LIC Premium Payment Online

Introduction

In Today’s world of Digital era, convenience, and efficiency plays a key role. Life Insurance Corporation of India (LIC) has recognized this need and introduced a seamless online payment service that enables LIC Policyholders to make their premium payments without the hassle of logging into LIC India’s official website i.e. without having a customer login.

Usually, LIC customers may opt for Monthly, Quarterly, or Annual premium payment options and pay it as per their timelines. However, there may be a chance that all the LIC policy holders might not have registered in the LIC official portal to make the premium payments or to get complete information about their LIC Policies.

In this article, I will discuss How to make LIC Premium Payment Online through Credit Card from LIC’s official website and also I will show you the entire process in 15 easy step-by-step along with Pictures. Therefore, you will find it easy and you can pay your LIC Premium payment dues easily.

Let’s get started with “LIC Premium Payment online”..!!

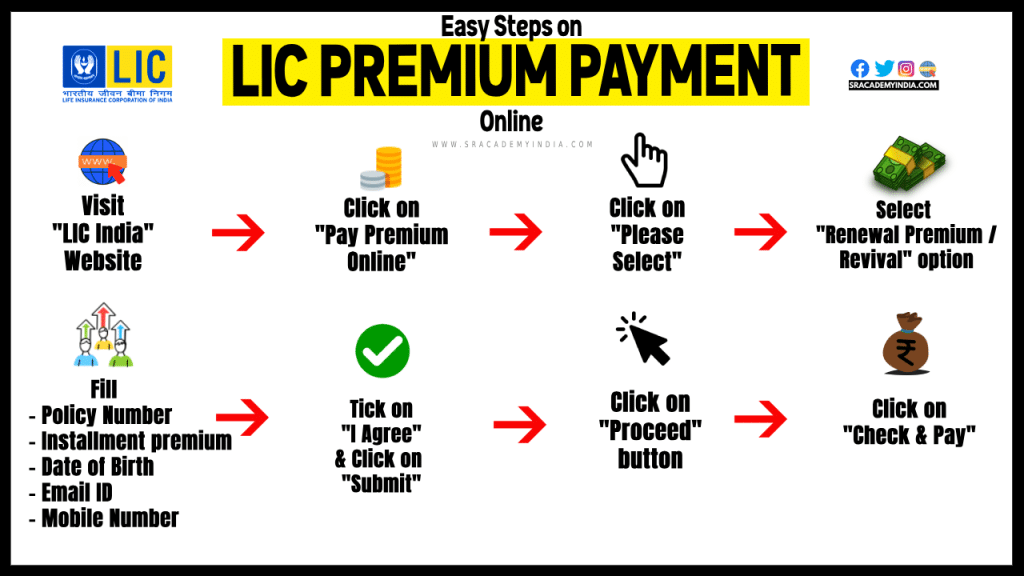

15 Easy Steps on LIC Premium Payment Online [Procedure]

Let me go through the complete LIC Premium Payment online procedure through the Direct pay option.

Step 1:

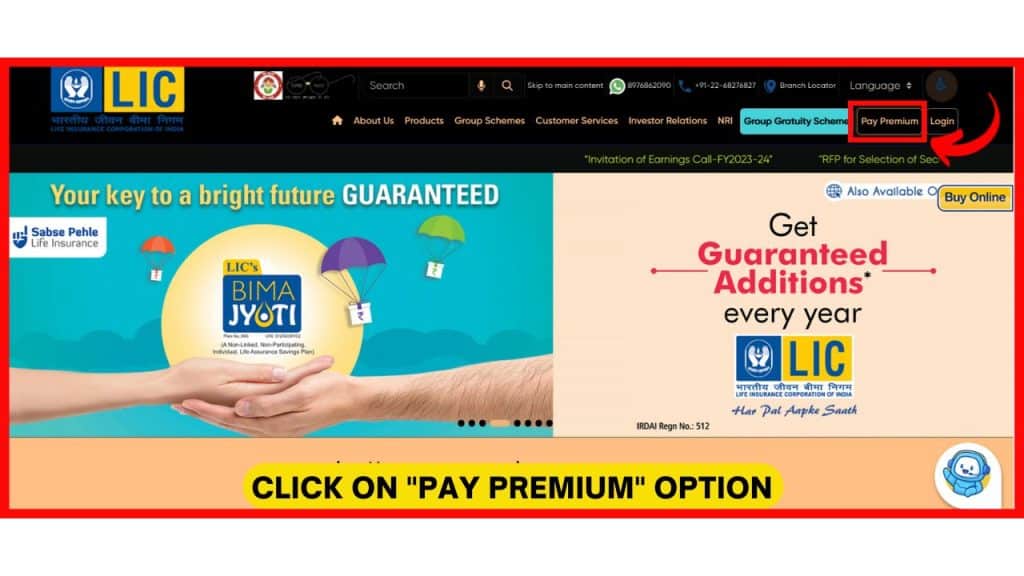

Go to the LIC India Portal and click on “Pay Premium Online” which appears on the right top of the portal.

