IDFC First Select Credit card

If you are looking for a Lifetime FREE Credit card, then, you should go through “IDFC First Select Credit Card” issued by IDFC First Bank.

This IDFC First Bank is a Mumbai based Private Sector Bank which started its operations in October 2015. Both IDFC Bank and Capital First Bank together started the “IDFC First Bank”.

This IDFC Credit card, offers various benefits on Airport Lounge access for the domestic travellers and also offers Reward points on Online and Offline spends.

This Free card’s main focus is to cater Daily spenders who buys more on online with a budget consciousness. If you are looking for an instant approval with assured Life Time FREE credit card, then, you can apply.

Not only that, before you apply for this Credit card, I request you to read this post completely so that you can easily understand about this Credit card.

Without a further ado let’s see What are the Features, Charges and also I will share my Genuine opinion on this Credit card by discussing about its Drawbacks as well.

Let’s get Started..!!

IDFC First Select Credit Card Overview

| Reward Type | Reward Points |

| Joining Fees | Nil |

| Renewal Fees | Nil |

| Best Suited for | Travel |

What Benefits you get from IDFC First Select Credit Card ?

IDFC First Select Credit Card Benefits:

Let me go through 6 Top benefits offering of this Credit Card [Incl. My Analysis]

1. Welcome Benefit

– As a Welcome benefit, this IDFC First Select Credit Card holder will get a Gift voucher of Rs.500/- as a Welcome benefit on spending Rs.15,000/- rupees or more within 90 days of issuance of the credit card.

My Analysis

In case of IDFC First Millenia credit card, you just need to spend Rs.5,000/- or more to get Rs.500/- worth of Gift voucher. But in this First Select Credit card, you need to spend Rs.15,000/- or more is comparatively on a higher side to get the equal benefit.

– Also the card holder will get 5% Cashback upto Rs.1,000/- within 30 days of issuance of the card.

My Analysis

This feature might be helpful, if you convert your Big purchases made on this IDFC First Select Credit Card into EMI’s but don’t be enthusiastic to spend for the sake of Cashbacks.

2. Travel benefit

IDFC First Select Lounge access :

– The IDFC Select credit card holder will get 4 Complimentary Domestic Airport lounge visits per quarter.

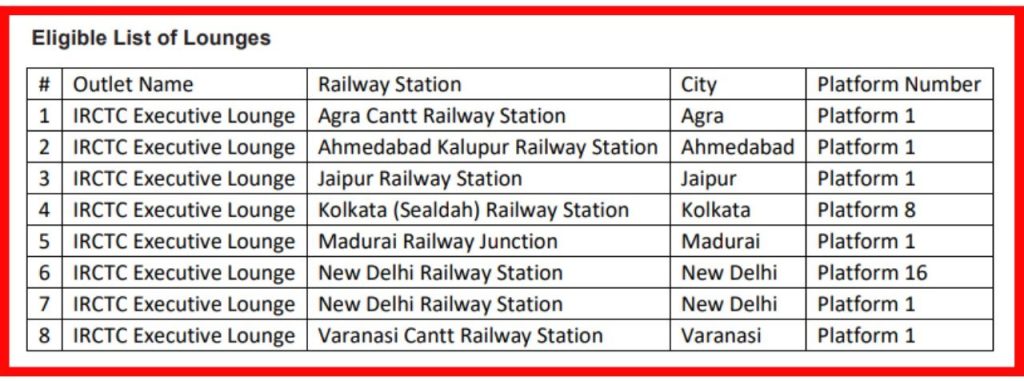

– This card holder also gets 4 Railway lounge visits per quarter.

And also the 4 Complementary road assistance for a year worth Rs.1,399/- rupees included with the benefits of Towing of Vehicle, Alternate Battery, Tyre change, Breakdown support, Taxi benefit, Arrangement of Fuel and a lot more.

You can also get

– Free airport meet and greet with the discounts,

– Discount on Airport Liosure services.

– Also you will get Concierge service that helps you to book your Flights, Hotels and Dining etc

My Analysis

This feature might be helpful, if you are a Regular Air Travel.

3. Movie and Dining

IDFC First Select Credit card Movie offer :

– If you are a regular Movie Goer, then, you will get Buy 1 Get 1 offer on Movie Ticket booking up to Rs.250/- on Paytm Mobile app by using your IDFC first select credit card. This benefit can be availed twice a every calendar month i.e. 24 times a year.

– If you Dine outside, then, if you pay using this credit card then you can also get 20% discount on dining across 1500 + participating restaurants.

