ICICI Rupay Credit card

Introduction

Nowadays, in the digital era, seamless financial management plays an important role. You can find plenty of credit cards but you can see Rupay Network credit cards stand out as India’s domestic network for both Indian customers and businesses as well.

The Rupay network was launched in 2012 by the National Payments Corporation of India (NPCI) gained prominence and offered a wide range of features and benefits to cattle the unique needs of the Indian market.

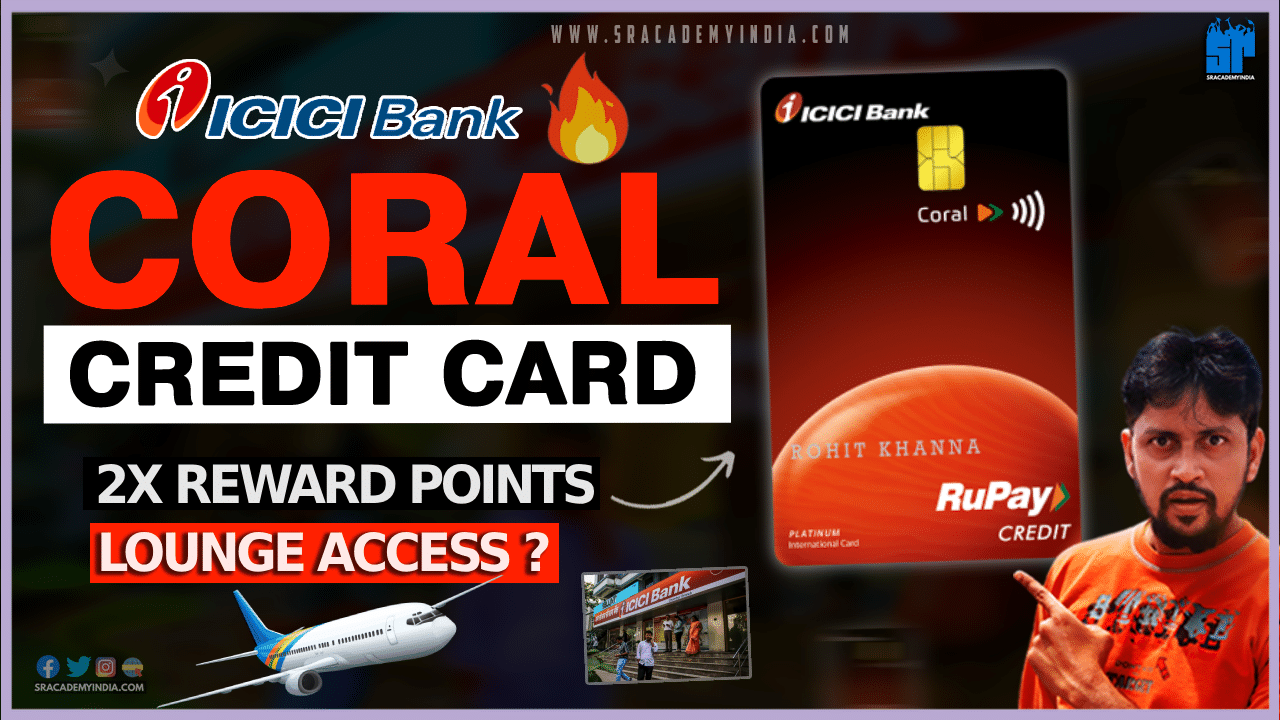

In this article, we delve into one of the Rupay Credit Cards i.e. ICICI Coral Rupay Credit card. We also discuss the Features and benefits this Credit card is offering. I also share my Genuine opinion on this Credit card by discussing its Charges and Drawbacks as well.

Without further ado, Let’s get Started..!!

ICICI Coral Rupay Credit Card Overview

| Particulars | Description |

|---|---|

| Credit Card Type | Reward Points |

| Joining Fees | Rs.500/- |

| Renewal Fees | 2nd Year onwards: Rs.500/- |

| Best for | Entry-Level users |

What Benefits do you get from ICICI Coral Rupay Credit Card?

