How to Pay the HDFC Credit card bill Online

Credit cards becomes part of our daily lives because of it’s flexibility and convenience in doing daily financial transactions. As Digital banking is on rise, it becomes quite easier and more convenient to make Credit card payment.

If you are a HDFC Credit card holder, now, you can pay your HDFC Credit card bill payment simply from the comfort of your home quite easily.

In this post, I will guide you simple and most secured process on How to Pay the HDFC Credit card bill Online through your HDFC Internet banking in two minutes.

Let’s get started folks…!!!

10 Steps on How to Pay the HDFC Credit card bill Online

HDFC Credit card Customers can follow below mentioned steps along with the pictures to pay your monthly Credit card bill through HDFC Internet Banking.

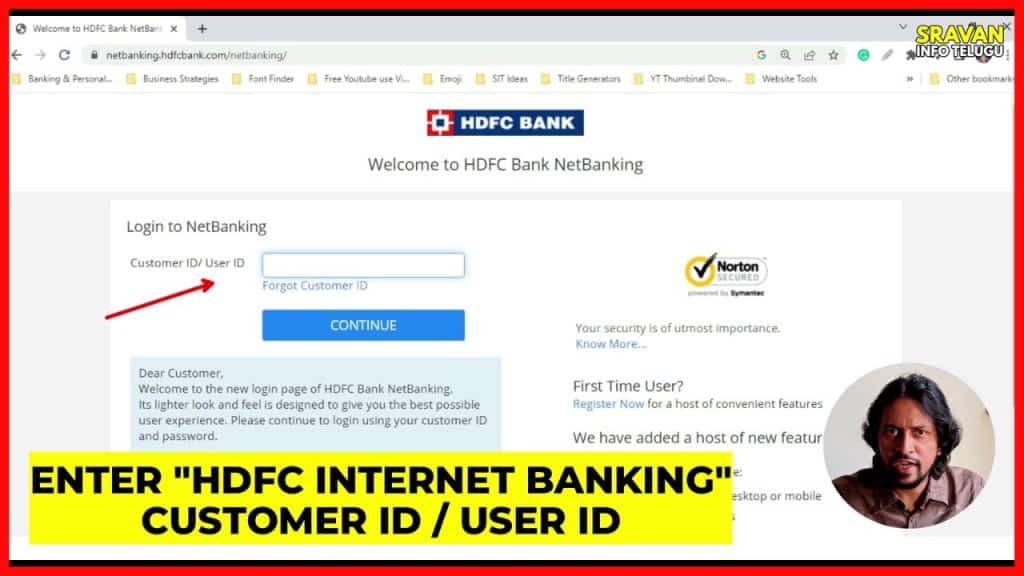

Step 1:

Open the HDFC Internet banking website and Login in to HDFC Net banking.

Now, Enter your “HDFC Internet Banking Customer ID or User ID” and Click on “Continue” button.

