Post Office FD Interest rate

Introduction

As the World is a volatile market with Interest rates, many individuals look for a Secure and Reliable place to invest their money.

Post office Fixed Deposits (FDs) have long been one of the great choices for Indian depositors, offering safety and attractive returns.

Many depositors choose the Post Office Fixed Deposit scheme as it is backed by the Government of India, with attractive interest rates, Tax benefits, Easy renewals, and a lot more.

In this article, we delve into the interest rates offered by the Indian Post Office on the Fixed Deposit (FD) scheme. Here, if you deposit Rs.10,000, Rs.20,000, Rs.1 lakh, or Rs.10 Lakhs, let’s see how much amount you will get at the maturity time and how much interest will be paid.

Let’s discuss..!!

Overview of Post Office FD

| S.No. | Particulars | Description |

|---|---|---|

| 1. | Name of the Scheme | Post Office National Savings Time Deposit Account (TD) or Post Office Time Deposit Account (TD) |

| 2. | Eligibiliy | 1. Single Adult 2. Joint Adults 3. Guardian on behalf of Minor 4. Guardian on behalf of Person of Unsound Mind 5. Minors with their Name |

| 3. | Deposit Limit | Minimum – Rs.1,000/- Maximum – No Limit |

| 4. | Interest Payout | Interest payable Annually but calculated Quarterly |

| 5. | Nomination Facility | Yes |

| 6. | Pre Mature Withdrawl | Yes |

| 7. | Income Tax Benefit | U/s 80C of the Income Tax Act, 1961 |

3 Key Features of Post Office FDs

The Post Office FD scheme is officially termed as “Post Office National Savings Time Deposit Account” (TD) or “Post Office Time Deposit Scheme”

Let’s see what the Key Features offered by the Post Office are.

1. Safety

As Post office Fixed Deposits (FD) are secured by the Indian government, they are considered the most trusted and safest investment choice by many Indian depositors.

2. Tenure

In this Postal Fixed Deposit, the Depositors will get the Fixed interest rate for the complete FD tenure. Therefore, you can predict your returns earlier.

The depositors have a choice to choose the FD tenure between 1 -5 years. It may be either for 1 year, 2 years, 3 years, and 5 years.

3. Tax Benefits

Interest earned through a Post office Fixed deposit is Taxable. However, the depositors can avail tax exemption under Section 80TTA of the Income Tax Act,1961.

Who is eligible to open this FD account in the Post Office?

Keep on Reading..!!

Post office FD Eligibility

1. Single Adult

A Single Adult i.e. Aged 18 Years above can open a Post office account independently.

2. Joint Adults

Two or 3 adults can open a Post office account together.

For Example,

Two friends like Mr. Ramu & Somu,

Two family members Wife and Husband,

Two Partners of Partnership firm etc.,

3. Guardian

A Guardian can open a Post office FD account on behalf of a Minor i.e. for below 18 years old children.

4. Person of Unsound Mind.

A Person who is Unsound Mind can also open a Post office FD account with the help of a guardian. The guardian may be a father, mother, or any other person who is taking complete responsibility for such person.

5. Minors with their Name

Yes. Minors who completed 10 years of age can open a Post office FD account in their name.

How much amount I can deposit in this FD of Post Office?

Is there any limit..!!

Oh.. Yeah.

Check now..!!

Post office FD Minimum Amount

The Minimum amount to deposit in Post office FD is Rs.1,000/- in multiples of Rs.100/-.

It means the depositors can deposit Rs.1,000, Rs.1,100, and Rs.1,200 only as they are in multiples of Rs.100/- only and cannot make Rs.1,111 rupees as a sentiment or fancy number type.

Bro, I want to invest more..!!

How much amount I can invest in this Post office FD per year?

Maximum limit of Fixed deposit in Post Office

There is no upper limit on the Maximum amount to deposit in this Post office Fixed Deposit scheme. The depositor can make any amount as per their wish.

How much Interest do I get in the Post Office Fixed Deposit Scheme?

Post Office FD Interest rate [for Regular Citizens]

From 01.01.2024 to 31.03.2024, the Post Office FD Interest rate for Regular citizens is as follows.

| Period | Rate of Interest p.a. |

|---|---|

| 1 Year | 6.90% |

| 2 Year | 7.00% |

| 3 Year | 7.10% |

| 5 Year | 7.50% [Highest] |

Post office FD Interest rate [for Senior Citizens]

From 01.01.2024 to 31.03.2024, the Post Office FD Interest rate for Senior citizens i.e. aged 60 years or more is as follows.

| Period | Rate of Interest p.a. |

|---|---|

| 1 Year | 6.90% |

| 2 Year | 7.00% |

| 3 Year | 7.10% |

| 5 Year | 7.50% [Highest] |

Interest rates are fine.!

