Axis NEO Credit Card

Introduction

In today’s fast-paced world, we need versatile credit cards that are designed to cater various financial needs of customers.

To serve the customer needs, Axis Bank launched a Lifetime Free Credit card with a Rs.2,880/- Zomato discount along with a Rs.1,200/- Book My Show discount through Axis Bank Neo Credit Card.

Let’s see What Features or Benefits this Credit card is offering. And I also share my Genuine opinion on this Credit card by discussing its Drawbacks as well.

Let’s get Started..!!

Axis NEO Credit Card Overview

| Particulars | Description |

|---|---|

| Credit Card Type | Discount type |

| Joining Fees | Rs.250/- |

| Renewal Fees | 1st Year: Nil 2nd Year onwards: Rs.250/- |

| Best for | Zomato |

What Benefits do you get from Axis NEO Credit Card?

When it comes to Axis Bank Neo Credit Card, it looks dark purple with a black and white combination.

On the top left-hand side of this credit card, you can see the Axis Bank Logo.

On the top right-hand side, you can see the card name “NEO” and at the bottom of it, you can see the “Contactless logo” symbol which supports near-field communication (NFC) technology.

On the bottom left-hand side of it, it is represented as a “Credit Card” along with the Name of the cardholder on it.

Axis bank NEO Credit card Benefits:

Let me go through the Top benefits offered by this Credit Card [Incl. My Analysis]

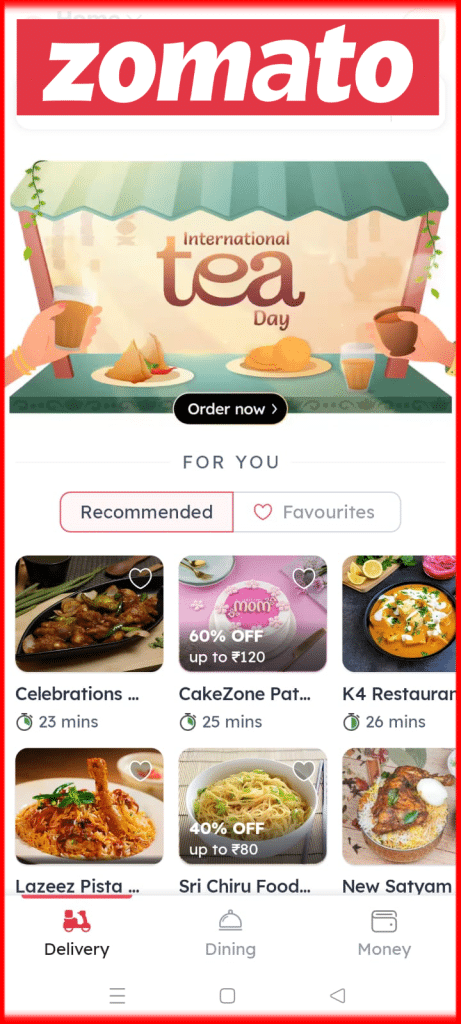

1. 40% off on Zomato

Coming to the benefits, the Axis Bank Neo Credit card users are offered a 40% discount on Zamoto.

It means, that if you use this Axis NEO Credit Card and order food on Zomato, then, you will get a 40% discount on your total outstanding bill.

Generally, when you order food you will get zero delivery fees.

But, that cannot be applied in this case. That means you have to pay extra in the form of delivery charges on your Zomato orders through this Axis NEO Credit Card.

In short, the Axis NEO Credit Card users should bear extra delivery charges for their Zomato orders for the 40% discount offered.

To get this 40% discount on your Zomato order, you should enter the coupon code “AXISNEO” in capital letters while making the payment.

The Maximum discount you can get for one Zomoto order is Rs.120.

To get a 40% discount on your Zomato, you need to spend a minimum of Rs.200.

The Axis NEO Credit Card customers can avail of this discount only for a Maximum of 2 times a month.

At the beginning of the article, I said Rs.2,880/- discount on Zomato.!!

Check how..!!

On Zomato orders, one can get a Maximum discount of Rs.120 per order.