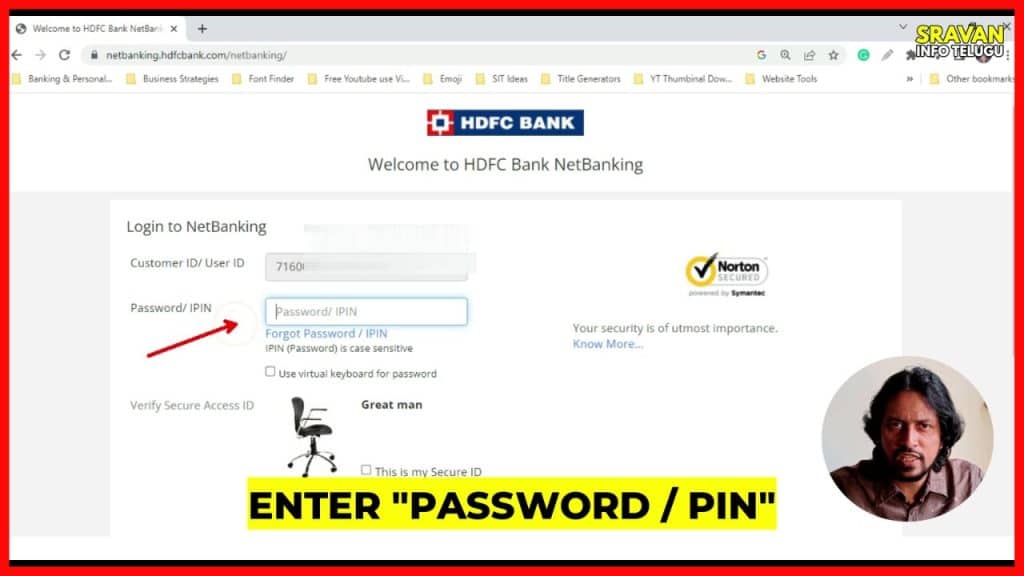

Step 2:

After that, you have to enter HDFC Internet Banking Password or PIN number.

Now, you need to tick on “Verify Secure Access ID”.

It is a kind of Captcha you should verify, before logging into HDFC Internet banking.

As a captcha, you can see a “Chair” symbol here. I’ve already selected this “Chair” picture for my HDFC Internet banking access as a verification including a text of “Great man”.

To proceed furhtur in HDFC Internet banking, all the HDFC Credit card users should check their Secured Picture. If it displays, they, you can continue through this login process. Otherwise you should stop forwarding and check your HDFC Internet banking security in another system / laptop.

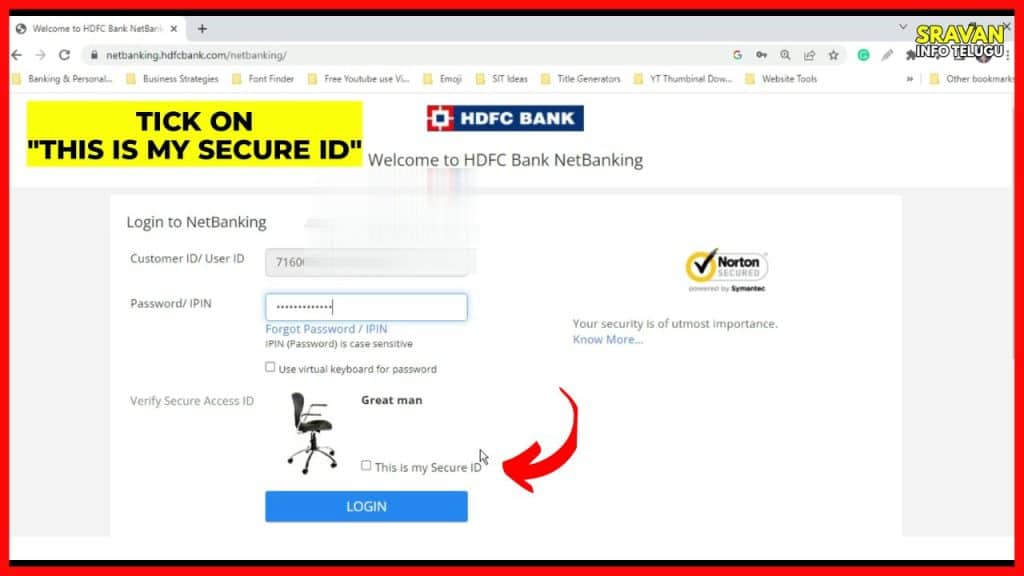

If your verification picture matches, then, you should Tick on “This is my Secure ID” and Click on “Login” button.

It is to be noted that, here, you don’t need to enter any OTP’s to enter into HDFC Internet banking.