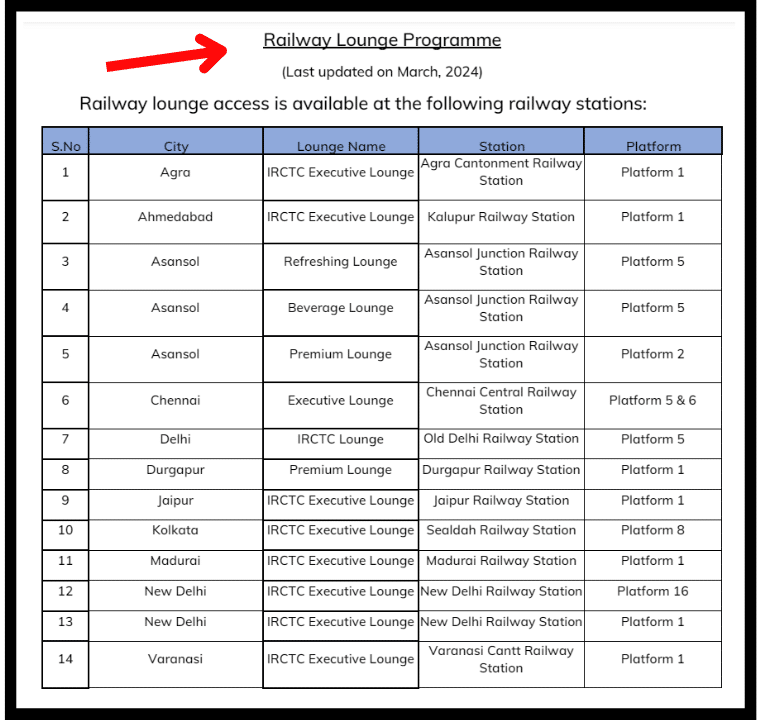

Coming to the ICICI Rupay Coral Credit card, this credit card looks in a vertical stylish format in an Orange and Black combination.

On the top left-hand side of this credit card, you can see the “ICICI Bank Logo”.

On the middle right-hand side, you can see the “Contactless logo” symbol which supports Near-Field communication (NFC) technology, and also the name of the card as “CORAL”

If you see, at the bottom of this credit card, you can see the type of Credit card network as “Rupay” Credit Card along with the Name of the cardholder on it.

Now, Let’s crack this vertical card features.

ICICI Coral Rupay Credit Card Benefits:

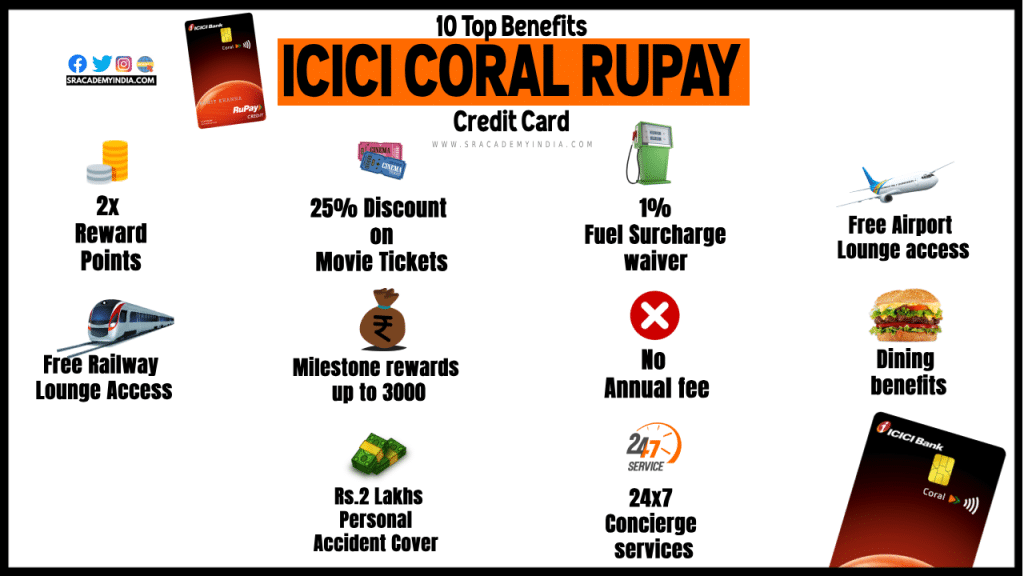

Let me go through the Top 10 benefits offered by this ICICI Rupay Credit card [Incl. My Analysis]

1. Reward Points

Coming to the Major Benefits offered by this credit card is about Reward Points.

