Mr. Kishore threw a Lavish party for their colleagues on his promotion occasion and spent money with his newly applied HDFC Credit Card. He and his colleagues enjoyed the party well. Not only that Mr.Kishore swiped his new Credit card for pumping Diesel and also for the purchase of Household groceries as well.

His credit card due date is the 6th of every month. As the due date is nearing, he wants to clear the Outstanding balance on his credit card to maintain his credit score healthy.

Let’s see How to pay HDFC credit card payment through the HDFC Mobile banking app.

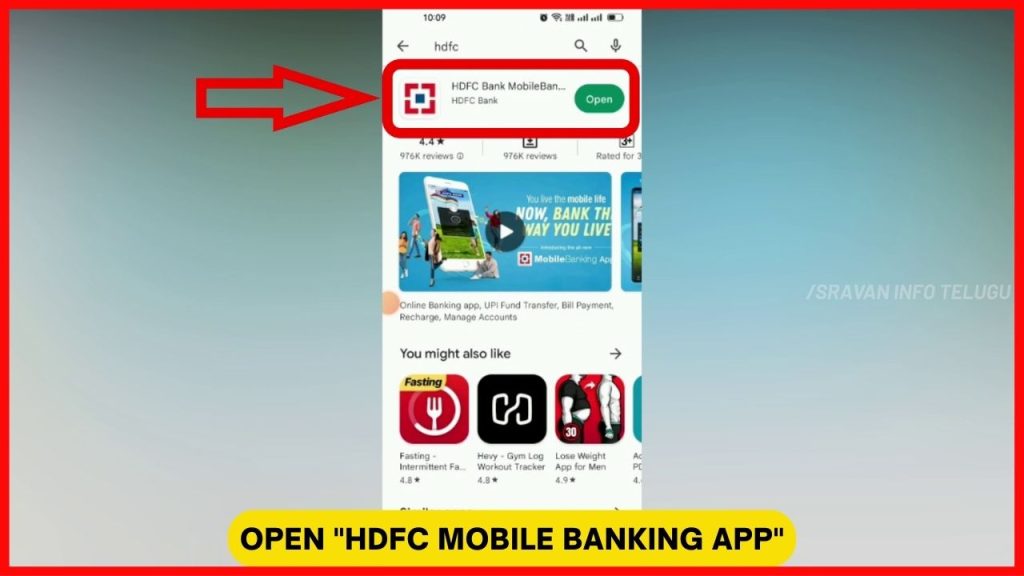

Step 1:

Firstly, open the “HDFC Mobile banking app” on your Mobile.

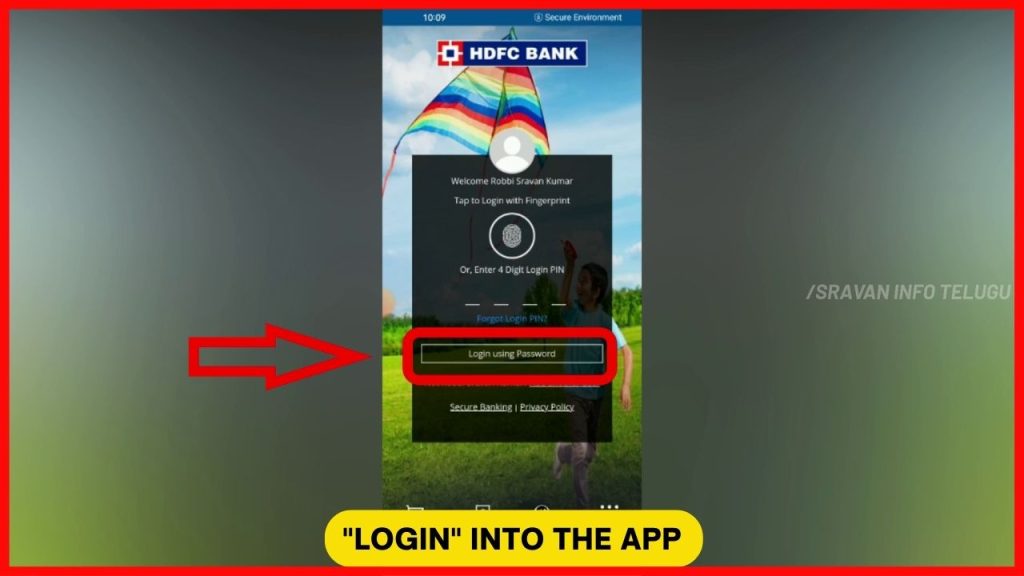

Step 2:

Now, Login into the app using the User name, Password (or) using your Fingerprint (or) using HDFC PIN number.