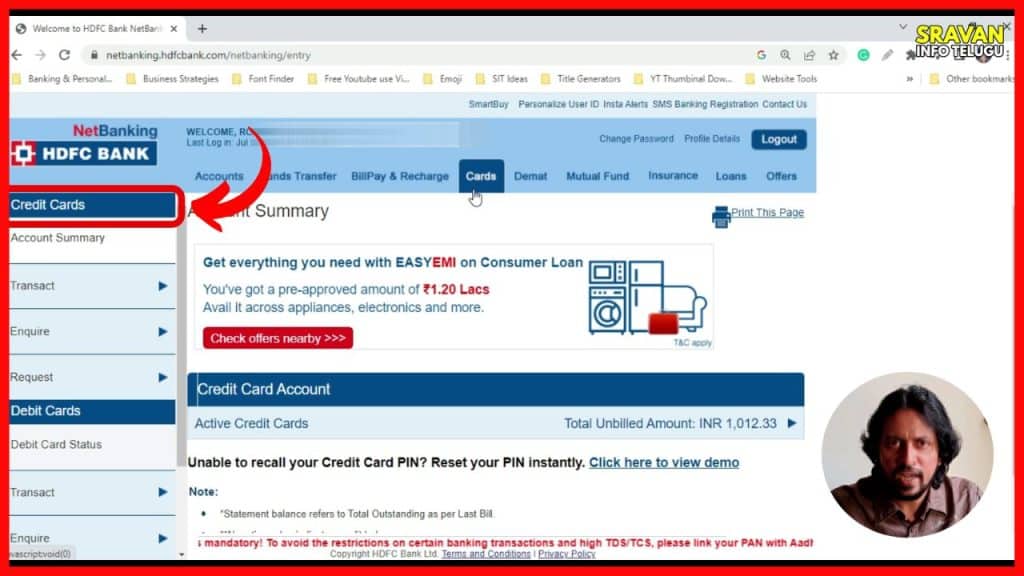

Step 3:

Once you logged in, the interface will appear like this. Now, you can see “Cards” section at the top and click on it. A new interface will be opened.

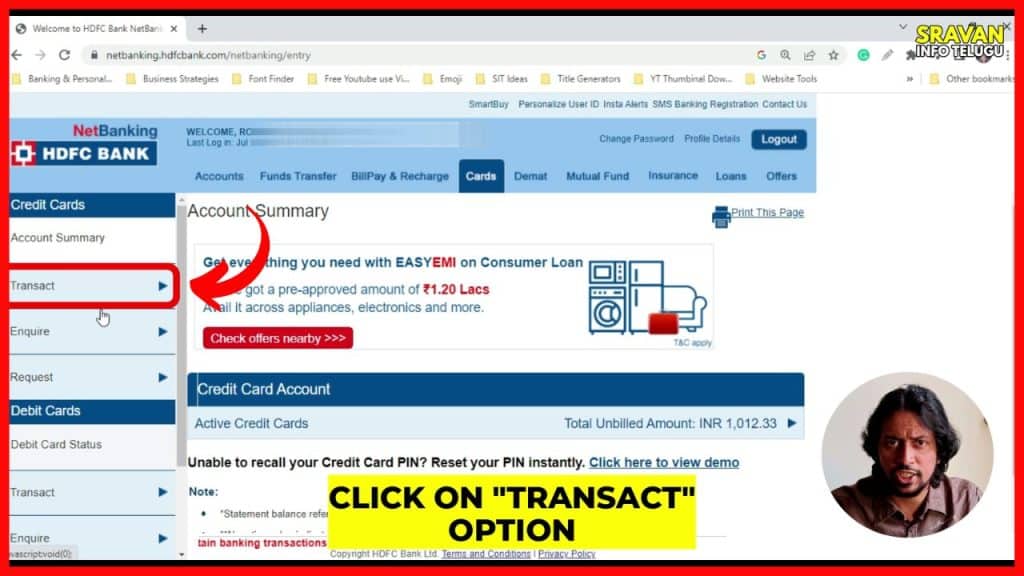

Step 4:

Later on, you can see a section called “Credit Cards” on the left side of the screen

And click on the category of “Transact”.

