Phonepe HDFC Credit card

Introduction

Generally, people use credit cards for various benefits. Earning cash back from it is one of the main reason. However, the monthly rewards limit is a small cap, which significantly reduces their ultimate benefit. No matter how much you spend, the cashback you get will be reduced by almost 40–50%.

Have you faced it any time with your card?

Now, PhonePe, in collaboration with HDFC Bank has launched a Cashback credit card of PhonePe HDFC Ultimo Credit Card.

Is this credit card also a regular one, or is it a card that really gives value to the middle-class?

Today, I will explain each benefit, each condition, and each exclusion line-by-line, CLEARLY for you, my dear friend.

So, READ this article for the next 10 minutes with a little bit of patience.

Then, you won’t have to go for any other article or video for this 3 inch credit card.

Finally, you will decide whether this card will work for you or not.

I won’t tell you.!

Without further ado, let’s get started.!

Phonepe HDFC Ultimo Credit Card Overview

The overview of the credit card is as follows

| Particulars | Description |

|---|---|

| Credit Card Type | Cashback |

| Joining Fees | Nil (Limited Period only) |

| Renewal Fees | Rs.999+GST |

| Best for | Shoppers |

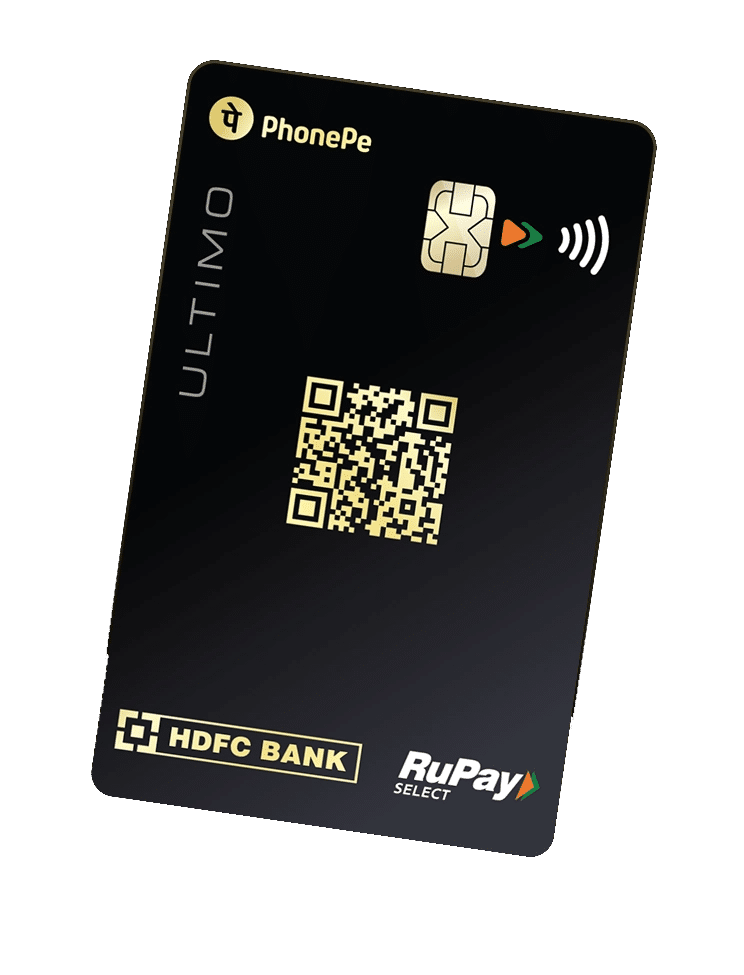

On first look, this PhonePe HDFC credit card comes in a dark black background with a gold text colour.

If you look at the top right of this credit card, you can see the “PhonePe” logo.

On the right below, you can see the chip card, and on right next to it, you can see the “Contactless Logo” symbol.

In the middle of the card, you can see a “QR Code” symbol, which represents that this card is made for the majority of UPI payments.

Along with that, at the bottom left of this credit card, you can see the issuing bank name as “HDFC Bank”, and on the bottom right of the card, you can see the “Type of Credit Card Network” as “Rupay Select”, which enables making UPI Payments.

Now, let’s crack this credit card’s features and benefits.

Keep on reading…!!

PhonePe HDFC Ultimo Credit Card Benefits

What Benefits do you get from PhonePe HDFC Credit Card?

