HDFC Personal Loan Preclosure Charges

Introduction

HDFC Bank is India’s largest Private sector bank, which provides Personal loans with attractive interest rates along with easy repayment options. This Indian Private sector bank is Headquartered in Mumbai city of Maharashtra state.

People opt for personal loans for numerous reasons. To finance their dream wedding, for home renovation, or for any other personal reason.

When the purpose is served, they may prefer to close their loan. Then, it is always important to know the associated charges, if they pre-closure their personal loan.

So, let’s discover more about HDFC Personal Loan Preclosure Charges.

Before you get started to know about HDFC Personal Loan Preclosure Charges, you should be aware of pre-closure…!!

What is a Pre-closure?

Preclosure refers to paying off the loan amount before its maturity date. It can be done by making a lumpsum payment which includes Interest and principal portion.

The customer can initiate Preclosure for various reasons due to having a lumpsum amount in hand, wanting to get out of monthly EMI, or if the customer doesn’t want to pay interest on the loan.

Then, HDFC customer should know about applicable Preclosure charges on their Personal Loan.

HDFC Personal Loan Preclosure Charges

If you are planning to pre-close your HDFC Personal Loan, then, the preclosure charges vary depending on

1. Loan tenure and

2. Number of EMIs paid.

Under HDFC Personal Loans, the Preclosure charges for Personal loans will be applicable on Outstanding Principal balance only and on Post cooling Period off / Look up period.

Post cooling Period is the period after you sign the loan agreement. It allows the borrower to exit the loan without having any additional penalty.

As per the Consumer Credit Act 1974, the customer has a right to cancel a credit agreement within 14 days without penalty.

HDFC Personal Loan Preclosure Charges vary depending on EMI repayment

Case 1: Within 24 EMI Repayment

If you want to close your personal loan before 24 EMI Repayments, then, HDFC Customer will be liable to pay 4% of Principal Outstanding as a Pre Mature charge.

Case 2: Post 24 EMI Repayments & up to 36 EMI Repayments

If you want to close your personal loan after 24 EMI Repayments and below 36 EMI Repayments, then, the HDFC Customer is liable to pay 3% of Principal Outstanding as a Pre Mature charge.

Case 3: After 36 EMI Repayment

If you want to close your personal loan after 36 EMI Repayments, then, the HDFC Customer is liable to pay 2% of Principal Outstanding as a Pre Mature charge.

| S.No. | Period | Pre Mature charges |

|---|---|---|

| 1. | Below 14 days | Nil |

| 2. | Upto 24 EMI Repayment | 4% on Principal Outstanding |

| 3. | Post 24 EMI Repayments & upto 36 EMI Repayments | 3% on Principal Outstanding |

| 4. | Post 36 EMI Repayment | 2% on Principal Outstanding |

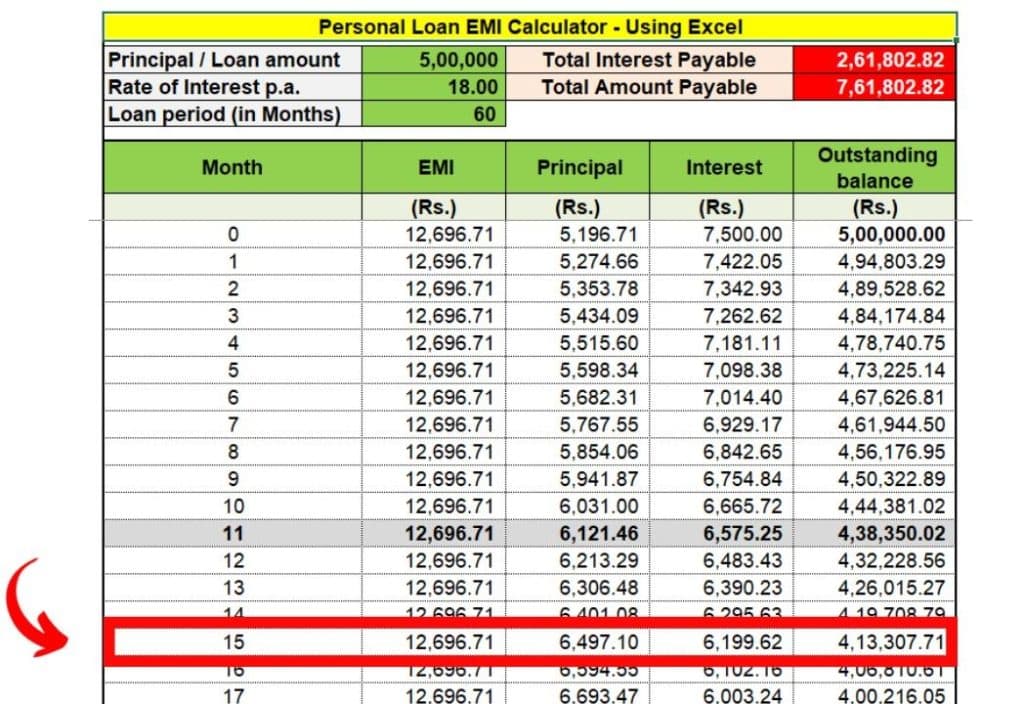

#Example 1

Let’ say, You have an 18% HDFC Personal Loan of Rs.5,00,000/- with a tenure of 5 Years. Due to Monthly EMI burdens, you have decided to pre-pay the loan in full after 15 EMI repayments.