But, When I will get the Money into my Account?

Interest Payout

In the Post Office FD scheme, the Interest will be calculated on a Quarterly basis but paid on an annual basis to the depositors. If you hold any accrued interest unclaimed by the depositors, no additional interest will be paid.

Upon request, the earned annual interest can be deposited into the Savings account of the depositor.

Maturity

When the Maturity amount will be paid to the depositor?

The Maturity amount of Post Office FD will be re-paid to the depositor after the expiry of 1 year, 2 years, 3 Years, and 5 Years as per the instructions given by the depositor at the time of opening of FD.

Time Extention

I held my Post Office FD for 3 years, I want to extend the period. Can I?

Yes.!!

But you should know certain terms and conditions as mentioned below.

1-Year FD

If you made Post Office FD for a 1-Year, you can extend the period within 6 months of the Maturity

2-Year FD

If you made Post Office FD for 2 years, you can extend the period within 12 months of the Maturity

3-Year FD

If you made Post Office FD for 3 years, you can extend the period within 18 months of the Maturity

| For FD Term | Extention Period |

|---|---|

| 1-Year | Extend within 6 Months of Maturity |

| 2-Year | Extend within 12 Months of Maturity |

| 3-Year | Extend within 18 Months of Maturity |

How to Extend:

1. Account Opening time

The first option to extend your Post office FD is when you open your Post Office FD Account.

At the time of Account Opening, the depositor can request an extension of their Fixed Deposit period from the date of Maturity itself.

2. After Maturity

My Post office FD maturity time is over. How can I extend?

Suppose your Post office FD Maturity time is completed. In that case, the depositor may request for extension by submitting the prescribed Application Form along with your Post office Passbook at the relevant Post office.

Premature Withdrawal Rules

I have an urgent money requirement, Can I Withdraw money Prematurely?

Yes. You can Pre-maturely withdraw your Post office FD. But you should know about Interest calculations and terms and conditions if you withdraw before maturity.

Conditions

1. Initial Lock-in Period

Post office Fixed Deposits cannot be withdrawn for the first six months.

2. Early closure (6 Months to 1 Year)

If your TD account / FD account is closed before the first year, you will get the Interest at the rate offered for the Post Office Savings Account Interest rates. i.e. 4% per annum.

Instead of getting 7.50% p.a. of interest, the depositors who withdraw prematurely will get the amount with the Interest rate of 4.00% per annum.

You will lose money..!!

Interest Calculation for Premature Closure (After 1 Year)

1. For 2/3/5 Year TD Accounts

If you have opened a 2, 3, or 5-year TD account, you can close your TD account prematurely after one year, the interest calculation is as follows.

For Completed Years:

For the Completed years, the Interest will be calculated 2% less than the applicable TD Interest rate

For Partial Years:

For the partial years, the Interest will be calculated at the applicable Post Office Savings rate.

| Particulars | Applicable Rate |

|---|---|

| For Completed Years | Interest will be calcualted 2% less than the applicable TD Interest rate |

| For Partial Years | Applicable @ Post Office Savings rate |

Let me give you an example..!!

Example

Mr. Ram opened a 3-Year Post Office FD of Rs.10,000/-. He wants to withdraw it after 1 year and 2 months. What is the applicable Post Office FD Interest rate?

Solution

Mr. Ram withdrew from Post Office FD after 1 Year and 2 Months.

FD Term – 3 Years

Total Completed Years are 1 Year

The applicable Interest rate for the Completed Years of 1 Year is 5.10% (I.e. 7.10% -2.00%)

Total Partial Years are 2 Months only

The applicable Interest rate for the Parital Years of 2 months is 4.00% per annum. i.e. Post Office Savings rate.

The computation is as follows:

= (7.10%-2.00%) + ( 2 x 4 /12)

= 5.10% + 0.67%

= 5.76%

You lost almost 1.34%

Premature Closure Procedure

To close your Post office TD prematurely, you can submit an application with your Passbook to the relevant post office.

Nomination Facility

Upon the death of the depositor of a single account or all the depositors in a joint account, the balance available in their account will be disbursed first, to the designated nominee if any, and secondly to the legal heirs of the deceased depositor.

Let’s see a few examples to understand it a little better.