As I mentioned earlier, the LIC Policy holders can enter the LIC Premium payment portal, without providing any username and password i.e. without logging into the LIC portal.

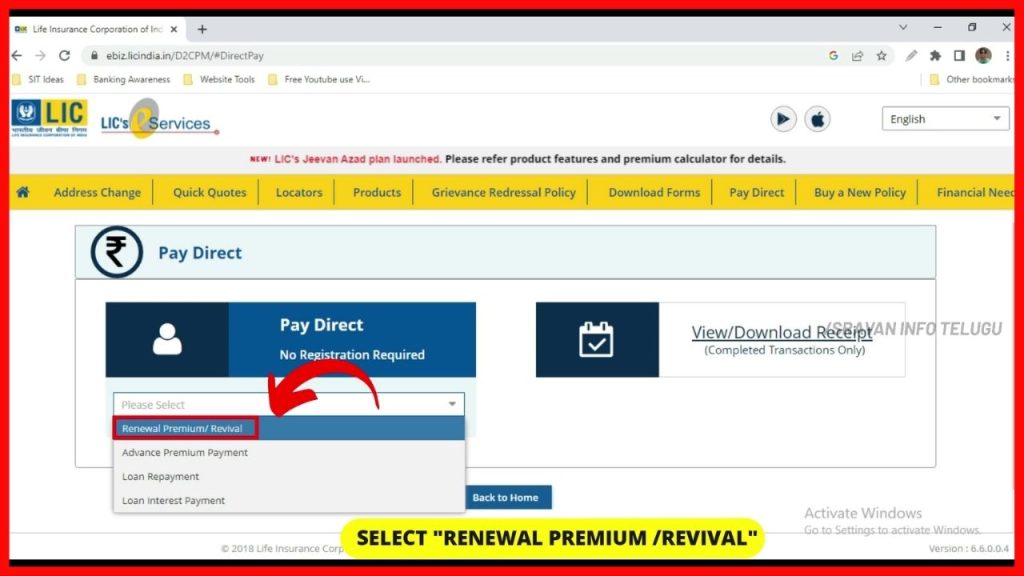

Step 2:

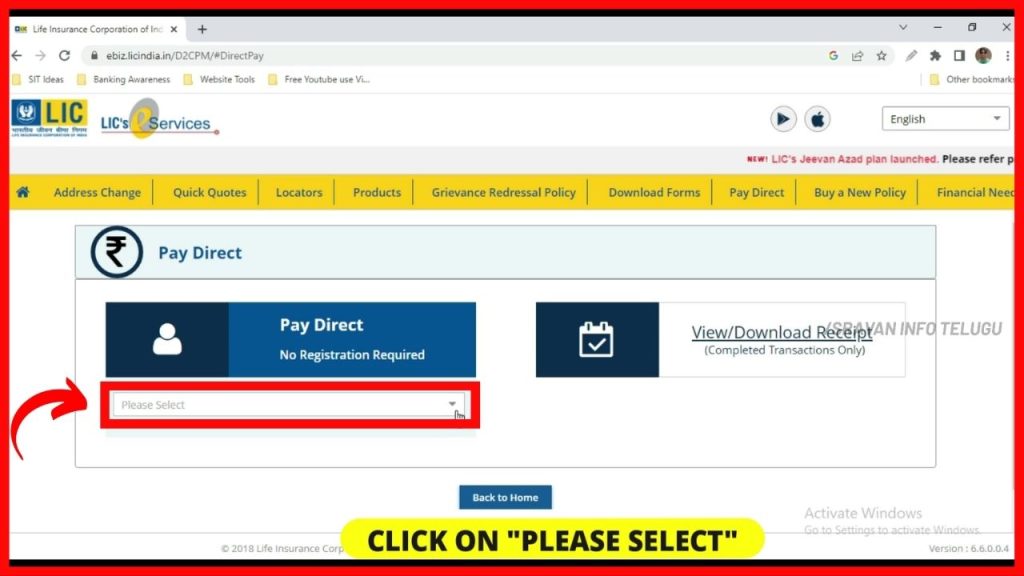

Now, you can see the “Pay Direct (No registration required)” option.

To Pay your Outstanding Monthly, Quarterly, or, Annual Life insurance Premiums directly without logging in, click on the “Please Select” option as you can see in the below image.

Once you select it, the LIC Policyholder will get the below Payment options

1. Renewal Premium / Revival

2. Advance Premium Payment

3. Loan Repayment

4. Loan Interest Payment

Step 3:

To pay your ongoing LIC Premium, click on the “Renewal Premium/Revival” option.

