BOB Easy Credit card

Introduction

Bank of Baroda launched a Lifetime Free contactless Credit card that offers a wide range of benefits like 5x Reward Points on Daily expenses, Fuel Surcharge Waiver, EMI Conversion, and a lot more.

Let’s see What Features or Benefits this Credit card is offering. And I also share my Genuine opinion on this Credit card by discussing its Drawbacks as well.

Let’s get Started..!!

BOB Easy Credit Card Overview

| Particulars | Description |

|---|---|

| Credit Card Type | Reward Points |

| Joining Fees | Rs.500/- |

| Renewal Fees | Rs.500/- |

| Best for | Entry Level users |

What Benefits do you get from the BOB Easy Credit Card?

When it comes to the BOB Easy Credit Card, the card looks light and dark blue color combination with white and silver text.

On the top left-hand side of this credit card, you can see the “Bank of Baroda Logo”.

On the top right-hand side, you can see the card name “Easy” and at the bottom of it, you can see the “Contactless logo” symbol which supports near-field communication (NFC) technology.

On the bottom left-hand side, the Credit card number along with the Name of the cardholder.

BOB Easy Credit Card Benefits:

Let me go through the Top 7 benefits this Credit Card offers [Incl. My Analysis]

1. 5X Reward Points

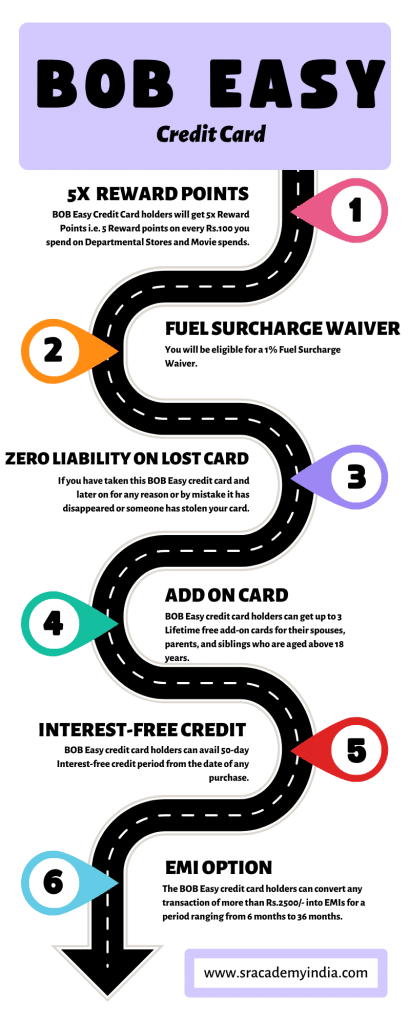

BOB Easy Credit Card holders will get 5x Reward Points i.e. 5 Reward points on every Rs.100 you spend on Departmental Stores and Movie spends.

You can earn 1 Reward point for every Rs.100/- spent on the other categories and 0.50 Reward Points on select MCC*

I’ve never heard about 0.50 Reward points in the credit cards to the best of my knowledge. I also don’t know who the mastermind behind this design of 0.50 Reward points and I say it’s completely a business trap and nothing more.

The idea is to make customers foolish by making them to spend on the mentioned category. If the customer spends on it but who fails to pay the outstanding amount before the due date, then, they will get into the trap and will pay more money in the form of interest.

Forget about Reward points but take care of your money, my dear friend.

2. Fuel Surcharge Waiver

By using this Easy Credit Card, If you spend Petrol/Diesel between Rs.400-Rs.5,000/- across any fuel station in India, then, a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost. In case you paid it through this BOB Easy credit card, then, you will be eligible for a 1% Fuel Surcharge Waiver.

With this BOB Easy credit card, you will get a Fuel Surcharge Waiver up to a Maximum of Rs.250/- per statement cycle.

It is also to be noted that the BOB Easy credit card user will not earn any reward points on this transaction.

3. Zero Liability on lost card

If you have taken this BOB Easy credit card and later on for any reason or by mistake it has disappeared or someone has stolen your card.

In such a case, firstly the credit card user should call the 24×7 helpdesk BOB credit card customer care service numbers either 1800-266-5100 / 1800-266-7100 and report the lost card.

By making such a report, what benefits the customer will get?

By chance, if any online transaction is noticed on post reporting to the BOB Bank from your credit card fraudulently, then, you will be protected from financial loss under zero lost card liability.

If you do not complain, then, You are responsible for the financial loss and you should bear it.

4. Add-on-Card

BOB Easy credit card holders can get up to 3 Lifetime free add-on cards for their spouses, parents, and siblings who are aged above 18 years.

5. Interest-free Credit Facility

BOB Easy credit card holders can avail 50-day Interest-free credit period from the date of any purchase.

