GST has undergone many changes in the recent past. One of the key changes is QRMP, which is nothing but “Quarterly Return and Monthly Payment” scheme.

There is a lot of confusion amongst the tax payers especially for the Startups whether to opt in to this Scheme or not.

In this article, I have provided an exhaustive analysis on “QRMP Scheme” so that you can decide whether it is beneficial for you or not. So, please bear with me for some time to understand it better.

In this article, let’s understand completely about the scheme.

Let’s get started…!!

1. What is QRMP Scheme?

QRMP means “Quarterly Return Monthly Payment scheme“

It means the persons who are registered under the GST are eligible to file their returns on Quarterly basis. Whereas GST liability is to be paid to the Government on Monthly basis. i.e. Pay tax monthly, file return quarterly.

The QRMP scheme is effective from 01st Jan, 2021 and it is an Optional facility for the GST tax payers.

2. Who is Eligible to file returns on Quarterly basis

The persons who are eligible to file GST returns on Quarterly basis is based on their business Turnover and also on status of Returns filed. The eligibility is as follows.

- All the taxpayers whose Annual aggregate turnover (AATO) is below Rs.5 crores in the Current financial year and in the Preceding financial year ( if applicable ) are required to file their GST returns on Quarterly basis and

- Also the persons who have already filed the last due GST-3B return are eligible to opt for this scheme.

It means, in case of Newly registered GST persons / Existing GST registered persons Whose Turnover is below Rs.5 Crores for the Current Financial Year (or) the Turnover of the business has not crossed Rs. 5 Crores in any of the previous years of your existing business, then, you are eligible to file GST returns on Quarterly basis.

Not only that, the taxpayers who are willing to opt this quarterly scheme, they must have filed any pending GSTR – 3B returns before they opt for it.

Therefore, the above 2 conditions must be satisfied to avail QRMP.

Examples:

Case 1 : When your business AATO is less than Rs.5 Crores in CFY & PFY and filed GSTR-3B

If your business Annual aggregate Turnover (AATO) for the Current financial year 2020-21 is Rs.4.5 Crores and for the preceding financial year (PFY) of 2019-20 is Rs.3.9 Crores.

And assume that you have filed the latest GSTR-3B of your business.

Is your business eligible to opt for QRMP Scheme ?

Solution:

Yes. As your business Annual aggregate turnover (AATO) is below Rs.5 crores in the current financial year of 2020-21 is Rs.4.5 Crores and also in the preceding financial year of 2019-20 is below Rs.5 Crores i.e. Rs.3.9 Crores.

Also you have already filed the last due GST-3B return of your business.

Therefore, your business is eligible to opt for QRMP scheme.

Case 2 : When your business AATO is more than Rs.5 Crores in CFY & PFY and filed GSTR-3B

M/s X Ltd Annual aggregate turnover (AATO) for this Cell phone business is as follows:

| S.No. | Financial Year | Annual aggregate turnover (AATO) | Status of GSTR-3B return filed |

| 1. | 2017-18 | Rs.39,00,000 | Filed |

| 2. | 2018-19 | Rs.3,20,00,000 | Filed |

| 3. | 2019-20 | Rs.43,00,000 | Filed |

| 4. | 2020-21 | Rs.5,10,00,000 | Filed |

Is M/s X Ltd eligible to opt QRMP scheme ?

Solution:

No. As your business Annual aggregate turnover (AATO) is below Rs.5 crores in the preceding financial years of 2017-18, 2018-19 & 2019-20 but in the Current financial year 2020-21, the Annual aggregate turnover (AATO) is above Rs.5 crores i.e. Rs.5,10,00,000 Crores.

Therefore, M/s X ltd is not eligible to opt for QRMP scheme even though they have filed their latest GSTR -3B returns.

Case 3 : When your business AATO is less than Rs.5 Crores in CFY & PFY and Not filed GSTR-3B

M/s Seetha Pvt Ltd Annual aggregate turnover (AATO) of Dorr curtains business is as follows

| S.No | Financial Year | Annual aggregate turnover (AATO) | Status of GSTR-3B return filed |

| 1. | 2017-18 | Rs.2,70,00,000 | Filed |

| 2. | 2018-19 | Rs.3,60,00,000 | Filed |

| 3. | 2019-20 | Rs.1,35,00,000 | Filed |

| 4. | 2020-21 | Rs.2,77,00,000 | Not Filed |

Is M/s Seetha Pvt Ltd eligible to opt QRMP scheme ?

Solution:

No. Even though business M/s Seetha Pvt Ltd’s Annual aggregate turnover (AATO) is below Rs.5 crores in the preceding financial years of 2017-18, 2018-19, 2019-20 and 2020-21 but in the Current financial year of 2020-21, M/s Seetha Pvt Ltd has not filed the last due GSTR -3B returns.

Therefore, M/s Seetha Pvt Ltd is not eligible to opt for QRMP scheme.

3. Which returns can be filed on Quarterly basis ?

As per the QRMP scheme, this scheme filers are eligible to file GSTR-1 & GSTR -3B returns on Quarterly basis. Whereas the payment of GST (i.e. GST collected customers less GST Credit) is required to be paid to the Government on Monthly basis using form GST PMT-06 either through Fixed Sum method (or) Self assessment method in GST portal.