Let me go through the Top 8 benefits offered by PhonePe HDFC Ultimo Credit Card [Incl. My Analysis]

1. Welcome Benefit

The first thing to talk about with this card is the welcome benefit.

As soon as you get this card, PhonePe will tell you that you will get a BIG gift if you make a small UPI payment with this card.

What does it mean?

That means, by using this RuPay credit card on your PhonePe app and making your 1st UPI transaction, you will get Rs.499 as a PhonePe Gift Card.

But if you make an Rs.50 or Rs.60 payment, then you will not get any benefit, so if you pay Rs.100, then you will get Rs.499 as a gift card. So, Rs.399 is the net benefit.

2. Added Welcome Benefit – Upto Rs.500

The 2nd benefit is in the Welcome benefit itself.

Let’s see what it is.

Later on, if you make more than 10 UPI transactions with the same Credit card on PhonePe, then you will get a Gift card with a value of Rs.50 for each transaction.

Total 10 Gift cards.

So, its value is Rs.500.

Here too, the trick is, the Minimum value of every transaction should be Rs.100 of these 10 transactions.

So, in this case, 10 transactions at a rate of Rs.100. That is, if you spend Rs.100 rupees x10 Transactions = Rs.1,000,

For these, Rs.1,000 Minimum spends, you will get a benefit worth Rs.500.

My analysis:

Case 1: With Zero Joining Fee

In the 1st case, if you spend Rs.100, you will get a net benefit of Rs.399

In the 2nd case, if you spend Rs.1,000, you will get a benefit of Rs.500

In total, here if you have spend a total of Rs.1,100 and you will recieve a a benefit of Rs.899.

so, here, you will end up with a loss of Rs.201

This is also if you do not pay the joining fees of Rs.999+GST. This is a limited period. It is not known for how long the joining fee will be zero.

Case 2: With Joining Fee of Rs.999

If you pay the joining fee of Rs.999+GST i.e. Rs.1,178 with GST and get the card, then, you will spend extra Rs.1178 along with the above shown spends of Rs.1100, it makes the total spends to be Rs.2278 bu the benefit is Rs.899 only.

If you are a regular UPI spender, then you will get a benefit of Rs.899, but if you are not a frequent UPI user, do not spend that much money for this nominal benefit.

There is a HIDDEN benefit that I like, which is further explained in this article.

So, keep reading, brother..!

3. Reward Points – 10% On What?

Now let’s come to the third benefit about Phonepe Rewards.

10% Rewards on this.

1. Recharges – i.e. prepaid, DTH, data packs

2. Bills – Electricity, water, gas

3. Travel – Flights, Bus, Train bookings

4. Hotels – only if you book on PhonePe

5. Pincode orders – PhonePe delivery service

If you add this Rupay credit card to your Phonepe and make UPI Payments on the above mentioned categories,then, you will get 10% rewards on the value you pay.

Example 1

If you pay Rs.1,000 on any of the above spends, you will get 10% Reward Points (RPs).

That is, 100 RPs in this case.

If you spend Rs.10,000, you will get 10% RPs. That is, 1,000 RPs.

No matter how much you spend in these categories, you will get 10% PhonePe rewards.

But there is a condition.

Only a maximum of 1,000 reward points can be earned during a calendar month.

That means, a user can earn maximum of 1,000 RP’s only in a month.

Example 2

Let’s say, you spend Rs.12,000 in a month on PhonePe on the above mentioned categories.

Actual Reward = 10%

That means you should get 1,200 rewards right.

But you a maximum cap limit to earn only 1,000 Reward points, right?

So, here you will loose 200 reward points.

4. Reward Points – 5% on Online Shopping Brands?

Let’s see the other benefit on Shopping.

If you spend with this credit card on your favorite brands like Flipkart, Amazon, Swiggy, Zomato, Uber, Myntra & AJIO, then the benefit you get is 5%.

That means, no matter how much you spend on all these apps – you will not get 5% reward. There is a limit here too.

That is, Only a maximum of 500 reward points can be earned during a calendar month.

That means, a user can earn maximum of 500 RP’s only in a month in this category.

That is, no matter how many orders you place in these in a month, You will get the benefit if you spend only up to Rs.10,000 only.

That means , Rs.10,000 × 5% = 500 RPs. If you exceed Rs.10,000, you can but you will not get extra cashback due to this cap.

