Mutual Funds Basics for Beginners

If you are planning to start your Mutual Fund investment journey, understanding these Mutual Funds basics will help you invest confidently. After reading this article, I’m sure you will certainly learn some essential basics required for your investment journey. So let’s start.

Introduction

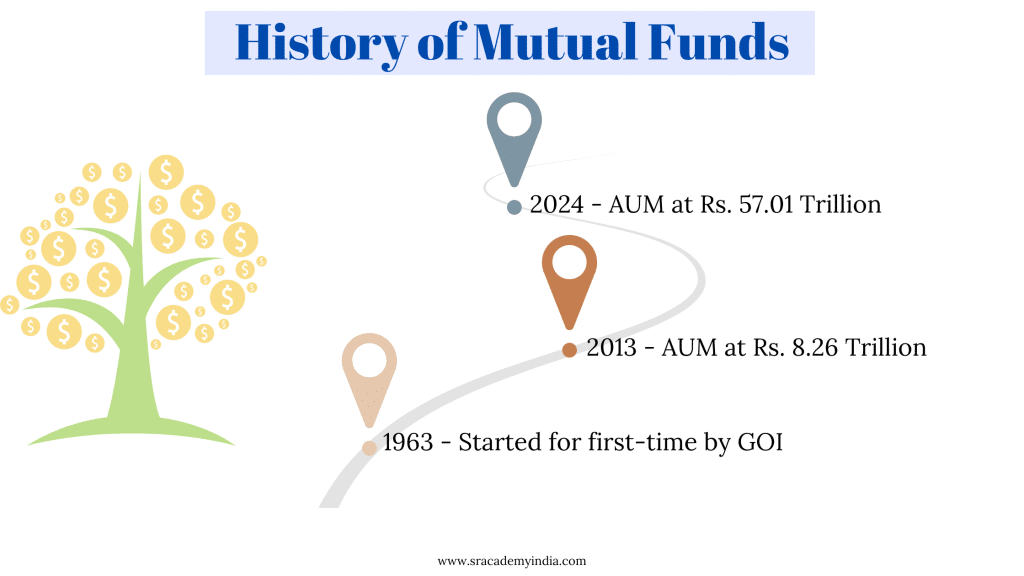

Mutual Funds need no introduction as they are very popular saving instruments for most individuals. Mutual Fund was introduced in India for the first time in the year 1963 by the Government of India.

Since then Mutual Funds gained popularity and now recently the Assets Under Management (AUM) of the Mutual Funds industry as of April 2024 is Rs. 57.01 Trillion. Whereas in Dec 2013, the industry’s AUM stood at Rs. 8.26 Trillion. So it’s a seven-fold increase compared to the year 2013.

(Source: Wikipedia & AMFI India)

There are several reasons for such a multi-fold increase in the AUM of Mutual Funds in the recent past. The main reasons are Liquidity, Diversification, Professional Management & Ease of investing to attract more investors towards Mutual Funds.

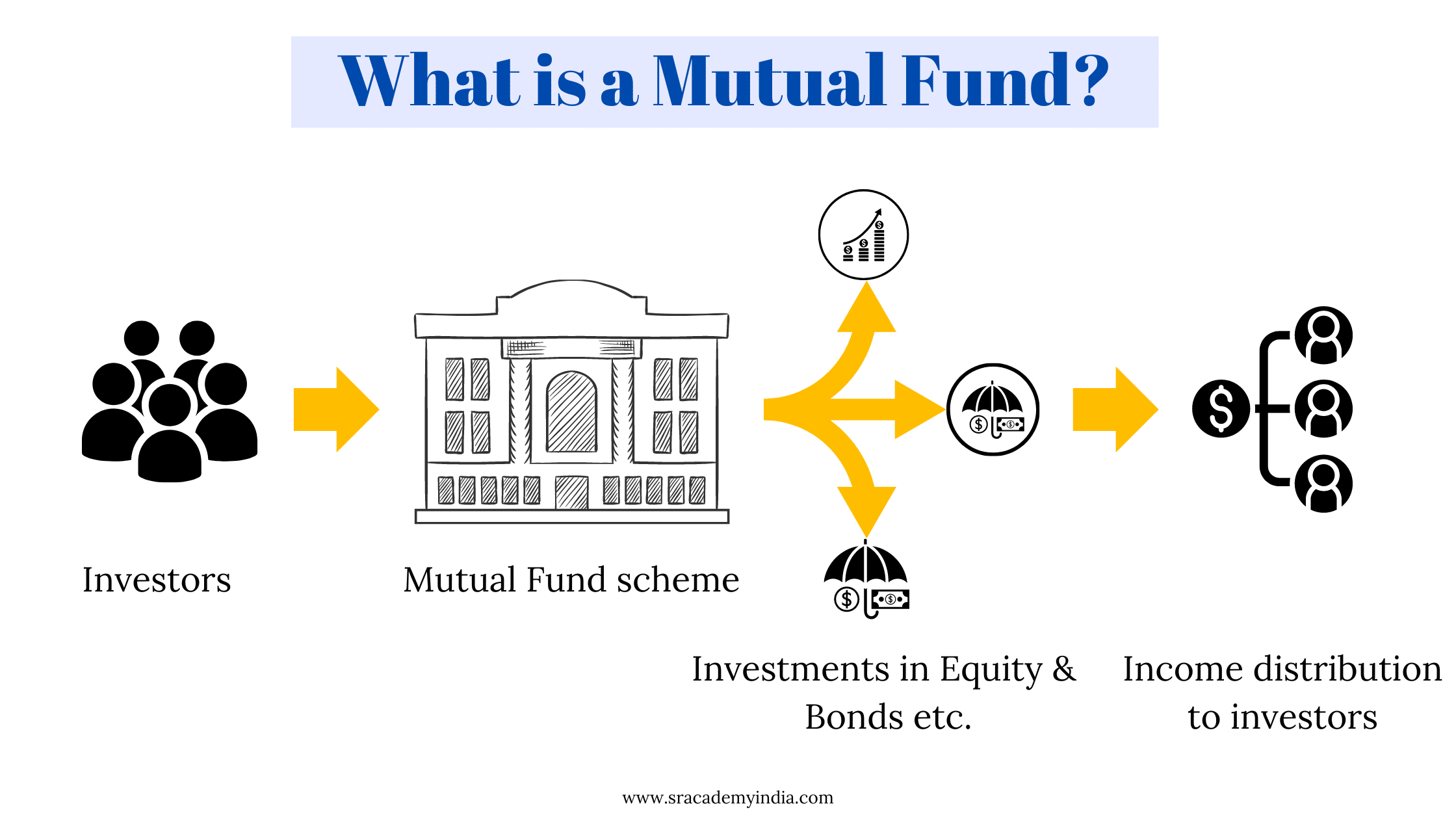

What is a Mutual Fund

I don’t want to confuse you by quoting the actual definition of Mutual Fund here. So let’s put the definition of Mutual Fund in simple words:

A Mutual Fund is a body which collects money from various investors and invests such pooled money in Equity, Bonds, Government securities and other money market securities (as per the investment objective) to generate income. Such income will be distributed to the investors after deducting expenses incurred for managing such funds.