Computation

The applicable preclosure charges will be as follows

| Particulars | Terms |

|---|---|

| Personal Loan taken | Rs.5,00,000/- |

| Loan period (in Months) | 60 |

| Outstanding Principal balance | Rs.4,06,811 |

| Applicable Foreclosure rate (%) | @ 4% on Principal Outstanding |

| Applicable Foreclosure charges | Rs.16,272/- [i.e. Rs.4,06,811 x 4%] |

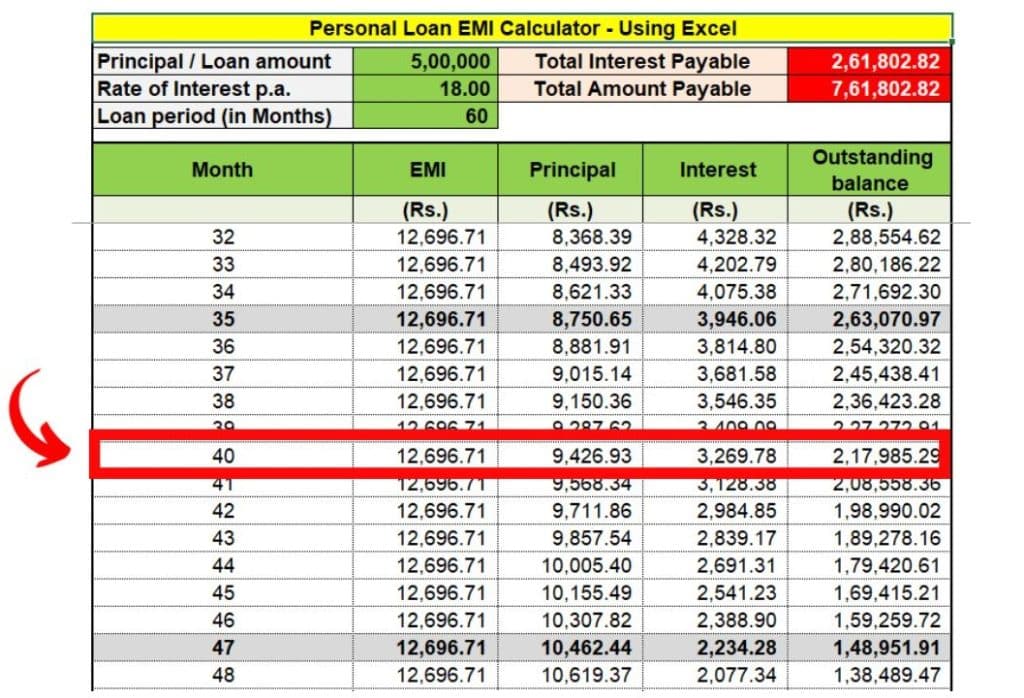

#Example 2

Let’ say, You have an 18% HDFC Personal Loan of Rs.5,00,000/- with a tenure of 5 Years. Due to Monthly EMI burdens, you have decided to pre-pay the loan in full after 30 EMI repayments.

The applicable preclosure charges will be as follows

| Particulars | Terms |

|---|---|

| Personal Loan taken | Rs.5,00,000/- |

| Loan period (in Months) | 60 |

| Outstanding Principal balance | Rs.2,96,800/- |

| Applicable Foreclosure rate (%) | @ 3% on Principal Outstanding |

| Applicable Foreclosure charges | Rs. 8,904/- [i.e. Rs.2,96,800x 3%] |

#Example 3

Let’ say, You have an 18% HDFC Personal Loan of Rs.5,00,000/- with a tenure of 5 Years. Due to Monthly EMI burdens, you have decided to pre-pay the loan in full after 40 EMI repayments.

The applicable preclosure charges will be as follows

| Particulars | Terms |

|---|---|

| Personal Loan taken | Rs.5,00,000/- |

| Loan period (in Months) | 60 |

| Outstanding Principal balance | Rs.2,08,559 |

| Applicable Foreclosure rate (%) | @ 2% on Principal Outstanding |

| Applicable Foreclosure charges | Rs.4,171/- [i.e. Rs.2,08,559 x 2%] |

From the above analysis, it is clear that the HDFC Customer loses more money in the form of Pre-closure charges when he closes earlier.

Conclusion

Pre-closure charges are a regular practice in the Banking industry including for HDFC Bank.

If you are considering prepaying your HDFC Personal Loan, it is quite important to know all the applicable charges. By understanding all the above-mentioned charges, the customer can make better decisions and ultimately it minimizes the financial burden of pre-closure.

Thanks for your time folks 🙂