Jupiter Credit Card

Introduction

If you are looking for the best Rupay Credit card with Zero Joining and Zero Annual fees, then, you should look at “Jupiter Edge CSB Bank Rupay Credit card”.

This Credit card will be issued by CSB Bank and the Credit card will be operated by Jupiter, which is a Fintech company. These two companies will work under the guidelines of the Reserve Bank of India (RBI)

CSB Bank is formally known as Catholic Syrian Bank Limited, headquartered in Thrissur, Kerala. This bank was founded in the year 1920 and is also listed in BSE and NSE (As per Wikipedia source)

The Jupiter Credit card is a Co-branded Rupay credit card.

Co-branded credit cards will be launched in a collaboration of a Banking company with another company or brand. They mutually collaborate to launch a New credit card that combines the major benefits of both entities, to attract new customers.

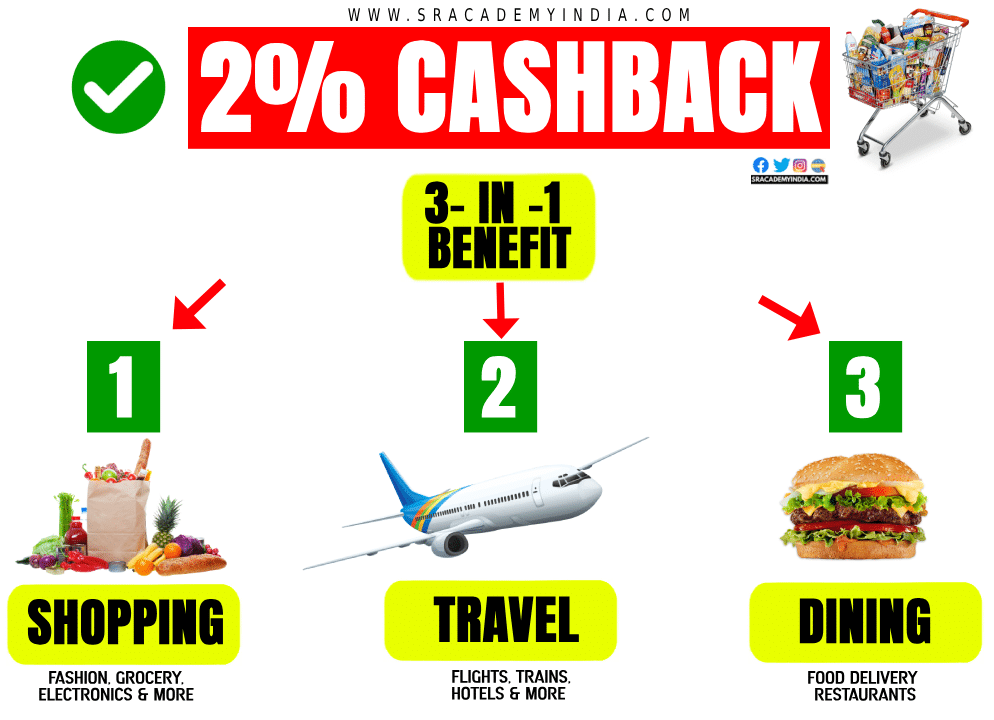

This Jupiter Credit Card offers 2% Cashback under 3 Categories

1. Travel,

2. Shopping, and

3. Dining

And, also it is a Rupay credit card that offers 0.40% cashback on UPI payments.

However, this Jupiter Edge CSB Bank Credit Card launched on 6th September 2023 and it’s Free for the first 2 lakh customers.