2X Reward Points

The ICICI Coral Rupay Credit card offers 2 Reward Points for every Rs.100 rupees you spend with this credit card.

1X Reward Points

This ICICI Bank Coral Rupay Credit card will get 1 Reward Point for every Rs.100 rupees you spend on

– Utilities,

– Insurance including

– Any payments related to any Government transactions.

Zero reward points

It is also to be noted that you will get no reward points for the below payments using this credit card.

1. Fuel

2. Rental payments

3. E-Wallet loadings

My Analysis

I see Reward Points offered on Credit cards as Peanuts only.

The reason behind that is you cannot get any useful products for the reward points you accumulated. Simply, you will get silly things for your accumulated reward points which you normally don’t require.

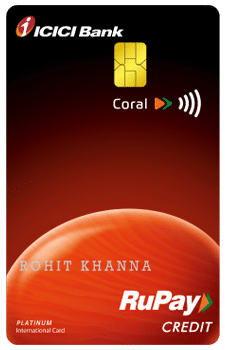

2. Movie Tickets with 25% Discount

Do you Watch movies in Theatres.!

If yes, this feature might help you.

This ICICI Rupay Credit card holder can avail 25% discount on Book My Show and INOX movie ticket bookings.

The Maximum discount you can avail of is up to Rs.100 per transaction on a purchase of a minimum of 2 tickets. However, you can avail of this offer Twice a month only.

It means in a year you can get Rs.2,400/- maximum benefit.

| Particulars | Description |

|---|---|

| Minimum Purchase of Tickets | 2 No’s |

| Maximum discount per Transaction | Rs.100/- |

| Maximum discount per Month | Rs.200/- |

| Maximum discount per annum | Rs.2.400/- |

If you watch movies on OTTs like Netflix, Amazon, or other Platforms, then, you cannot consider it as a benefit.

3. Fuel Surcharge Waiver @ 1%

By using this ICICI Rupay Credit Card, If you pump your vehicle with Petrol / Diesel, then you will be charged with a Fuel Surcharge. It may be around 3-4% of your Fuel Cost. But, if you use this ICICI Rupay Coral Credit card and spend on HPCL pumps, then, you will be eligible for a 1% Fuel Surcharge Waiver.

To avail Fuel Surcharge Waiver with this ICICI Rupay Credit card, you can spend a Maximum amount of Rs.4,000 on fuel and cost and you will be eligible to get a Fuel Surcharge Waiver up to a Maximum of Rs.1000/- per statement cycle.

My analysis

I wrote an article about the Fuel Surcharge Waiver and I thoroughly discussed whether it is useful or not and to whom it is useful. I mentioned the complete facts, so try to read it to understand this concept clearly.

Read: How I Lost Money by Paying Fuel Bills with Credit Cards | Fuel Surcharge Waiver

4. Free Airport Lounge access?

ICICI Coral Rupay Credit Card Lounge access:

I really surprised to see this feature on this credit card since as a basic credit card providing this benefit is like a privilege. But don’t think it’s a Free benefit.

To get this Airport Lounge facility on this ICICI Rupay credit card, then, you should spend a Minimum of Rs.35,000 or above in a Calendar quarter to get this benefit in the next calendar quarter.

However, the Airport Lounge facility access is limited to Domestic Airport Lounge only with one complimentary lounge access each quarter.

Let me give you an example.

If you have spent more than Rs.35,000 on this credit card during the period of April-June, then, you can avail of One complimentary Airport lounge access in the following quarter of July-September.

This benefit is somehow reasonable as credit card holders need to spend an average of Rs.12,500 per month.