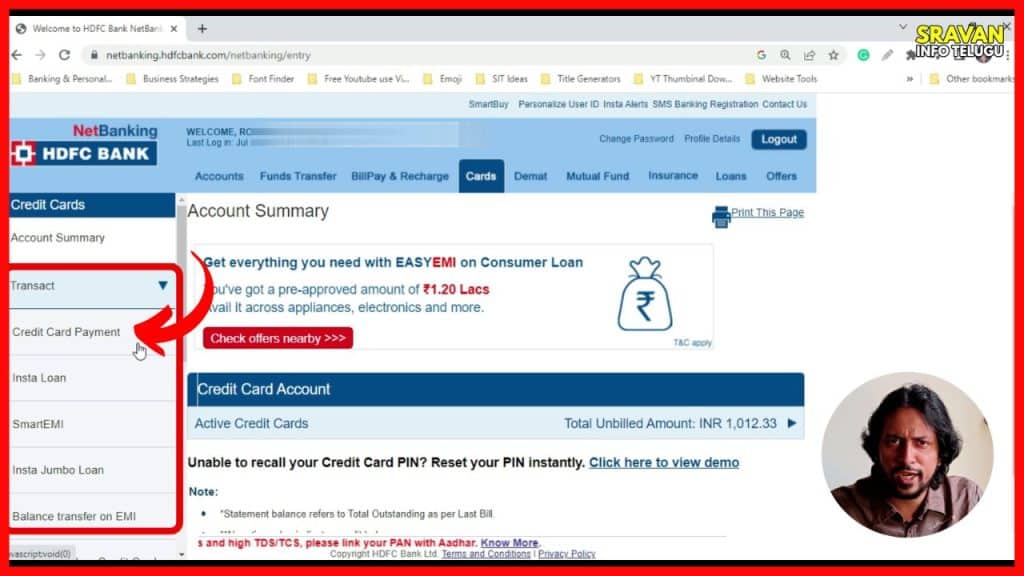

Step 5:

Once you click on it, multiple options will be displayed. Now, click on the option of “Credit card payment”.

Now a new screen will be displayed and you have to complete your Credit card payment in 3 simple steps.

Let’s see.