Now, let’s understand this concept with the help of a simple example.

Imagine you along with 4 of your close friends planning for a vacation next year. Since it’s a week-long trip, you people decide to pool the money required for the trip which is Rs. 1000 per month from each member for 6 months. Assume you took the responsibility to collect the money every month from your friends.

So every month, you are getting Rs. 4,000 (4 members * Rs. 1000 each) to your bank account from your friends. And, you kept aside your share of Rs. 1,000 in your bank account. So altogether it is Rs. 5,000 per month.

After getting the 1st month pool, you have decided to invest the same in FD (at 5% p.a.) instead of keeping it idle in your bank account. So, Rs. 5,000 invested for 6 months (assuming invested on 1st day in 1st month and withdrawn on the last day of 6th month) you will yield an interest of Rs. 125 (Rs. 5,000 * 5% * 6/12). You repeated the same process for the money received in the later period as well.

For simplicity, let’s assume the total fund of Rs. 30,000 has earned an interest of Rs. 1000 from the FDs created for different tenors. So finally at the end of 6 months, when divided among 5 members each person will get Rs. 5,200 (his original share of Rs. 5,000 plus Rs. 200 interest earned from FD investment).

Mutual Fund also runs on a similar concept as well. Instead of collecting from a close group of individuals, it accepts investments from the large public. And unlike the case discussed in the above example, for managing the entire fund a professional Fund manager will be appointed and the mutual fund house will charge a certain percentage of NAV as an expense for managing such fund (known as Total Expense Ratio i.e. TER). So any income from the mutual fund will be distributed to the investors only after deducting such expenses.

How Mutual Funds Work in India

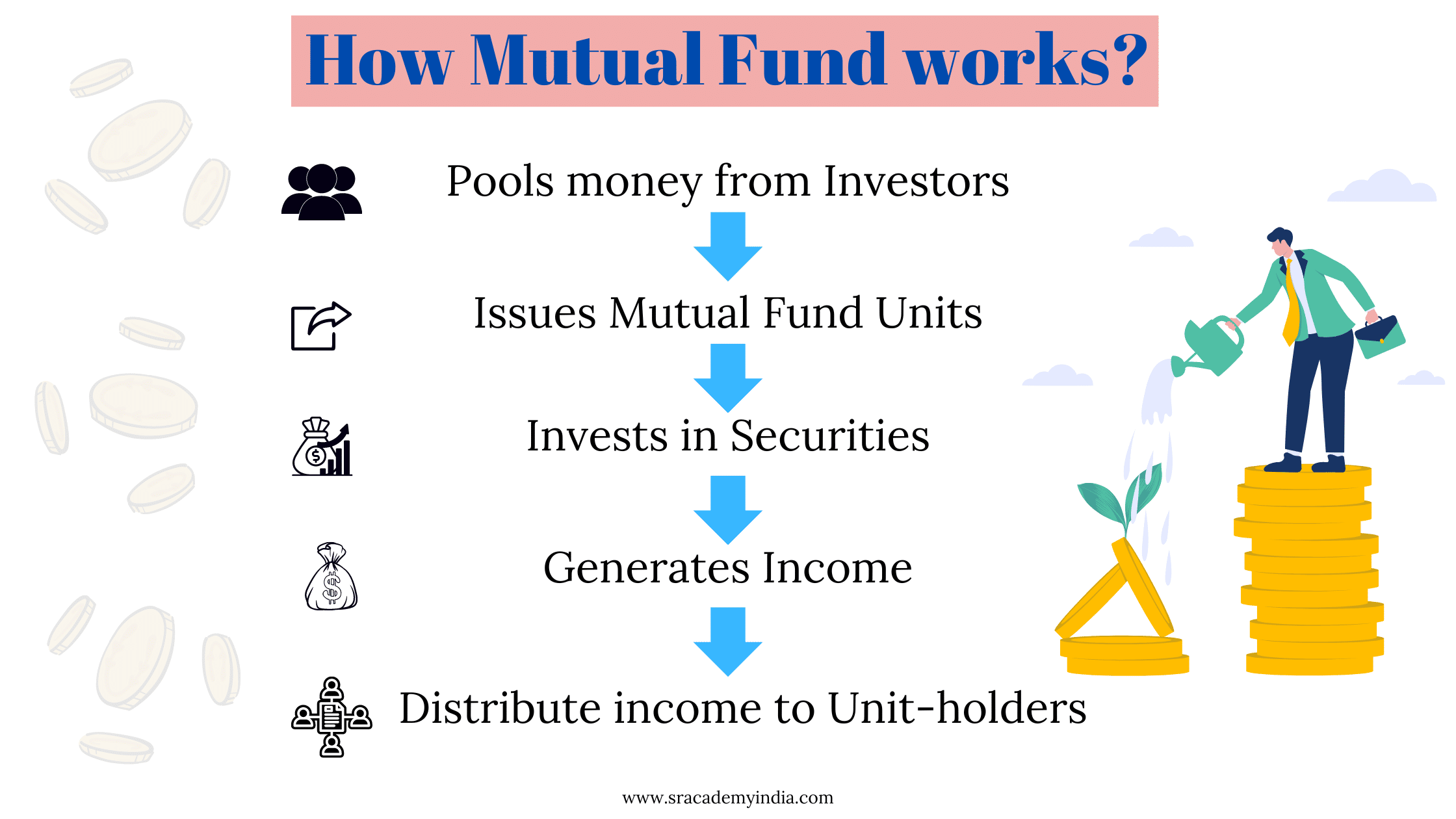

Before forming the scheme itself, the mutual fund will define its investment objective. Once the investment objective is decided, the sponsor of the Mutual Fund will form a Mutual Fund Trust. Then such trust starts collecting money from investors by issuing the units.