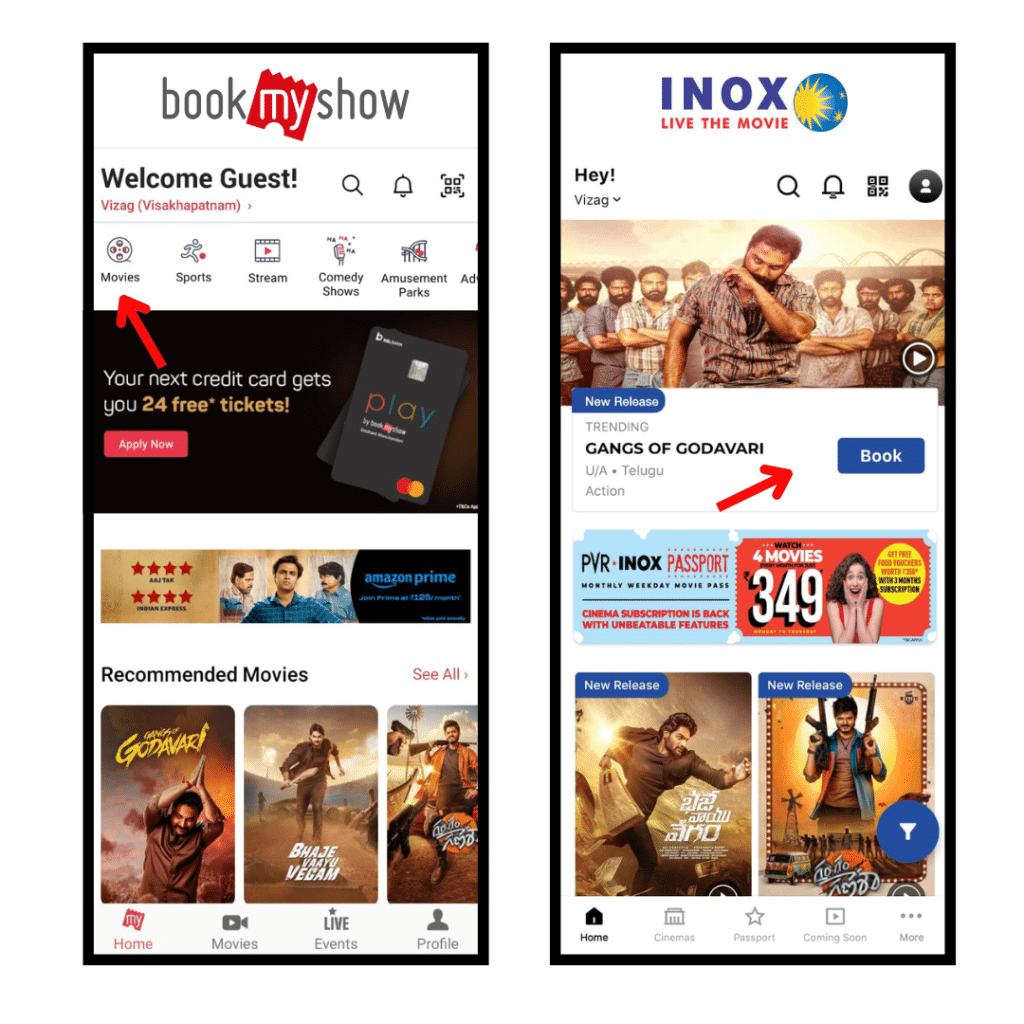

5. Free Railway Lounge Access?

If you travel more on Trains, You can use this card to avail of one Complimentary Railway Lounge benefit for 4 times in every 3 months. i.e. 1 time per Quater.

This Credit card holder will get these Railway lounge benefits.

– Two hours of lounge stay in normal seating

– Breakfast / Lunch / Dinner as per the time of visit and as per the offering by the lounge operator at that particular time of visit.

– Unlimited Tea & Coffee with cookies

– Free Wi-Fi

– Newspaper & Magazine

Some major Railway Stations offer Free Wifi, Free Food, and Free AC, here, this credit card holder will have to swipe your ICICI Coral Credit card through the Point of Sale (POS) machine in that lounge. Then, an amount of Rs.2/- will be deducted from your card account as a Confirmation.

ICICI Coral Rupay Credit Card Railway Lounge Access List:

The Major drawback is that this Lounge benefit is being provided only in the 14 lounges across India.

6. Milestone rewards up to 3000

This ICICI Coral Credit card offers another feature i.e. Milestone reward program.

It is nothing but spending money and taking benefits.

Let me tell you how this Reward Program works with an example.

I will give you Rs. 10,000/- worth of flight tickets free. But with the condition that you should Pay me Rs.2 Lakh rupees for that. Here, to get the Rs.10,000 rupees flight tickets for free you should spend a much bigger amount.