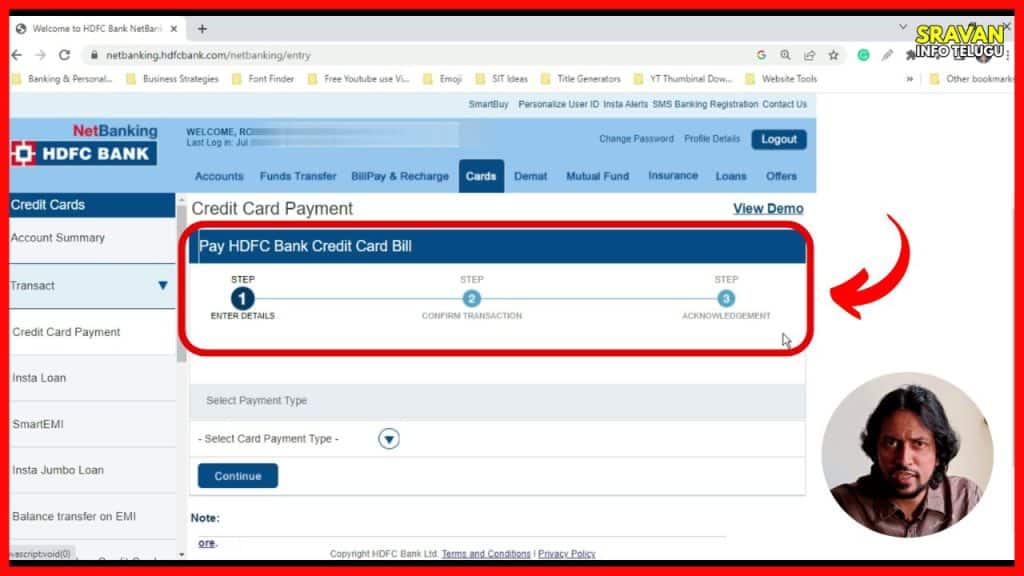

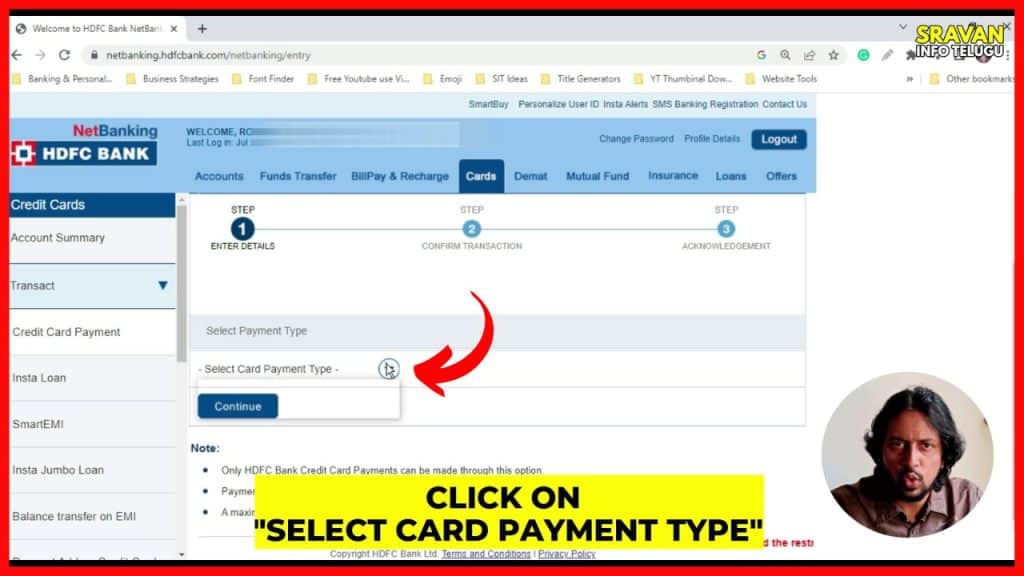

Step 6:

Under Step 1, you have to select your “Credit card payment type”.

Once you click it, a pop down menu will be opened. Here, you will see 2 options and select the first option i.e. “Registered HDFC bank Credit card” out of 2 options.

Select it and Click on “Continue” button.

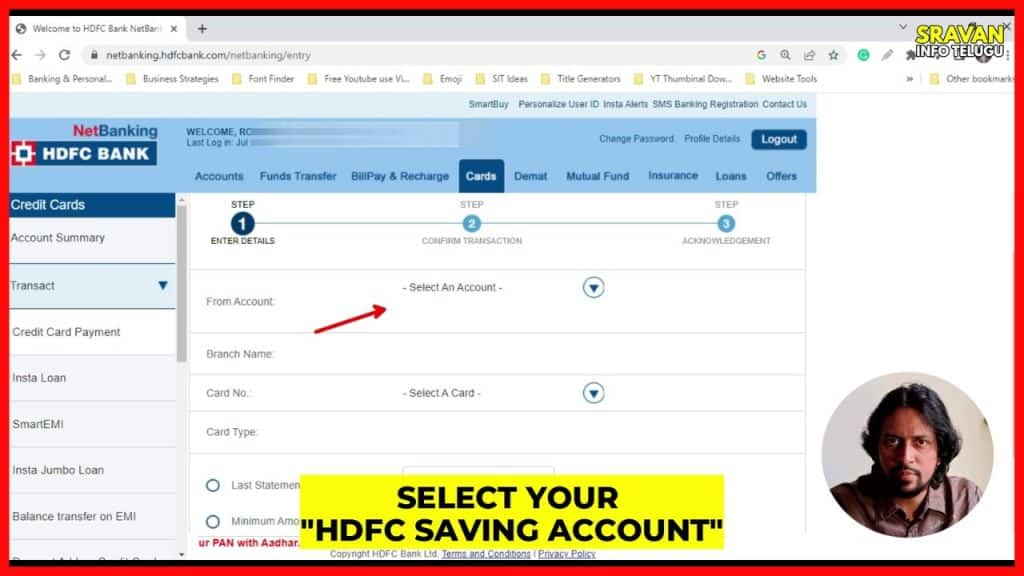

Step 7:

After clicking that, you have to confirm your Savings account details in Step 2.

Under Step 2, you will be asked you to select your Savings account from which you pay your HDFC Credit card bill.

For that you need to select your HDFC Savings account from the option of “From account”. Click on it and select your HDFC bank Savings account.

Step 8:

Once selected, your HDFC bank branch name will be displayed automatically.

Now it asks for “Card Number”. You need to select your HDFC Credit card for which you want to pay your Credit card bill.

And Click on “Select A Card” and a pop down menu will be displayed and you need to select, “Registered HDFC Credit cards”.

