How to find CIF number in SBI [6 Methods]

Finding your CIF number in State Bank of India (SBI) can be a very crucial step in managing your finances and accessing various services offered by the bank.

Whether you are a totally new customer or an existing customer of SBI, knowing that unique CIF number can absolutely save you lots of time and effort when completing those super important transactions.

In this post, I will guide you all through the entire process of locating your CIF number in SBI, including all the various methods you absolutely can use to retrieve it. So, if you happen to be an SBI loyal customer looking forward to locating your CIF number, continue reading on to learn even more!

Let’s get started on “How to find CIF number in SBI”

What is the Meaning of CIF ?

Before you find your CIF number, you should know What is CIF ?

CIF stands for “Customer Information File“. It is a 11-Digit unique number. It is created and allotted to each and every SBI Customer by the State Bank of India (SBI), when a new customer opens his Bank account or taken any Loan.

CIF contains customer’s Personal details, contact details, identity details, address proof, transaction history, and lot more. Based on this CIF only Savings Account, Personal accounts, Loan, Insurance accounts, Mutual Funds, Government schemes etc will be opened by the Banks.

When you open your SBI Internet Banking or SBI Yono app, then, you can see all your Savings Account, Personal accounts, Loan, Insurance accounts, Mutual Funds, Government schemes will be displayed which are linked with your CIF.

Benefits of CIF number

CIF number is super important as it helps the bank to access a customer’s all banking-related information. Here, you can see few benefits of it.

CIF Number is helpful in getting the Bank account details of the customer. Loans can be approved and Mutual Fund accounts and all other accounts of a customer can be opened using this CIF number.

How to Find CIF number in SBI

An SBI customer can find their CIF Number in multiple ways. I will show you few of it.

Let’s check it out 6 different ways

1. Through Passbook

2. Through Bank Statement

3. Cheque Book

4. Internet Banking

5. Through Customer Care

6. By visiting Branch

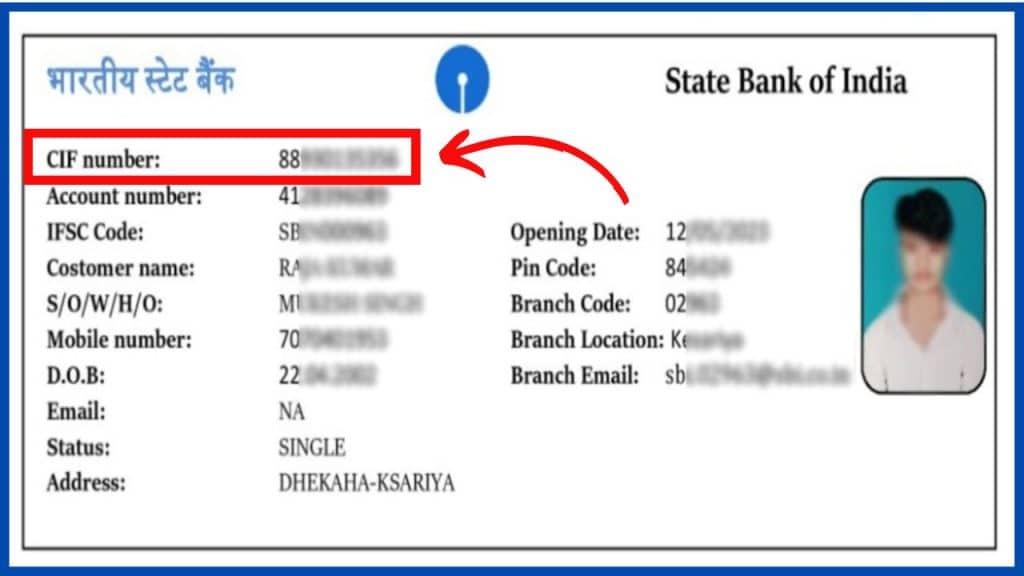

#Method 1: How to Find CIF number in SBI via Passbook

Passbook is a primary a document which was given at the time of opening your SBI bank account. On passbook, you can easily find your SBI CIF number on the first page itself. On below CIF number, you can find your “SBI Bank account number”.

