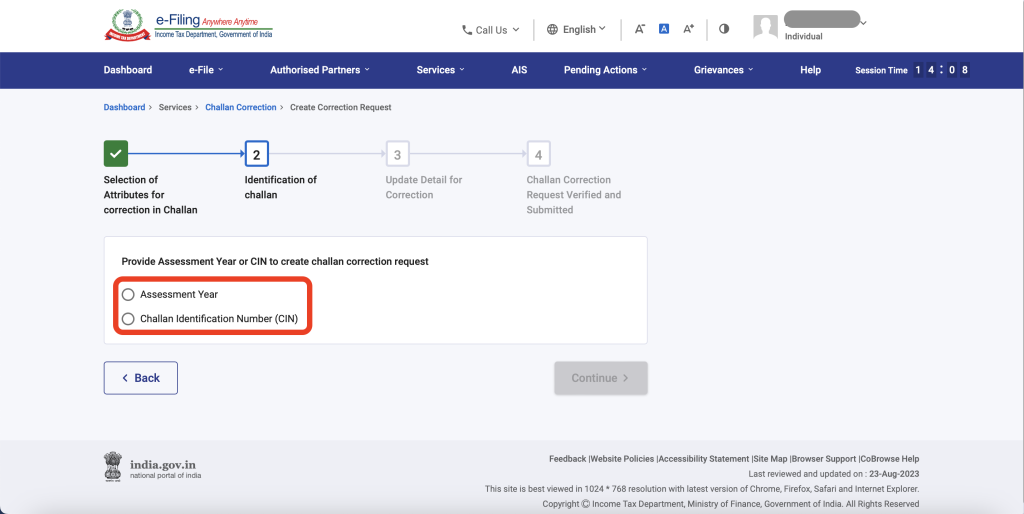

Step 5: On this page, you need to select either “AY” or “CIN”. CIN can be found in your Income Tax payment challan. But make sure you have an unconsumed challan for that particular AY or CIN i.e. which is not claimed in any of your ITR filing.

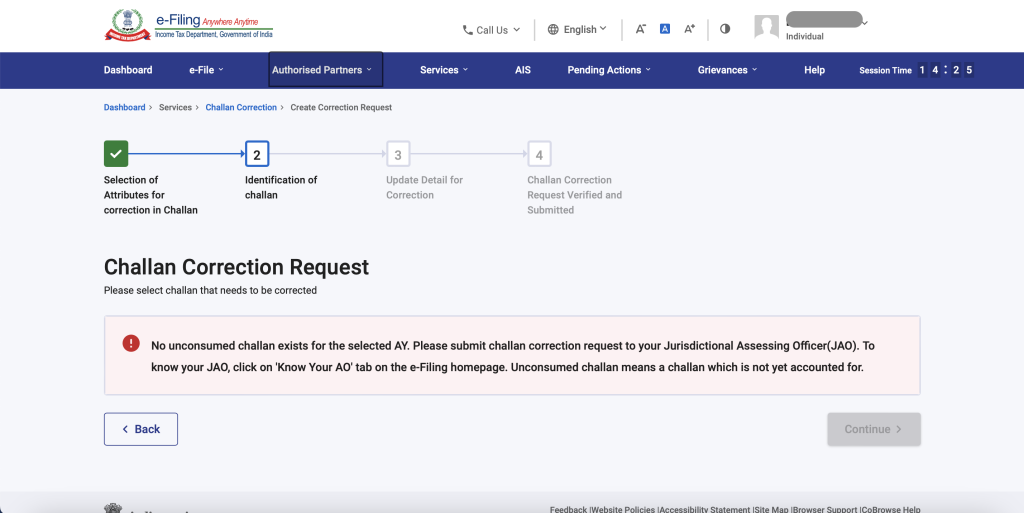

Step 6: If you have already consumed your challan, you can see this kind of message

