Are you looking for get rewarded for every UPI transaction on your Credit card ?

If Yes, then, you must know about IDFC First Power plus Rupay select credit card from IDFC First Bank..!!

The IDFC First Bank is a Mumbai based Private Sector Bank which started its operations in October 2015. Both IDFC Bank and Capital First Bank together started the “IDFC First Bank”.

In this post, I will also tell you Who is eligible for this UPI Credit card? Moreover, you should read this post till the end so that you can understand completely about this card.

If you want to take this card, You can apply here. Without a further ado let’s see What are the Features or Benefits this Credit card is offering? And also I will share my Genuine opinion on this Credit card by discussing about its Drawbacks as well.

Let’s get Started..!!

Card Overview

| Reward Type | Reward Points |

| Joining Fees | Rs.499 + GST |

| Renewal Fees | Rs.499 + GST |

| Best Suited for | Fuel spends |

What Benefits you get from this Power Plus Credit Card ?

IDFC First Power plus Rupay select Credit card Benefits:

Let me go through 14 Top benefits offering of this Credit Card [Incl. My Analysis]

1. Welcome Benefit

1. As a Welcome benefit, this IDFC Wow Credit card holder will get 5% Cashback up to Rs.1,000/- rupees on the first EMI transaction done with in 90 days of the card activation.

It is noted to be noted that the Cashback will be applicable in case of Direct EMI Purchases only. No cashback will be provided if the purchase transaction is converted into EMI.

My Analysis

Persons who cannot afford to make big spends on a lumpsum basis, then this feature might be useful to them.

2. Fuel Benefit

With IDFC First credit card, you can enjoy upto 20% discount at more than 1500 restaurants. You can also get Health and Wellness offer up to 15% discount over 3000 health and wellness outlets.

expenses on loading money through HP pay app wallet i.e. Zero Happy Coins.