Right..!!

Similarly the same is provided in the case of ICICI coral credit card.

As per the official website of ICICI, If you spend Rs.2 Lakh rupees on this credit card, you will get 2,000 reward points. However, if you spend Rs.1 Lakh rupees additionally on this credit card, then you will get an additional 1,000 reward points.

My analysis

I don’t understand what we can do with these reward points.

Are these 3,000 Rewards points worth Rs.3,000/- rupees at least?

No..!!

Not at all..!!

ICICI Coral Rupay Credit card 1 reward point value = Rs.0.25/- paisa.

i.e. 3000 Reward Points = Rs.750/- worth.

Hardly you will get either an Earphone or a Mouse or something similar but nothing costlier.

Right..!

So you are buying a Mouse Rs.750/- worth of Mouse or less by spending Rs.3 lakh rupees.

Is it worth it?

Don’t consider these Reward points as a benefit otherwise if you spent it for a purpose.

As advised by Financial experts, the credit card holder should spend only 30% of their credit card limit to not get into the debt trap.

To understand it, if you have a credit card limit of Rs.2 Lakh rupees, then, at any point in time it is always better not to cross 30% of your credit card limit i.e. Rs.60,000 in this case.

7. No Annual fee

A similar case with the annual fee waiver as well.

If you spend Rs.1.50 lakh in a year by using this credit card, then the Annual fee on this credit card of Rs.500 will be waived.

My Analysis

Here, the cardholder gets the benefit of 0.33%.

Treat it as a benefit, if it helps you dear..!!

8. Dining benefits

By using this Credit card, you can also have special dining deals through ICICI Bank’s Culinary treats.

9. Personal Accident Cover of Rs.2 Lakhs

The ICICI Rupay Credit card also provides a Personal Accident Cover benefit to their cardholders. Its coverage is up to Rs. 2,00,000/-.

10. 24×7 Concierge services

A Concierge service can be either an Individual or an organization that provides personalized assistance with different aspects like Managing households or providing chauffeur service for a price.

Annually Save Rs.11,175: Worth or Not?

As per the ICICI website, by using this coral credit card you can save annually Rs.11,175 rupees. Let me show you how much you need to spend to get this annual benefit.

To save Rs.11,175 rupees annually, this ICICI Rupay Credit Card holder should spend Rs.3,60,000 in a year. Ultimately, you can save 3.10% of your total spending.

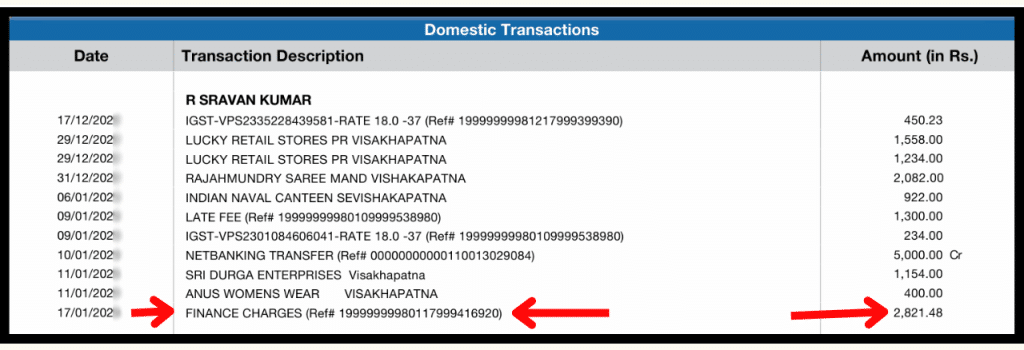

Forget about your Savings, If you have failed to pay the Outstanding amount you will be liable to pay 13 times your saved amount in the form of Finance charges.

To know about the charges on this credit card, keep on reading my dear friend.

Who is Eligible for ICICI Coral Rupay Credit Card?

To get eligible for this ICICI Rupay Credit card, you should meet the below conditions.

Age:

1. Minimum Age – 21 years old for both Salaried & Self-employed people.

2. Maximum Age – 60 years old for Salaried.

3. Maximum Age – 60 years old for Self-employed.

Nationality:

– Must be an Indian citizen

Annual Income:

– The applicant of this card must have an Annual Net Income of Rs.2,50,000 are eligible to apply for this card.