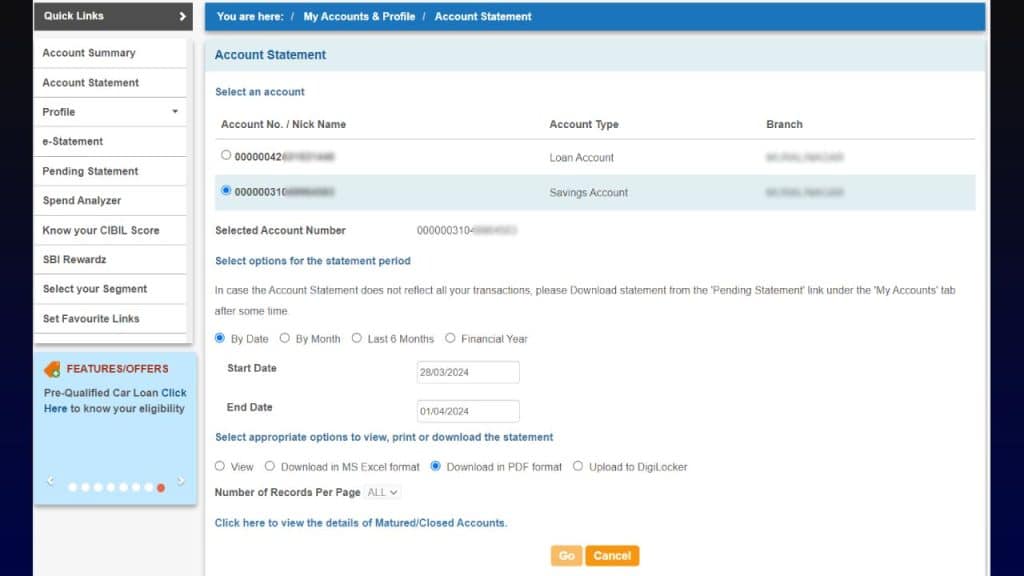

#Method 2: How to Find CIF number in SBI via Bank Statement

You can find your SBI bank CIF number on the first page of your Bank Statement. Let’s see how to download your Bank Statement through SBI Internet banking easily.

Steps:

1. Visit the SBI Internet Banking Login page.

2. Enter the Valid Username, Password & Captcha and Click on Login

3. Enter the One-time-password (OTP) and Click on “Submit”

4. Now your SBI Bank dashboard will be appeared. Select “Account Statement” on the left menu.

5. Select your “Savings account”

6. Select the “Period” for which you want to download Bank Statement.

Eg: By Date, By Month, Last 6 Months, Financial Year

7. Select the “Start date & End date”

8. Select the format you want to Download the Bank Statement like MS-Excel, PDF etc.,

9. Click on “Go” option.

10. Your Bank Statement will be downloaded successfully.

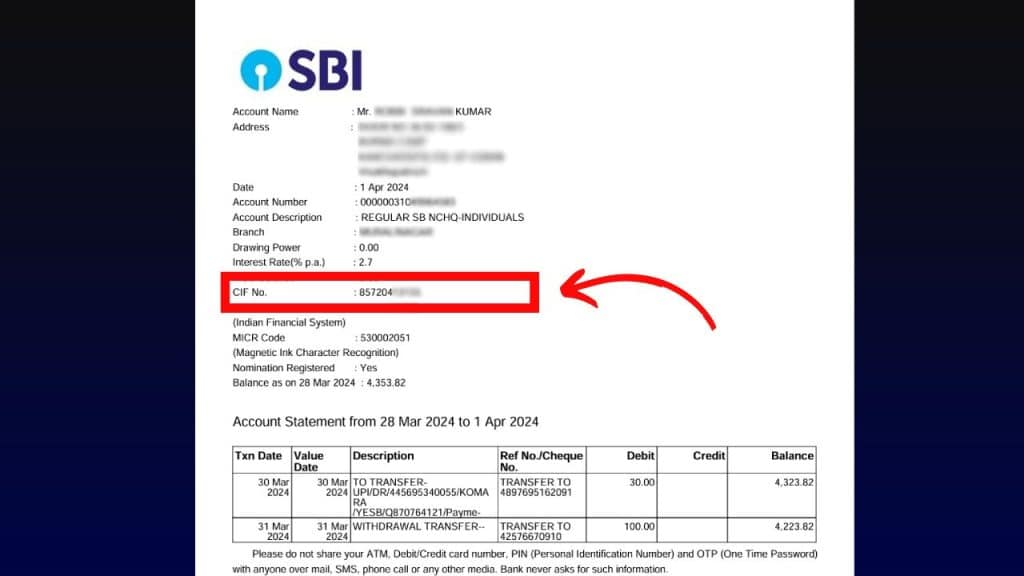

Once you have downloaded the Bank statement for any period, then, on the first page of it, you can find your CIF account number & all the remaining pages you can see your all debit and credit transactions you made.