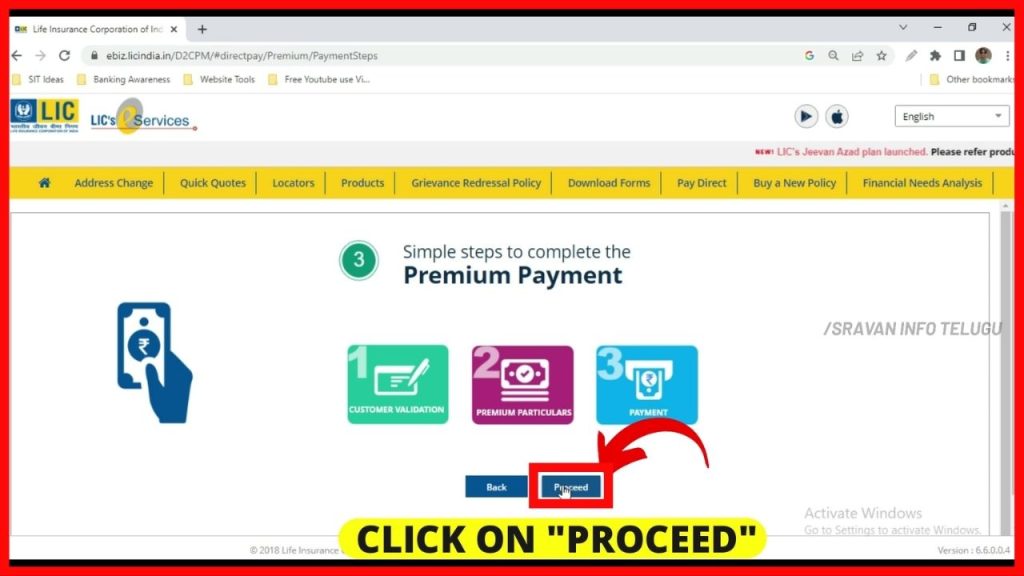

Step 4:

Now it will be displayed that you are required to complete 3 steps to complete the premium payment.

1. Customer Validation

2. Premium Particulars

3. Payment

so, click on the “Proceed” button.

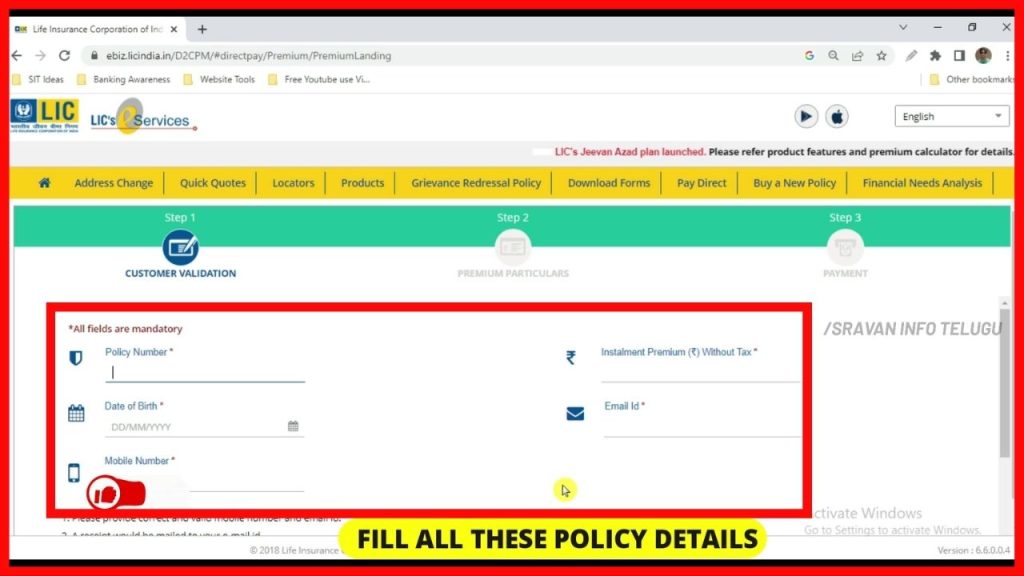

Step 5:

After clicking that, you have to fill in some of your personal and policy details like

1. Policy number,

2. Installment premium without Tax,

3. Date of Birth,

4. Email ID,

5. Mobile Number.

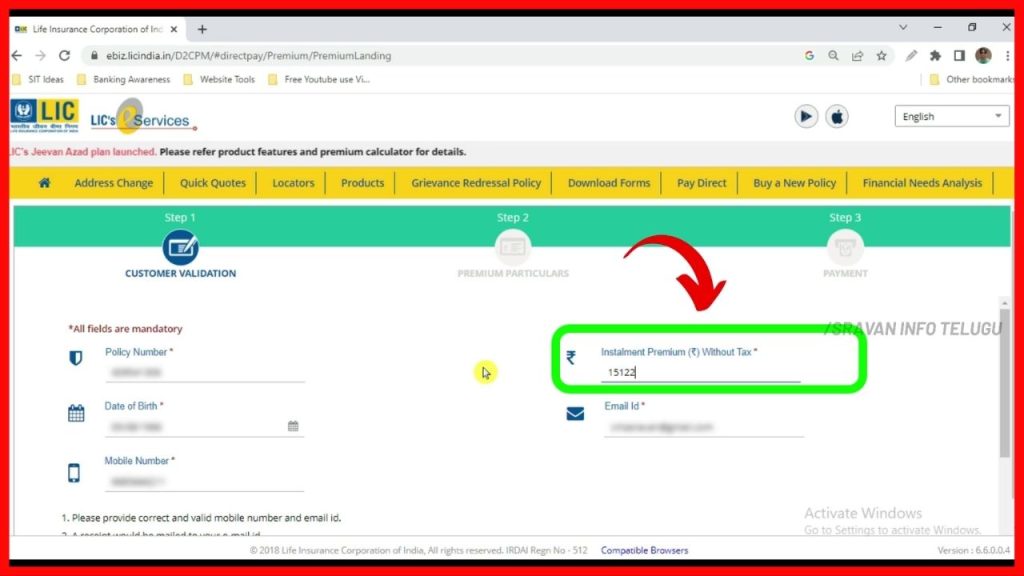

Step 6:

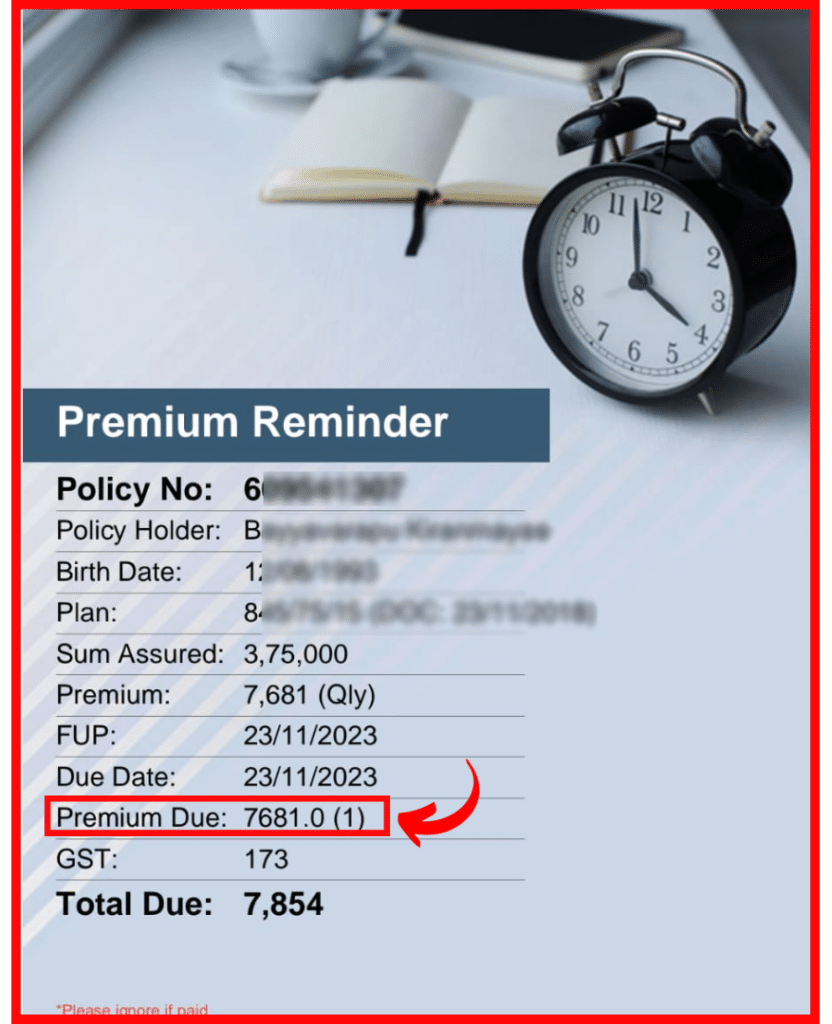

It is to be noted that “Installment Premium without Tax” means you have to enter your installment premium without including the GST portion. This will be available in the “Premium receipt” you paid earlier.

In case the premium receipt is not available, then you can contact your Insurance agent, they will assist you in this regard.

But do not enter the Total amount of the Insurance premium paid, you cannot proceed further.

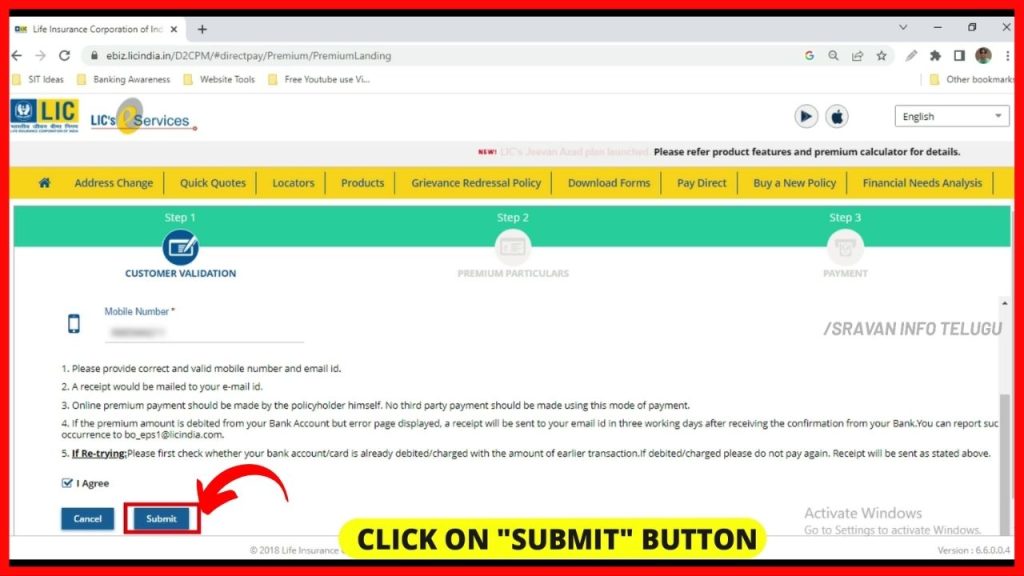

Step 7:

Once you enter it and scroll down a bit, you will see some guidelines and terms. Then, Tick on “I Agree” and click on the “Submit” button.