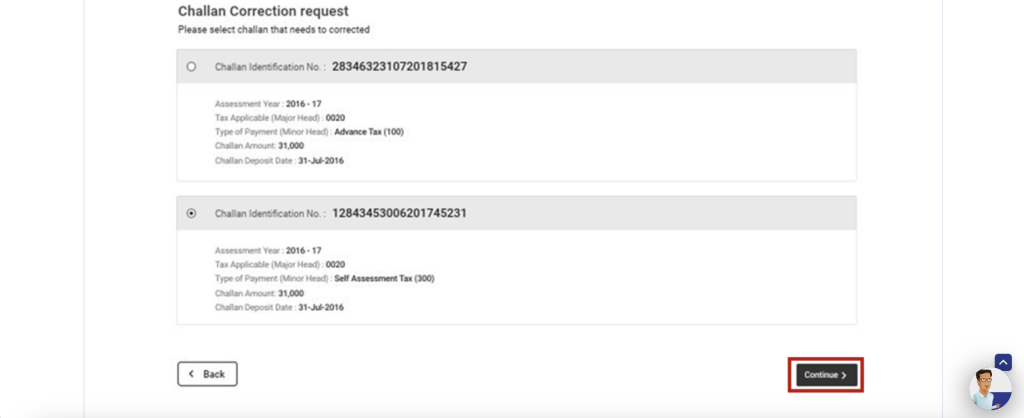

Step 7: In case of an unconsumed challan, you can see the following screen. In case of multiple challans, all details will be displayed. Choose the challan that you want to rectify

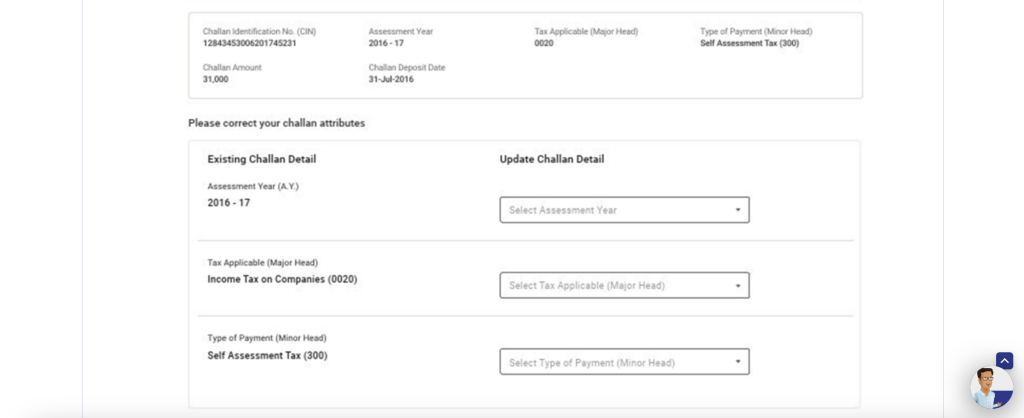

Step 8: On this page, select the applicable section you want to change and click on continue at the bottom

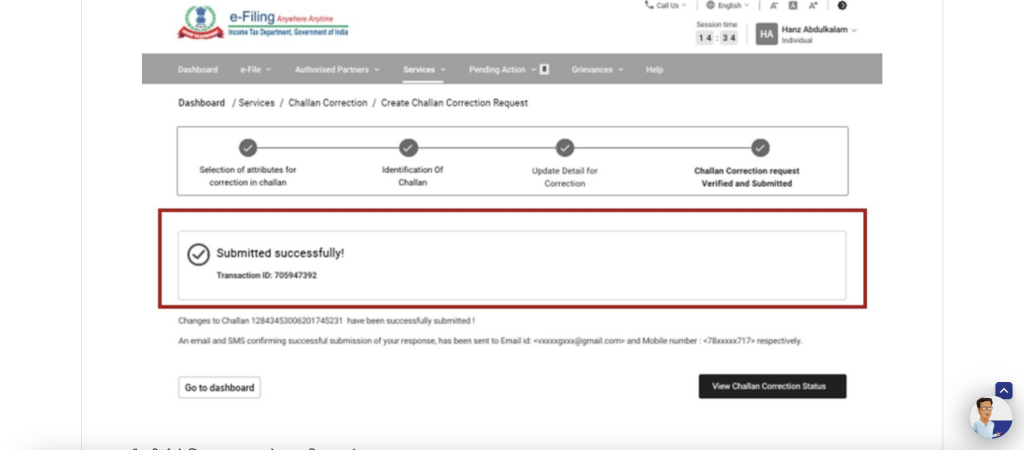

Step 9: You will get mobile OTP. Validate then you can see this screen. Meaning, you have successfully submitted your correction request online.

Conclusion

In this way, you can rectify the income tax challans from the assessment year 2020-2021 onwards but make sure you do not consume your challan for which you want to rectify the details.

Hope you have enjoyed this article thank you for your time.