Phonepe HDFC Ultimo credit card Cashback limit

Example 1

If you order Rs.8,000 on Amazon in a month, you will get 400 RPs.

If you order Rs.2,000 on Swiggy, you will get 100 RPs

Total = 500 RPs you will get.

Note: You will not get any rewards beyond that limit under this category.

I Liked this BENEFIT my dear friends..Lets findout why in “My opinion” which will be discussed clearly in the next few minutes.

5. Rewards (1% on UPI Scan & Pay)

Now we will talk about the “UPI Scan & Pay” category.

Since this is a RuPay credit card, you can use it in UPI apps. But the reward here is very low – Just 1% only my dear friends.

Example 1

If you spend Rs.2,000 in Kirana shops – You will earn 20 RPs only.

However, If you spend Rs.3,000 in a restaurant – then, You will earn only 30 RPs.

With the above calculations, it is quite clear that the comparative cashback is very low. Here too, there is a maximum monthly cap – i.e. the same 500 RPs per month.

That means, even if you scan this credit card through UPI apps and spend more than Rs.50,000 in a month, then, you will get only 500 RPs.

6. ZERO Reward Categories

Now the List is very important.

Whether you pay for this below list of items with your credit card or not is the same. The REASON is the rewards you get through these payments are absolutely ZERO. Duck OUT..!

1. Fuel transactions

2. Wallet load – PhonePe wallet too

3. EMI transactions

4. Insurance premiums

5. School/College Fees

6. Government payments

7. Rent transactions

8. Jewelry purchases

9. Investment payments – SIP/Mutual funds

Examples

if you pay rent of Rs.15,000 with this card ? Rs.0 cashback

If you pay school fees Rs.25,000 ? Rs.0 cashback

Pumoed Fuel of Rs.3,000? Rs.0 cashback

Further, I will tell you further who can TAKE and who can AVOID this card.. So, Keep Reading guys..!

7. Free Lounge Access – Domestic / International?

What I’m saying now is the KEY BENEFIT of this credit card.

This Phonepe HDFC Ultimo credit card comes with a premium benefit. i.e. Airport lounge access.

This means, the card user is being offered with 8 complimentary Domestic Lounge access with this credit card, for a period of 1 year. Simply, you can avail only a Maximum 2 Lounge access per quarter.

Example

If you have 3 flights in a quarter – the lounge facility free for 2 only. If you go to the lounge for the third time, you have to pay the full amount.

8. Fuel Benefit – Real Benefit?

As you can see, No reward points offered on fuel, but there is a Fuel Surcharge Waiver – 1% for the fuel transactions spent between Rs.400 to Rs.5,000.

Example

If you spend Rs.2,500 on fuel with this HDFC bank card, 1% means, Rs.25 will be saved.

I wrote a complete article on Fuel Surcharge Waiver, in which I explained it in detail. You can also watch the script in my Youtube channel which already 7000+ people have already watched it so, don’t miss that video.

Watch it here

PhonePe HDFC Ultimo Credit Card Charges [Must Read]

If you are applying for this PhonePe HDFC Credit Card, then looking at the benefits won’t help you my dear friend. You should look at the charges as well. Once you get the card in your hand, you should bear it first.

The overview of the Top charges of the Yes Bank Rupay Credit Card is as follows.

| S.No. | Particulars | Description |

|---|---|---|

| 1 | Joining fees | Nil |

| 2 | Renewal fees | Rs.999 |

| 3 | Interest charges | @3.75% p.m ; @ 45% p.a. |

| 4 | Foreign currency Markup | 3.50% of the transaction value |

1. No Joining fees

If you want to use this Rupay Credit Card, then, you will be offered Zero Joining fees as a welcome offer. i.e. Free for the first year.

But it is a limited period deal. Once the period ends, you should pay RS.999+GST i.e. almost Rs.1,178/-

2. Renewal fees

However, If you want to continue using this Rupay Credit Card from the second year onwards also, then, you are needs to pay an amount of Rs.999+GST i.e. almost Rs.1,178/- every year.

But if your credit card annual spends exceed Rs2,00,000 in the previous year, then, you are not liable to pay any Renewal fees.

3. Cash Advance charges / Cash Withdrawal charges

If you withdraw money by using this HDFC Bank Credit Card, a Transaction fee will be levied on all such Cash Withdrawals at ATMs. Such fees would be billed to the Cardholder in the next statement.