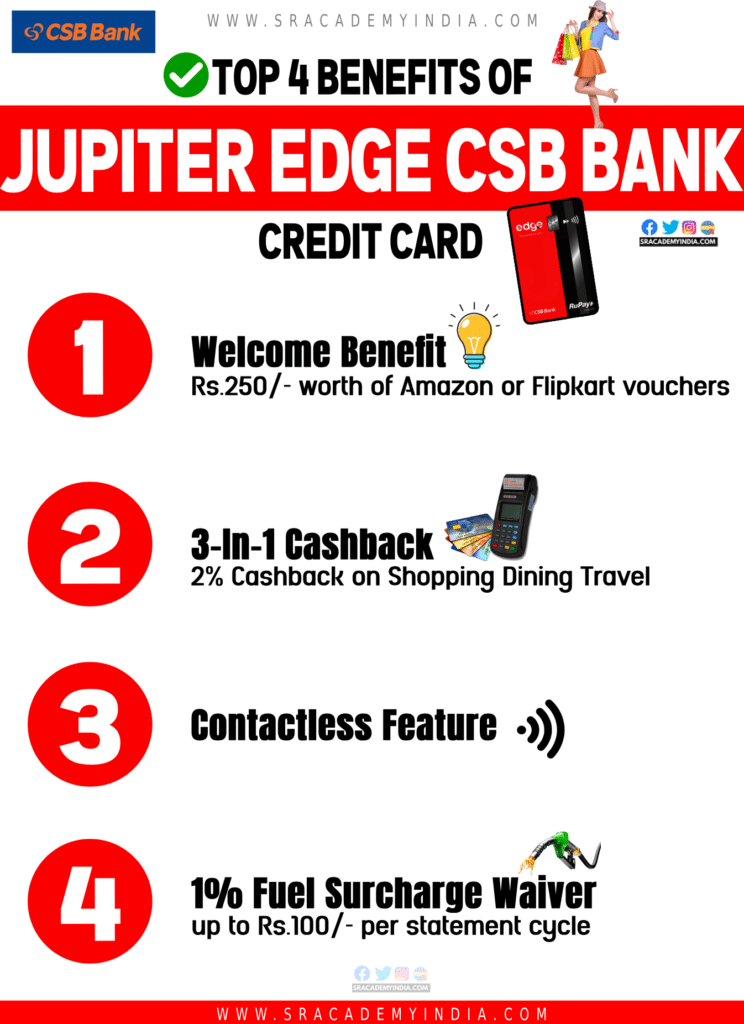

Let’s check out the top 4 features and benefits offered by this credit card.

Jupiter Credit Card Overview

| Particulars | Description |

|---|---|

| Credit Card Type | Cashback |

| Joining Fees | Nil |

| Renewal Fees | Nil |

| Best for | Entry-Level Credit card users |

If you look at the top left of this credit card, you can see the card name as “Edge”. Along with that, it displays “Powered by UPI” which enables making UPI Payments.

If you look at the top right of this credit card, you can see a Chip card and also, there is a “Contactless Logo” symbol.

If you look at the bottom left of this card, it shows the issuing bank name as “CSB Bank” and by looking at the right bottom of this credit card, you can see the “Type of Credit card network” as “Rupay”

Let’s crack this Square Credit card features and benefits.

Jupiter Credit Card Benefits

What Benefits do you get from Jupiter Credit Card?

Let me go through the Top 4 benefits offered by Jupiter Credit Card [Incl. My Analysis]

1. Welcome Benefit

As a Welcome benefit, the Jupiter Edge CSB Bank Credit card holder will get Rs.250/- worth of Amazon or Flipkart vouchers with 1-year validity from the issue date.

2. Cashback Benefit

i) 2% Cashback

This Jupier Credit Card offers a unique 3-in-1 feature that allows the cardholder to choose between 3 categories of cashback. The bank is mainly concentrated on regular Indian spending only i.e.

1. Shopping

2. Dining

3. Travel

If you spend on any of these categories, then you can earn 2% Cashback.

ii) 0.4% Cashback

As the Jupiter Credit card is a Rupay Credit Card, if you make any payments by “Scan and Pay”, then this cardholder can earn 0.4% cashback. i.e. making UPI Payments and all other spending.

UPI Payments are one of the fastest and most popular payment methods available today.

Under this method, If you link your Credit card with any UPI payment app, then, you can scan the QR code at any small shop and can complete the payment without needing a Physical Credit Card or Bank account balance.

The earned cashback can be seen and will be added to your Jupiter app and also you can redeem it later on.

Maximum Limit

This Jupiter Credit card doesn’t mention about Maximum Cashback limit on your spending. Therefore, credit card holders can enjoy up to 2% unlimited cashback on this credit card.