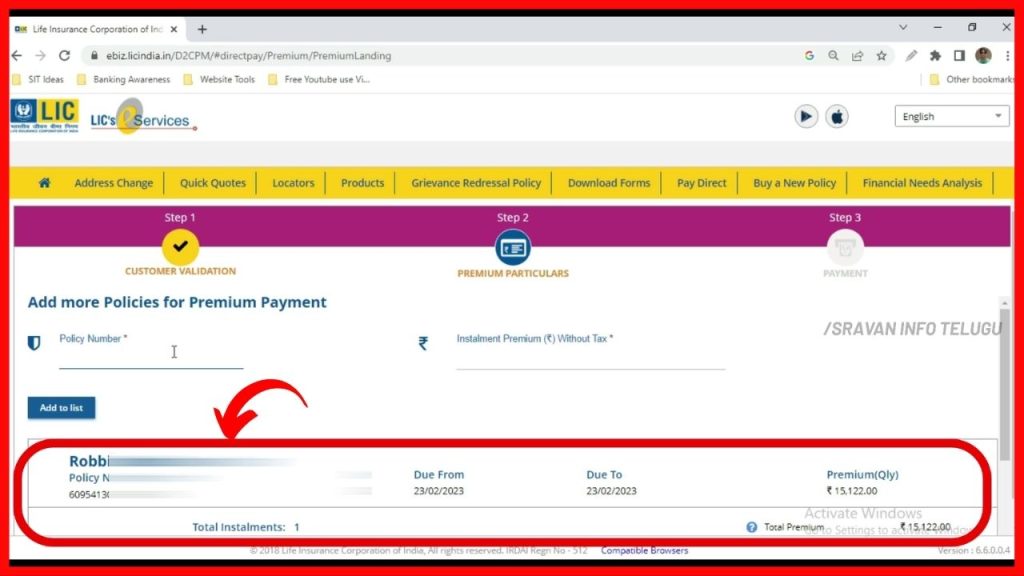

Step 8:

Now all your Life Insurance Policy details will appear, Policyholder Name, Policy number, Due date, etc.,

And also details like

– The premium payable either on a Quarterly or Monthly basis

– How much to pay as a Total premium will appear here.

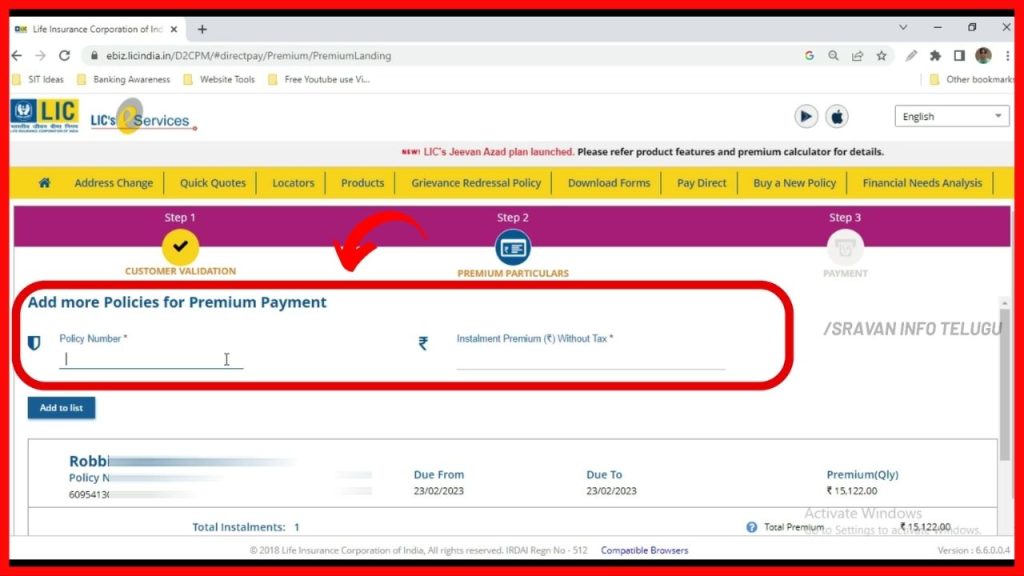

Step 9:

If you want to add your spouse’s or other family member’s policy details to pay it in a bunch, then you can also add more policies for whom you would like to pay the Insurance Premium.

For that, you have to enter their “Policy Number” and “Installment premium Without Tax” and click on “Add to List”.