6. Revolving Credit Facility

One of the interesting benefits that raised my eyeballs and kicked off my sleep while writing the article is the Revolving Credit facility.

It means this credit card user should Pay a Minimum Amount Due and finance their spending at their convenience.

It is nothing but allowing the credit card user to convert their transactions into EMI.

7. EMI Option

Bought AC to beat the summer ..!

Is it a burden for you on your Credit card..!!

Then, you can check for the EMI option.

The BOB Easy credit card holders can convert any transaction of more than Rs.2500/- into EMIs for a period ranging from 6 months to 36 months.

BOB Easy Credit Card Charges:

The overview of the top charges of the BOB Easy credit card is as follows.

| S.No. | Particulars | Description |

|---|---|---|

| 1 | Joining fees | Rs.500/- |

| 2 | Renewal fees | Rs.500/- from Second year onwards |

| 3. | Cash advance charges | 2.5% or Rs.300/ |

| 4. | Interest charges | @3.25% p.m ; @ 39% p.a. |

| 5. | Late payment charges | Rs.100 – Rs.750/- |

| 6. | Over-the-limit charges | 1% on the overdrawn amount |

| 7. | Foreign currency Markup | 3.50% of the transaction value |

1. Joining fees

If you want to use this BOB Easy credit card, then, on 1st year you will have to pay a Joining fee of Rs.500 excluding GST. With GST, you should pay Rs.590/-

If you spend Rs.6,000 rupees or more within 60 days of taking this card, then, you are not required to pay the joining fee on this credit card.

I told you that Bank of Baroda is offering a lifetime free card at the beginning of this article, which means you spend Rs.6,000 rupees for not paying a joining fee of Rs.500 rupees.

Consider this if at all it is beneficial for you.

2. Renewal fees

If you want to use this BOB Easy credit card from the second year onwards, then, you will have to pay a Renewal fee of Rs.500/- per year excluding GST. With GST, you should pay Rs.590/- every year.

If you spend Rs.35,000 rupees in a year, then, you are not required to pay the renewal fee on this credit card i.e. either waiver or reversal of annual fees.

If you are looking for a FREE Credit card, without Joining Fees and Renewal fees, then, you can check here.

3. Cash advance charges / Cash Withdrawal charges

If you withdraw money by using this BOB Easy credit card, a Transaction fee will be levied on all such Cash Withdrawals at Domestic or International ATMs. Such fees would be billed to the Cardholder in the next statement.

A transaction fee of 2.5% or Rs.300/- whichever is higher will be charged at ATMs.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

You can Withdraw Money using this BOB Easy credit card but Don’t withdraw cash from any credit card. If you have an urgent cash requirement / Cash crunch, then I suggest you to take a Gold Loan or a Personal Loan.

Those are much better options.

In a Personal Loan, every month you pay the Principal amount plus Interest as an EMI. The rate of interest for Personal Loans usually ranges from 15-20% p.a. on a higher note.

4. Interest charges / Finance Charges?

Do you know how much interest you will be charged on Credit Cards?

You have used this BOB Easy Credit Card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the bank will charge you interest between @3.25% per month. It means the Annual interest is almost 39% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

5. Late payment charges

Apart from Interest charges, if you delay paying this BOB Easy Credit Card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, the Late payment charges range from a minimum of Rs.100/- rupees to a Maximum of Rs. 750/- depending on your Credit card outstanding.

So if you use a credit card you have to be very organized and should deal with Credit card timelines properly.

| Credit Card Outstanding Balance is | Late payment charges |

|---|---|

| Between Rs.201-Rs.500 | Rs.100/- |

| Between Rs.501-Rs.1,000 | Rs.400/- |

| Between Rs.1,001 – Rs.10,000 | Rs.500/- |

| Greater than Rs.10,000 | Rs.750/- |

6. Over the limit charges

If you spend more than the available limit on the credit card. That means you have overused your Credit card. Then, you will be charged with “Over The Limit charges”.

The more you spend than your BOB Easy Credit card limit, the more you will be charged i.e. @1% on the overdrawn amount.

7. Foreign currency Markup

If you travel abroad and make any International transactions, you will be charged 3.50% of the transaction value as a Forex Markup Fee.

BOB Easy Credit Card Review

BOB Easy Credit Card is an entry-level credit card. For people who want to take a credit card for the first time from the Bank of Baroda, I will recommend this credit card.

In case in your family if any of you are looking for a basic credit card to improve their CIBIL score. You can have a try.

Don’t expect any huge benefits on this credit card. Expect low and you will get something to cheer about.

In case, you are an existing credit card holder, then, you can skip this credit card.

Thanks for Reading folks 🙂

Also Read: Is IDFC First Millenia Credit Card Right for you