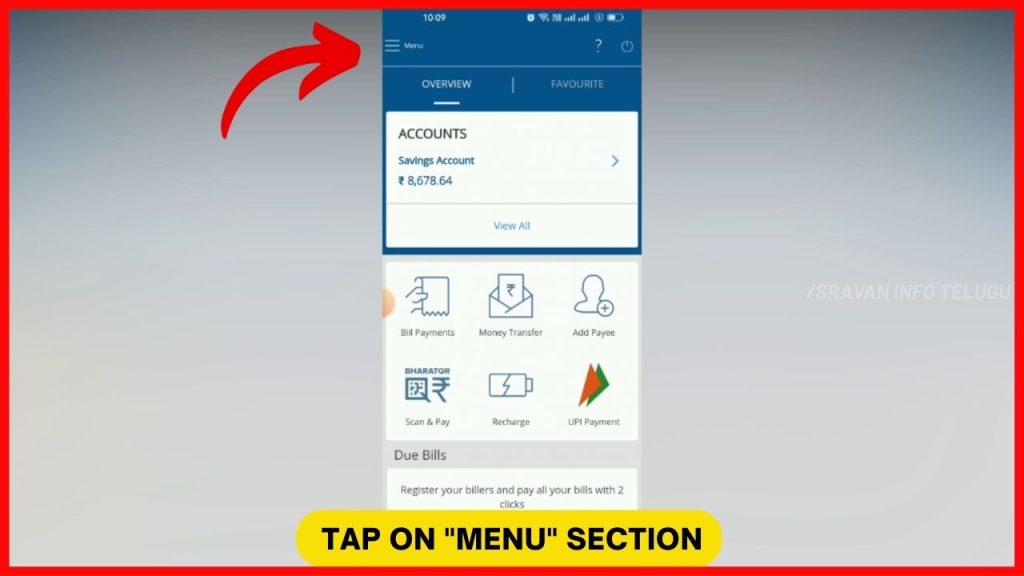

Step 3:

After logging in, your HDFC Dashboard will look like this. Now, Tap on the “Menu” section which appears on the top left.

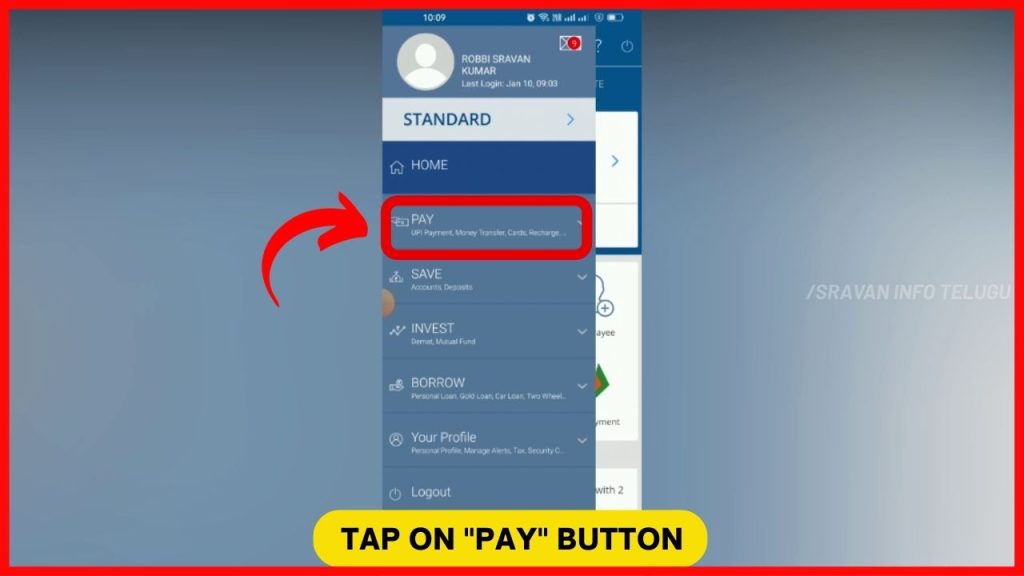

Step 4:

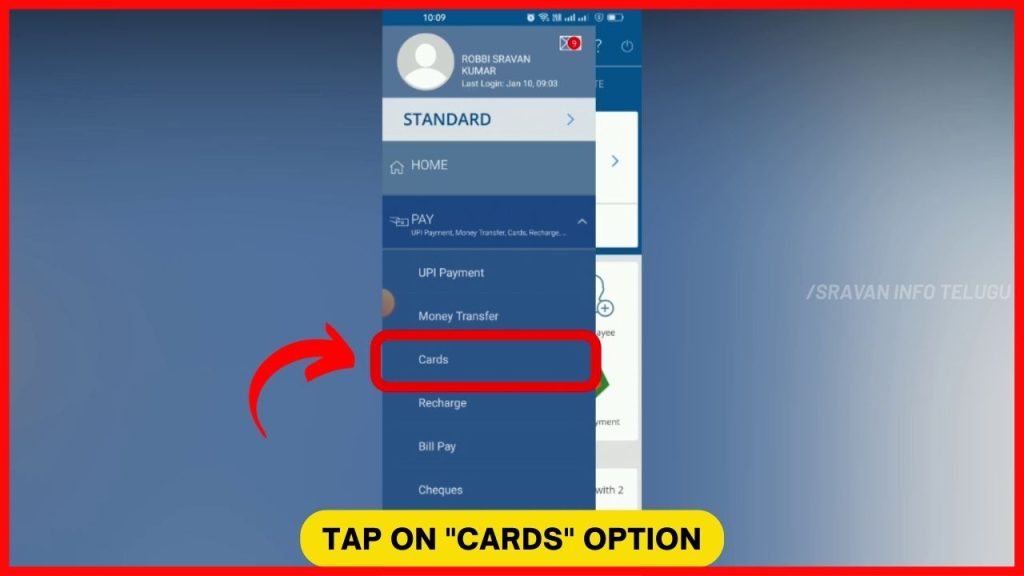

Now you can see multiple options. Now tap on the “Pay” button to make HDFC credit card payment

Step 5:

After you tapped on it, a drop-down menu will be opened. From those options, you select the 3rd option of “Cards”

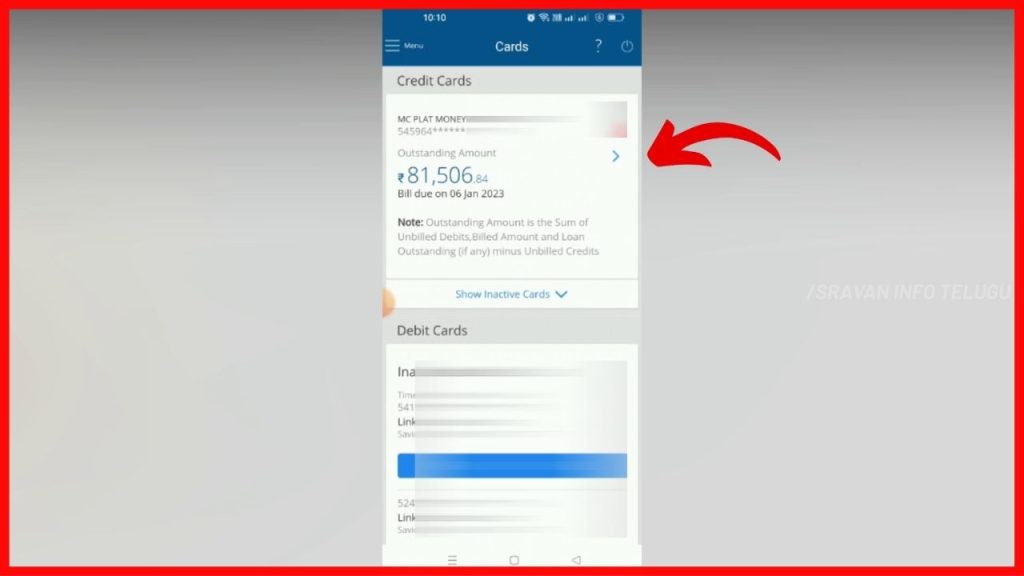

Step 6:

Now, you can see your HDFC registered card details like HDFC issued Card type, Credit Card number, Outstanding balance, etc.,

Now tap on a small arrow button on the right side of the outstanding amount. Now the payment option will be enabled.

???? Click below to Watch it in Telugu

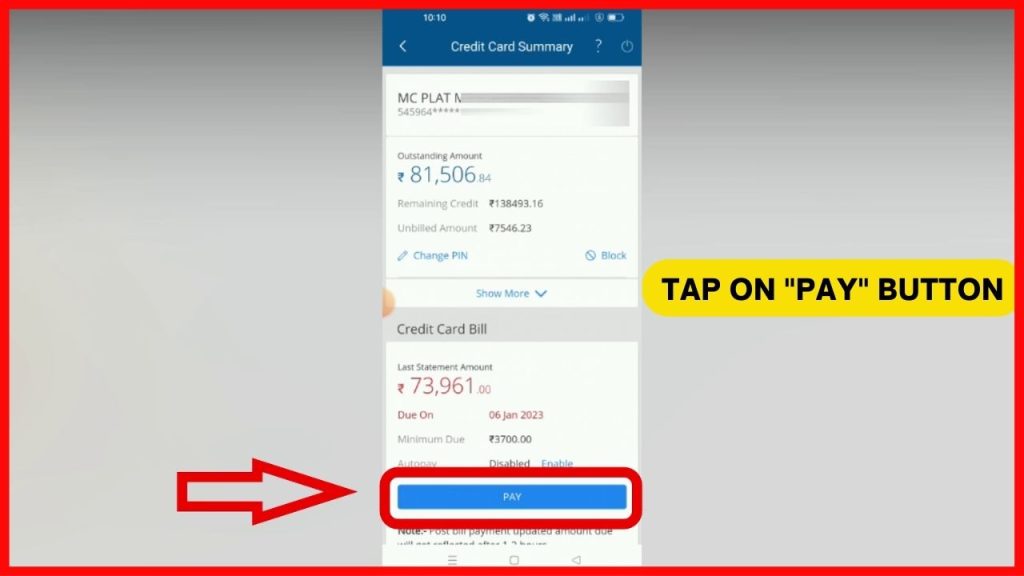

Step 7:

Here, you can see the Outstanding balance on your HDFC Credit card, Remaining Credit available, and Unbilled amounts can also be checked.

Also, under the Credit card bill section, you can also see the “Minimum Due” amount on your HDFC Credit card, and also “Due date” of the Credit card appears here.

Step 8:

Now, to pay your HDFC Credit card bill, just tap on the “Pay” button

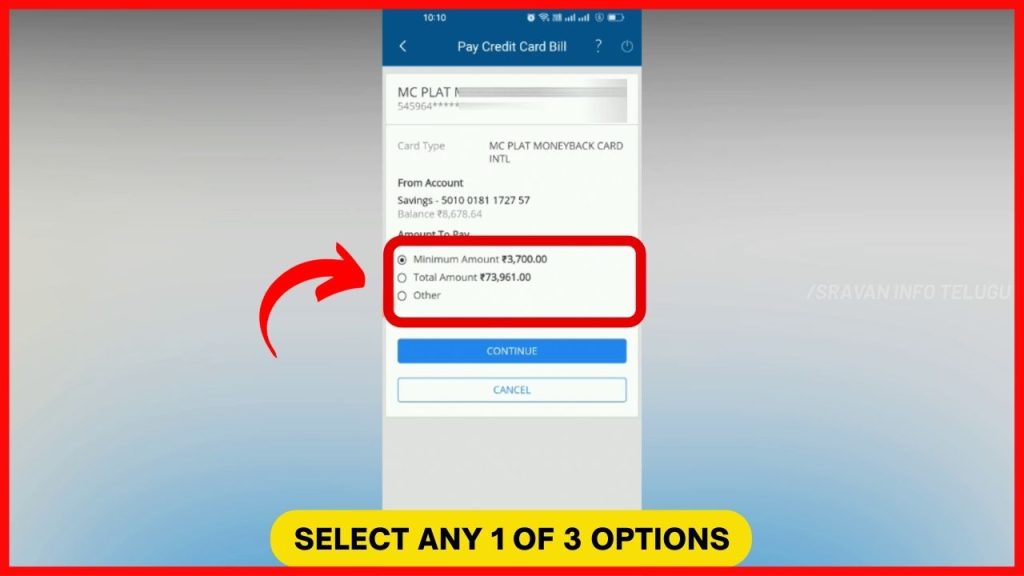

Now you will get 3 options.

1. Minimum amount – It is the amount of interest you are required to pay on your HDFC credit card for this month. By paying this amount, your overall outstanding amount will never be reduced since it is just an interest portion.

2. Total amount – It is the Total amount that is pending on your HDFC credit card.

3. Other – If you want to pay other than the Minimum amount or Total amount, then, you should select this option.

Now select any one of the above-mentioned options and enter the amount you want to pay on your HDFC Credit card.

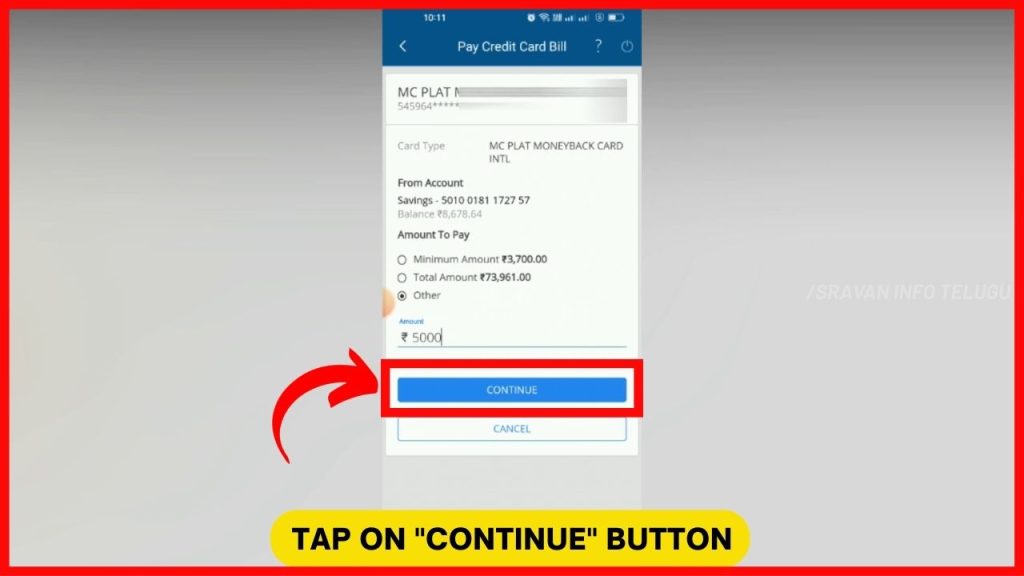

Step 9:

After the amount is entered, tap on the “Continue” button.