A maximum of two orders can be made in a month. Therefore, you can save a maximum of Rs.240/- (i.e. Rs.120/- *2 orders = Rs.240 rupees) per month.

When you calculate it for 12 months, then you can save Rs.2,880/- per year as a discount (I.e Rs.240/- *12 months = Rs.2,880 rupees)

| Particulars | Description |

|---|---|

| Minimum Zomato Order | Rs.200/- |

| Maximum discount per order | Rs.120/- |

| Maximum discount per month | Rs.240/- |

| Maximum discount per annum | Rs.2,880/- |

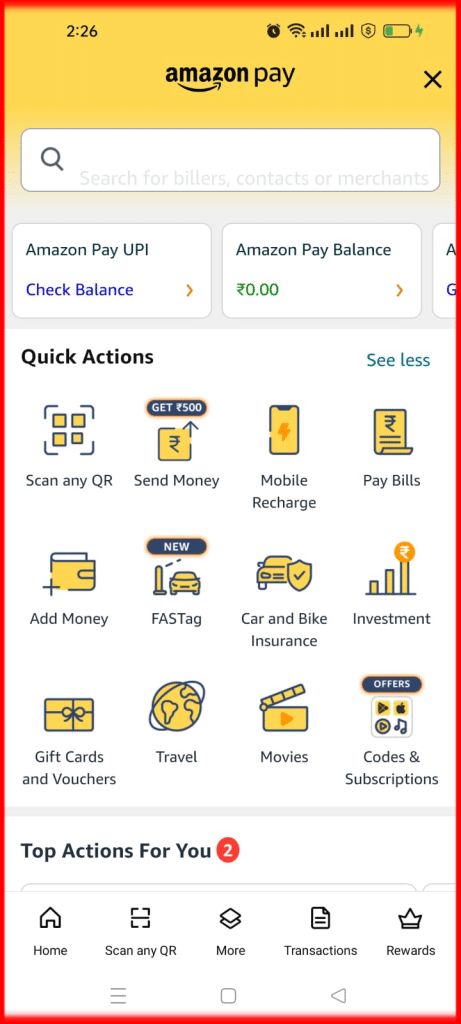

2. 5% Off on Utility Bill payments via Amazon Pay

The second benefit is 5% off on Utility bill payments if you have paid through Amazon Pay..!!

It means if you pay your Mobile recharges, Broadband payments or DTH recharges through Amazon Pay, you will get a 5% discount.

You will get a Maximum discount of Rs.150 rupees per month.

For that, you have to do a Minimum transaction of Rs.299. So, for an order of Rs.299/- you will get a discount of Rs.15 only.

To get the Maximum discount of Rs.150, you should spend Rs.3,000.

This discount can be availed only once per month.

| Particulars | Description |

|---|---|

| Minimum Transaction value | Rs.299/- |

| Maximum discount per month | Rs.150/- |

| Maximum discount per annum | Rs.1,800/- |

3. Enjoy the “Power of 10”

Let’s see what this benefit is.!

Do you know about the Blinkit delivery platform?

Frankly, I don’t know this.

But in some major cities in India, it will deliver Vegetables and Groceries within a short period of 5-10 minutes.

So, if you place an order of Minimum Rs.750 rupees in a month through this Blinkit delivery app, then, you have a chance to get a discount of up to Rs.250 rupees.

| Particulars | Description |

|---|---|

| Minimum Transaction value | Rs.750/- |

| Maximum discount per month | Rs.250/- |

| Maximum discount per annum | Rs.1,800/- |

The Shopping app, Myntra is also offering an extra Rs.150 rupees discount if you spend a minimum of Rs.999 rupees on some selected styles. To avail of it, you should use the coupon code MYAXISBANK23.

Do you watch movies in the theater regularly?

If Yes, then, if you buy Movie tickets in Book My Show through this NEO credit card, you will get a 10% discount on the value of the tickets you bought.

The Maximum discount is Rs.100 rupees per month. This offer is valid only till 31st December 2024.

4. 15% Discount on Dining

Axis Bank’s exclusive dining program is tied up with Easy Diner which provides a 15% discount to restaurants that have a partnership with Easy Diner.

– Maximum discount of Rs.500 only.