For Example,

| S.No. | LIC Policy Premium Without GST | LIC Policy Premium With GST |

|---|---|---|

| 1. | Rs.7,681 | Rs.7,854 |

| 2. | Rs.15,122 | Rs.15,462 |

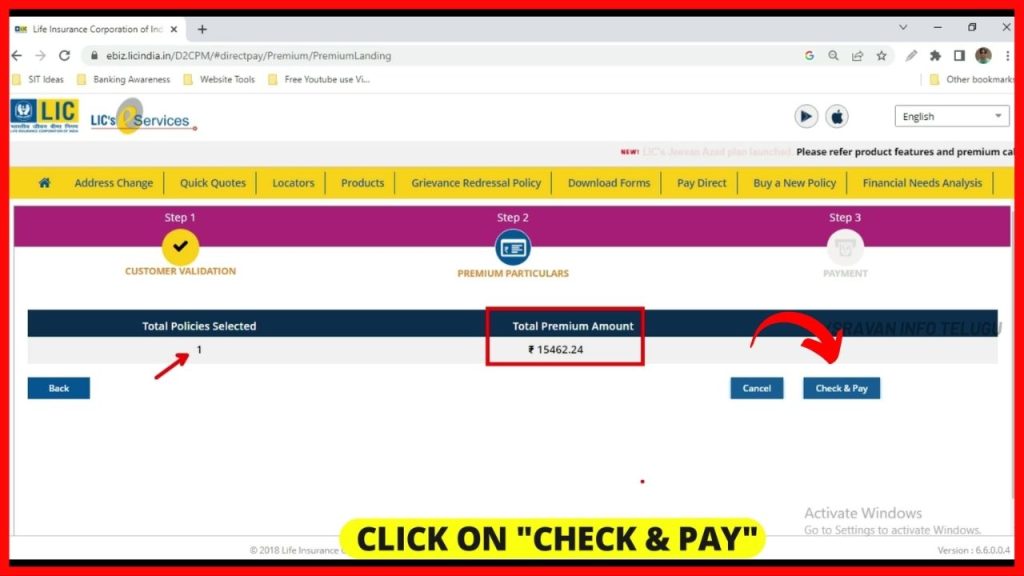

Step 10:

After clicking that, it displays how many policies you have selected and your Total LIC Premium payable amount including GST.

To confirm it, click on “Proceed”.

Step 11:

Now, Two gateways will be opened for the policyholders to complete payment in this final & 3rd step. i.e.

1. Paytm.

2. Bill Desk.

The LIC Policyholders can complete their payment by using either of these gateways.

I click on “Check & Pay” in the 2nd Gateway to pay the Premium amount.

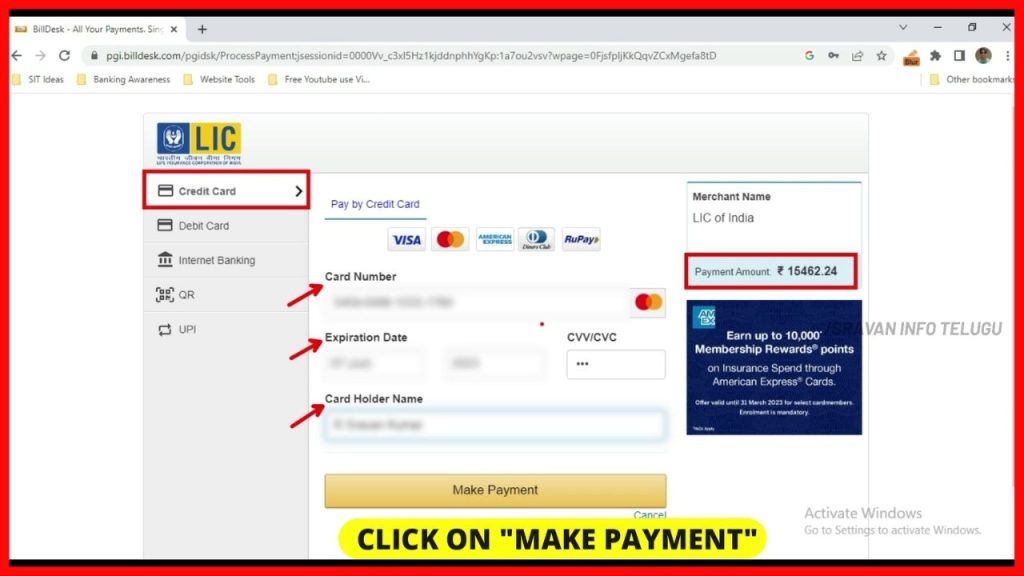

Step 12:

After clicking on that, different payment options will appear

1. Credit card,

2. Debit card,

3. Internet banking

4. QR

5. UPI.

LIC Premium Payment Online Credit Card

If you don’t have enough money with you, but if you want to make the LIC Payment through your Credit Card, then click on the “Credit card” option.

LIC Premium Payment Online through Debit Card

If your Bank account has a sufficient balance, then, you can make LIC Premium Payment through your Debit Card, then click on the “Debit card” option.