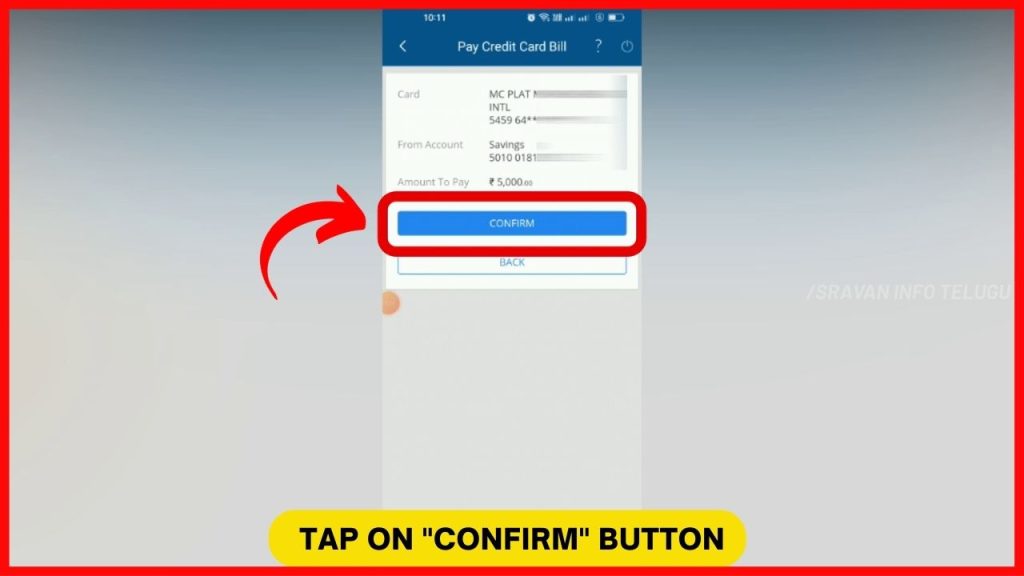

Step 10:

Now to make your HDFC Credit card payment, your HDFC Savings account will be selected by default. So, ensure that your HDFC Savings account has sufficient balance to clear your HDFC Credit card due.

Now tap on the “Confirm” button.

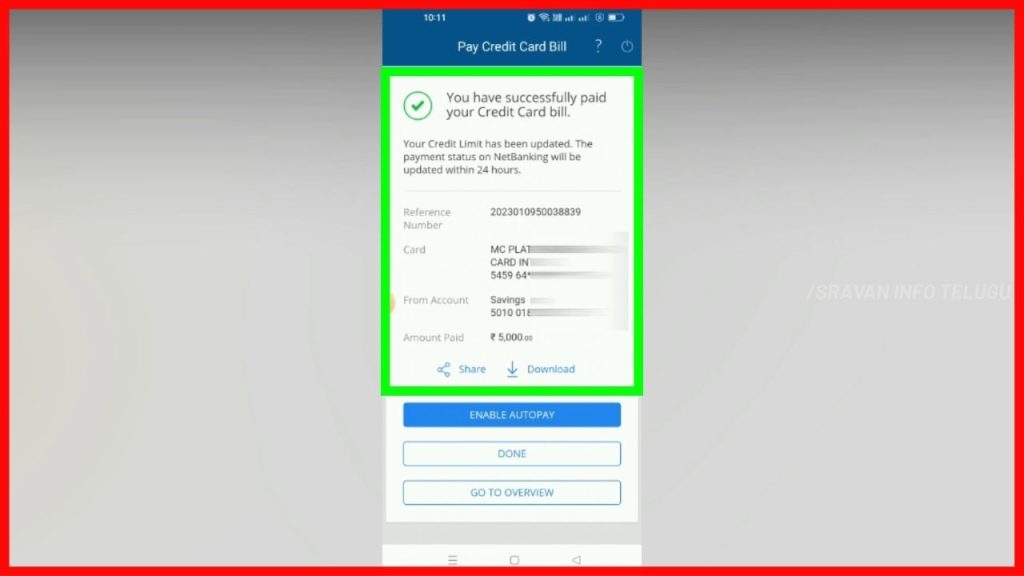

Later on, you will get a confirmation message that ” You have successfully paid your Credit Card Bill” along with the reference number.

I hope you understood the “How to pay HDFC Credit card bill through the HDFC Mobile banking app” concept.

Please Comment “GOOD” if you like the article and it encourages us. Also, share this article with your Friends & Family…

Thanks for reading HDFC Credit Card Payment process completely..!!!

—————————————————————End——————————————————

Disclaimer: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

Also, every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error, or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. In no event, the author or the website shall be liable for any direct, indirect, special, or incidental damage resulting from or arising out of or in connection with the use of this information.