A transaction fee of 2.5% or Rs.500/- whichever is higher will be charged at ATMs.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

You can Withdraw Money using this PhonePe HDFC Credit Card but Don’t withdraw cash from any credit card. If you have an urgent cash requirement / Cash crunch, then I suggest you take a Gold Loan or a Personal Loan.

Those are much better options.

In a Personal Loan, every month you pay the Principal amount plus Interest as an EMI. The rate of interest for Personal Loans usually ranges from 15-20% p.a. on a higher note. Whereas in credit cards, you have to pay up to 42% per year at the rate of 3-4% per month.

That means the interest rate you pay on a credit card is more than double the rate of interest you pay through a personal loan.

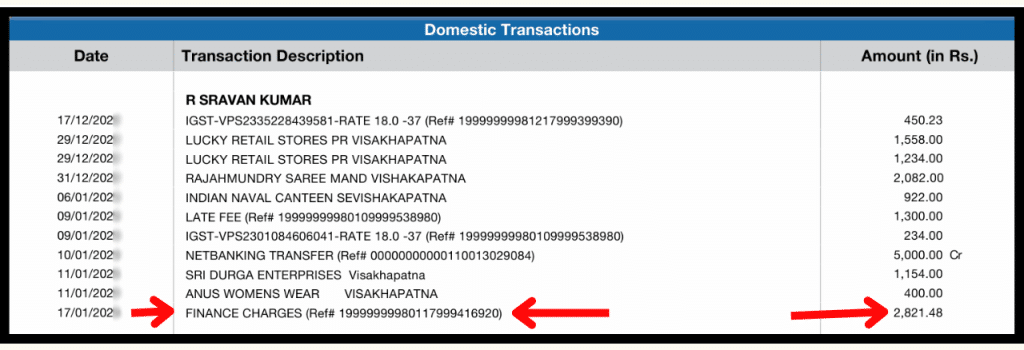

Apply Now4. Interest charges / Finance Charges?

Do you know how much interest you will be charged on this Credit Card?

You must know it, boss.!

For Example,

You have used this Rupay Credit Card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, this bank will charge you interest @3.75% per month. It means the Annual interest the bank will charge is almost up to 45% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

5. Late payment charges

Apart from Interest charges, if you delay paying this HDFC PhonePe Credit Card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding amount.

Generally, the Late payment charges range from a Minimum of Zero rupees to a Maximum of Rs. 1,300/- depending on your Credit card outstanding. On this card, you don’t need to pay any late penalty charges as long as your credit card’s outstanding balance is less than Rs.100 rupees.

If your credit card outstanding balance is more than Rs.100/-, then you will incur Late payment charges.

So if you use a credit card you have to be very organized and should deal with Credit card timelines properly.

| Credit Card Outstanding Balance is | Late payment charges |

|---|---|

| Less than Rs.100 | Nil |

| Between Rs.101-Rs.500 | Rs.100/- |

| Between Rs.501-Rs.1,000 | Rs.500/- |

| Between Rs.1,001-Rs.5,000 | Rs.600/- |

| Between Rs.5,001-Rs.10,000 | Rs.750/- |

| Between Rs.10,001-Rs.25,000 | Rs.900/- |

| Between Rs.25,001-Rs.50,000 | Rs.1,100/- |

| More than Rs.50,000 | Rs.1,300/- |

5. Foreign Currency Markup fee

Also, whatever international transactions you do by using this credit card, you will be charged a foreign mark fee of 3.50% on that transaction.

PhonePe HDFC Ultiomo Credit Card Review [My HONEST Review]

Coming to my opinion, a Reward point in this credit card is worth Rs.1 and not Rs.0.25p. I think SBI people have seen my previous Credit cards videos on my youtube channel.

Because if you watch any of the videos I have made on the Credit Cards Playlist, I keep saying every time in suggestive mode that 1 RP is offered worth Rs.0.25 paisa is not worthy, unless 1 RP is worth of Rs.1 rupee atleast on a constructive basis.

Any way, any good work should be appreciated. So, offering that value to the customer without making the rewards peanuts is really an appreciable thing. So, I appreciate SBI in this regard. That is why I liked this card.

In general, I will not say that I liked a credit card. But this card is fine. There is nothing much to say negative.

Because, If you spend Rs.10,000 in 10% Rewards category, you will get 1,000 RPs. That means, it’s worth of Rs.1,000.