After pooling the money from various investors, mutual fund units will be issued to the investors in the proportion of their investment. A professional Fund manager manages the fund in accordance with an investment objective of the mutual fund scheme and makes sure to achieve the desired objective by investing in diverse investment options.

Administrative and other expenses incurred for managing the entire fund will be deducted from the income of the mutual fund (Interest, Dividend or Capital appreciation) before arriving at NAV for the respective day. Balance income will be available for distribution to the investors.

Mutual Fund terminology one should understand

Whenever you refer to any of the mutual fund scheme-related documents, you will come across certain complex terminology related to the mutual funds. As a beginner, it is difficult to interpret how each term is important in evaluating the performance of the scheme. However, you need to understand a few terms which are important to get a basic overview of the mutual fund you are about to invest.

Since the terminology list is unlimited, we have compiled the most relevant and basic terms one needs to understand to get going. All these below-mentioned terms can be seen on the face of any mutual fund scheme you refer to. Let’s start.

Net Assets Value (NAV)

As the name itself suggests, it is the net assets value of the mutual fund scheme on a particular day. Nothing but, from the total market value of the fund’s investments, current liabilities (if any) will be deducted and the net value will divided by the number of units outstanding to get the NAV of the scheme, which will expressed in rupees.

Net Assets Value (NAV) = (Total market value of investments + Current Assets – Current Liabilities) / Number of Mutual Fund units

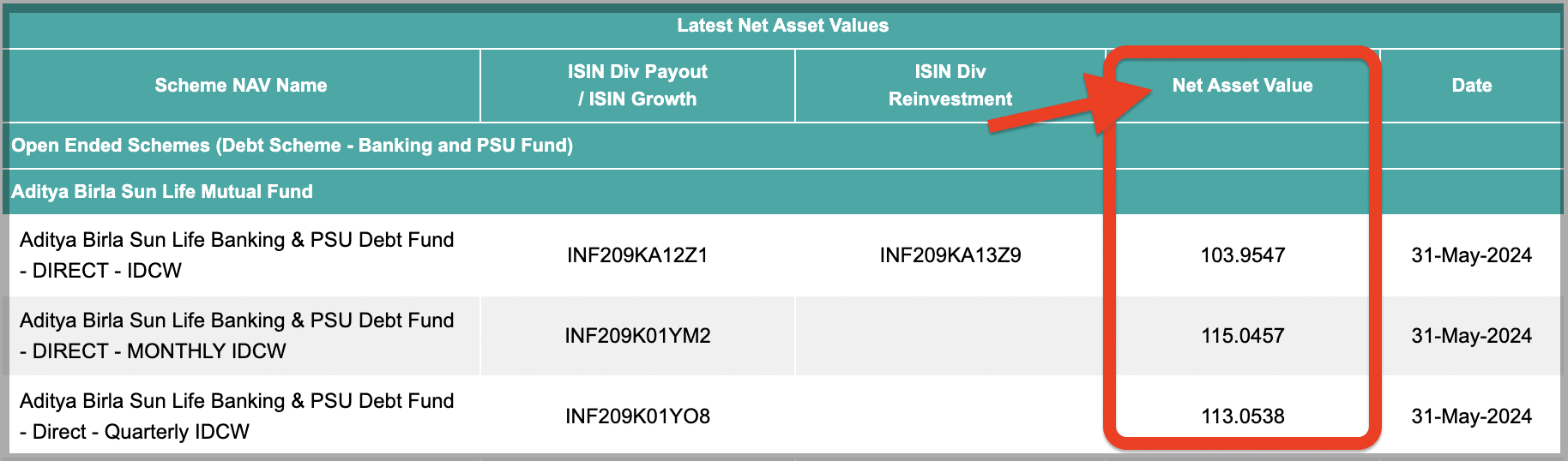

Every Mutual Fund house must disclose all their scheme’s NAV daily after the closing of the market hours. Here is an example:

Source: AMFI

Relevance: To understand the performance of a Mutual Fund scheme. A rise in the NAV is treated as Growth and a decline in NAV is treated as Downfall.

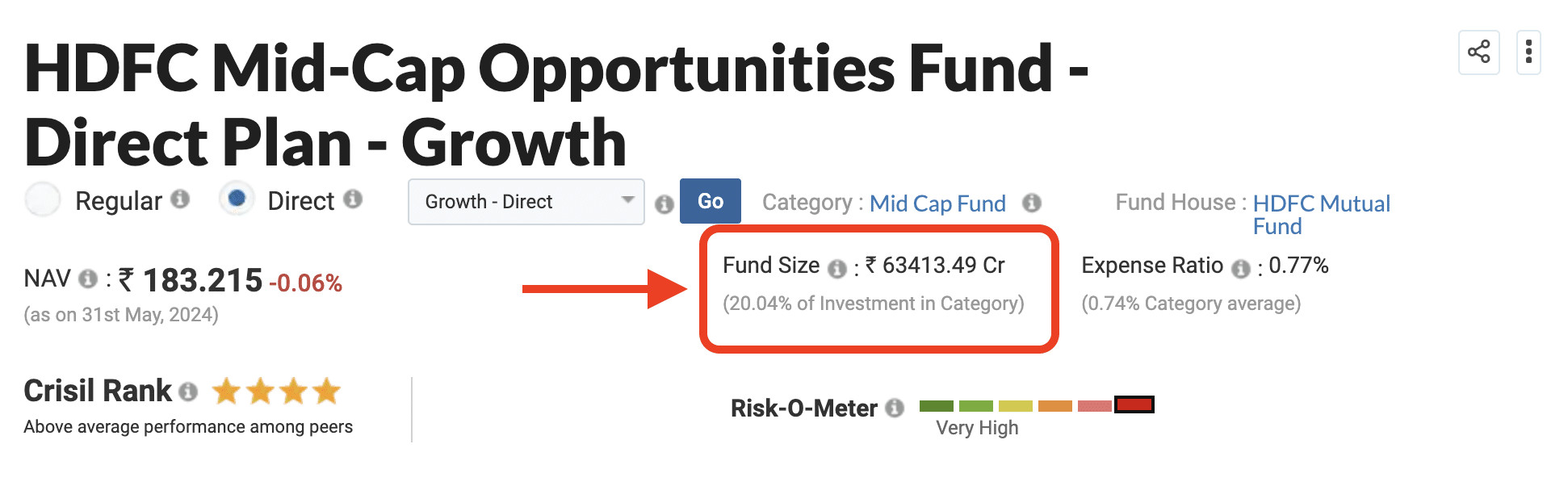

Assets Under Management (AUM)

It is the total market value of all investments held by a scheme. This includes cash as well. This denotes how big the MF scheme is and how attractive is to the investors.