Once you selected your credit card, your HDFC credit card number’s first 6 digits and the last 4 digits will be displayed. Therefore, you can easily identify your credit card from that.

As soon as you select it, your “Card Type” will be automatically displayed as HDFC Bank Credit Card.

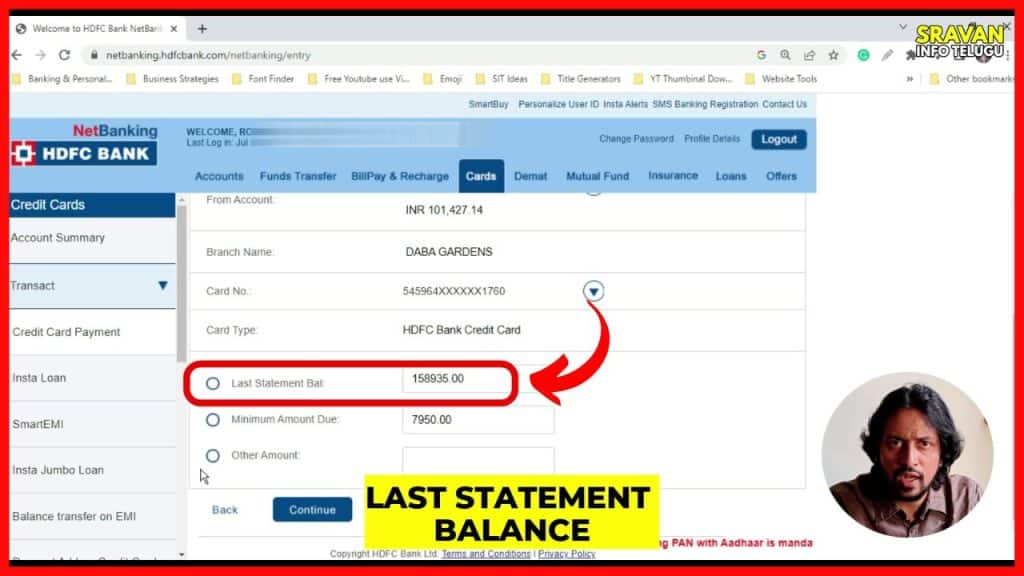

Now, you can pay your HDFC Credit card bill through 3 options

1. Last Statement Balance

2. Minimum Amount Due

3. Other amount

Step 9:

HDFC Credit card holders will have all the 3 above options to complete their Credit card bill payment.

1. Last Statement Balance

Last Statement balance is the Total outstanding or Total liability, you should pay on your HDFC credit card.

My Credit card statement shows Rs.1,58,935/-.

It means, My HDFC Credit card’s total liability is Rs.1,58,935 and I need to clear on this card for that month.

If you can clear this amount, then, your entire HDFC Credit card liability becomes zero. For that, you need to select “Last Statement Balance” option.

But, I’m not selecting it my dear friends.