1% Fuel Surcharge

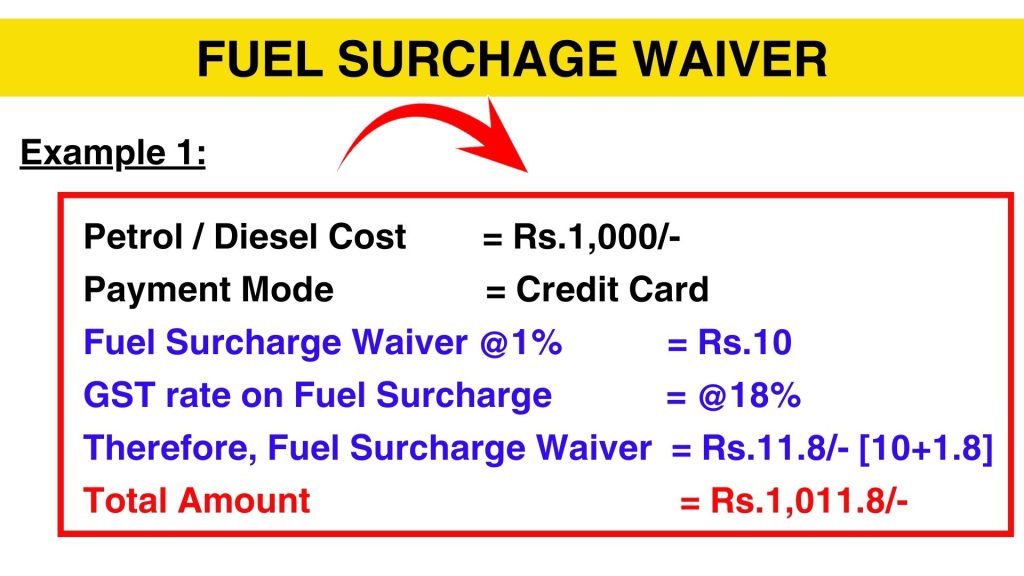

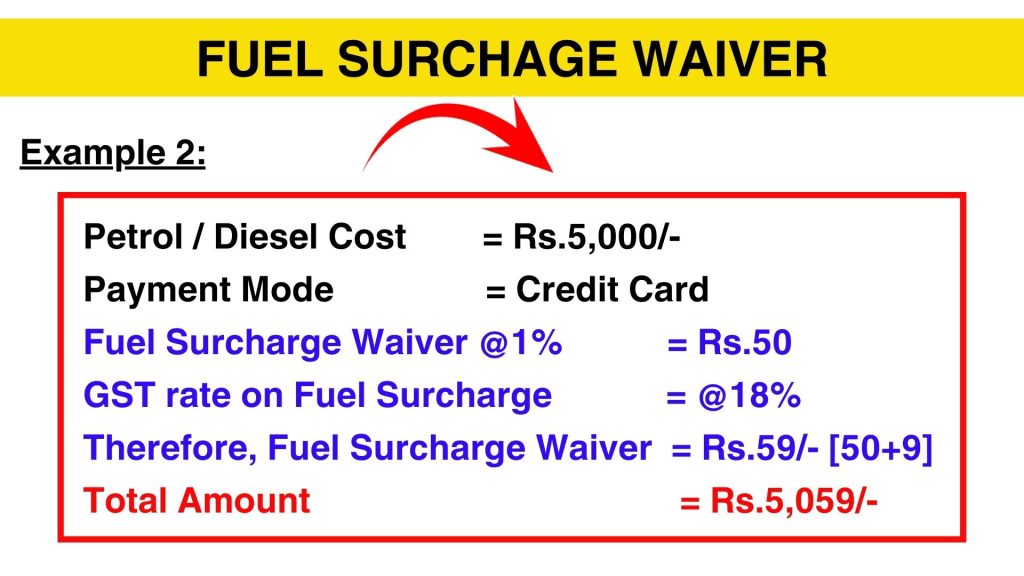

y using this Credit Card If you spend on Petrol/Diesel between Rs.200-Rs.5,000/- in any fuel stations, then, a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost. In case you paid it through this card, you will be eligible for 1% of Fuel Surcharge Waiver.

With this IDFC First Power plus Rupay select Credit card, you will get a Fuel Surcharge Waiver upto a Maximum of Rs.200/- per month.

Let me clarify you about Fuel Surcharge Waiver with 2 Examples.

I really don’t understand why Credit card companies are highlighting Fuel Surcharge Waiver..!! This is not even a Nominal benefit to the Card user because you have to pay it only if you use this Credit card. Normally if you pay it in cash there will be No such Surcharges at all.

Also Read: How I lost Money by Paying Petrol Bills with Credit Cards

3. Groceries and Utility

If you spend by using this IDFC credit card, you can get 5% Savings on Grocery and Utility transactions. For every Rs.150/- spends, you will get 30 reward points.

Here, 1 Reward Point = Rs. 0.25/- paisa.

You can spend up to Rs.2,000/- per statement cycle on Grocery and Utility, for that, you will get a Maximum 400 reward points per statement cycle.

My Analysis

The Maximum limit of Rs.2,000/- on Groceries and Utility is too Low.

For a Family of 4 members living in B class city in a apartment, the Electricity bill will be around Rs.5,000 – Rs.7,000/- per month. And the monthly Grocery expenses would be around Rs.5000-Rs.10,000/-. So, Providing a limit of Rs.2,000/- on both Utility and Grocery per statement cycle is too Low.

4. FAST Tag recharge

You can earn 5% savings on IDFC FAST tag recharge done using IDFC First bank Mobile banking app or IDFC First Forward app and on every Rs.150/- spend on FAST Tag, you will get 30 reward points.

Here, 1 Reward Point = Rs. 0.25/- paisa.

You can spend up to Rs.1,000/- per statement cycle on FAST Tag recharges and you will get Maximum 200 reward points per statement cycle.

My Analysis

If you are a regular outstation car traveller, then, this limit is too low. But if you are a within City traveller or Within city office goer, then, FAST Tag recharge might be useful to a certain level.

5. Retail Spend Benefits

3 Reward Points

You can spend on other retail spends and you can earn 3 Reward Points for every Rs.150/- spends.

Here, 1 Reward Point = Rs. 0.25/- paisa.

0 Reward Points

You get Zero points if you spend on

– Insurance payments

– Non-HPCL Fuels spends

– EMI transactions

– ATM Cash withdrawals &

– Also if you spend on HPCL Fuel, LPG spends, Utility & Grocery spends, FAST Tag recharges beyond the monthly capped limit.

How to apply

If you want this IDFC First Credit Card card, You can apply here

Apply Now6. If Cardholder met with an Accident ?

IDFC First Bank also provides a Personal Accident Cover benefit to their Card holders. It’s coverage is up to Rs. 2,00,000/-.

To avail this benefit, you should meet atleast 2 Conditions.

1. You have to make at least 1 Credit card transaction compulsorily within 30 days of receiving the card.

2. You will be covered only if you do at least 1 Credit card transaction through this Credit card in the last 30 days, otherwise you will not get coverage.

In my opinion, it is much better to take Term Life Insurance directly instead of taking this card and making every month a Credit Card transaction to get covered.

7. Lost your Credit Card ?

In case if you lost your Millennial Credit card & suffered with any Financial loss, then, that loss will be covered to you up to Rs.25,000/- rupees under the cover of “Lost Card Liability” and this card has World wide acceptance and you can use it at any part of the world.

8. Roadside Assistance

With this Credit card, you will get a Complimentary Roadside assistance worth of Rs.1,399/-

9. Add-on-Card [FREE]

If anyone in your family wants this HDFC Rupay credit card, then, they will provide you with an Add-on-card which is Life time Free Credit card.