Source: Moneycontrol.com

Relevance: To know the size of the scheme and how attractive is to the investors. More AUM, more investors. Lower AUM, less number of investors.

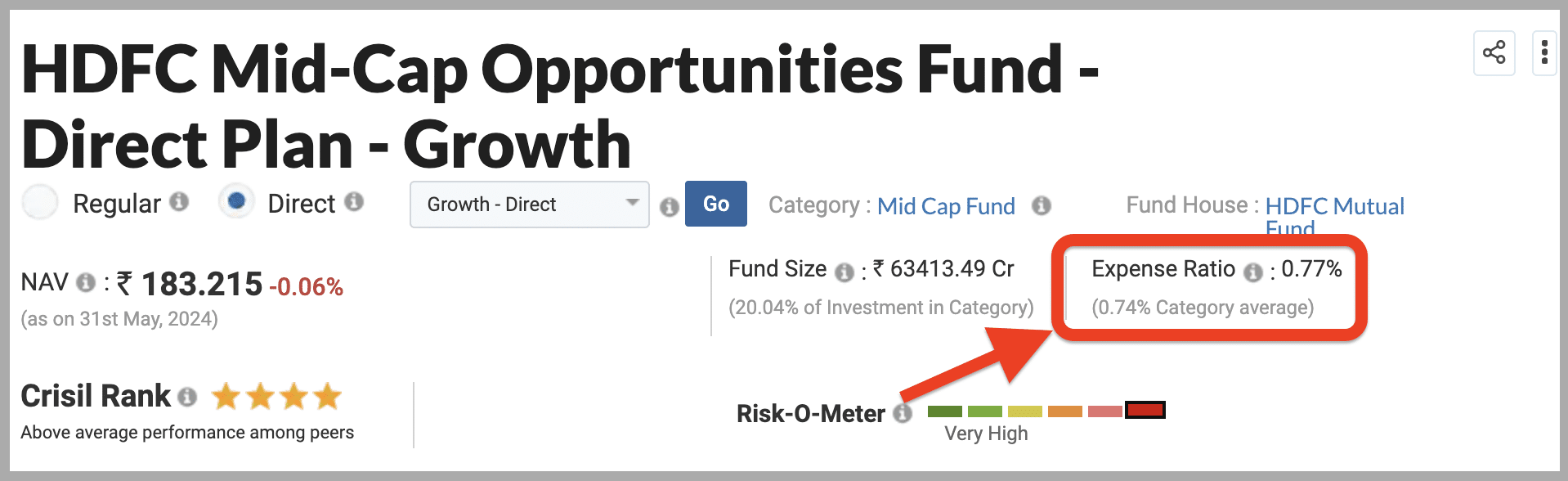

Total Expense Ratio (TER)

As mentioned earlier in this article, for managing the scheme’s fund certain expenses will be incurred. As per the SEBI (Mutual Fund) Regulations, 1996 every mutual fund is allowed to charge a certain % of its NAV as an expense for managing the fund. All such costs together will be called as Total Expense Ratio (TER).

Source: Moneycontrol.com

So TER includes all administrative costs, transaction costs, registrar fees, custodian fees, audit fees and sales & marketing expenses. Though there is no limit on the allowability of a particular type of expense overall expenses should not exceed % of TER specified in SEBI Mutual Fund Regulations. Disclosing TER on a daily basis is also mandatory for the mutual fund houses.

Relevance: To decide whether to buy a mutual fund or not. Higher TER results in lower NAV, so a lesser realisable amount. And lower TER results in higher NAV, so a more realisable amount.

Entry Load

It is a fee charged from the investors while joining a mutual fund scheme. Generally, it is collected from the investor to cover the distribution costs of the company. Nowadays, most of the mutual fund schemes are not charging the entry load. From Aug 2009 SEBI has done away with the practice of charging such entry load on all mutual fund schemes.

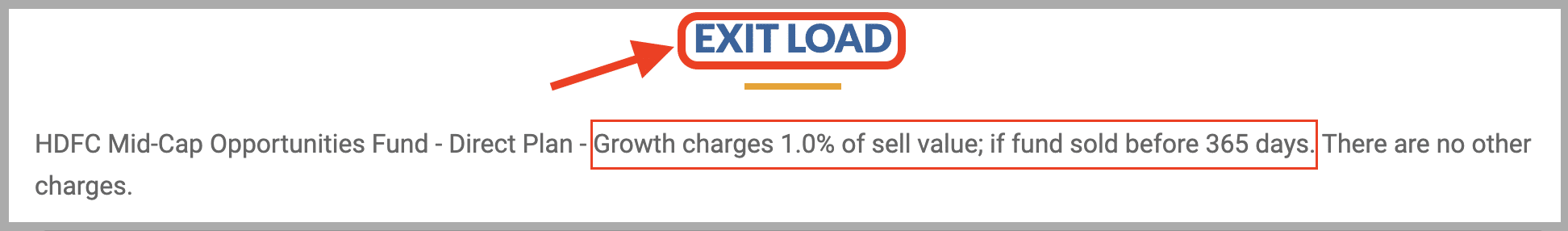

Exit Load

It is a fee charged from investors when they leave or exit from the mutual fund scheme. It is levied to discourage investors from leaving the scheme up to a specific period. Different mutual fund houses charge different exit loads.