– The minimum order value is Rs.1,500 rupees.

– The Maximum benefit is Rs.1,000 rupees on one card for two times a month.

– Validity till 30th June 2024 only.

5. Zero Lost Card Liability

If you have taken this Axis Bank Neo credit card and later on for any reason or by mistake it has disappeared or someone has stolen your card.

In such a case, firstly this credit card user should call Axis Bank customer care service numbers either 18605005555 or 18604195555 and should complain.

By making such a complaint, what benefit customer will get?

By chance, if any online transaction is noticed on post complaint to the Axis Bank from your credit card fraudulently. Then, you will be protected from financial loss under zero lost card liability.

If you do not complain, then, You are responsible for the financial loss and you should bear it.

6. Can I Convert purchases into EMI

if you make big purchases using this New Axis credit card, i.e. whatever transactions you make above Rs.2,500 rupees, then, you can convert those transactions into EMI by contacting customer care, Internet Banking, Mobile Banking, and so on.

7. Activation benefit

If you make any utility bill payment within 30 days of this credit card issue, you will get a cashback offer of up to Rs.300 rupees. This is a one-time offer.

Axis bank NEO Credit card Apply

If you want this Axis Bank Neo credit card, You can apply.

Apply NowAxis bank NEO Credit card Charges

The overview of the top charges of the Axis Bank NEO Credit card is as follows.

| S.No. | Particulars | Description |

|---|---|---|

| 1 | Joining fees | Rs.295/- (Free, if you spend Rs.2500 or more) |

| 2 | Renewal fees | Rs.295/- from Second year onwards |

| 3. | Cash advance charges | 2.5% or Rs.500/ |

| 4. | Interest charges | @3.60% p.m ; @ 52.86% p.a. |

| 5. | Late payment charges | Rs.0 – Rs.1,200/- |

| 6. | Over-the-limit charges | Rs.450 – Rs.1,500/- |

| 7. | Foreign currency Markup | 3.50% of the transaction value |

1. Joining fees

If you want to use this Axis NEO Credit Card, then, on 1st year you will have to pay a Joining fee of Rs.250 excluding GST. With GST, you should pay Rs.295/-

If you spend Rs.2,500 rupees or more within 45 days of taking this card, then, you are not required to pay the joining fee on this credit card.

I told you that Axis Bank is offering a lifetime free card at the beginning of this article, which means you spend Rs.2,500 rupees for not paying a joining fee of Rs.250 rupees.

2. Renewal fees

If you want to use this Axis NEO Credit Card from the second year onwards, then, you will have to pay a Renewal fee of Rs.250/- per year excluding GST. With GST, you should pay Rs.295/- per year.

If you are looking for a FREE Credit card, without Joining Fees and Renewal fees, then, you can check here.

3. Cash advance charges / Cash Withdrawal charges

If you withdraw money by using this Axis NEO Credit Card, a Transaction fee will be levied on all such Cash Withdrawals at Domestic or International ATMs. Such fees would be billed to the Cardholder in the next statement.

A transaction fee of 2.5% or Rs.500/- whichever is higher will be charged at ATMs.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

You can Withdraw Money using this Axis NEO Credit Card but Don’t withdraw cash from any credit card. If you have an urgent cash requirement / Cash crunch, then I suggest you to take a Gold Loan or a Personal Loan.

Those are much better options.

In a Personal Loan, every month you pay the Principal amount plus Interest as an EMI. The rate of interest for Personal Loans usually ranges from 15-20% p.a. on a higher note.

4. Interest charges / Finance Charges?

Do you know how much interest you will be charged on Credit Cards?

You have used this Axis NEO Credit Card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the bank will charge you interest between @3.60% per month. It means the Annual interest is almost 52.86% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

5. Late payment charges

Apart from Interest charges, if you delay paying this Axis NEO Credit Card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, the Late payment charges range from a Minimum of Zero rupees to a Maximum of Rs. 1,200/- depending on your Credit card outstanding.

If your credit card outstanding balance is more than Rs.500/-, then you will incur Late payment charges.