This feature will be beneficial to the customers as it saves money on almost every expenditure.

3. Contactless Feature

This Jupiter credit card comes with Contactless technology.

Let me explain..!

In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

4. Petrol / Diesel Benefit

By using this Credit Card, If you spend on Petrol/Diesel between Rs.400-Rs.3,000/- in any fuel outlets across the country, then, a Fuel Surcharge will be charged. It may be between 1-3% of your Fuel Cost.

In case, you have paid fuel bills through this card, then, you will be eligible for a “1% Fuel Surcharge Waiver“. The Maximum Fuel Surcharge waiver you get is up to Rs.100/- per statement cycle.

I wrote a detailed article on Fuel Surcharge along with an analysis of whether it is useful or not.

Read here: How I Lost Money by paying Fuel bills with Credit Cards

Jupiter Bank Credit Card Apply Online

If you want this Jupiter Edge CSB Bank Credit Card, You can apply.

Apply NowJupiter Credit Card Charges [Must Read]

Let’s check all the applicable charges for using this Jupiter Edge CSB Bank Credit Card.

| S.No. | Particulars | Description |

|---|---|---|

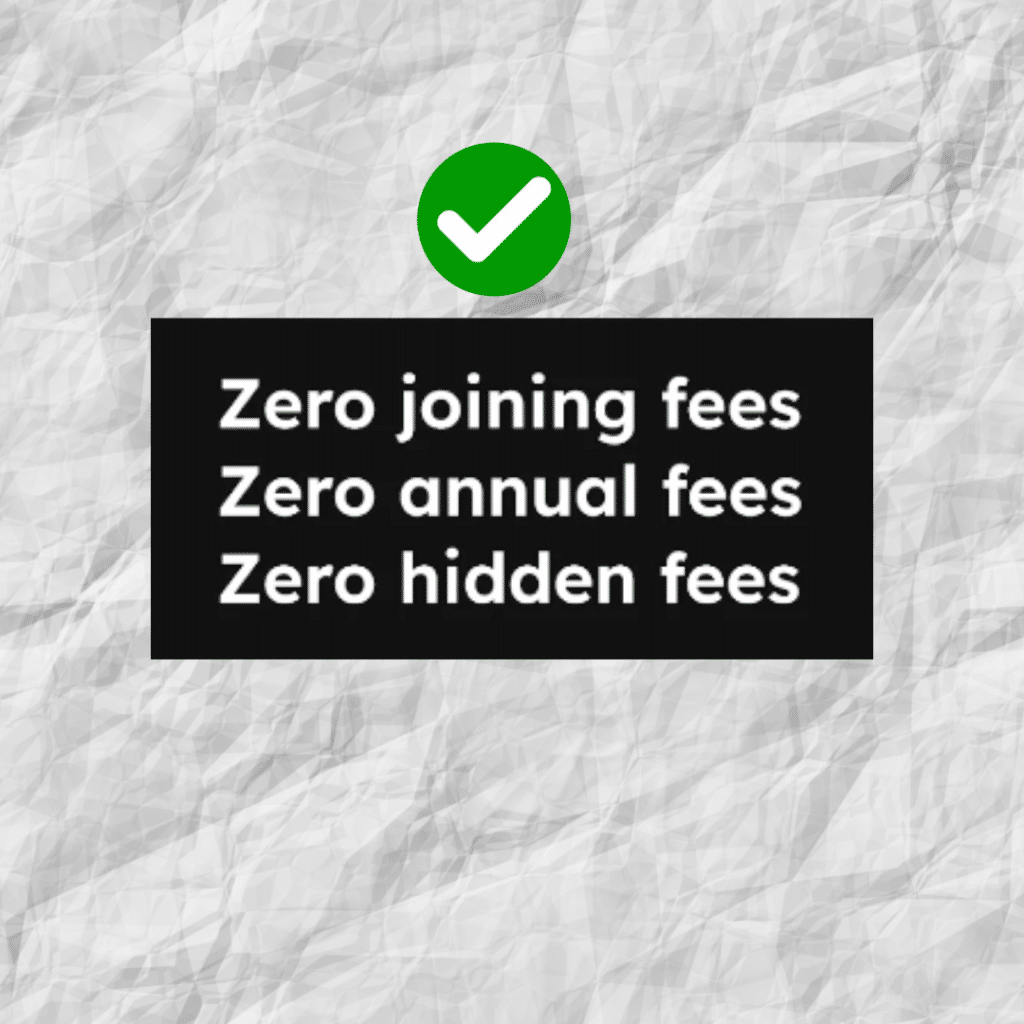

| 1. | Joining Fees | Nil |

| 2. | Renewal Fees | Nil |

| 3. | Interest charges | @3.50% p.m. i.e. 42% p.a. |

| 4. | Foreign Currency Markup | 3.50% of transaction amount |

| 5. | Late payment charges | From Rs.Nil – Rs.1200 |