Source: Moneycontrol.com

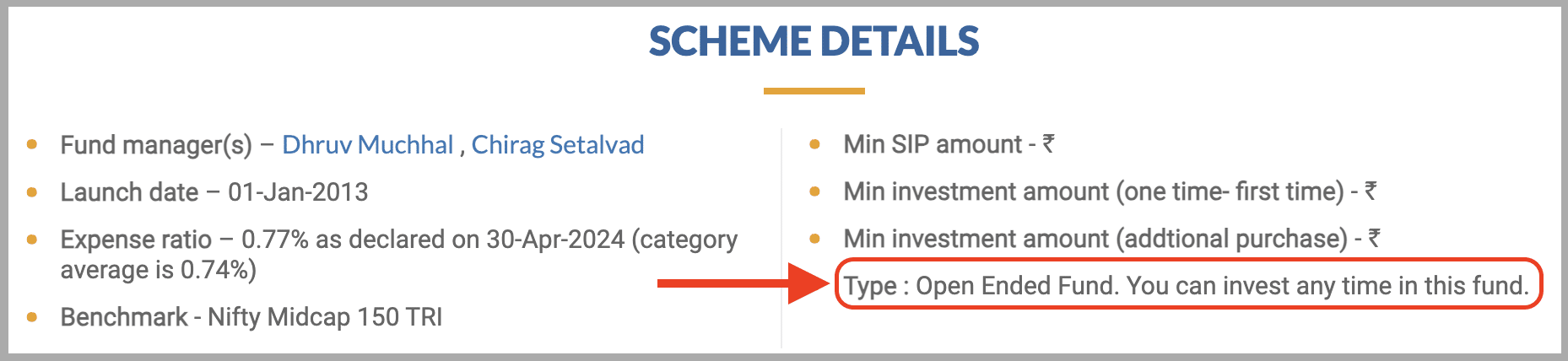

Open ended scheme

An open-ended scheme will not have a restriction on the number of units that a fund can issue. So an investor can buy or sell the units anytime they wish. So these schemes are highly liquid. Another key difference is you can invest either through SIP or Lumpsum mode.

Source: Moneycontrol.com

Close ended scheme

A close-ended scheme will have a restriction on the number of units that a fund can issue. So investors can buy only during the New Fund Offer (NFO) period (i.e. the period during which it is open for subscription) and can be redeemed only after the maturity. So entry and exit options for investors are restricted in Close ended schemes. So these are less liquid when compared to other instruments.

Another downside is only lumpsum investment can be made, no SIP mode of investment is allowed.

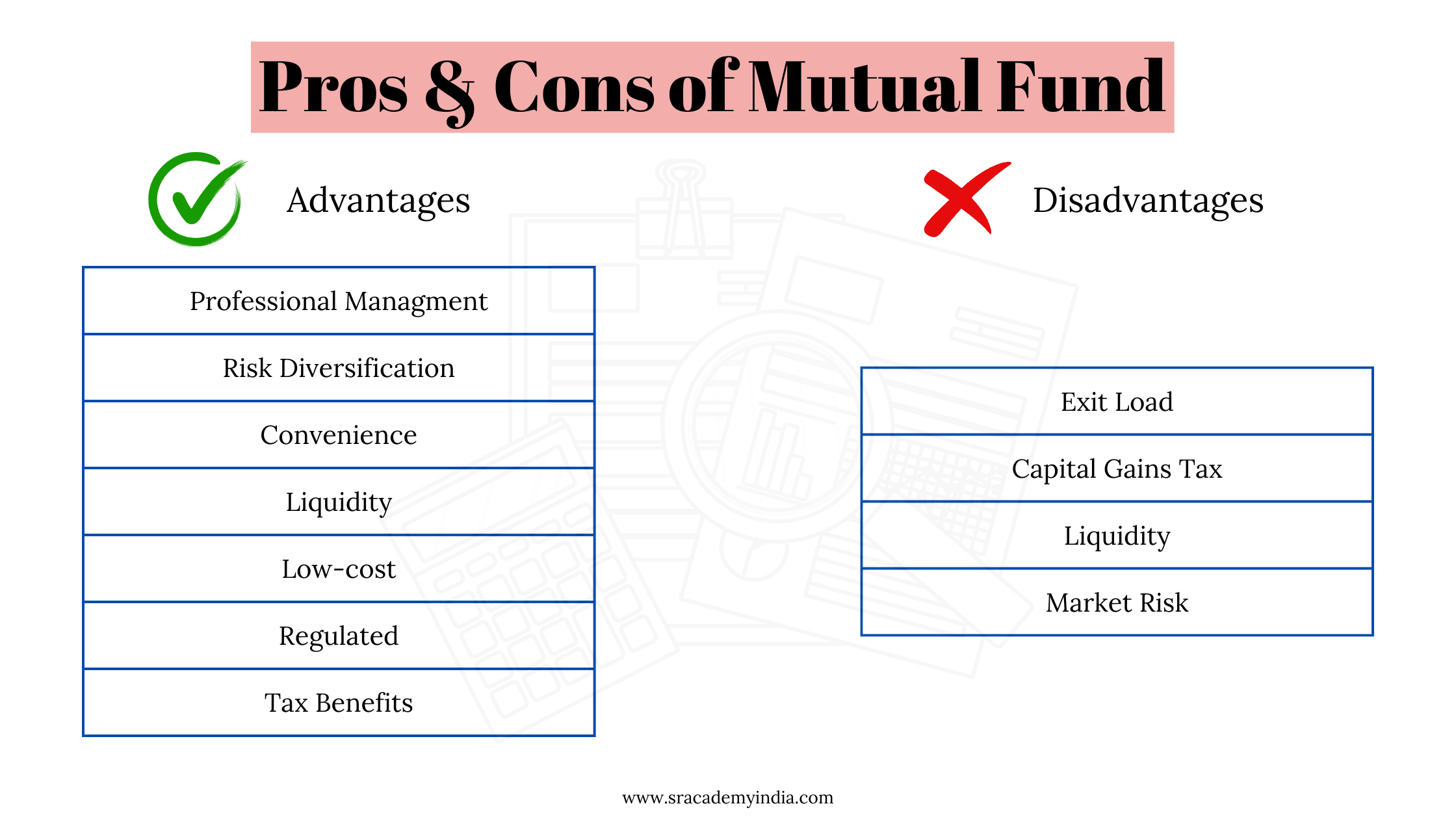

Advantages and Disadvantages of Mutual Funds

Advantages of Mutual Funds

1. Professional Management: Many investors may not have either sufficient skill/expertise to understand how the stock market works or to achieve the maximum return on their investments. As each mutual fund scheme is managed by professional fund managers, it provides variety of opportunities to investors in achieving the desired return on their mutual fund investment.

2. Risk Diversification: We all know diversifying the risk is important while investing. Mutual Funds are one of the best diversified investments since the investment is not limited to a single company or a sector in the market. So even if one investment in the portfolio doesn’t perform well, it will be counterbalanced by other investments to maintain a reasonable return.

3. Convenience: This is one of the important factor which helped in attracting a lot of investors towards mutual fund investment recently i.e. Convenience. Most of the investors cannot go for large investment in the beginning. Whereas with the mutual fund schemes, one can start their investment from a minimum investment of Rs. 500 and in addition SIP option is also available for those who want to invest regularly.

4. Liquidity: This is the utmost important factor to consider while investing. Because after investment, if you are unable to withdraw the money for your needs it doesn’t serve the basic purpose. So always consider liquidity as your highest priority.

