Cashback SBI Credit Card

The Cashback SBI Credit card offers cashback on Purchases. You can earn cashback of up to 5% on all Online transactions without Merchant restriction. If you spend on Offline purchases by using a credit card, you can earn up to 1% Cashback.

This cashback SBI credit card is not Free, you should pay Annual fees to avail of it. But this can be waived off by meeting minimum spending requirements.

The Cashback SBI credit card also offers additional benefits on the Complimentary Airport lounge facility.

Without further ado let’s see What are the Features or Benefits this Credit card is offering? And I also share my Genuine opinion on this Credit card by discussing its Drawbacks as well.

Let’s get Started..!!

Cashback SBI Credit Card Overview

| Credit Card Type | Cashback |

| Joining Fees | Rs.999/- (One-time) |

| Renewal Fees | Rs.999/- per annum |

| Best for | Shopping |

What Benefits do you get from Cashback SBI Credit Card ?

Let me go through the Top benefits offered by this Credit Card [Incl. My Analysis]

SBI Cashback Credit Card Benefits:

1. Card Cashback Benefit

When you shop online merchants offer cashback only on a few purchases. But this Cashback SBI credit card offers you 5% Cashback on every transaction you buy online.

If you spend for offline transactions by using this credit card, the SBI will offer you 1% Cashback.

Cashback is not applicable on

– Merchant EMI & Flexipay EMI transactions

– Utility, Insurance, Fuel, Rent, Wallet, School & Educational Services, Jewellery, Railways, petrol pumps/service stations, etc.,

The Maximum Card Cashback earned on online and offline spending will be capped at Rs.5,000/- per statement cycle.

Once you reach the Maximum Cap limit of Rs.5,000/- spent with a Cashback SBI Card for that statement month will not earn any CASHBACK.

My Analysis:

SBI has almost excluded all the regular and monthly recurring expenses from Cashback purview. So, as per my understanding the Customer has to spend money on Shopping, Groceries, Flight booking, Bus Bookings, etc can be made using this Credit card.

2. Spend based Reversal

Moreover, If your Annual spending is more than Rs.2,00,000/- in the previous year, then, you are not supposed to pay Renewal fees of Rs.999+GST for the next year. Simply, Zero Renewal Fees.

My Analysis

This Cashback SBI Credit Card holder should pay the renewal fees inclusive of GST an amount of Rs.1,178/-. For that, the cardholder should spend Rs.2,00,000/-. It means the reward percentage you get is 0.58% only.

This feature can’t be said to be beneficial to the Cardholder but if you spend through this credit card for any of your needs, then, this voucher might be helpful for you otherwise this is also not a benefit.