LIC Premium Payment Online PayTM

If you don’t want to fill in all the Bank account details and want to conveniently pay through UPI apps like PayTM, then, you can make an LIC Premium Payment, then click on the “UPI” option.

Here, Select any of your most convenient options to make an LIC Premium payment.

I select the “Credit card” option.

Step 13:

Enter your Credit card or Debit Card details like Card number, Card Expiry Date, CVV, and Cardholder Name, and click on the “Make Payment” option.

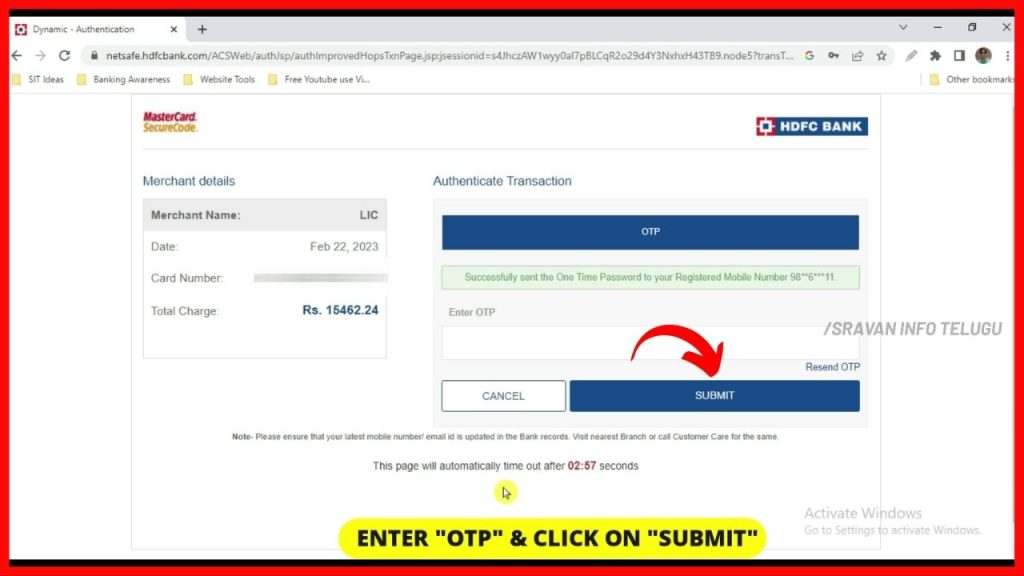

Step 14:

Once you click on that, an OTP will be sent to your bank-registered mobile.

Enter it and click on the “Submit” button.

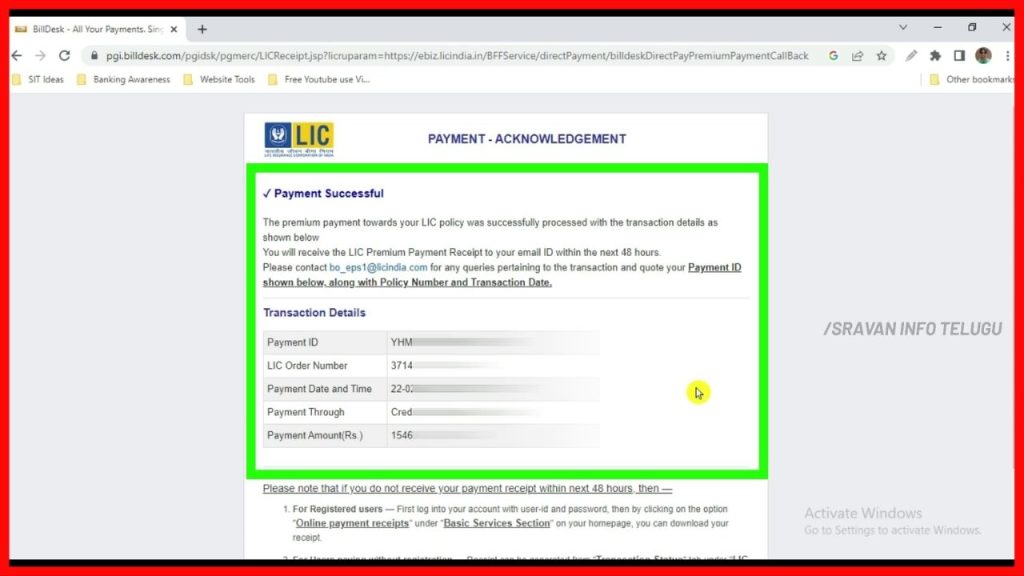

Step 15:

Now you will get a payment successful message. Also, all your transaction details will be displayed here. You can also see the details like How much you have paid and How you have paid.

Again we got the message that the premium payment is successful. Now you will see “Download Receipt” here, if you click on it, your LIC Renewal Premium Receipt will be displayed.

Frequently Asked Questions

Still, have Questions, this might help you, my dear friend..!!