How to apply for ICICI Coral Rupay Credit Card?

ICICI Coral Rupay Credit Card Apply Online:

If you want this ICICI Coral Rupay Credit Card, then, You can apply here.

ICICI Rupay Credit card Charges

f you are applying for this ICICI coral credit card then looking at the benefits won’t help you. You should look at the charges as well.

The overview of the top charges of the ICICI Coral Rupay Credit Card is as follows.

| S.No. | Particulars | Description |

|---|---|---|

| 1 | Joining fees | Rs.295/- |

| 2 | Renewal fees | Rs.295/- from Second year onwards |

| 3. | Cash advance charges | 2.5% or Rs.500/- w.e.h |

| 4. | Interest charges | @3.40% p.m ; @ 40.80% p.a. |

| 5. | Late payment charges | Rs.0 – Rs.1,200/- |

| 6. | Over-the-limit charges | 2.5% or Rs.500/- w.e.h |

| 7. | Foreign currency Markup | 3.50% of the transaction value |

| 8. | Reward Redemption Fee | Rs.99/- per redemption |

1. Joining fees

If you want to use this ICICI Coral Rupay Credit Card, then, on 1st year you will have to pay a Joining fee of Rs.500 excluding GST. With GST, you should pay Rs.590/-

If you spend Rs.1.50 lakh in a year by using this credit card, then the Annual fee on this credit card of Rs.500 will be waived i.e. you are not required to pay the joining fee on this credit card.

2. Renewal fees

If you want to use this ICICI Coral Rupay Credit Card from the second year onwards, then, you will have to pay a Renewal fee of Rs.500/- per year excluding GST. With GST, you should pay Rs.590/- per year.

If you are looking for a FREE Credit card, without Joining Fees and Renewal fees, then, you can check here.

3. Cash advance charges / Cash Withdrawal charges

If you withdraw money by using this ICICI Rupay Credit Card, a Transaction fee will be levied on all such Cash Withdrawals at ATMs. Such fees would be billed to the Cardholder in the next statement.

A transaction fee of 2.5% or Rs.500/- whichever is higher will be charged at ATMs.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

You can Withdraw Money using this ICICI Coral Rupay Credit Card but Don’t withdraw cash from any credit card. If you have an urgent cash requirement / Cash crunch, then I suggest you take a Personal Loan or Gold Loan.

Those are much better options.

In a Personal Loan, every month you pay the Principal amount plus Interest as an EMI. The rate of interest for Personal Loans usually ranges from 15-20% p.a. on the higher side in most cases.

4. Interest charges / Finance Charges?

Do you know how much interest you will be charged on this Credit Card?

You must know it, boss.!

For Example,

You have used this ICICI Coral Rupay Credit Card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the ICICI bank will charge you interest @3.40% per month. It means the Annual interest the bank will charge is almost up to 40.80% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

5. Late payment charges

Apart from Interest charges, if you delay paying this ICICI Coral Rupay Credit Card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, the Late payment charges range from a Minimum of Zero rupees to a Maximum of Rs. 1,200/- depending on your Credit card outstanding.

If your credit card outstanding balance is more than Rs.100/-, then you will attract Late payment charges.

| Credit Card Outstanding Balance is | Late payment charges |

|---|---|

| Less than Rs.100 | Nil |

| Between Rs.101-Rs.500 | Rs.100/- |

| Between Rs.501-Rs.5,000 | Rs.500/- |

| Between Rs.5,001-Rs.10,000 | Rs.750/- |

| Between Rs.10,001-Rs.25,000 | Rs.900/- |

| Between Rs.25,001-Rs.50,000 | Rs.1,000/- |

| Greater than Rs.50,000 | Rs.1,200/- |

So if you use a credit card you have to be very organized and should deal with Credit card timelines properly.

6. Over the Limit charges

If you spend more than the available limit on the credit card. That means you have overused your Credit card. Then, you will be charged with “Over The Limit charges”.

The more you spend than your ICICI Coral Rupay Credit Card limit, the more you will be charged i.e. @2% on the overdrawn amount.

The Minimum amount will be charged starts from Rs.500/- rupees.