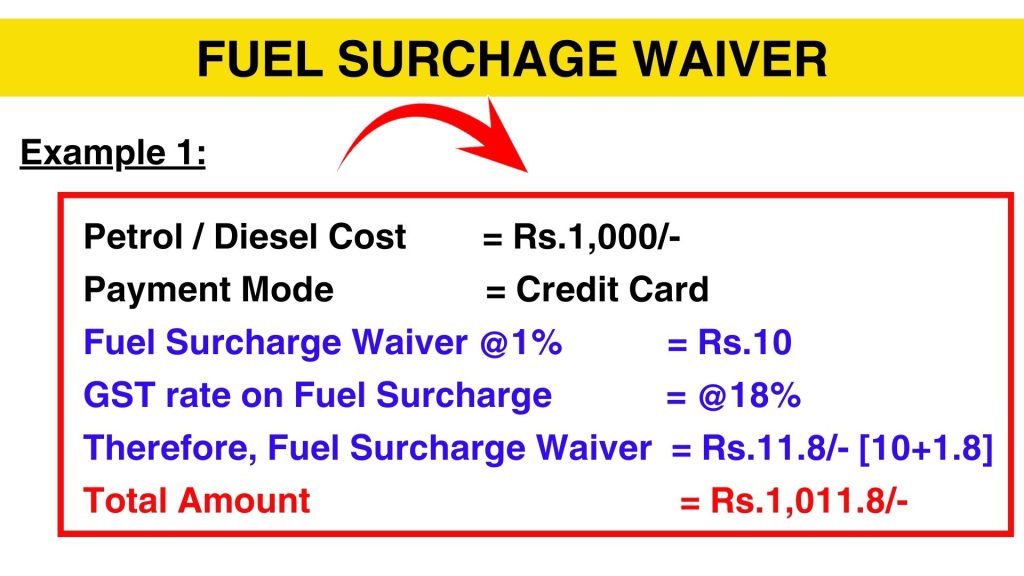

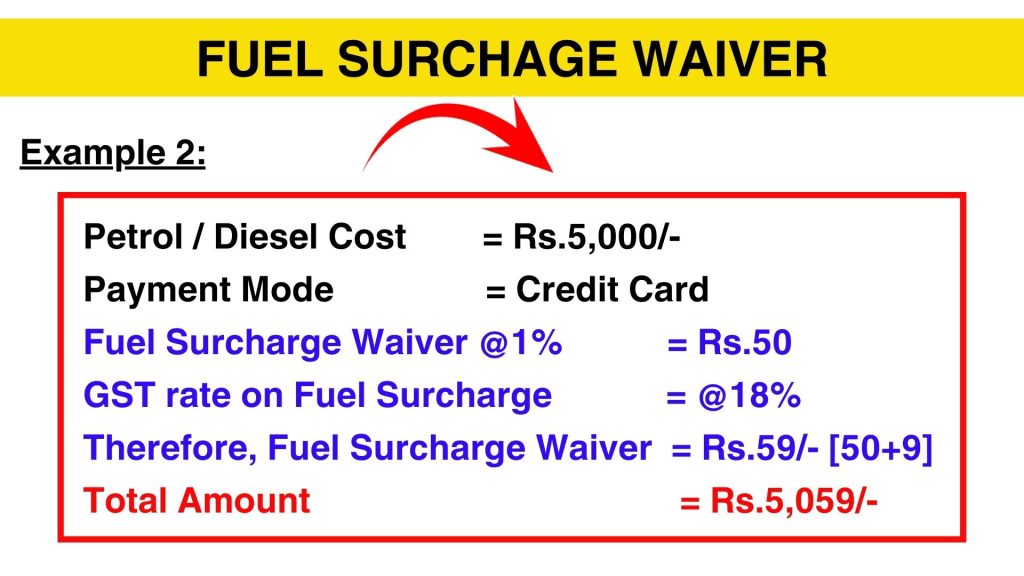

3. Fuel Surcharge Waiver

By using this Credit Card If you spend Petrol/Diesel between Rs.500-Rs.4,000/- in selected fuel stations, then, normally a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost.

In case you paid it through this card, you will be eligible for a “Fuel Surcharge Waiver”. Let me clarify for you about Fuel Surcharge Waiver with 2 Examples

I don’t understand why Credit card companies are highlighting Fuel Surcharge Waiver..!! This is not even a Nominal benefit to the Card user because you have to pay it only if you use this Credit card. Normally if you pay it in cash there will be No such Surcharges.

Also Read: How I Lost Money by paying Fuel bills with Credit Cards

4. Contactless Card feature

Cashback SBI Credit Card comes with Contactless technology. In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

5. Other Features

You can use this card at almost 3,25,000 outlets in India and also in Foreign countries. If you shop at any outlet, if that particular outlet accepts Visa or MasterCard, then, you can use this card and can make payments.

Moreover, you can pay your Electricity bill payments, Mobile bills, other Utility bills, etc by using this Reliance SBI card.

SBI Cashback Credit Card Apply

If you want this Cashback SBI Credit Card card, You can apply

Apply NowCashback SBI Credit Card Charges [Must Read]

1. Cash Withdrawal charges

A Transaction fee would be levied on all such Cash Withdrawals from Domestic or International ATMs. Such fees would be billed to the Cardholder in the next statement.

A transaction fee of 2.5% or Rs.500/- whichever is higher will be charged at domestic and international ATMs.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

You can Withdraw Money using this Credit card but Don’t withdraw cash from any credit card. If you have an urgent cash requirement / Cash crunch, I suggest you take a Gold Loan or a Personal Loan. Those are much better options.

Because in a Personal Loan, every month you pay the Principal amount plus Interest as an EMI. The rate of interest for Personal Loans ranges from 15 to 20% p.a. on a higher note.

Do you know how much interest you will be charged on Credit Cards?

As per the SBI Card website, the Rate of interest will be charged is up to 3.50% per month. It means you must pay up to 42% per annum as a Finance / Interest charge on your Credit Card Outstanding balance.

In short, the Rate of interest you will be charged on a Credit card is more than double the interest you will be charged on a Personal Loan.

2. Interest charges / Finance Charges ?

You have used this Credit card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the bank will charge you interest between @3.50% per month. It means the Annual interest is almost 42% per annum.

3. Late payment charges

Apart from Interest charges, if you delay paying this Credit card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, the Late payment charges range from a Minimum of Rs.0/- rupees to a Maximum of Rs.1,300/- depending on your Credit card outstanding.

| Credit Card Outstanding Balance is | Late payment charges |

|---|---|

| Between Rs.0-Rs.500 | Nil |

| Between Rs.500-Rs.1,000 | Rs.400/- |

| Between Rs.1,000-Rs.10,000 | Rs.750/- |

| Between Rs.10,000-Rs.25,000 | Rs.950/- |

| Between Rs.25,000-Rs.50,000 | Rs.1,100/- |

| Greater than Rs.50,000 | Rs.1,300/- |

So if you use a credit card you have to be very organized and should deal with Credit card timelines properly.

4. Over the limit charges

You might not have heard about these charges earlier. Let’s check it out.

If you spend more than the available limit on the credit card. That means you have overused your Credit card. Then, you will be charged with “Over The Limit charges”.

The more you spend than your Credit card limit, the more you will be charged i.e. @2.50% on the overdrawn amount. The Minimum amount will be charged starts from Rs.600/- rupees.

SBI Cashback Credit Card Review

Those who shop online for Footwear, Accessories, Groceries, Entertainment, and Food can use this card. The Major drawback of this Cashback SBI card is that the cashback is not applicable for utilities, insurance, and lot more.

I personally felt that if the SBI has provided cashback on Regular and recurring transactions then, this card might be helpful for the customers instead of just for the shopping.

It seems like the idea behind the issuance of this SBI card is to spend money on shopping by using this credit card. Otherwise, all the remaining benefits like Spend-based Reversal, and Fuel Surcharge Waiver are for the name-sake benefits only.

If you want a Credit card for shopping purposes, then, you can apply for this card otherwise, skip this credit card.

Thanks for your time 🙂