So if you use a credit card you have to be very organized and should deal with Credit card timelines properly.

| Credit Card Outstanding Balance is | Late payment charges |

|---|---|

| Less than Rs.500 | Nil |

| Between Rs.501-Rs.5,000 | Rs.500/- |

| Between Rs.5,001-Rs.10,000 | Rs.750/- |

| Greater than Rs.10,000 | Rs.1,200/- |

6. Over the limit charges

If you spend more than the available limit on the credit card. That means you have overused your Credit card. Then, you will be charged with “Over The Limit charges”.

The more you spend than your Axix NEO Credit card limit, the more you will be charged i.e. @2% on the overdrawn amount. The Minimum amount will be charged starts from Rs.450/- rupees and the Maximum is up to Rs.1,500/-.

7. Foreign currency Markup

If you travel abroad and make any International transactions, you will be charged 3.50% of the transaction value as a Forex Markup Fee.

Axis bank NEO Credit card Review [My Strong Views]

For people who mostly order food on Zomato, I would 100% recommend this credit card to them. Also, the 5% discount on Utility bill payments is not offered by all credit card companies, this is a special benefit.

If you don’t know the app called Blinkit or you don’t buy food in Zomato and you cut tomatoes and eat home food and If you think home food is the best food ever, then, this credit card is not for you dear. You can completely skip this card, my friend.

This Axis NEO Credit Card has no UPI Payment option. Therefore, this Credit card holder cannot link their Credit card to make UPI Payments through UPI apps like PhonePe, Google Pay, etc., With that, you can understand that the Axis NEO credit card is not a Rupay Credit Card.

You don’t get an Airport Lounge facility or Fuel surcharge waiver with this credit card.

I Don’t Recommend it

Why..!

Even if you liked all the features, I don’t recommend this ICICI Rupay credit card for one reason i.e. Finance Charges.

Axis Bank is charging yearly interest charges of 52.86% per annum is just a cruel thing. Even though the Reserve Bank is allowed to charge it, Banks should act with some decency.

Charging a nominal or commercial interest of up to 20% is reasonable. But all the banks are following the same pattern charging a minimum of 40% of yearly interest charges is a real burden to the customer.

Ultimately, the customer will lose their hard-earned money.

Banks are not allowing customers to take credit, banks are allowing them to lose hard-earned money through Credit card interest charges.

Frequently Asked Questions

1. Axis NEO Credit Card Lounge access?

The Axis Bank Neo credit card has no facility of airport lounge facility

2. Axis NEO Credit Card Lifetime free?

If you want to use this Axis NEO Credit Card, then, on 1st year you should pay Rs.295/-. However, If you spend Rs.2,500 rupees or more within 45 days of taking this card, then, you are not required to pay the joining fee.

3. Axis NEO Credit Card Customer Care Number?

The Axis Bank NEO Credit card customers can reach these Customer service numbers 1860 419 5555 & 1860 500 5555

4. Axis Bank NEO Credit card Cash Withdrawal charges

If you withdraw cash from ATMs using an Axis Bank NEO Credit card, a transaction fee of 2.50% or Rs.500/- whichever is higher will be charged.

5. Axis Bank NEO Credit card Fuel Surcharge?

Fuel stations usually charge a Fuel Surcharge of around 1% on the Fuel cost. Some of the Petrol bunks may charge even 3-4% surcharge on your Fuel Bill. This surcharge will be waived by Credit card companies by issuing 1% as a Fuelsurcharge waiver. However, the Axis Bank NEO Credit card does not offer Fuel surcharge waivers to its customers.

6. Is Axis NEO Credit Card has UPI Payment option?

This Axis NEO Credit Card has no UPI Payment option. Therefore, this Credit card holder cannot link their Credit card to make UPI Payments through UPI apps like PhonePe, Google Pay, etc., With that, you can simply understand that the Axis NEO credit card is not a Rupay Credit Card.

7. If I make Electricity and Gas bill payments via Axis NEO Credit Card, can I get 5% Cashback or not?

If you pay your Mobile recharges, Broadband payments or DTH recharges through Amazon Pay, then only you will get a 5% discount.

The above statement does not mention Electricity and Gas bill payments. Therefore, you will not get 5% discount under this section.

Thanks for your time, my dear friends:)