7. Foreign Currency Markup

If you travel abroad and make any International transactions, you will be charged 3.50% of the transaction value as a Forex Markup Fee.

8. Reward Redemption Fee

If you have accumulated Reward points on this credit card, to redeem it you need to pay the Reward Redemption Fee of Rs.99 excluding GST. With GST, you will be charged with Rs.117/-.

ICICI Coral Rupay Credit Card Review

ICICI coral credit card is an entry-level credit card that will be helpful for those who started their job as a fresher.

As you normally cannot ask your friends her family members whenever you need money then you can maintain one credit card, and this credit card is one of them.

All the benefits offered by this credit card are just name-sake benefits only and don’t expect much from this card except the Airport Lounge facility.

However, this ICICI Coral Rupay Credit card is not a Lifetime Free Credit card as you need to pay Rs.590/- in the form of Annual charges.

I consider the Airport Lounge benefit to some extent considered as beneficial and all other benefits are part of the number game in terms of features but the cardholder really cannot enjoy it.

If you have a habit of shopping online regularly and want a contactless credit card, then you can check the SBI Simple credit card from SBI, You can check it now.

Frequently Asked Questions

1. What is the Credit period of ICICI Coral Credit Card

With ICICI Rupay Credit Card you can enjoy a grace period of 18 to 48 Days after you make any purchase. In case, if the credit card user fails to pay the full outstanding balance, then, interest will be applied to the remaining debt as well.

2. Does the ICICI coral credit card have Lounge access?

The ICICI Rupay Coral credit card comes with Airport Lounge access. However, to avail of this Airport Lounge facility once on this ICICI Rupay credit card, this credit card holder should spend a Minimum of Rs.35,000 or above in a Calendar quarter to get this benefit in the next calendar quarter.

3. Does the ICICI coral credit card have International lounge access?

The ICICI Rupay Coral credit card comes with domestic Airport Lounge access only. And it has no International Airport lounge access.

4. What is the value of ICICI Coral bank credit Reward points in cash?

If you earn Reward Points on your ICICI credit card, each point is worth Rs.0.25 paisa. To redeem your accumulated points, you can make a call to ICICI customer care 080-40146444 and the equivalent amount will be credited to your Credit card account within 7 business days.

5. ICICI Coral Rupay Credit card 1 reward point value?

As per the ICICI website, 1 Reward point earned through a Credit card is worth of Rs.0.25/- paisa. Therefore, the ICICI Coral Rupay Credit card 1 reward point value = Rs.0.25/- paisa.

i.e. 3000 Reward Points = Rs.750/- worth.

6. ICICI Coral Rupay Credit card Lifetime Free?

ICICI Coral Rupay Credit card is not a Lifetime Free credit card.

If you want to use this ICICI Coral Rupay Credit Card, then, on 1st year you will have to pay a Joining fee of Rs.500 excluding GST. With GST, you should pay Rs.590/-.

However, If you spend Rs.1.50 lakh in a year by using this credit card, then the Annual fee on this credit card of Rs.500 will be waived i.e. you are not required to pay the joining fee on this credit card.

If you want to use this ICICI Coral Rupay Credit Card from the second year onwards, then, you will have to pay a Renewal fee of Rs.500/- per year excluding GST. With GST, you should pay Rs.590/- per year.

Therefore, ICICI Coral Rupay Credit card is not a lifetime free credit.

7. What is the annual fee of ICICI Coral RuPay credit card?

If you want to use this ICICI Coral Rupay Credit Card, then, on 1st year you will have to pay a Joining fee of Rs.500 excluding GST. With GST, you should pay Rs.590/-.

8. What is the fees of ICICI Coral credit card?

The major fees charged on ICICI Coral credit card is as follows

1. Joining fees – Rs.295/-

2. Renewal fees- Rs.295/- from Second year onwards

3. Cash advance charges: 2.5% or Rs.500/- w.e.h

4. Interest charges: @3.40% p.m ; @ 40.80% p.a.

5. Late payment charges: Rs.0 – Rs.1,200/-

6. Over-the-limit charges: 2.5% or Rs.500/- w.e.h

7. Foreign currency Markup: 3.50% of the transaction value

8. Reward Redemption Fee: Rs.99/- per redemption

Thanks for your time folks 🙂