5. Low-cost: The kind of returns different MF schemes are generating these days, the Total Expense Ratio (TER) they are charging from the investors is much less. Due to large economies of scale, particularly for funds with higher AUM, schemes will have a lower expense ratio. Schemes with low expenses will result in higher NAV which is ultimately beneficial to the investors.

6. Regulated: Mutual Funds are regulated by market regulator SEBI and also all mutual funds are governed by SEBI (Mutual Fund) Regulations, 1996. In addition, SEBI from time to time lays down stringent rules for the protection of the investors and to enable transparency in the financial market.

7. Tax Benefits: Not all mutual fund schemes are eligible for tax benefits. However, some of the schemes like Equity Linked Savings Schemes (ELSS) are eligible for tax benefits under sec 80C of the Income Tax Act. If tax benefits from investing are the priority, then make sure to consider equity-oriented mutual fund schemes only as the debt fund schemes are not eligible for tax benefits.

Disadvantages of Mutual Funds

1. Exit load: Most of the time we don’t consider exit load as one of the crucial factors. Generally, a higher exit load will eat up the earnings of the investors. To avoid this exit load, one must stay invested for a specific period. So make sure to consider this factor also while investing.

2. Capital Gain Tax: Whenever an investor exits from the scheme by selling the units, if any gain (i.e. sale price – buy price) arises on such sale it will be called Capital Gain as per the Income Tax Act, 1961. Depending on the period of holding (period from buy date to sell date) of the scheme, either such gain will be called Short Term Capital Gain (STCG) or Long Term Capital Gain (LTCG). So one should always consider tax aspect as well while calculating ROI on any investment.

3. Liquidity: One should consider liquidity carefully as it can be seen both as an advantage and disadvantage as well. Because not all mutual fund schemes are liquid. Even if they are liquid, it will take 3-4 working days to get your money credited to the bank account (except for liquid funds). So decide carefully on how much you want to invest in mutual fund schemes.

4. Market Risk: Since mutual fund schemes deals with stock market, there is always risk associated with your investment. Though mutual fund scheme’s investments depends on their investment objective, most of their investments are parked in stock market only. As we all aware that stock market is highly volatile, expected returns may not be guaranteed at all times.

Why one needs to invest in Mutual Funds

As discussed above, Mutual Fund comes with a lot of advantages. As a beginner, if you don’t want to spend much of your time researching the right stocks and lack the specialised skill of investing in the stock market directly, then Mutual Fund is one of the best investment options.

In addition, by default, all Mutual fund schemes provide diversification of risk since they invest in a variety of stock market investments. So the primary objective of risk diversification for many investors is taken care of. Also mutual fund returns are adjusted for Inflation.

Any scheme will have both advantages and disadvantages. As an investor, you need to observe and analyse how a particular investment option will help in achieving your wealth or income goal in your investment journey. While doing so if mutual funds give such a vibe, go for it it’s worth investing.

But please choose wisely as mutual funds have multiple schemes, you will get lost easily in the flow.

Mistakes to avoid while investing in Mutual Funds

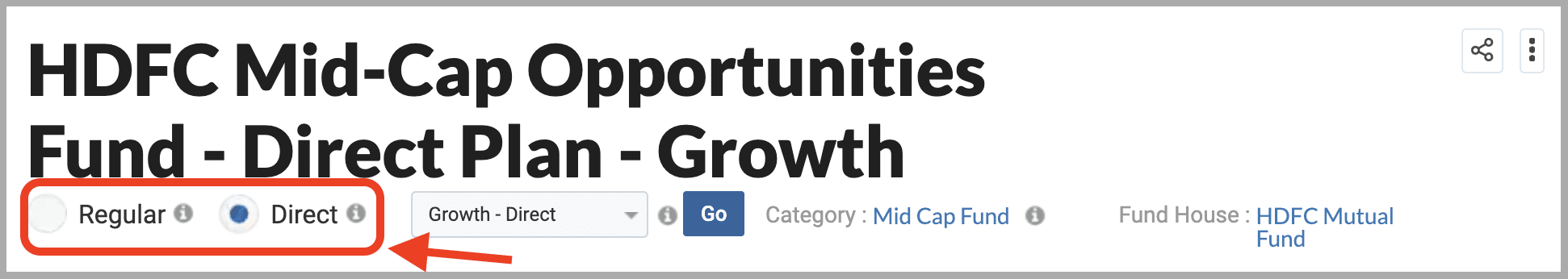

1. Never Invest in Regular Option

Each Mutual Fund will have 2 options, Direct and Regular.

Direct option is when you buy mutual funds directly from the Mutual Fund House itself. So TER will be less as no middleman involved, hence NAV of the scheme will be higher.

The Regular option is, investing in mutual funds through middlemen i.e. Broker. So it involves some commission which forms part of TER, resulting in lower NAV.

So higher the NAV, the higher the redemption amount and vice-versa. So always ensure to invest in the DIRECT option only while investing in Mutual Funds.

Source: Moneycontrol.com

2. Don’t invest in the wrong Mutual Funds

There are so many types of Mutual Fund options available in the market. They are Equity Mutual funds, Debt mutual funds, Hybrid mutual funds, Funds of Funds and Index funds.

Depending on the Investment objective and the quantum of equity investment, mutual funds are categorised into various types as mentioned above. So NO two mutual funds are the same as another.

Hence, before investing in mutual funds consider factors like:

– Are you willing to take risk,

– How long do you want to invest &

– Purposes for which are you investing?

Please keep all these factors in mind and select a suitable fund as per your needs and invest.

If you are new to mutual funds, please avoid investing in Index funds and Funds of Funds as these come under the high-risk category of investments. As you might be aware, since the risk is high return will be high and the risk of losing your money is also high.

So if you are an absolute beginner and ready to take minimal risk, go for either of these: Equity funds or Hybrid funds. Instead, If you don’t want to take the risk at all, go for Debt mutual funds.

3. Invest as SIP instead of Lumpsum

Another point is that whenever you want to invest, don’t invest the entire amount at once. Mutual fund schemes allow investors to invest in their schemes either through a Systematic Investment Plan (SIP) or through a Lumpsum mode. When purchased, the allocation of units happens on the basis of the prospective NAV of the scheme i.e. NAV at the end of the day. So, higher NAV leads to less number of units and lower NAV leads to more number of units.

Obviously, it is more advantageous if you invest when the market is down, so that the NAV of the scheme would be down you will be allotted more units.