1. What is the applicable GST rate for LIC Premium

In the case of LIC Endowment Policies, the premium rates are as follows

1. For first-year premiums – 4.50% GST

2. For subsequent premiums – 2.25% GST is applicable.

2. LIC Premium Payment Online PhonePe

Step 1: Open PhonePe app

Step 2: Go to the “Recharges & Bill Pay” section

Step 3: Now, Go to the “Financial Services & Taxes” section and Select the “LIC/Insurance” option

Step 4: Select the “Insurance Provider” Eg: Life Insurance Corporation of India

Step 5: Now you need to enter your Policy Number and Your Registered Mail ID & Click on the “Confirm” button.

Step 6: Your Policy details will be displayed, including your “LIC Premium Payable” and the due date.

Step 7: To make an LIC Payment, Click on “Proceed to Pay”

And Pay it by entering the PIN Number.

Step 8: You will get a Payment Successful message as you complete the payment.

3. LIC Premium Online Payment Customer Portal?

For assistance with LIC Services, the Policyholders can call the 24/7 Call Centre at +91-22-68276827. The Policyholders can get help in English, Hindi and around 8 regional languages.

4. LIC Premium Payment Online Google Pay

Step 1: Open the Google Pay app

Step 2: On the dashboard, you can see the search button, Type “Life Insurance Corporation or LIC”. Select it.

Step 3: Tap on Get Started and Now link your LIC Policy by providing your LIC Policy number, Email ID, Nickname (Optional)

Now, you need to review your given details.

Step 4: Click on “Link Account”

Step 5: Now, it shows the LIC Bill Paybale amount, Tap on “Pay Bill”

Step 6: After that, pay your LIC premium amount with your Google Pay.

Step 7: You will get a Payment Successful message as you complete the payment.

5. LIC Premium Online Payment with Late Fee?

Life Insurance Corporation of India (LIC) offers various online premium payment options like LIC Website, PhonePe, Google Pay, and a lot more. However, if you have failed to clear the earlier LIC premium payments, the policyholder can clear it at a penalty of 9.50% of the undue premium, with a minimum amount of Rs.5/-. The late fee will be varied based on risk profile and also the late penalty fees escalate proportionally to the duration of payment delay.

6. LIC Premium Payment receipt?

Step 1: Visit LIC India Official Website

Step 2: Click on “Pay Premium Online” & Select “View/Download receipt (Completed Transactions only)”

Step 3:

Now, you have to fill 3 things.

1. Policy number

2. Date of the Transaction – Eg: 25/12/2022

3. Transaction Type

& click on the “Submit” button.

Step 4: Now to download the LIC Premium receipt, Click on the “Receipt number”

Step 5: Once you click on that, your “Renewal premium receipt” will be successfully downloaded in a PDF format.

7. How to Check LIC premium due?

Step 1: Open “LIC Digital” app

Step 2: click on the “Login” button

Step 3: Enter your User ID /Mobile / Email” & PAssword” and Click on the “Login” option. Click on “Later” here

Step 4: Go to “Self Policies” under Policies section

Step 5: Then, you see your existing policies along with the Policy due date

Eg:28th Apr 2024

8. How to pay Missed LIC premium Online?

Step 1: Go to the LIC India Portal and click on “Pay Premium Online“

Step 2: click on the “Please Select” option

Step 3: click on the “Renewal Premium/Revival” option & click on the “Proceed” button

Step 4: After clicking that, you have to fill in some of your personal and policy details like Policy number, Installment premium without Tax, Date of Birth, Email ID and Mobile Number

Step 5: Tick on “I Agree” and click on the “Submit” button.

Step 6: Now Late fee, if any will be included in the Total LIC Premium payable amount.

Step 7: Complete the Payment with OTP through Internet Banking, UPI, etc.,

9. How can I get my LIC premium paid statement?

Step 1: Go to the LIC India Website and click on “Login to Customer Portal”.

Step 2: you can log in with 2 options

1. Using User ID

2. Using OTP

Step 3: Enter your “User ID/ E-Mail ID / Mobile number” enter the “Password” and click on the “Sign in” button.

Step 4: Now, Click on the “Proceed” button & enter the OTP.

Click on the “Later” option.

Step 5: Now, Click on “Self policies” in the “Policies” section.

Step 6: Click on the “Policy Premium Paid Statement” option to download it in PDF format.

Step 7: Now, to download your Premium statements which you have already paid, click on “Select Year (FY)”.

Step 8: After that, tick on your Policy Number and click on “Generate Statement”. After clicking on that, the Premium Paid statement for the selected financial year (Eg: 2023-24), will be displayed in PDF format.

Step 9: Click on the “Download” button

10. How to check LIC Policy status?

Step 1: Go to the LIC India Website.

Step 2: On the bottom right side, you can see the “LIC Mitra” chat option. Click on it. Now a chatbot will be opened.

Step 3: In the chatbot, you will be asked to “Type a Message”. You, Simply type “Policy Information”

Step 4: Then, you will be asked to enter “Your 9-Digit LIC Policy number”

Step 5: Later on, you will be asked to enter the Policyholder “Date of Birth” in DD/MM/YYYY. Enter it.

Step 6: Then, your Policy information will be successfully displayed like Policy Number, DOB, FUP date, Status, and Last paid date.

Thanks for your time folks 🙂