#Method 3: How to Find CIF number in SBI via Cheque Book

You can find your bank CIF number on your SBI Cheque book. If you have applied for the SBI Cheque book, then, on each and every page of cheque leaf, you can easily see your CIF number.

#Method 4: How to Find CIF number in SBI via Internet Banking

In case if you have SBI Internet banking Login credentials, you can also get CIF number by sitting at home easily. However, you should have a valid SBI internet banking username and password.

1. Visit the SBI Internet Banking Login page.

2. Enter the Valid Username, Password & Captcha and Click on Login

3. Enter the One-time-password (OTP) and Click on “Submit”

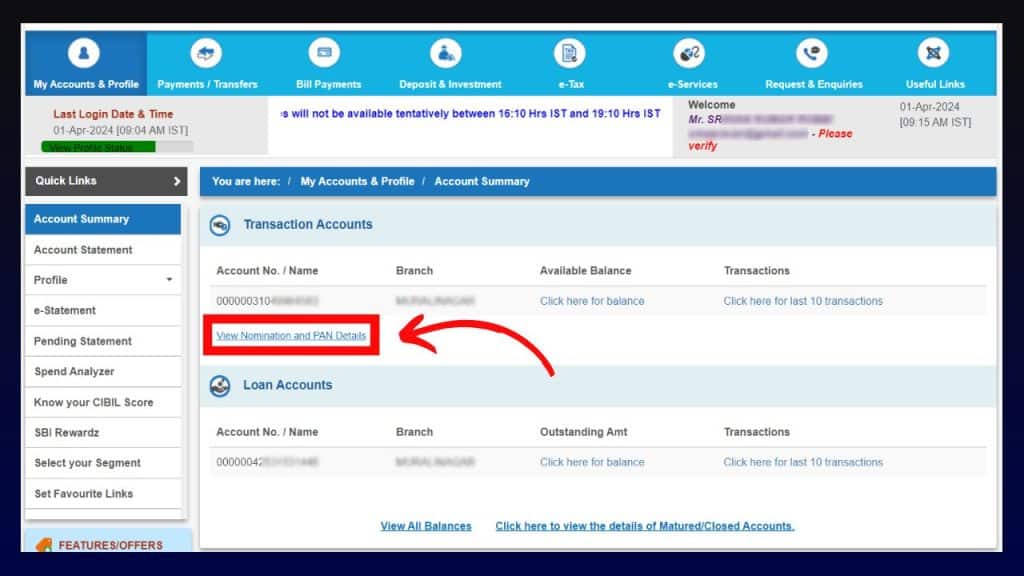

4. Now your SBI Bank dashboard will be appeared. Select “Account Summary” on the left menu.

5. Click on “View Nomination & PAN details”

This way also quite helpful to check your Bank CIF Number.

#Method 5: How to Find CIF Number in SBI without Passbook

How to Obtain CIF Number through Customer Care

If you’re not feeling totally up to it with the Website or App method or whatever, you can just directly call customer care to grab your CIF number!

1. Call literally any of these Toll-free numbers:

– 1800-425-3800

– 1800-11-2211,

– 080-26599990

2. Choose the Language and talk to the customer representative about getting that

sweet CIF Number!

3. Some basic identity verification questions will be thrown your way (just have your

passbook ready).

4. Once the super legit verification process is finished. The customer representative will hand over the CIF number to you!

#Method 6: How to Find CIF number in SBI via Visiting Branch

You can visit State Bank of India (SBI) home branch and ask them for CIF number by providing your Bank Account number.

Frequently Asked Questions [FAQ’s]

1. Is Bank Account number and CIF Number both are Same ?

Bank account Number and CIF number are not same. Bank account represents any account opened in the Bank. It may be Savings account, Current account, Loan account, and more. However, the CIF number is a Customer Information file which tracks all your linked accounts including Mutual Fund accounts and Government schemes as well.

2. Can I get CIF number through SMS ?

As for now, there is no way to get the CIF number of the SBI account. But you can send an SMS from the registered stuff to get an

E-statement.

3. How to get SBI CIF Number Without Passbook ?

SBI Customers can call directly to Call literally any of these Toll-free numbers 0f 1800-425-3800, 1800-11-2211, 080-26599990 and can ask for CIF number after conforming your Bank account with some few basic questions.

Thanks for your time & Comment which method you felt easiest 🙂