How can I make payment in any UPI app, Phone Pe, Paytm, Google Pay with this UPI Credit card?

– For that, after you taking this IDFC credit card, you can add this Credit card in UPI app’s and give all this Credit card details, you can add this.

– After adding, you can use these UPI apps to make payment by scanning the receiver QR code and select the Credit Card option and Complete the payment.

My analysis

When you are money crunch or if you feel that there is no chance of getting money from any other source, then, you can use this Credit card option and can make payment at such a time only.

10. Can I convert any Transaction into EMI ?

By using with this Credit Card, which transactions can be converted into EMI?

If you use this credit card and do any UPI transaction above Rs.2,500/- rupees, then, you can convert those transactions into EMI through the Mobile app itself.

11. Lounge Benefit

This IDFC card holder will get 1 complimentary domestic airport lounge visit per quarter for every Rs.5,000/- spent per month.

My analysis

This feature can’t be said to be very beneficial to the Cardholder but if you spend through this credit card for any of your need, then, this voucher might be helpful for you.

But don’t be in a hurry to spend it within 30 days of receiving the card.

“It’s not wrong to spend for your need and take the benefit but never spend it for the sake of benefit without need.”

Ultimately, You will loose your money.

12. Movie Tickets Discount

If you are a regular movie goer, you can get 25% off on Movie tickets i.e. Upto Rs.100/- once in every month.

13. Swiggy Discount

If you are a food lover, then you can get Rs.150/- discount on orders above Rs.500/- on Swiggy

14. Zoom Car offer

If you want to travel with a rental car on your own driving, then, you would have chosen Zoom Car option. If you pay these Car rentals through this IDFC Credit card, then, you will get Rs.500/- discount for a Minimum trip duration of 2 days.

Who are Eligible for this Card?

IDFC First Power plus Rupay select Credit card Eligibility:

Individuals

– Aged 21 years old

– Salaried or Self Employed with Annual Income of Rs.3,00,000/- or more are eligible to apply for this card.

IDFC First First Power plus Rupay select Credit card Charges [Must Read]

1. Cash Withdrawal charges

One of the major benefit of using this IDFC Frist Power plus Credit Card is that “Interest Free Cash Withdrawal“. Read this point little carefully My dear Friends.

“Interest Free Cash Withdrawal” means no interest will be charged up to 48 days if you withdraw Cash anywhere either in Domestic or in International ATM’s. But you need to pay Cash Advance Fee of Rs.199/- per transaction excluding GST.

If for any reason whatsoever you are unable to pay the withdrawn amount within 48 days, you will have to pay huge interest. That is also covered in this article, so Keep on reading till the end.

2. Joining & Renewal Fees

This IDFC Credit card holders should pay Joining fees of Rs.499+GST and Renewal Fees of Rs.499+GST.

Moreover, If you spend Rs.1,50,000/- or more in the previous financial year, then, you are not supposed to pay Renewal fees of Rs.499+GST for the next year. Simply, Zero Renewal Fees.

3. Interest charges / Finance Charges ?

IDFC First bank Credit card Interest rate :

You have used this idfc first credit card and bought all the stuff you need. But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the IDFC First bank will charge you Interest between @0.75% – @3.50% per month. It means, the Annual interest is almost 9% – 42% per annum.

4. Late payment charges

Apart from Interest charges, if you delay paying this Credit card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, even if you delay IDFC Credit Card payment by one day, IDFC bank will charge almost 15% on the Due amount of your credit card. The Late payment charges ranges from Minimum Rs.100/- rupees to Maximum Rs. 1,300/-.

So if you use credit card you have to be very organized and should deal with Credit card timelines properly.

5. Over the limit charges

You might not have heard about these charges earlier. Let check it out.

If you spend more than available limit on this idfc first credit card. That means you have over used your Credit card. Then, you will be charged with “Over The Limit charges”.

The more you spend than your Credit card limit, the more you will be charged i.e. @2.50% on the overdrawn amount. The Minimum amount will be charged starts from Rs.550/- rupees.

IDFC First Power plus Rupay Select Credit card Review

The IDFC First Power Plus Rupay Select Credit Card launched in collaboration with Hindustan Petroleum Corporation Limited (HPCL). This card completely focused on Fuel spends in terms of Reward points and Happy coins.

This credit card is best suited for Regular Travelers who fill their Fuel tanks on a regular basis. And also providing a Life Time Free Add-on-Card is a decent blend. With this card, you can save a bit on Grocers and Utilities.

Finally, i thought apart from the rewards on fuel spends, all other benefits provided are just attached to this credit card for just number sake.

If you don’t have any credit card and want to apply for this IDFC First Credit Card card, then, You can apply.

Thanks for your time 🙂