| 6. | Rent Payment Fees | 1% of transaction amount |

| 7. | Over-limit Charges | NA |

1. No Joining fees

If you want to use this Jupiter Credit Card, then, you will be offered Zero Joining fees as a welcome offer. i.e. Free for the first year.

2. No Renewal fees

However, If you want to continue using this Jupiter Credit Card from the second year onwards also, then, you are not liable to pay any Renewal fees.

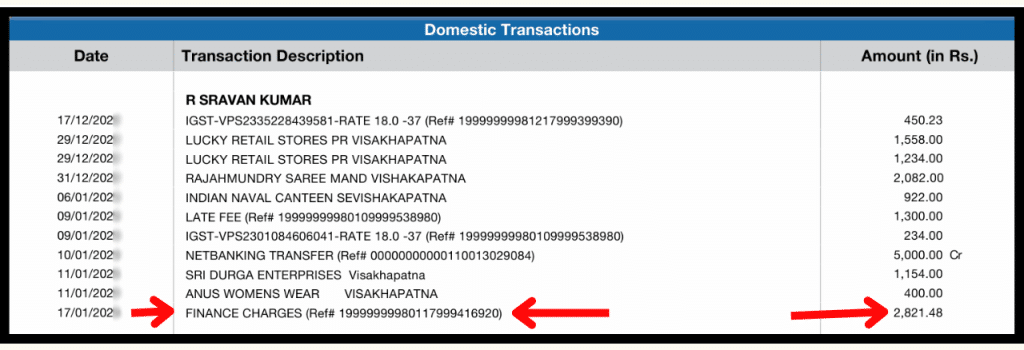

3. Interest charges / Finance Charges?

Do you know how much interest you will be charged on this Credit Card?

You must know it, boss.!

For Example,

You have used this Jupiter Credit Card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, this bank will charge you interest @3.50% per month. It means the Annual interest the bank will charge is almost up to 42% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

4. Foreign Currency Markup

Also, whatever international transactions you do by using this credit card, you will be charged a foreign mark fee of 3.50% on that transaction.

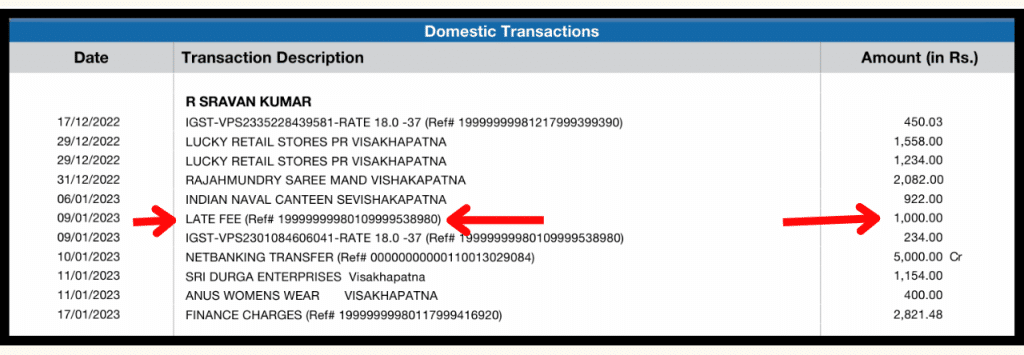

5. Late payment charges

Apart from Interest charges, if you delay paying this Jupiter Credit Card outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, the Late payment charges range from a Minimum of Zero rupees to a Maximum of Rs. 1,200/- depending on your Credit card outstanding.