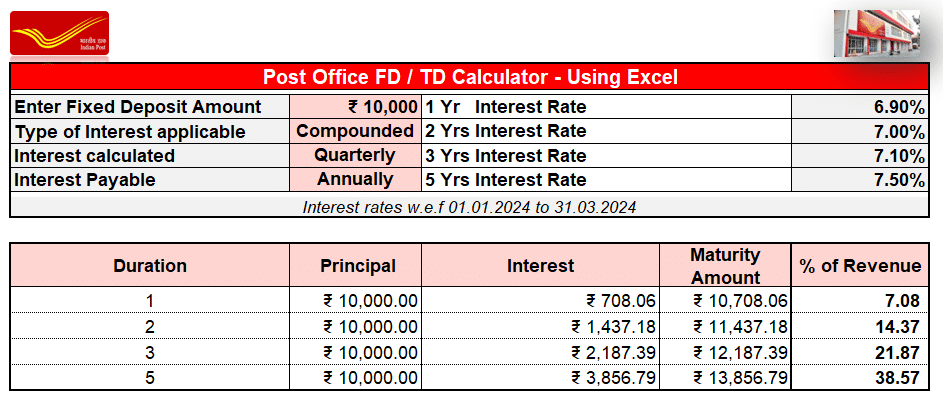

Example 1: When I deposit Rs.10,000, How much Interest I can earn?

If you invest Rs.10,000 rupees as a single deposit, then, your earnings as per Post Office FD Interest rate are as follows.

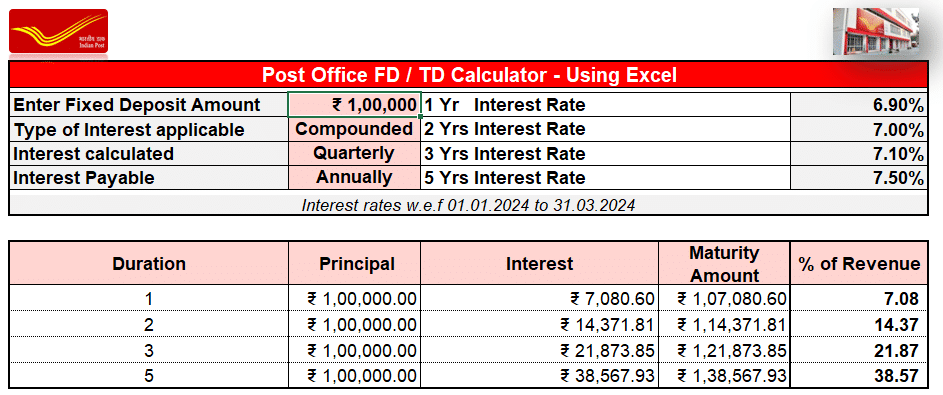

Example 2: When I deposit Rs.1,00,000, How much Interest do I earn?

If you invest Rs.1,00,000 rupees as a single deposit, then, your earnings as per the applicable Post Office FD Interest rate are as follows.

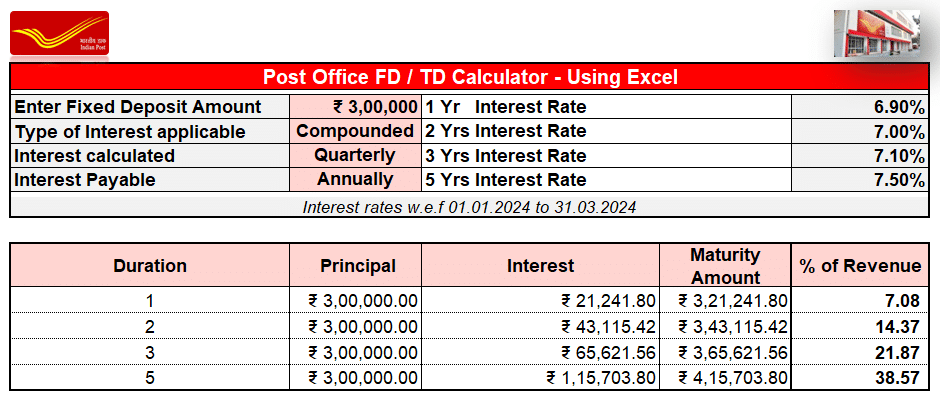

Example 3: When I deposit Rs.3,00,000, How much Interest I can earn?

If you invest Rs.3,00,000 rupees as a single deposit, then, your earnings as per the applicable Post Office FD Interest rate are as follows.