So instead of investing the entire amount, it is better to invest it as an SIP and spread the tenure for at least 3,6 months or 1 year. That’s how you can get an optimum number of units since you are able to utilize the opportunity for more units when the market is down.

SIP mode is preferred, if you cannot track the market always to invest when the market is down. Instead, if you can track the market regularly even the lump sum investment also may give benefit. But if you are a beginner, SIP mode suits you better.

Example: Let’s say you are investing Rs. 1000 per month through monthly SIP mode and allotment happens on the 1st day of each month. Assume on 1st Jan 24 NAV is Rs. 25, so you have been allotted 40 units (Rs. 1000/Rs. 25). And on 1st Feb 24, the market was down and NAV became Rs. 20 so you got 50 units (Rs. 1000/Rs. 20).

So when did you get more units?

Correct, on 1st Feb 24. Because the ups and downs of the market will be taken care of when you invest through SIP mode.

4. Keep some funds as the Emergency fund

This is another important point to note down while investing in mutual funds. Though returns are good in mutual funds, please don’t invest all your savings in mutual fund schemes. Always keep some funds in your bank account for ready use to meet emergencies, if needed.

In case of emergency, accessing the funds in your bank account is easier than placing a request to withdraw funds from your mutual fund scheme. Even after placing the redemption request also, the amount will come to your bank only after 2 working days as these requests follow the T+3 mechanism.

5. Don’t invest in a single mutual fund, diversify it

Never keep your entire amount in a single mutual fund scheme. Because mutual fund schemes invest the funds in the sectors and companies of their choice as per the investment objective. If those companies perform well, you will get good returns.

If the contrary happens, forget about the returns sometimes you don’t even get your original investment as well. So never invest all your money in the same company or the same mutual funds. Choose different mutual funds and invest according to your requirements.

6. Past returns do not guarantee future returns

Normally before investing in any scheme, the basic thing we will do is to see how they have performed in the past. If their performance is good, we will consider it. Otherwise, we will ignore it.

Is it the right approach?

Here always remember, past performance does not guarantee future returns.

Since mutual fund invests the majority of their fund in the stock market, their performance depends on the stock market only. Maybe in the past, stock markets might have performed so well that equally reflected in the scheme you are about to invest also. So that scenario may or may not repeat in the future.

So don’t expect either considerably higher returns or at par with the past returns. However, nowadays most of the mutual fund schemes are able to yield a minimum of 15-20% return.

Hence, don’t consider return alone while evaluating mutual fund options. Instead, consider where the scheme intends to invest i.e. Large cap stocks or Mid-cap stocks or Small cap stocks. Also sometimes, who is managing the fund i.e. Fund manager also plays a crucial role in choosing the right scheme. So, consider all these factors and then make a decision.

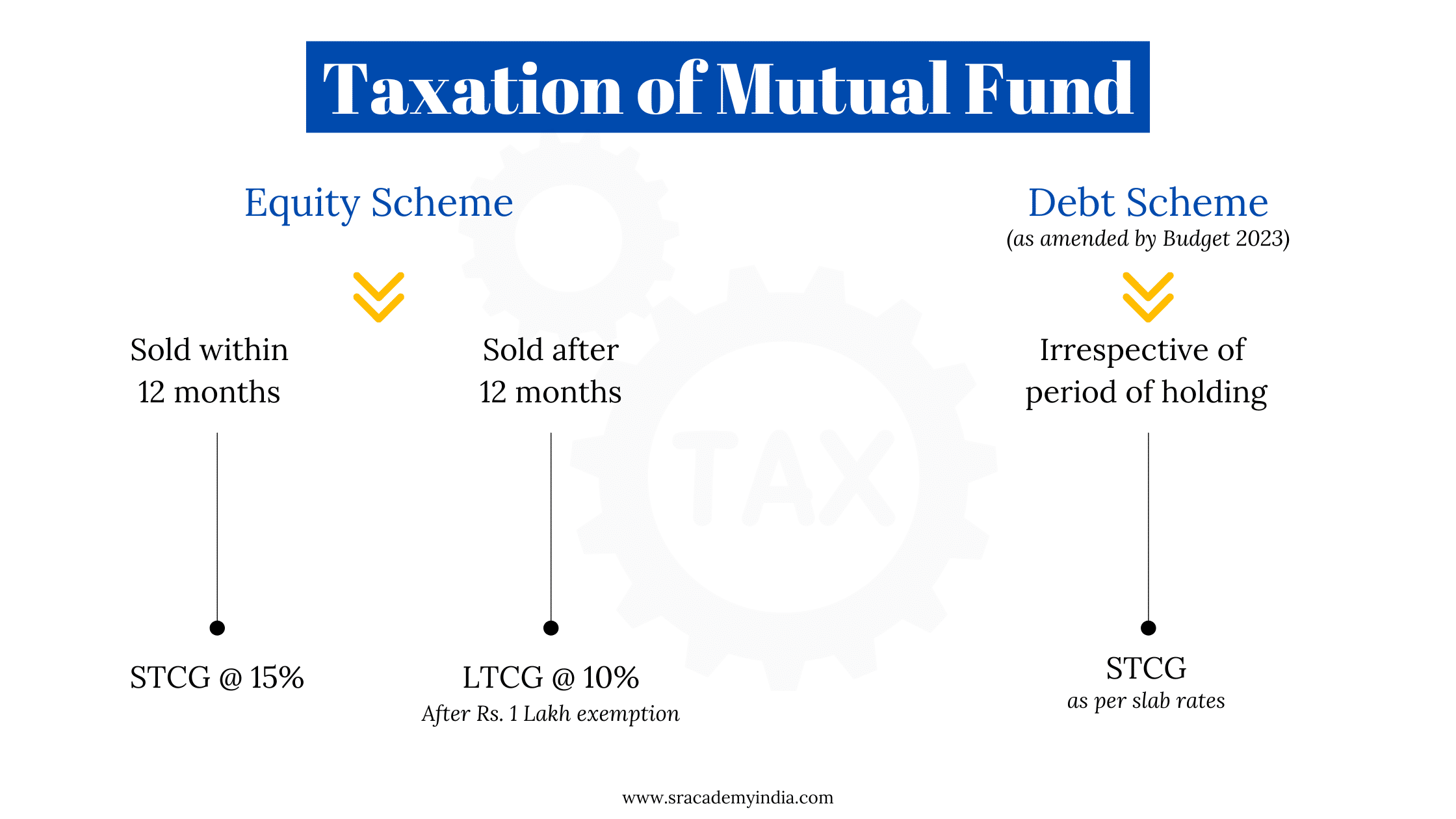

7. Not understanding taxes on Mutual funds

Taxes play a major role as they significantly impacts the net realisable amount when you redeem the mutual fund units. Never invest in mutual funds without understanding taxation.