4. What are the QRMP Scheme benefits

The persons who avails QRMP scheme will get the below mentioned benefits:

- Compliance burden & Cost

QRMP scheme Reduces the Compliance burden for the taxpayers to a larger extent. Thereby it reduces the compliance cost as well. - Fewer Returns

The total Number of returns will come down to 4 instead of 12 (which is for regular taxpayers). Because regular taxpayers should file their GSTR-3B and GSTR-1 Returns every month. - Easy Opt-in & Opt-out: Eligible persons can Opt in and Opt out of the scheme very easily.

- Availing ITC: QRMP helps the buyer to avail ITC on a monthly basis.

5. What is IFF ?

- IFF means “Invoice Furnishing Facility“

- Under IFF, the taxpayers should declare the Outward Supplies made to registered persons for the first 2 months of any Quarter.

i.e. Simply B2B Supplies details.

- In Simple, Whenever the supplier makes Outward supplies of Goods / Services or both, then, those details are to be submitted in the same month. Otherwise the recipient taxpayer cannot take credit of those invoices in the same month. i.e. Loss of GST ITC Credit.

- The Last date of filing for IFF for a month is 13th of Succeeding month.

Eg: For October, 13th November is the Last date to file IFF.

6. What is the Due date to file GSTR-1 under QRMP?

The QRMP availed GST Taxpayers shall file their Form GSTR-1 regarding the Details of Outward Supplies of Goods & Services on quarterly basis and by 13th of the next month.

For each of the 1st & 2nd months of any quarter, such a registered person will have the IFF facility to furnish the details of such Outward supplies to a registered person.

The said details of outward supplies shall, however, not exceed the value of Rs.50 Lakhs in each month. And It may be noted that after the 13th of the month, this facility for furnishing IFF for the previous month would not be available.

As a facilitation measure, continuous upload of invoices would also be provided for the registered persons wherein they can save the invoices in IFF from the 1st day of the month till 13th day of the succeeding month.

The facility of furnishing details of invoices in IFF has been provided so as to allow details of such supplies to be duly reflected in the FORM GSTR-2A and FORM GSTR-2B of the concerned recipient.

7. What is the Due date to file GSTR -3B under QRMP?

GST Taxpayers who are under QRMP scheme shall file their Form GSTR-3B quarterly by 22nd or 24th of the month succeeding such a quarter (based on their State).

8. How to Opt-in to QRMP scheme

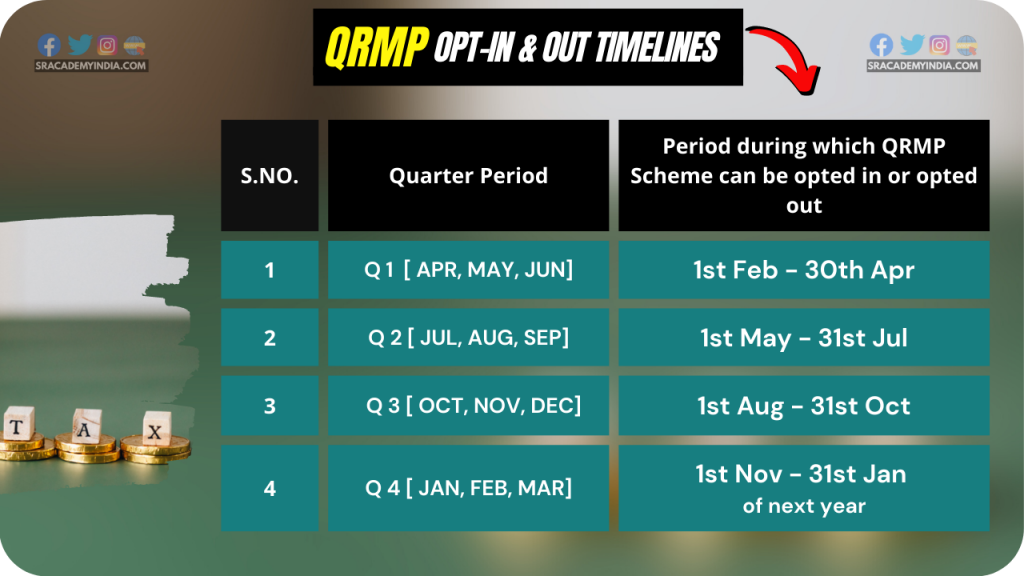

Small taxpayers can opt-in to the scheme throughout the year. But based on certain time limits, they are eligible to file quarterly returns accordingly.

- A registered GST person can enter into this scheme on the first day of second month of preceding quarter till the last day of first month of the quarter.

- Such a registered person should have furnished the last due GST return.

- The registered taxpayers once the option exercised they will continue to furnish the returns as per the selected option until they revise it.

Let’s see how to Opt into QRMP scheme through GST Portal

- Firstly, Go to https://www.gst.gov.in/ &

- Login to portal by providing the User Name and Password

- Now, Go to Services > Returns > Opt in for Quarterly return

- And Select the Financial Year

In simple terms, the Time limit to Opt in & out of the QRMP scheme is as follows

9. How to Exit from QRMP Scheme

If the annual aggregate turnover (AATO) of your business crosses the threshold of Rs.5 Crores during any quarter in the current financial year, then the taxpayer will become ineligible for the scheme from the next quarter onwards.

In Simple words, the taxpayer is required to file returns Monthly basis and be transformed as a Regular taxpayer. Therefore, the taxpayer cannot enjoy the privilege of filing quarterly Returns. But the good thing here is that the business is in growing path.

Please do share if you like it. And, also give your feedback/suggestions to improve the content in the comments.