If your credit card outstanding balance is more than Rs.500/-, then you will attract Late payment charges.

| Credit Card Outstanding Balance is | Late payment charges |

|---|---|

| Less than Rs.500 | Nil |

| Between Rs.501-Rs.5,000 | Rs.250/- |

| Between Rs.5,001-Rs.10,000 | Rs.750/- |

| Rs.10,001 & Above | Rs.1,200/- |

So if you use a credit card you have to be very organized and should deal with Credit card timelines properly.

6. Rental Payment Fee

If you make any rental payments by using this credit card will be charged 1% of the transaction amount.

Jupiter Credit Card Review

Coming to my opinion, this Jupiter Credit card is an entry-level credit card that offers 2% cashback on Shopping, Dining, and Travel. Also, the cardholder can earn 0.4% Cashback on UPI payments is beneficial to the customers.

1% Fuel Surcharge Waiver and Contactless features are additional features only, therefore, those cannot be considered major benefits.

Therefore, this Jupiter Rupay Credit card is suggestible only to first-time credit card users, who are looking for a basic credit card with minimum benefits only. Also, those who want to earn some bugs in the form of cashback on 3 categories of Shopping, Dining, and Travel can apply for this lifetime free credit card.

In case, if you are already using any other credit cards, then you can skip this basic credit card.

Frequently Asked Questions

If you still have any questions, Check the below Frequently Asked Questions for more clarity.

1. What is Jupiter Credit Card?

Jupiter Credit Card is a Co-branded Credit card launched by CSB Bank and Jupiter, a Fintech company to tailor to the needs of frequent travelers, regular diners, and shoppers. This credit card offers rewards in the form of Cashback of 2% on Shopping, Dining, and Travel spending & 0.40% Cashback on UPI Payments.

2. Is Jupiter a Bank?

The Edge CSB Bank credit card is provided by CSB Bank, a scheduled commercial bank, in collaboration with Europa Neo Marketing Pvt Ltd. This card can be accessed solely through the Jupiter app.

It is important to note that ‘Jupiter’ is not a bank and does not possess or assert any banking license.

3. Is Jupiter Credit Card Rupay Card?

The Jupiter Edge CSB Bank Credit Card is a Rupay Credit Card. These cards currently good for domestic use with lower processing fees.

4. Can I Link Phonepe in Jupiter Credit Card?

As Jupiter Edge CSB Bank Credit Card is a Rupay Credit card, the cardholder can link this credit card to their PhonePe.

5. Is Jupiter Credit Card has Lounge access?

The Jupiter Credit card offers no Airport or Railway Lounge facility to its customers.

6. Is the Jupiter credit card contactless card?

The Jupiter credit card comes with Contactless technology.

In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

7. Can I use Jupiter Credit Card in petrol pump?

The Jupiter Edge CSB Bank Credit Card customers can fuel their vehicles at fuel stations. Whenever you pay with your Jupiter Credit card, you should be liable to pay a Fuel Surcharge i.e. around 1-3% of fuel cost. However, with this Jupiter Edge CSB Bank Credit Card, you will be eligible for a 1% Fuel Surcharge waiver.

8. Does the Jupiter Credit Card has Fuel Surcharge Waiver?

The Jupiter Credit card offers a Fuel Surcharge Waiver. If you spend Petrol/Diesel between Rs.400-Rs.3,000/- in fuel stations in the country, then you will be eligible for a 1% Fuel Surcharge waiver with a Maximum of Rs.100/- per statement cycle.

9. Is Jupiter Credit Card Lifetime Free?

This Jupiter Credit Card comes with Zero Joining fees. i.e. Free for the first year i.e. you are not required to pay card joining charges. However, If you want to continue using this Jupiter Credit Card from the second year onwards also, then, you are not liable to pay any Renewal fees.

Thanks for your time my dear friends..!!