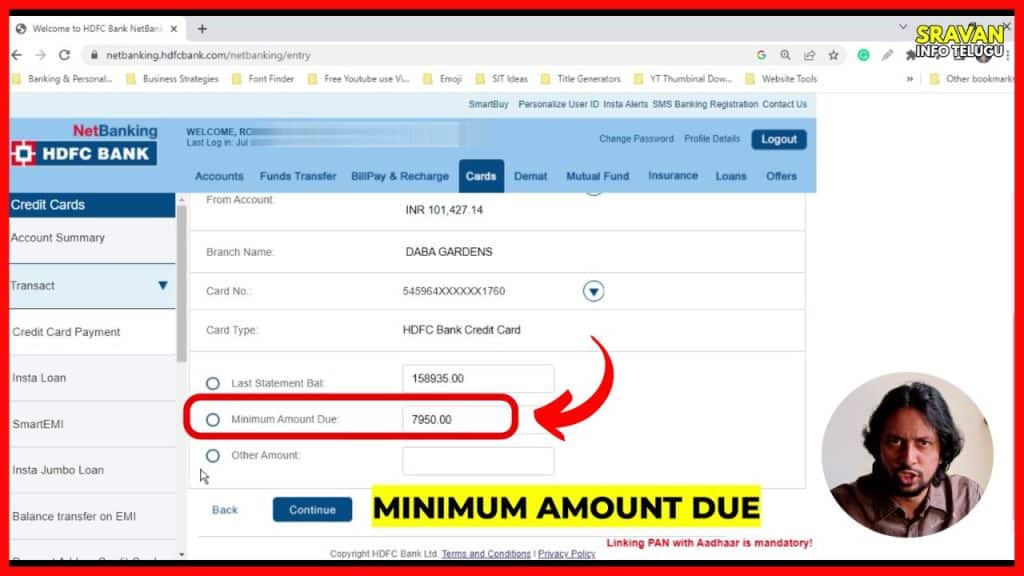

2. Minimum Amount Due

Minimum amount is amount of Interest and other charges, you need to pay on this HDFC Credit card for that month.

If you pay Minimum Amount due on your Credit card, you are free from asking remaining outstanding amount by the HDFC for that month by its dude date.

If you have failed to pay it, then, the same will be informed to the RBI as a “Default” immediately and it will impact on your Credit score /CIBIL score.

If you want to pay Minimum due amount in this month, then, you select “Minimum amount due” option.

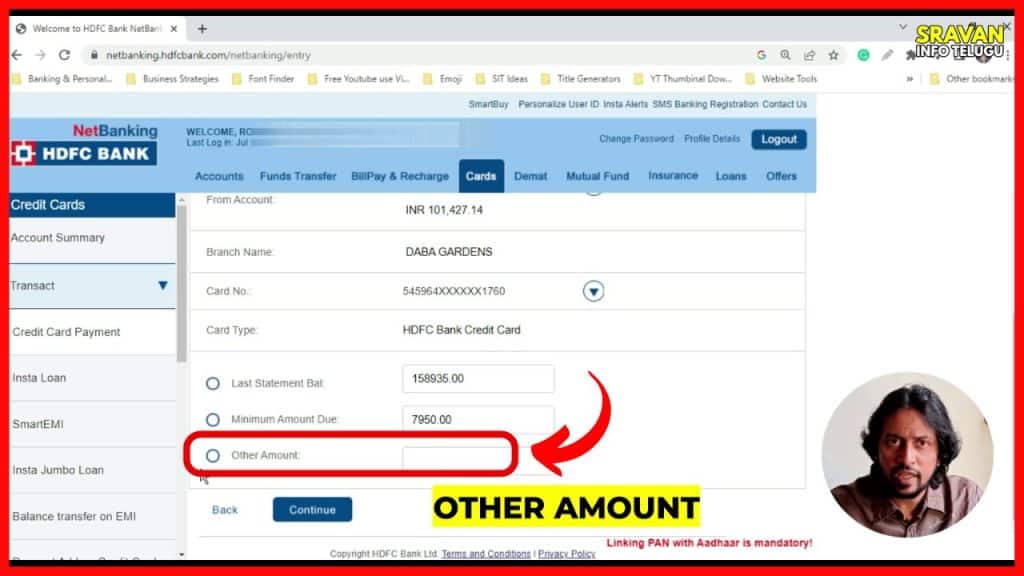

3. Other amount

If you want to pay any amount other than the Last statement balance and Minimum amount due, then, you need to select “Other amount” option.

You select any 1 option out of 3.

Now, I’m not going to pay neither Last statement balance of Rs.1,58,935/- nor Minimum amount due of Rs.7,950/- for this month. But, i will pay my HDFC Credit card bill for this month through “Other Amount” option and enter the amount you want to pay.

I’m going to pay Rs.1,00,000/-.

Enter the amount you want to pay and click on the “Continue” button to complete the payment.

Now, you will be asked for confirmation of payment.

if you think everything is fine, then, you can click on “Confirm” button.

Step 10:

Once you click on it, you will see a “Reference Number” showing that your credit card bill payment has been paid successfully and also, you will receive a message on your HDFC registered mobile from HDFC Bank.

Also, if you want to know Top 7 Banks with latest FD interest rates. Check the below article friends.

Thanks for your time 🙂