4. Insurance benefits

The IDFC First Select Credit Card comes with the following insurance benefits

| Travel Insurance Cover | Rs.25,000/- |

| Lost Card cover Liability | Rs.50,000/- |

| Delay in Checked-in Baggage | USD 100 |

| Loss of Passport | USD 300 |

| Flight Delay | USD 300 |

| Loss of Checked-in Baggage | USD 500 |

| Personal Accident Cover | Rs.5,00,000/- |

| Air Accident Cover | Rs. 1 Crore |

5. Fuel Benefit

Fuel Surcharge Waiver

By using this Credit Card If you spend on Petrol/Diesel between in any fuel stations, then, a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost. In case you paid it through this card, you will be eligible for 1% of Fuel Surcharge Waiver across all petrol stations across India.

With this IDFC First Select Credit Card, you will get a Fuel Surcharge Waiver upto a Maximum of Rs.300/- per month.

Also Read: How I Lost Money by paying Fuel bills with Credit Cards

6. Reward Points

IDFC First select Credit card Reward Points

– When it comes to Reward Points, you will get 10 reward points for every Rs.125/- on Purchases above Rs.25,000/- & also You will get 10 reward points for every Rs.125/- on your Birthday.

– If you are a online spender then you can earn up 6 Reward points on every Rs.125/- Online spends.

– If you spend offline, you will earn 3 reward points on every 125 rupees spends up to Rs.25,000/- including Rental and Property management transactions.

– You will get 1 reward points for every Rs.125/- on Utility and Insurance premium payments.

– You will get Zero reward points on Fuel transactions.

If you want to earn 1 reward point, you have to spend at least Rs.125/- using this Select Credit Card. i.e. 1 reward point = Per Rs.125/- spends

Rewards redemption

These Reward points earned on this credit card are unexpired. And also, you can carry forward the earlier reward points to the current year.

On every redemption card holder should pay Rs.99/- plus taxes as a Reward redemption fees.

Who are Eligible?

IDFC First Select Credit card Eligibility

– Individuals with Minimum age of 21 years and the Maximum age of 60 years

– Salaried / Self employed having an Annual Income of more than Rs.12 lakh rupees with Decent CIBIL Score are eligible to apply for this card.

How to Apply for this Card ?

IDFC First Select Credit card Apply:

If you want this Credit card, you can apply.

IDFC First Select Credit Card Charges [Must Read]

IDFC First Select Credit card Charges

1. Cash Withdrawal charges

IDFC First Select Credit card Cash Withdrawal Charges :

IDFC First Select Credit Card offers you “Interest Free Cash Withdrawals“. Read this point little carefully My dear Friends.

“Interest Free Cash Withdrawal” means no interest will be charged up to 48 days if you withdraw Cash anywhere either in Domestic or in International ATM’s. But you need to pay Cash Advance Fee of Rs.199/- per transaction excluding GST.

If for any reason whatsoever you are unable to pay the withdrawn amount within 48 days, you will have to pay huge interest. That is also covered in this article, so Keep on reading till the end.

2. Joining & Renewal Fees

This IDFC First Select Credit Card comes with Zero Joining fees and Zero Renewal Fees.

My Analysis

It’s a real benefit for the Customers.

3. Interest charges / Finance Charges ?

IDFC First Select Credit Card Interest rate :

You have used this IDFC First Select Credit Card and bought all the stuff as per your needs. But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the IDFC First bank will charge you Interest between @0.75% – @3.50% per month. It means, the Annual interest is almost 9% – 43.80% per annum.

4. Late payment charges

Apart from Interest charges, if you delay paying this Credit card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, even if you delay IDFC Credit Card payment by one day, IDFC bank will charge almost 15% on the Due amount of your credit card. The Late payment charges ranges from Minimum Rs.100/- rupees to Maximum Rs. 1,300/-.

So if you use credit card you have to be very organized and should deal with Credit card timelines properly.

5. Over the limit charges

You might not have heard about these charges earlier. Let check it out.

If you spend more than available limit on this IDFC First credit card. It means, you have over used your Credit card. Then, you will be charged with “Over The Limit charges”.

The more you spend than your Credit card limit, the more you will be charged i.e. @2.50% on the overdrawn amount. The Minimum amount will be charged starts from Rs.550/- rupees.

6. Forex Markup Fees

IDFC First Select Credit card Forex Markup :

If you pay for any International transactions by using this IDFC Select Credit card, then, you will be charged with 1.99% as a Forex mark up fees.

IDFC First Select Credit Card Review

This IDFC First Select Credit card is best suited for the people who are looking for a FREE credit card with No joining and renewal fees. 4 Complimentary Airport lounge access is helpful for the frequent travellers within India. I personally felt that the Lost Card cover is a good feature in this card.

By using this credit card there is no feature of EMI Conversion but If you want a FREE credit card for your personal use, then, you can apply.

Thanks for your time 🙂