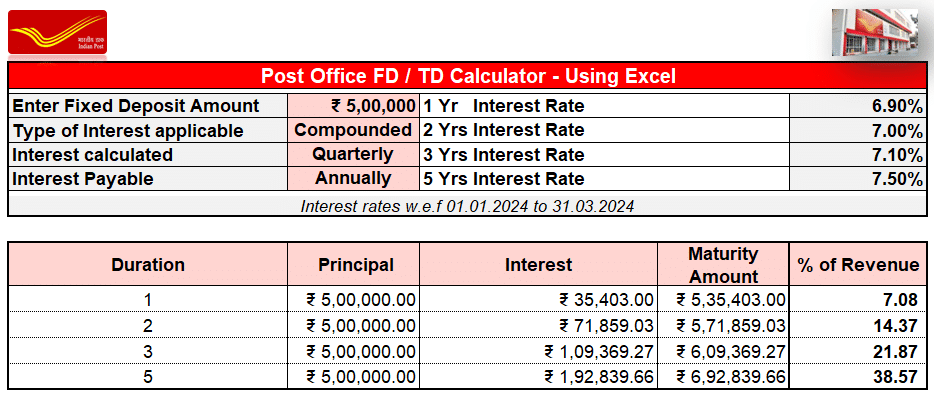

Example 4: When I deposit Rs.5,00,000, How much Interest I can earn?

If you invest Rs.5,00,000 rupees as a single deposit, then, your earnings as per the applicable Post Office FD Interest rate are as follows.

Example 5: When I deposit Rs.10,00,000, How much Interest I can earn?

If you invest Rs.10,00,000 rupees as a single deposit, then, your earnings as per the applicable Post Office FD Interest rate are as follows.

Conclusion

If you are looking for stable and secured returns with minimum risk, you can go with these Post Office Fixed Deposits. The major benefit I considered is the Interest payout type. The Interest will be calculated Quarterly and you will be paid Annually i.e. Compounding Interest will be applicable on this investment.

If the depositor prematurely wants to withdraw their deposit before the maturity period, the depositor will lose the interest portion. Therefore, think twice before you prematurely withdraw your Post office FD.

Frequently Asked Questions

1. What is the Post Office Time Deposit Scheme

The post office Time deposit scheme is nothing but a Post office Fixed Deposit (FD) scheme. It is also called as “Post Office Time Deposit scheme” offered by the Indian Central Government. This scheme provides competitive interest rates. Individuals can easily invest in this scheme through a network of post offices across India.

2. When the Maturity amount will be paid in Post Office FD?

The Maturity amount of Post Office FD will be re-paid to the depositor after the expiry of 1 year, 2 years, 3 Years, and 5 Years as per the instructions given by the depositor at the time of opening of FD.

3. Post Office FD Minimum Amount?

The Minimum amount to deposit in Post office FD is Rs.1,000/- in multiples of Rs.100/-.

4. Maximum amount for Fixed Deposit in Post Office?

There is no upper limit on the Maximum amount to deposit in this Post office Fixed Deposit scheme. The depositor can make any amount as per their wish.

5. Post office 1 Year FD Interest rate?

If you deposit 1 Lakh The Post Office FD Interest rate for 1 Year term for both Regular and Senior citizens from 01.01.2024 to 31.03.2024 is 6.90% only.

6. Post office 3 Year FD Interest rate?

The Post Office FD Interest rate for a 3-Year term for both Regular and Senior citizens from 01.01.2024 to 31.03.2024 is 7.10% only.

7. Post office 5 Year FD Interest rate?

The Post Office FD Interest rate for a 5-year term for both Regular and Senior citizens from 01.01.2024 to 31.03.2024 is 7.50% only.

8. Post Office FD Interest rate Senior Citizen?

The Post Office FD Interest rate for Senior citizens ranges from 6.90% -7.50% p.a. only. The depositors have a choice to choose the FD tenure between 1 -5 years. It may be either for 1 year, 2 years, 3 years, and 5 years

9. 1 lakh FD interest for 1 year in post office?

If you deposit 1 Lakh rupees in the Post office for a term of 1 year, the present applicable interest rate of 6.90%. Therefore, you can earn an Interest of Rs.7,080 with a Maturity value of Rs.1,07,080/- at the end of 1 year.

10. 50000 fd for 5 years post office?

If you deposit 50000 rupees in the Post office for a term of 5 years, the present applicable interest rate of 7.50%. Therefore, you can earn an Interest of Rs.19,283 with a Maturity value of Rs.69,283/- at the end of 5 years.

11. Post office Fixed Deposit Double in 5 years?

The thumb rule is to divide the number 72 by the average Interest rate you estimate. For example, if the Average Interest rate is 7.10%, the FD will double in 10.14 Years (72/7.10)

Thanks for your time folks 🙂