In the same 5% Shopping category, if you spend Rs.10,000, you will get 500 RPs. That means, its worth is of Rs.500. Even this benefit is also not given in many credit cards.

Likewise, under 1% category, if you spend Rs.10,000, you will get 100 RPs, which is worth of Rs.100.

Coming to Reward redemption, the Rewards earned will be converted into cashback. The earned cashback will be deducted directly from your credit card bill. But, the Minimum redemption of 500 Reward points are must and these Reward points comes with 2 years validity.

Who can Apply for this Card?

Now, the Question is, who can take this card?

1. Those who do most of their bills, travel, and recharges on PhonePe

2. Those who do most of their Swiggy, Zomato, and Amazon orders

3. Those who make daily payments through UPI

4. Those who travel a lot domestically can apply for this card.

Who should AVOID this card?

1. Those who have high expenses like rent, school fees, insurance

2. Those who use a lot of fuel

3. Those who do not use PhonePe

If you are an EMI-heavy user, then like the audience who did not go to the theaters after the arrival of OTTs, keep a little distance from this card. This card is not for you my brother.

Stressed with Loan EMIs?

We keep doing money transactions every day, right..!

But if you do not have the right card – hundreds and thousands of rupees go away silently every month.

I also made the same MISTAKE..!

But after learning proper personal finance systems, my loans and credit cards have cleared a few years ago.

If you still struggling to pay lakhs of debts with monthly EMIS but if you want to make it zero. Then, you Start you Debt-free life today by enrolling in my 6 hours Money Management course in telugu (Recommended for Job Beginners – Flat Rs.499 off)

Frequently Asked Questions

1. Is Phonepe HDFC Ultima Credit Card Rupay Card?

The Phonepe HDFC Ultima Credit Card is a Rupay Credit Card. It means this card run by Indian banks with India’s domestic payment system.

2. Can I Link Phonepe in HDFC Ultima Credit Card ?

As an Phonepe HDFC Ultima Credit Card is a Rupay Credit Card, the cardholder can link this credit card to their PhonePe.

3. Is Phonepe HDFC Ultima Credit Card have Lounge access?

The Phonepe HDFC Ultima Credit Card offers 8 Complementary Domestic Airport Lounge access facility to its customers.i.e. 2 per quarter.

5. Is the Phonepe HDFC Ultima Credit Card a contactless card?

The Phonepe HDFC Ultima Credit Card comes with Contactless technology.

In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

6. Can we use Phonepe HDFC Ultima Credit Card in petrol pump?

The Phonepe HDFC Ultima Credit Card customers can fuel their vehicles at fuel stations. Whenever you pay with your Kotak Credit card, you should be liable to pay a Fuel Surcharge i.e. around 1-3% of fuel cost. However, with this Credit card, you will be eligible for a 1% Fuel Surcharge waiver.

7. Phonepe HDFC Ultima Credit Card Fuel Surcharge Waiver Rule?

The Phonepe HDFC Ultima Credit Card offers a Fuel Surcharge Waiver.

If you spend Petrol/Diesel between Rs.400-Rs.5,000/- in any fuel station in the country, then you will be eligible for a 1% Fuel Surcharge waiver with a Maximum of Rs.250/- per statement cycle.

8. What is the Annual Fee of Phonepe HDFC Ultima Credit Card ?

If you want to use this Phonepe HDFC Ultima Credit Card from the second year onwards, then, you will have to pay a Renewal fee of Rs.999/- per year excluding GST. With GST, you should pay Rs.1,178/- per year.

If you have spent Rs.2,00,000/- or more in a year by using this credit card, then the Annual fee on this credit card of Rs.1,178 will be waived i.e. you are not required to pay the Renewal fee on this credit card in the next year.

9. Phonepe HDFC Ultima Credit Card reward points value

The Phonepe HDFC Ultima Credit cardholder can redeem Reward Points as Instant Cashback at a rate of 1 Reward Point = Rs.1/- rupee worth.

10. What is Phonepe HDFC Ultima Credit Card limit?

This credit card limit will be decided by the HDFC based on your Income potential and with a good CIBIL score. You can get to know only when the Bank issues this credit card.

11. Phonepe HDFC Ultima Credit Card Customer Care Helpline?

For any questions or concerns about your Phonepe HDFC Ultima Credit Card , you can contact the below Customer Care helpline toll-free number 1800 1600 / 1800 2600 (Toll-Free)

Thanks for your time, my dear readers 🙂