Do remember that mutual fund gains are taxable under the Income Tax Act, 1961. If any gain arises on the sale of mutual funds, such gain has to be classified either as STCG or as LTCG (depending on the period of holding) and accordingly applicable taxes should be paid.

Depending on the nature of mutual funds invested (equity or debt), taxability and rates of taxation vary.

Equity Funds

Any gain from the sale of equity funds and if such units are redeemed within 12 months from acquisition, such gain is considered as Short Term Capital Gain (STCG) and is taxable at a 15% rate without any tax exemption as per sec 111A of the Income Tax Act.

Whereas, if such units are redeemed after 12 months from acquisition, such gain is considered as Long Term Capital Gain (LTCG) and is taxable at a 10% rate after tax exemption of Rs. 1 lakh as per sec 112A of the Income Tax Act.

Debt Funds

The taxation of Debt funds is slightly different than that of equity funds.

Any gain from the sale of debt funds, if such units are redeemed within 12 months from the acquisition will be considered as Short Term Capital Gain (STCG) as well but such gain is taxable as per the slab rates.

Whereas, if such units are redeemed after 12 months from acquisition, such gain from debt units is considered as Long Term Capital Gain (LTCG) as well, but taxable at 20% rate without any tax exemption.

However, in Budget 2023 debt fund taxation has been completely changed. Now irrespective of the period of holding, any gain from debt funds will be deemed as Short Term Capital Gain only and taxable as per the slab rates.

So equity funds have more tax advantages than debt funds. If you are aware of these taxation rules before investing, instead of investing in debt funds you should have considered equity funds, so that you can avail of tax benefits up to Rs. 1 lakh. Hence understand the tax provisions before you invest and then invest.

8. Invest for long tenure for better returns

Generally longer is better for mutual fund investments. It may not hold good for all scenarios, but to yield a better return one needs to invest for a long tenure.

Add any reference image for analysis done by any agency

Let’s say you invested in a mutual fund scheme and withdrew after 1 year with a return of 15% p.a. Assume the immediate next year, the same scheme has yielded a 40% return in the 2nd year alone. If you see the average return for 2 years, it’s 28% p.a. Instead of opting out from the scheme in the 1st year, if you would have continued for 1 more year you should have received 13% (28-15) more return from the same.

Sometimes, it may so happen that you might end up with losses also. I’m not saying investing for a longer tenure is always beneficial, my point is when you invest with patience probably, you are giving enough time to enjoy more stable returns.

So always try to invest for a longer tenure. Instead, if you want to invest for a short tenure, remember such gain may be taxable depending on the scheme and period of holding.

How to invest in Mutual Funds for beginners in India?

Since you understood the basics of Mutual Funds, now let’s talk about the different ways through which you can invest in it.

There are 2 broad modes you can invest, Online and Offline.

1. Nearest branch of Mutual Fund, Investor Service Centres (CSC’s) or Registrar & Transfer Agent (RTA) of the respective mutual fund.

2. Online through websites of mutual fund houses

3. Through any distributor registered with AMFI

KYC (Know Your Customer) verification is mandatory before you invest. One need to submit the duly filled-in application along with the PAN, Aadhaar, Bank statement & Cheque/DD.

FAQ’s

-

What is the full form of SIP in Mutual Fund?

SIP full form is a Systematic Investment Plan. It is one of the methods for investing in mutual fund schemes.

-

What is the full form of NAV?

NAV is Net Asset Value which is nothing but the market value of all assets held by a mutual fund divided by the number of units outstanding.

It is used to measure the performance of a mutual fund. -

AMC full form in Mutual Fund

AMC is an Asset Management Company which pools money from investors and invests such money into securities as per the investment objectives of the scheme.

Basically an AMC takes care of the entire fund management of the scheme. AMC’s are formed as Trust in India. -

CAGR Full form in Mutual Fund

CAGR is Compounded Annual Growth Rate which is one of the methods for calculating return on investment. It is a good indicator of scheme performance over a period of time. Generally scheme performance for period exceeding one year is expressed in terms of CAGR.

-

What are units in a Mutual Fund?

A Mutual Fund scheme issues units to investors in proportion of their investments. These units represents a portion of the total assets held by a mutual fund scheme. These units will be allocated on the basis of NAV of the scheme.

-

When did Mutual Funds start in India?

Mutual funds started in India for the first time in the year 1963 namely, Unit Trust of India (UTI) with a joint initiative of Govt of India and RBI.

-

What is the lock-in period in Mutual Funds?

Lock-in period is the period during which one cannot redeem the units of a scheme. Soon after the lock-in period, such units will be available for redemption. The basic purpose of lock-in period is to promote long term investing.

-

Can Government employees invest in Mutual Funds?

Yes, government employees are also eligible to invest in Mutual funds. There are absolutely no restrictions at all.

-

Can a minor invest in Mutual Funds?

Yes, minors are also eligible to invest in Mutual funds. Any person below the age of 18 years with the help of parents/guardian can become an investor.

-

How much time it takes to redeem Mutual Funds?

Generally once redeemed amount should be credited to bank within 3 working days from the redemption date. Whereas for liquid funds, amount will be credited within 1 day.

-

What is STT in a Mutual Fund?

STT in a mutual fund is Security Transaction Tax. It is a tax levied on purchase and sale transactions of a mutual fund. But it is levied on equity oriented mutual funds ONLY.

-

Can NRI invest in Mutual Funds?

NRI’s are allowed to invest in Mutual Funds as long as they follow Foreign Exchange Management Act (FEMA).

-

Is a Demat account required for Mutual Funds?

No, having a Demat account is a not necessary to invest in Mutual Funds. Earlier it is a mandatory requirement, but now one can invest in Mutual Funds through either a broker, AMC or online/offline distributors.

-

Can I redeem Mutual Funds anytime?

For Open-ended schemes, you can redeem anytime you want. But if have invested in Close-ended schemes, you can redeem only after the maturity. And also, if mutual funds specify any lock-in period you cannot redeem during such lock-in.

-

Can NRI invest in Mutual Funds without Demat account?

Yes, NRI’s can invest in Mutual Funds with just a PAN card and NRE/NRO account. They also need to do KYC and their bank account should be linked before investing into Mutual Funds.